- English (UK)

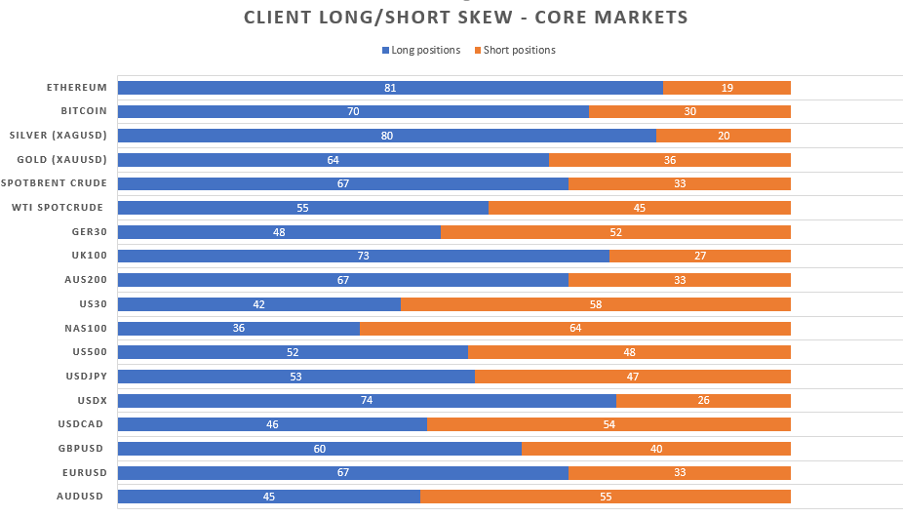

Focusing in on energy, both SpotCrude and BrentCrude have been given a solid run from clients, where the positional skew is modestly favoured from the long side. Volatility and range expansion will always flash red for CFD traders and it feels like there's certainly more left in this story, so our energy markets should be front and centre.

Clearly, relations between the UAE and Saudi Arabia have been a major focal point. However, the first instinct was to react to the tightness in the physical Crude market (global inventories are drawing down close to 3m barrels a day) and when married with inaction from OPEC to increase output saw Brent Crude trade to $77.82 and SpotCrude $77.16.

Naturally, it wasn’t long before the outside world caught on, with condemnation heard from the US, China, and Europe, prompting a solid reversal in the crude price, all whom:

- Don’t want crude to run too hot

- Obviously see huge implications from a deeply fragmented OPEC.

This would turn to a rampant grab for market share and a collapse in the crude price – an outcome that would hold deeply negative implications for investment.

There's been some calls that the US could even use its Strategic Petroleum Reserves (SPR) to meet global demand – a draw card to get OPEC back to the table, where all the talk is when a new round of OPEC talks take place. However, it feels like any deal is cosmetic and short-term in nature with Saudi and Russia the power brokers and the architects of output, and this does not sit well with the UAE.

Recall, the UAE has made noises before that they may leave OPEC and as the cartels fourth-biggest player would like a more defined voice in shaping output levels – this seems fair as their economic model is being reconsidered to one less reliant on crude. Having external influences going someway to dictate your economics rarely sits well.

Moving forward

The news flow requires monitoring and we could see some lively moves in Crude until we get clarity of a new meeting and a potential output agreement - headlines should dictate price action in the near term. OPEC does have clear scope to increase output without causing a significant sell-off in the market and the fact that price has pulled back sharply a factor that international condemnation has seen traders’ price in a greater chance of future agreement. It's no certainty though and when there is uncertainty volatility is always present.

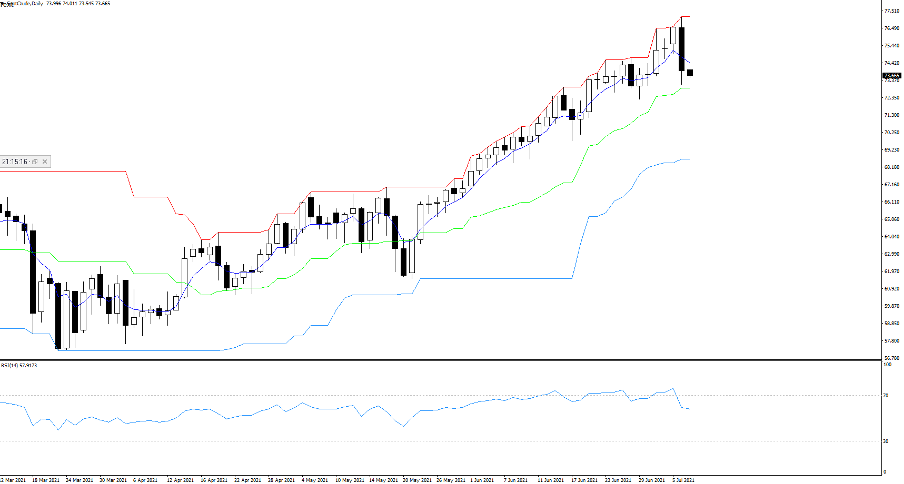

From a pure price action perspective, we saw price close below Monday’s low, subsequently printing a bearish reversal – follow-through selling could be telling and open a move to $73.09 (the 20-day MA) and $72.91 (50% of the 20-day range), ahead of the 29 June low of $72.23. A break here could see volatility really pick up and see price fall to the $$69.00/68.50.

The bulls will want to see the price close higher than at least 50% of yesterdays $77.16 - $73.12 range (at $75.15) in the session ahead to offer confidence that the market structure has not changed too dramatically, as it feels like the bears have the upper hand.

Energy is a must-watch space and with changing dynamics at play, how this unfolds is not just fascinating but could hold huge implications for broad markets, as well as economics.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.