- English (UK)

FX Outlook: How a Fed cut could send dollar higher

The third week of September will be another lively one for currencies. At the beginning of the month, breakouts turned into early trends for the Australian, New Zealand and Canadian dollars. Last week, big moves were seen in euro, sterling, Canadian dollar and Japanese yen. This week, we expect breakouts and wild swings for all of the major currencies, with the Federal Reserve set to lower interest rates for the second time this year.

While the decision is widely anticipated, the Fed’s guidance could be very different from what the market expects. The Bank of England, Bank of Japan and Swiss National also have monetary policy meetings. Add to that the closure of Chinese markets for Mid-Autumn holiday, and they can add up to significant volatility for currencies. USD/JPY is trading strongly ahead of the monetary policy announcement, but the greenback is weaker against other majors.

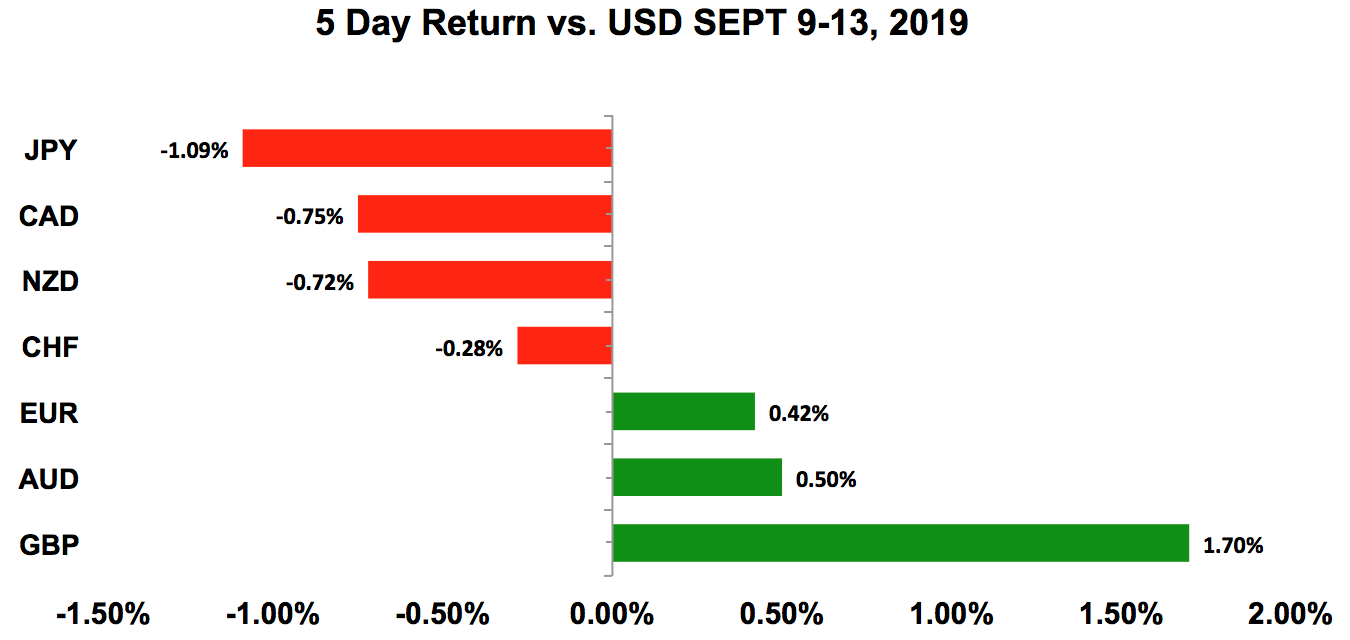

Last week, the US dollar traded higher against the Japanese yen, Canadian and New Zealand dollars. But the greenback also experienced losses versus sterling, the Australian dollar and euro. Considering that the FOMC meeting is on Wednesday, we expect quiet trading the first half of the week followed by a ramp-up in volatility post-FOMC.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- Producer price index 0.1% vs 0% expected

