Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

We consider the recent drivers, but we explore the scenarios that could see further gains in the USD as we roll into Q4. One such scenario is the potential for a rise in inflation, an outcome that could really shake things up in markets.

(USD index – daily)

Everything worked for the USD in Q3

One of the clear USD levers has been the US economic ‘exceptionalism’ story, where the US economy has arguably been the best house on the street.

Case in point, the Federal Reserve recently upgraded its 2023 GDP forecasts by 1.1ppt to 2.1% and 0.4ppt to 1.5% in 2024. Contrast the Fed’s positive actions to the weakness seen in China’s economy and concerns about the property sector – growth downgrades from the ECB, amid contractions in EU & UK service PMIs, with falling inflation leading the BoE to hold rates in the September meeting.

The Fed also reduced the level of anticipated rate cuts in 2024, portrayed in their ‘Dot Plot’ projections, by 50bp. This was a surprise to many, but this was designed to enforce the notion of a higher-for-longer policy stance, while signalling a view that they are not looking at rate cuts anytime soon.

This action has also seen both nominal and real US Treasury yields pushing to multi-year highs across the ‘curve’, with the US 10-year Treasury really underperforming, with yields hitting 4.70% and the highest since 2007. Moves in Treasuries have supported the USD’s valuation, but it also increased the demand for USDs as a hedge against equity drawdown.

The US labour market is tight but cooling

As Q4 gets underway, the US labour market will continue to get a strong focus. While we await the September nonfarm payrolls report, we head into the report seeing a cooling in the labour market.

Inflation is expected to head lower – but, what if?

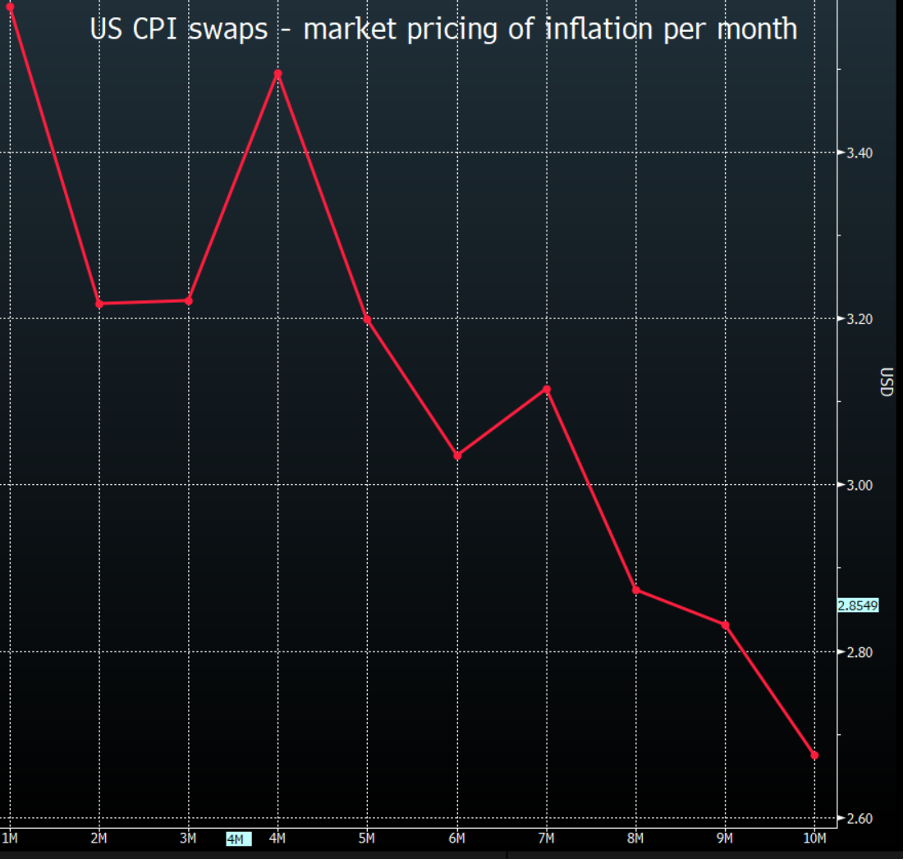

Where life becomes truly problematic would be if US inflation were to rise despite a further cooling in the labour market. With market-based consensus expectations (seen in CPI ‘fixings’) for headline US CPI to fall to 3% in 6 months’ time and 2.25% over the coming 12 months, any scenario which has us truly questioning this pricing could increase uncertainty and see volatility rise across markets.

On 12 October we see the US September CPI print. Expectations currently sit at:

- The consensus from economists is we see headline CPI at 0.3% MoM / 3.6% YoY (from 3.7%), while core CPI is eyed at 0.3% MoM / 4.1% YoY.

- The Cleveland Fed Nowcast model sees headline CPI coming in at 3.7% and core CPI at 4.2%.

- US CPI fixings (a way for interest rate traders to set a view on where inflation will be on release) sit at 3.58% for headline CPI.

Taking an aggregation of these market/economist expectations the lack of dispersion suggests market participants will have some confidence in their positioning over the upcoming CPI release. This suggests that if we do see an outcome vastly different from consensus expectations it will cause a big move across broad markets.

The big pain trade therefore comes from higher US core CPI print – let's say over 4.3%, married with a tick up in the well-watched ‘supercore’ print (core CPI ex-services & ex-shelter print). This potential outcome may force the Fed's hand at the November FOMC and compel them to hike by a final 25bp. The result would likely be further new cycle highs in US nominal and real Treasury yields, with the USD finding fresh buyers and taking a new leg up.

A higher USD driven not by resilient growth dynamics (and increased supply), but by a turn in inflation would not be taken well by equity markets or risk assets more broadly. Gold would trade closer to $1800 and the VIX would trade towards 25%. It could also accelerate the prospect that the BoJ/MoF intervene to support the JPY.

As traders we manage risk, and we attempt to price certainty – a renewed rise in US core inflation seems a low probability, but it is a scenario which could play out and the risk needs to be managed. Any situation which threatens the market's central vision and pricing will create sizeable market volatility.

Could the USD be looking to take a new leg higher? Potentially, and we can also need to consider a world where inflation does fall as expected to target and labour markets cool. However, if we’re assessing what could really get volatility pumping it’s the idea of the Fed hiking in November and inflation threatening the market’s trajectory on inflation.

It pays to recognise the risk, keep an open mind, and be prepared to react - it will serve you well in markets.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.