- English (UK)

Key thematic for 2021 - Inflation testing the resolve of central banks

This holds ever greater implications for economics and markets and makes 2021 such an incredibly interesting year.

Why?

Firstly, the negative USD trend is not a function that the US economy is in a relatively bad position – quite the opposite. Granted, trends in the US COVID cases do worry, but the market isn't seeing real-time data (such as retail web traffic, foot traffic, etc.) breaking down. The vaccine news flow has been a huge confidence boost, global PMI’s have rebounded strongly, expectations of higher dividends across global equity markets are rising strongly, as are earnings expectations for 2021 and 2022. Although, estimates are not rising fast enough to reduce the consensus forward P/E multiples, which are still at extreme levels.

We’ve seen massive inflows in US equity funds, with value working well and cyclical sectors destroying defensive sectors of the S&P 500. Longer-dated US Treasury yields are starting to lift again and yield curves are steepening – this is a powerful message about the outlook of global economics. A steeper curve also has implications for corporate hedging. At this stage, corporate FX hedging ratios of US bond holdings sit around 55%. As yield curves rise you tend to see companies increase their hedging ratios on their USD-denominated investments, which naturally means selling USDs and buying alternative currencies.

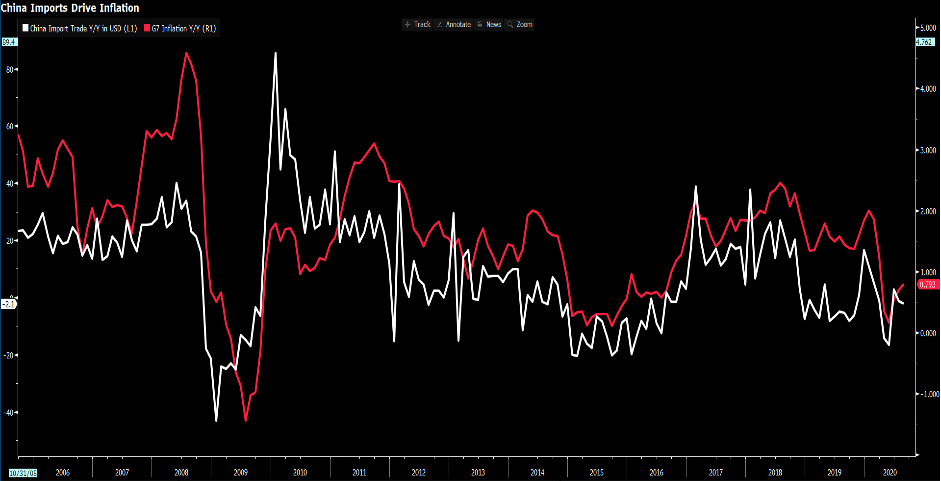

We’ve all seen the moves in industrial metals and iron ore, while crude has risen 32% since 2 November. Moves lower in USDCNH have been at the heart of this trade, with China’s importers obtaining ever greater levels of purchasing power, with the raw materials becoming cheaper as they are often priced in USD. Higher Chinese import demand has traditionally led to higher inflation in G7 countries.

(Source: Bloomberg)

The fact is, the US economy is in repair and so is the global economy too. Calls to own assets that benefit from a cyclical recovery are now a clear consensus view. EM is perhaps the standout core consensus view for 2021 with India, Indonesia and Thailand all touted as hotspots. In this backdrop, increasing global trade volumes are rising and synonymous with a falling USD.

Liquidity is incredibly abundant, with central bank QE still very much leading to ever larger central bank balance sheets, while the global money supply has pushed to an incredibly $93.7t. US and in fact global investors have been grossly overweight US assets, but that's changing as the world recovers in synchronicity and funds are re-positioning out of concentrated US exposure and increasing their geographically diversification. On current trends, 2021 is shaping up to be a year of chasing growth and where you see stronger relative growth, you'll likely see capital follow.

(Red – global money supply, blue – S&P 500)

(Source: Bloomberg)

Inflation on the radar

We see a weaker USD resulting in upside in US and global inflationary pressure. A weaker USD is an additional stimulus for many emerging markets, who've amassed huge USD-dominated liabilities. A falling USD amid rising global growth is a quasi-economic stimulus for EM. Which in turn will have a positive feedback loop to the US economy and many other DM countries.

That said, the weakness in the USD must be managed by central banks outside of the US. Global central banks are having to limit the appeal of their currency or risk attracting one-way flow, which will impact inflation.