- Producer price index ex food and energy 0.3% vs 0.2% expected

- Consumer price index 0.1% vs 0.3% expected

- Consumer price index ex food and energy 0.3% vs 0.2% expected

- CPI YoY 1.7% vs 1.8% expected

- Retail sales 0.4% vs 0.2% expected

- Retail sales ex autos and gas 0.1% vs 0.2% expected

- University of Michigan consumer sentiment index 92 vs 09.8 expected

Data preview

- FOMC rate decision: 25bp rate cut widely expected, but guidance may not be that dovish

- Bank of Japan rate decision: no changes are expected, outlook should be dovish

- Empire State manufacturing index and industrial production: likely to be weighed down by trade tensions

- Housing starts and building permits: prospect of lower rates should support housing

- Philadelphia Fed index: will have to see how Empire State fares, but likely to be lower given trade tensions

- Existing home sales: prospect of lower rates should support housing

Key levels

- Support 107.00

- Resistance 109.00

USD: will the Fed disappoint?

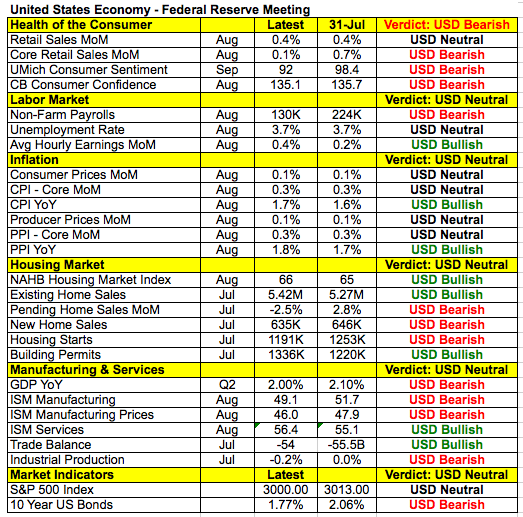

This week’s Fed monetary policy announcement is one of the most important events of the month. According to Fed fund futures, the market completely discounted a quarter point rate cut and sees a 70% chance of a second move before the end of the year. Interestingly enough, these odds shifted lower over the past week because prior to that the market was pricing in 100% of two rate cuts before the end of the year. Part of this has to do with stronger inflation and consumer spending numbers, but some economists feel that by easing aggressively, the European Central Bank reduces the pressure on the Fed to do the same, especially if they effectively avoid a deep, prolonged recession. Whether that’s true remains to be seen, but in the immediate future, how the dollar trades for the days and weeks ahead will be determined by the tone of Fed Chair Jerome Powell’s press conference.

US dollar bears could be setting up for disappointment because everything we heard from Fed officials suggests that they’re reluctant to ease. Earlier this month, rate cut expectations soared when Powell said there are significant risks to the economic outlook, and they’d act appropriately to sustain expansion. In that speech, however, he also described the economic outlook as favourable and said the economy continues to perform well and the labour market is strong. A quarter point cut will be coming because the Fed is “conducting policy in a way to address risks,” according to Powell. But he could repeat the mantra that the economy is in a “good place.” Over the past few weeks we’ve highlighted the long list of US policymakers who casted doubt on the need for easing. If the Fed remains optimistic, the dollar will rise. This includes FOMC voter Eric Rosengren who said, “No immediate Fed action is needed if data stays on track.” FOMC voter John Williams also feels that the baseline for the economy is continuing strong growth, and he won’t prejudge the outcome of the September meeting. Since July, consumer spending slowed but inflation is steady and service sector activity accelerated.

Come Wednesday, if the FOMC statement or Powell’s press conference oozes of optimism, the US dollar will rally even if the Fed lowers interest rates. If the decision to cut isn’t unanimous and two or more members vote to keep rates steady, we could see USD/JPY make a run for 110.

