- English (UK)

Analysis

Fed Quantitative Tightening (QT) – the biggest risk to markets

With US non-farm payrolls (NFP) in our sights in the session ahead (22:30 AEST), and consensus expecting 300,000 jobs, the unemployment rate of 3.5%, and hourly wages at 5.3% - the two overriding questions we should have:

- Given current trends in payrolls in 2022, and considering other recent inputs (such as Homebase numbers, the ADP report, the employment component of the ISM manufacturing report), do we see downside/upside risk to the consensus NFP call?

- Would we get a bigger downside move in the USD on a print below 150k, than we would on an upside move on a 450k print?

On point 1, I think trying to position trades around prior trends in the NFP report holds no edge at all, and time and time again we’re surprised by the outcome. That said, it feels that the prospect of a number between 200k-350k is high and that won’t alter the Fed’s thinking.

The more important aspect is where the market is positioned and for that, we know the world is long of USDs – so, to answer Q2 my view is a bigger downside move (equity markets up) should occur on a decent miss to consensus than a potential move from an upside beat, but it is unlikely.

Life is never easy, and we could get a poor US payrolls number and a strong earnings print – so, we ask - what is the reading that would please the Fed and have them thinking this could lead to a softening of the labour market? For that, it would have to be something woeful.

QT is the biggest issue facing markets

Concerns about the Fed lifting rates past 4% in 2023 is one aspect of support for the USD, that has weighed on equity markets – the USD strength has an impact on reducing global central banks’ balance sheets.

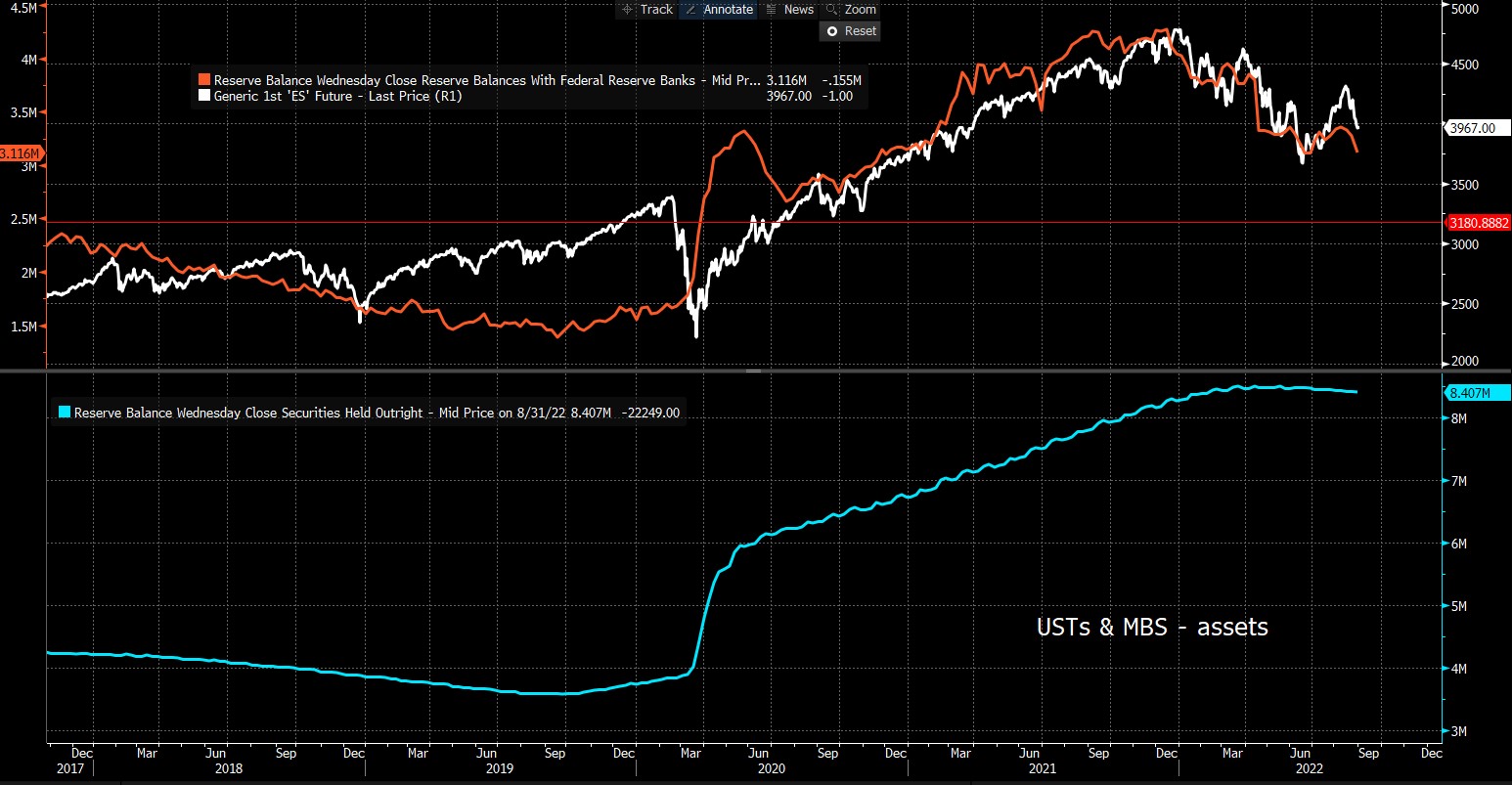

Top pane – Fed’s reserve liabilities vs the S&P500

Lower – Fed security portfolio

The other aspect is the Fed’s Quantitative Tightening’ (QT) program – this has not been as easy to follow as many would have anticipated, with the balance sheet reduced by $98b since June. There have been some technicalities which have limited the reduction, and in theory, the reduction should have been closer to $150b - but that dynamic changes this month and we move to a world where the pace of the Fed’s asset reduction increases rapidly.

