- English (UK)

Analysis

In a world where nearly all central banks are delivering hawkish surprises (certainly relative to their own guidance), it’s the Fed’s turn to step up – one of the many roles as traders is to assess the risk of shock and it becoming a volatility (vol) event and to decide if there is a clear skew in the distribution of outcomes – if the skew in risk is seen as two-way or balanced (‘normally distributed’) then it can be prudent to reduce exposures over the event.

For me, this is where we look at rates pricing, to understand what's already discounted, as well as positioning and expected movement.

Implied volatility

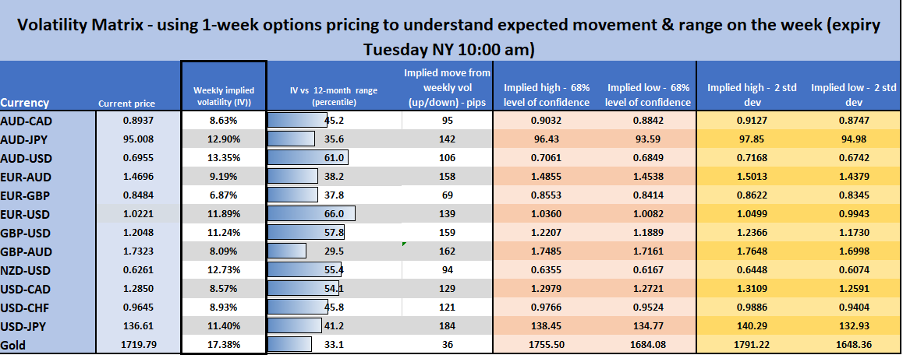

Derived from options pricing, this can tell us how the market is feeling about expected movement over a set period and this can dictate if the market sees an event (such as the FOMC meeting) as one that could impact our positions - so this becomes an essential part of our risk management. Many will use realised measures of vol, such as standard deviation, Bollinger Bands or ATR but this is based on past movement – we don’t dismiss it as a superb tool to help guide stops, but it is less predictive than implied vol.

As it stands, 1-week implied vol in most G10 FX pairs and XAU is around the 50th percentile of the 12-month range – the expiry here is the Tuesday, so it encompasses more event risk than just the FOMC meeting - either way, expected volatility and movement have come down a touch from last week, and this means utilising a tighter stop from the market/entry (than we would have last week) and potentially increasing the position size accordingly – at least for those who use a fixed dollar amount per trade.

(Implied volatility Matrix – we look at 1-week vol and calculate the implied trading range)

(Source: Pepperstone - Past performance is not indicative of future performance.

From a pure vol perceptive, the market is saying this is an event that can move broad markets, but it is not a defining moment in time – not like the June FOMC meeting and what we suspect will be the case in the September meeting.

Positioning

I see positioning in the USD as elevated – in the weekly CFTC report net USD longs are the highest since 2019 – As a percentage of open interest, USD longs are most extended vs the AUD, GBP, CHF, and JPY. While harder to source (I use Bloomberg), the Citigroup USD ‘PAIN’ index, which looks at the extent of USD positioning from a wide range of FX funds, shows the USD as the most crowded positioning since 2020, although it is still not at extremes. Either way, USD positioning is over two standard deviations of the long-term average and that suggests the FOMC statement will need to come up with something new or USD longs are at risk.

(Citi’s USD ‘PAIN’ index – looks at the crowdedness of USD positioning)

(Source: Bloomberg - Past performance is not indicative of future performance.

From a positioning perspective, the USD has a downside risk.

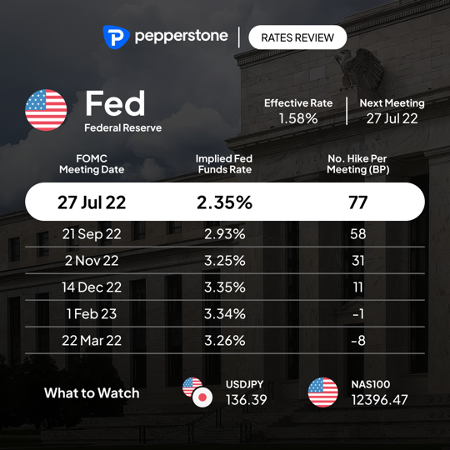

Interest rates pricing is rich, with the market expecting a lot – While the world would be truly shocked if they hiked by anything other than 75bp this week, the question as we address in the video above, is more the pricing for hikes in the September meeting which we currently see expecting 59bp of hikes. Will the FOMC statement give any colour that suggests this is under-pricing the possibility of another 75bp hike then? Most expect the statement to give the Fed the optionality to lift rates more aggressively (i.e 75bp) if needed.

(Source: Bloomberg - Past performance is not indicative of future performance.

With the fed funds rate eyed at 3.35% by December, the playbook is that we get a 75bp hike this week, 50bp in September and then a 25bp hike in both November and December. That should end the hiking cycle. That pricing seems in line with economists’ calls, so the question is whether the statement and the tone are wildly different from the journey the market holds.

It feels like this meeting is more about nuance than big sweeping changes, hence vols are lower. With that in mind, I may well come down to a market long of USDs that sways the balance of risk – so I see modest USD downside risks, but with the Fed unlikely to sway from its inflation-fighting mantra it’s hard to see a collapse anytime soon. It does feel like the USD is trying to find a top though and you can trade the possibilities with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.