EURO

Data review

- ECB cuts interest rates and rolls out major stimulus package

- German trade balance 21.4bn vs 17.4bn expected

- German current account balance 22.1bn vs 16.4bn expected

- EZ industrial production -0.4% vs -0.1% expected

- EZ trade balance 19bn vs 17.5bn expected

Data preview

- German and EZ ZEW survey: ECB easing and equity recovery will help sentiment, but economy weak

- EZ CPI revisions: revisions are difficult to predict, but changes can be market-moving

- Swiss National Bank rate decision: no changes are expected, outlook should be dovish

Key levels

- Support 1.0900

- Resistance 1.1100

Why euro soared after massive ECB easing

The ECB went above and beyond last week in rolling out a massive stimulus package. Their actions reflect their commitment to mitigating recession. Among other things, they lowered interest rates, dropped their calendar guidance, and restarted bond purchases. They also reduced their inflation and GDP forecasts for 2019 and 2020. This package was more comprehensive than the market had anticipated, and when first announced drove EUR/USD down to 1.0927. According to ECB President Mario Draghi, their actions were prompted by three elements — a more marked slowdown in the eurozone economy, the persistence of downside risks, and their baseline scenarios that included downward revisions to all of their inflation projections. However, instead of extending its losses below 1.09, EUR/USD reversed sharply after Draghi’s press conference to trade well above 1.10.

Five-part ECB September stimulus package:

- Interest rates cut by 10bp to -0.5%

- ECB dropped their calendar guidance

- Restarted bond purchases

- Changed their TLTRO rate to eliminate 10bp spread, and provide more favorable bank lending conditions

- Introduced a two-tier reserve system that’d exempt part of bank holdings from negative rates

There are at least three reasons for the turnaround in the euro. First and foremost, Draghi called on governments to go big with fiscal stimulus. He said “reform implementation must be stepped but substantially” to raise long-term growth potential. The central bank has long felt that monetary stimulus alone won’t be enough. And by doubling down on a massive stimulus package he’s put the ball in their court. With his bold curtain call, Draghi is taking the problem of low growth seriously and saying now’s time for the governments to act. Euro also U-turned on the hope that the stimulus will work, as the promise of unending QE should go a long way in boosting the economy. The market also thinks that all of this guarantees a rate cut from the Fed this week, and the prospect of Fed easing is bullish for EUR/USD.

Three reasons for euro recovery:

- ECB lays on fiscal stimulus pressure

- Unending QE will have positive impact on the economy

- ECB actions guarantee Fed cut next week

Looking ahead, we believe the ECB’s actions will mark a bottom for EUR/USD. Christine Lagarde takes over as head of the ECB in November and, like Draghi, she’s a big supporter of fiscal stimulus. The difference between Draghi and Lagarde is that she’s more politically rooted and could have a greater influence on Germany. If the eurozone existed in a silo, we’d declare this a sustainable bottom for euro. However, US President Donald Trump made it very clear that he isn’t happy the ECB is “weakening the euro.” So, we need to be mindful of the risks, including retaliatory actions from the US (such as tariffs) and Brexit.

BRITISH POUND

Data review

- July GDP 0% vs -0.1% expected

- Industrial production 0.1% vs -0.3% expected

- Manufacturing production 0.3% vs -0.3% expected

- Trade balance -9.1bn vs -9.5bn expected

- Jobless claims 28.2K vs 19.8K previous

- Average weekly earnings 4% vs 3.8% expected

- ILO unemployment rate 3.9% vs 3.9% expected

- RICS House Price Balance -4% vs -10% expected

Data previews

- Bank of England rate decision: no changes expected until there’s clarity on Brexit

- Consumer and producer price index: potential upside surprise given rise in manufacturing and services prices

- Retail sales: potential downside surprise given drop in spending, according to British Retail Consortium

