- English (UK)

Analysis

Certainly, the FOMC meeting could be incredibly symbolic and a milestone in the pandemic shock and awe central bank response.

Eyes on the BoE meeting

The BoE meeting (Thursday 12:00 BST / 9:00pm AEST) should, in theory, result in limited moves for the GBP given we’re coming off of a hawkish August BoE meeting and there are no new economic forecasts provided here and the recent forward guidance won’t change – that said, with two new members on the MPC and UK interest rates pricing the first hike in May 2022, with some even saying it could happen as early as February, there are risks to the GBP given the rich expectations.

Looking further out, we see nearly two hikes priced in for end-2022, which suggests the GBPUSD could be very sensitive to changes in UK/US interest rate differentials.

On the day I like playing a 1.3620 to 1.3710 range in cable and would fade moves into these levels – this is a wide range given the 5-day ATR is 57-pips, but we have two major events playing through over a fairly short period.

The wait is over the September FOMC meeting is upon us (Wednesday 19:00 BST / Thursday 04:00am AEST)

The Fed are the worlds price maker and this is the meeting many have been waiting for, as it promises to answer some important questions.

For traders, one key consideration is positioning – unlike the June FOMC where the world was very short of USDs into the meeting, this time around USD positioning is far more neutral (source: CFTC data). Our own client positioning is skewed long of USD’s, specifically vs the CAD, EUR, and AUD, so retail traders are either expecting a hawkish tilt from the Fed or see risk aversion kicking back into markets again.

USD index – daily

(Source: Tradingview - Past performance is not indicative of future performance)

If we look at the price action and set-up in the USD (above), it’s no surprise to see that the market has moved higher into the Fed meeting, but whether the USD flow continues is what we’ll naturally react too. US 5-year Treasuries may be influential on the USD and Gold, and traders can trade moves in the bond market with our ETF offering – put the SHY ETF (1–3-year US Treasury), IEF ETF (7-10yr US Treasury), or TLT ETF (20-year+ Treasury) on the radar (found on MT5) – if we see sellers in bonds (price down, yields up), it could push the USD higher and Gold lower and weigh on the NAS100. Naturally, the opposite is true if we see buyers.

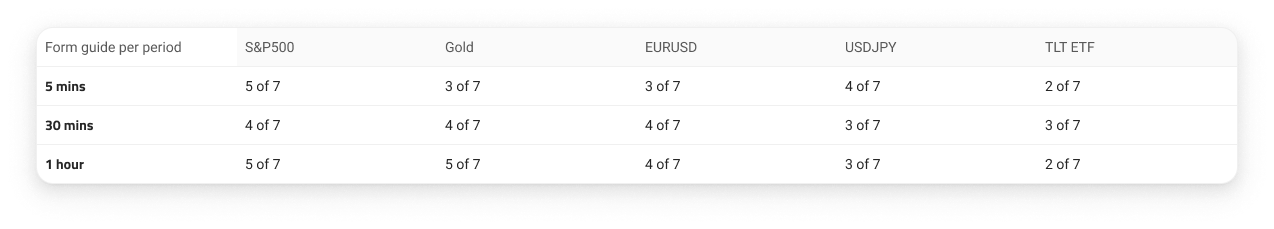

Past performance in core markets

(Source: Pepperstone - Past performance is not indicative of future performance)

While past performance is clearly not indicative of what may happen this time around, we can look over various timeframes at how key markets have fared to see if there have been trends. Typically, we’ve initially seen higher equity prices – however, consider that in the following cash session the US500 has fallen 0.8% on average on the day.

Catalyst for markets at this meeting

There are many factors the market will watch out for, but on a simplistic basis, the key focal points that should drive movement across markets will be:

- The ‘taper’ - The market should be put on ‘advance notice' that the Fed will start to reduce the pace of its monthly asset purchases – potentially to start in November or December. Perhaps just as important is whether we hear any clues around the anticipated pace in the monthly reductions

- The ‘dots plot’ – or the projections of where each Fed member sees interest rates at a specific time in the future. In the June meeting, seven of 18 Fed members called for a rate hike in 2022. Therefore, if we get three additional members changing their view for a hike next year then the median ‘dot’ projection of the members will move higher – this seems key, as it will promote a tighter link between tapering of the asset purchase program and rate hikes - something the Fed has tried hard to separate

- The Fed’s current median estimate for the Fed funds rate in 2023 sits at 0.63%, implying 2 hikes – if we don’t see a lift in the ‘dots’ for 2022, we should almost certainly get an additional one for 2023, taking the median dot to 0.875%

- We get the first-ever 2024 ‘dot’ projections – the market expects this to come in at 1.625% - this implies six hikes in the coming three years

- The outlook for inflation – the Fed should remain in the transitory camp, but any change in the level of concern may impact markets.

The market is widely expecting that the Fed will cut back on bond purchases in November or December, so in theory this concept alone shouldn’t promote too much volatility. However, markets can react unexpectedly to facts especially through this period of slower growth and concerns around China’s property sector.

The projections of the Fed funds rate through the ‘dot plot’, has the potential to spur volatility and while Fed chair Powell will downplay the ‘dots’ in his press conference, and say that tapering and rate hikes are two very different issues, one questions whether the market believes the Fed if the median dot pencil in a hike in 2022? I am not so sure.

So, while markets have been positioning for this event for some time, this could be a hugely symbolic meeting – after an incredible monetary response from the Fed, this could be the moment they start to officially unwind their actions. Given the crosscurrents in economics and other macro issues (such as peak earnings), could lower liquidity mean far greater headwinds for risk assets going forward?

The risks around this meeting, it seems, mostly point to a stronger USD and lower bond prices which could negatively impact equities and Gold. Naturally, trading around events carries inherent risk, but being long USDs feels like where the balance of risk lies.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.