- English (UK)

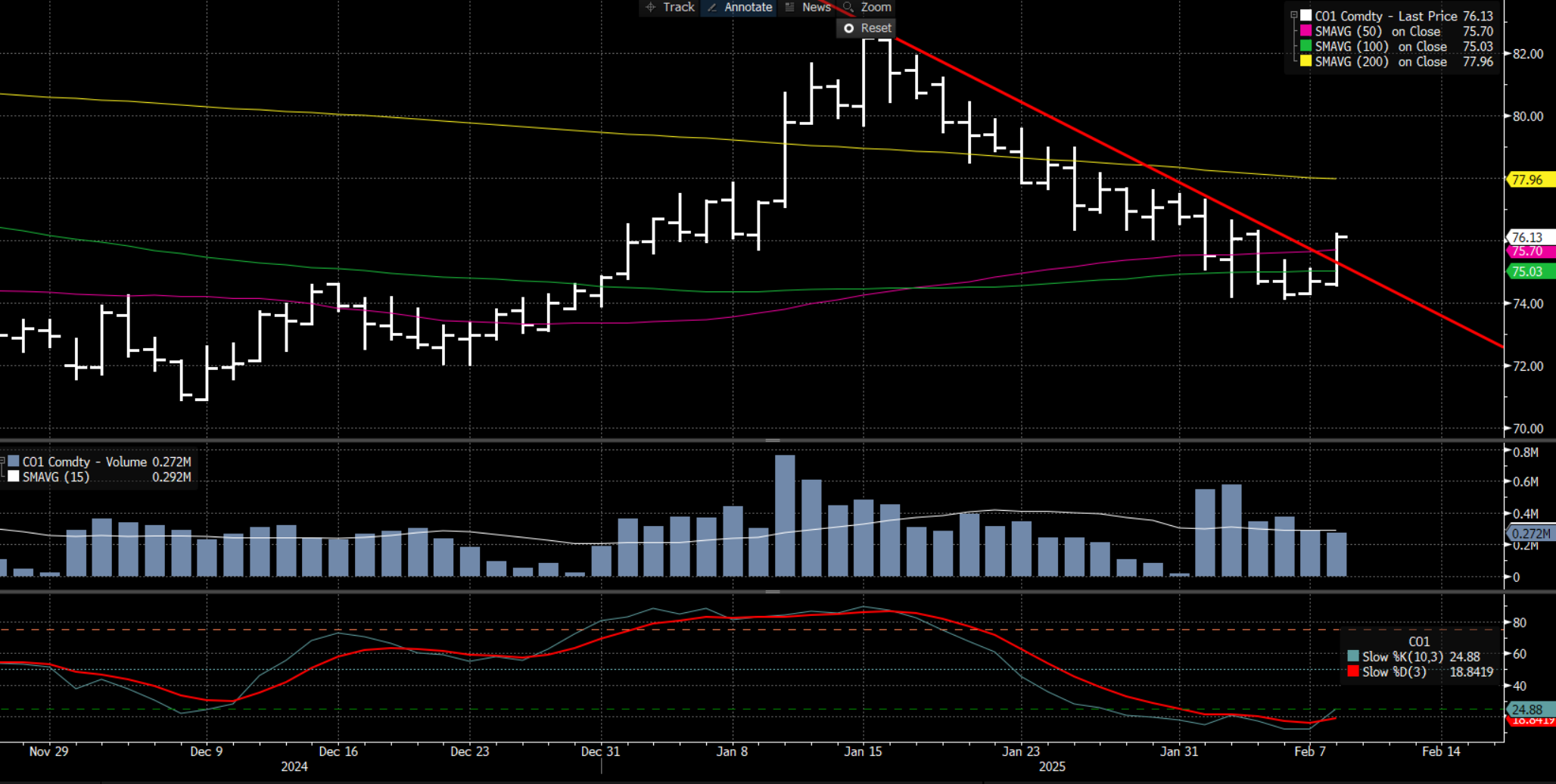

Crude Oil Breaks Downtrend as Brent Targets Key Resistance Levels

Increasing substance on tariff news, as well as Trump's strong rhetoric on the hostage situation has been digested well by the crude markets, with traders refraining from altering positions, as has been the case in the USD and US equity futures.

Of course, tariffs do have the capacity to impact demand for crude over time, which would have implications for future OPEC+ output decisions and could feasibly see the group further extended the current production quotas – however, attempting to model the impact on what we currently know, or what we don’t know remains a sizeable challenge, and given the Trump has shown a willingness to negotiate and to limit frictions, the visibility to act in the crude market is still low to really do anything in size.

Given the technical break of the downtrend, I see a high probability that price may by choppy in the near-term - that said, a push above the day's high of $76.23 (brent) and with the bearish momentum flipping, would likely see those sitting in profitable shorts look to further cover, increasing the risk of a push to the 200-day moving average at $77.96.

Tomorrow's US CPI release and the weekly DoE crude inventory report also pose risk to the crude market.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.