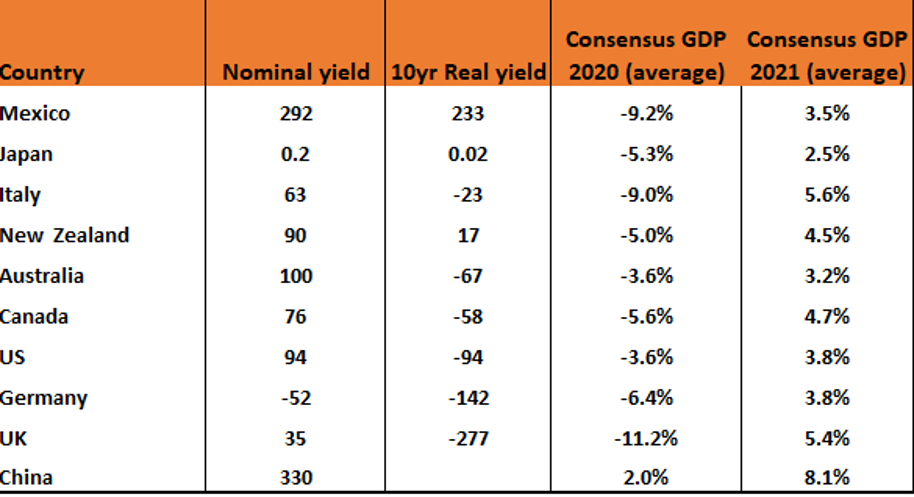

We’ve seen comments from the ECB on moves in EURUSD above 1.2000. The RBA rolled out a QE package partly to stay in lockstep with the Fed, which has been a reasoning why the AUDUSD is not above 75c. The RBNZ has moved away from negative rates, but NZ 10-year real rates are positive and that makes the NZD very attractive. Especially with NZ’s terms of trade pushing higher and the RBNZ will have a job trying to limit the appeal of the NZD.

In Asia, we’ve heard from the central banks of Thailand, South Korea and Taiwan, who've either jawboned their currency or have actually intervened by selling their domestic currency and in many cases buying EUR and JPY. The Czech central bank detailed that the strength in the CZK has even reduced their capacity to hike rates.

The fact is, if your domestic monetary policy setting falls remotely out of line with the Fed’s, the market will see this as a green light to buy your currency. Central bank policy divergence is real and if you raise your hand and get out of sync with the Fed you'll face the consequences.

Now this makes life very interesting in 2021 and provided the market's script of a cyclical led recovery plays out then we can start to identify a huge macro thematic – will higher inflation test the resolve of central banks to keep rates lower for longer?

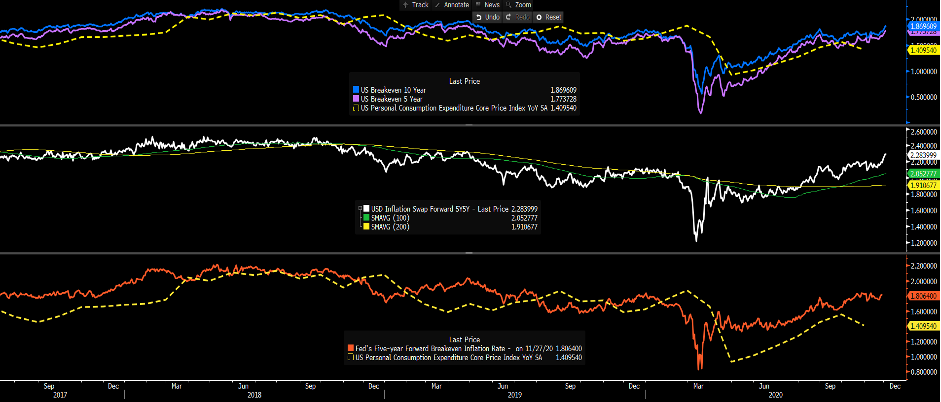

One must look to the markets-based view on inflation expectations – they're rising at quite a rate. Perhaps not enough to genuinely worry a central bank right now, but if this trend continues then it might. The markets view on inflation expectations will become incredibly important and volatility, not just in interest rate markets, but in FX could start to lift again.

(Inflation expectations – breakevens, 5y5y inflation swaps, Fed’s 5yr inflation gauge)

(Source: Bloomberg)

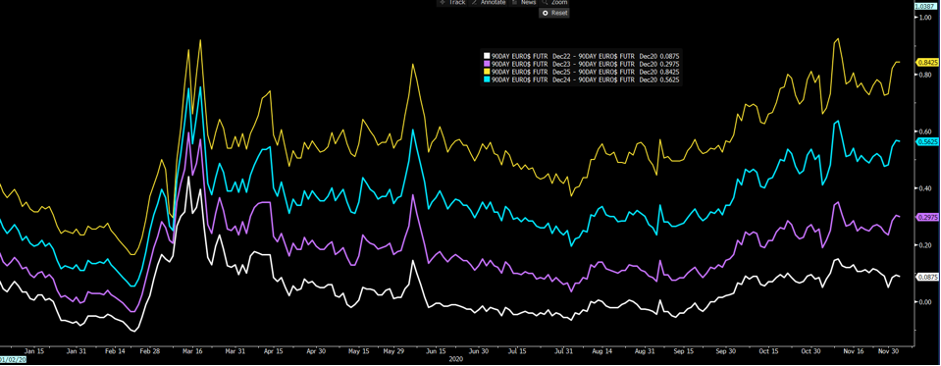

We can look at US interest rate (Eurodollar futures) markets and see a modest lift in expectations for future rate hikes. However, if the Fed hadn’t moved to target average inflation then I've no doubt that the 29bp of hikes priced by end-2023 (purple line) would be upwards of 50bp.

(Source: Bloomberg)

Will the resolve of the Fed be tested next year?

Clearly, the first step will be to slow the pace of bond-buying towards zero and change forward guidance based on a qualitative framework. The market has much time to become comfortable with a less accommodative policy. This conversation is already starting to be heard and providing the recovery goes as expected then price pressures will be a key theme for 2021. Inflation and growth trends won't be even across all countries and while central banks will always try and stay in lockstep with the Fed, they may have to respond to greater domestic forces.

Central bank divergence will therefore creep in and the market knows it. The resolve of central banks to tolerate inflation could be put to the test.

The further you diverge from the Fed the greater inflows you'll attract.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.