As with any accounting practice if assets are in decline, so must liabilities – that means reserves (a liability) must fall – most interest rates strategists would argue it's not the direction of reserves in the system but the absolute level – there is a level, let’s say $2.5t, where reserve balance balances fall to such a level that it could cause USD funding issues. This causes problems in the repo market and the Fed would have to radically alter its QT program.

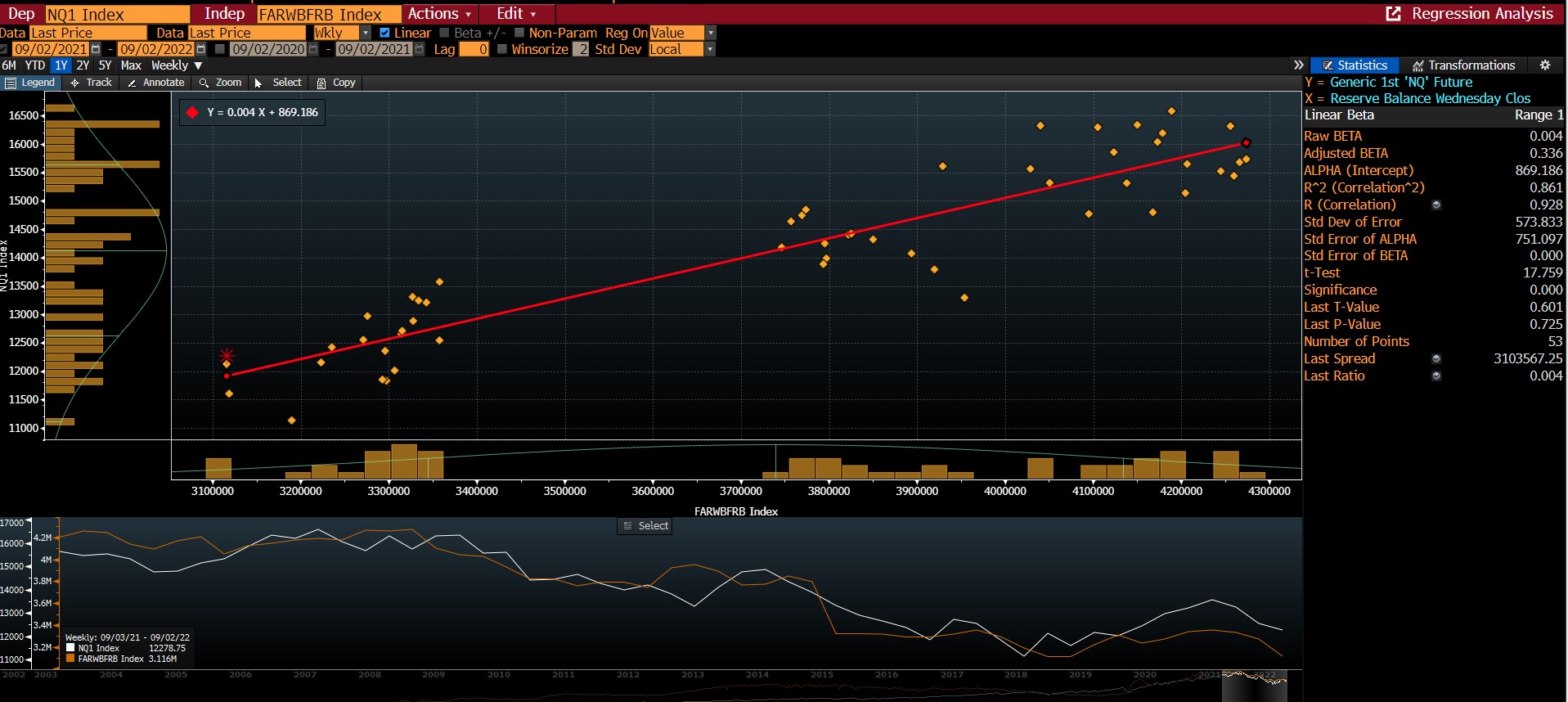

The issue I have here is the relationship between Fed reserve liabilities and equities are just so strong – A 12-month regression of reserves and NAS100 futures is 0.86 – in layman's terms, 86% of the variance in the US equity market can be explained by falling reserves liabilities. Reserves will fall further now and assuming that this relationship holds then this will be a huge headwind for equity markets.

QT is a massively unknown known and for many just not understood – it has the real potential to negatively impact USD funding channels. It could impact borrowing costs and it could significantly tighten financial conditions – everyone is looking for the Fed pivot to come by easing off from hiking, when in fact it is more likely be a change to QT.

This is obvious a complicated subject, and requires a knowledge of the plumbing of US monetary system - My advice is to put some time into understanding QT, as it’s the biggest risk to markets.

Aside from the QT vibe, it’s a massive week next week - here are five key focal points:

- ECB meeting (Thursday 22:15 aest) - Expect a super-sized 75bp hike and potential EUR volatility

- RBA meeting (Tues 14:30 AEST) – we fully expect a 50bp hike – AUD in focus

- Fed chair Powell and vice chair Brainard both speak Thursday – the USD, gold, NAS100 could be very lively as they explain how the payrolls report affects their view on policy

- Liz Truss likely gets the gig as Tory leader/new UK PM (5 Sept) – GBP in play, although this outcome is fully expected

- OPEC meeting (on Monday) – commentary from the Saudis of late that they could cut production may beef up given the falls in crude – crude in play

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.