- English (UK)

The USD bulls are taking this even higher in Asian trade, with the US bond market re-opening and 2 and 5-year US Treasury yields pushing higher.

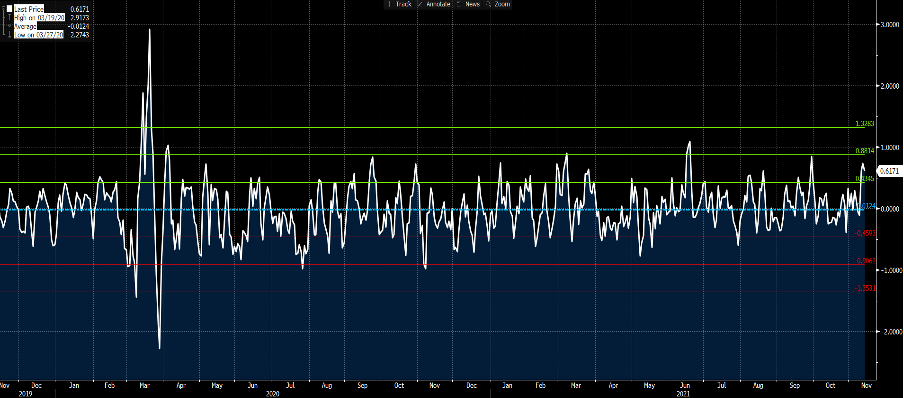

I'm seeing signs of an impending mean reversion play in the USD, but in this flow dips are a buying opportunity in my opinion. One model I like to assess is the (percentage) premium/discount to the 5-day EMA - as we can see, the USDX is approaching the 2 standard deviation level, which has been a reliable contrarian guide for the past two years.

USD vs 5 day EMA with std deviation bands

(Source: Bloomberg - Past performance is not indicative of future performance.)

Happy to trail stops on longs for now though more as a momentum play, but this could be one the intra-day mean reversion heads have on the radar. Is the long USD trade becoming to consensus? It's getting that way and that’s usually a sign of caution but we’re not there yet and positioning is by no means extreme.

Gold has been rallying in all currencies as systematic funds increase length, although we’re seeing small profit-taking as US real rates pushed 2bp higher today and the USD is bid. The inflation debate rages on though and is at the heart of the fundamental story here. However, for Gold to push into $1900 we will need US real rates continue to make daily record lows. As ever, perhaps buying Gold is AUD or GBP could be the better trade if the USD is going to continue finding form.

I stand by my call that the two most important economic data points going forward are the labour force participation rate and labour unit costs (compensation per hour vs productivity) – both will be hugely influential for both inflation and the Fed’s perception of policy.

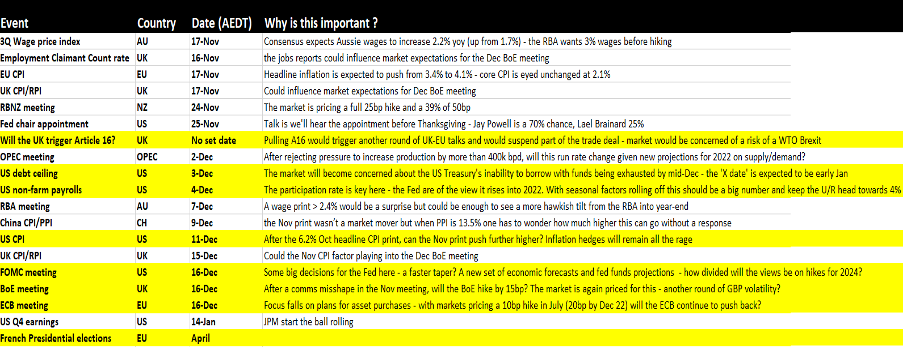

With so many moving parts to navigate into year-end, I have updated my event risk calendar – it's raw (a snip in Excel) so apologies for that, but I use it as part of my risk framework. Markets often run with a central theme, as we’re seeing now with the inflation vibe, and look for further fuel or answers – that’s where these dates come in. So often markets form a consensus view and run with it into the data release and when we learn the facts.

While each piece of data and event risk is known, the period around the 16 December, when participation in markets is light anyhow, could be huge for markets. If the debt ceiling isn’t sorted at a time and when the Fed may very well be turning more hawkish, the risk is this may be a toxic combination for markets. I think that’s what the USD is preparing us for now.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.