Key levels

- Support 1.2300

- Resistance 1.2600

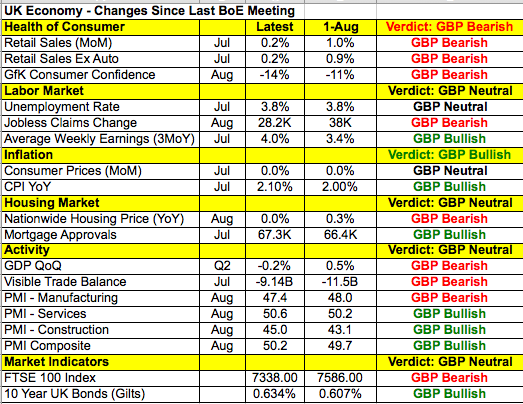

Sterling is up nearly 500 pips in September

The best-performing currency last week was the British pound, which broke through 1.24 for the first time since July. In less than a month, sterling gained nearly five cents versus the US dollar. While the news flow on the Brexit front remains confusing, with UK papers reporting that Democratic Unionist Party is willing to compromise on the Irish back stop issue — a major concession that’d make the current Brexit deal much more likely. However, DUP officials quickly denied the report, reaffirming their stance that Northern Ireland should remain under the UK rather than European Union economic rules.

Still, the market took the report as sterling positive, on the assumption that some sort of deal will be done. It's becoming clearer by the day that there’ll be no further concessions by the EU. For those in the UK who want to achieve Brexit, the only way to do a deal is to accept the open border between the Republic of Ireland and Northern Ireland. Otherwise, UK Prime Minister Boris Johnson's reckless gambit of taking the UK out of the EU without a deal will most likely result in full rebellion and a second referendum that could squash Brexit forever. So, for those Brexiteers who want to, above all else, leave the regulatory framework of the EU and create a low-tax jurisdiction in the UK, ditching DUP support — or perhaps somehow buying off their opposition to the deal — is the easiest path to ensuring that Brexit gets done. Northern Ireland is more of a nuisance rather than a true strategic concern for the majority of Brexiteers who simply want England out of the EU.

Although there’s strong opposition to Brexit within the UK, the biggest segment of the population appears to simply want to "get on with it" one way or the other. Johnson's Brexit allies therefore may have made the hard calculus that the Northern Ireland backstop should be sacrificed to get the Brexit deal done. Whether all of this Machiavellian manoeuvring results in a deal remains to be seen. But for now, the market believes that it’ll, and GBPUSD is responding accordingly. Until there’s a resolution, the Bank of England that meets this week will keep policy unchanged. With improvements and deterioration in the economy since the last meeting, there’s little urgency to ease.

AUD, NZD, CAD

Data review

Australia

- Home loans 4.2% vs 1.5% expected

- NAB Business Conditions 1 vs 3 previous

- NAB Business Confidence 1 vs 4 previous

- Westpac Consumer Confidence 98.2 vs 100 previous

- Consumer inflation expectations 3.1% vs 3.5% previous

New Zealand

- Manufacturing activity Q2 -0.7% vs 0.8% previous

- Card spending total 1.3% vs. -0.2% previous

- Food prices 0.7% vs 1.1% previous

- REINZ house sales -6.1% vs 3.7% previous

- Business PMI manufacturing 48.4 vs 49.1 previous

Canada

- Housing starts 226.6K vs 212.5K expected

- Building permits 3% vs 2% expected

- New housing price index -0.1% vs 0% expected

Data preview

Australia

- RBA minutes: minutes should show cautious but optimistic Reserve Bank of Australia

- Employment report: stronger employment conditions in services and construction offset by weakness in manufacturing

New Zealand

- PMI services: potential upside surprise given small uptick in manufacturing conditions

- Q2 GDP: stronger trade balance offsets weaker retail sales in Q2

Canada

- Existing home sales: should be stronger given rise in housing starts and building permits

- Consumer price index: potential downside surprise given sharp drop in price component of IVEY PMI

- Retail sales: should be stronger given robust labour market conditions

Key levels

- Support AUD .6800; CAD 1.3200; NZD .6350

- Resistance AUD .7000; CAD 1.3350; NZD .6450

AUD holds onto gains on US-China goodwill gestures

The Australian dollar held onto its gains last week while the New Zealand and Canadian dollars traded lower. These moves had nothing to do with data because business and consumer confidence in Australia declined while inflation expectations eased. In New Zealand, manufacturing activity improved. In Canada, housing data beat expectations. The main focus for AUD and NZD continues to be US-China trade relations. As the rhetoric between the US and China eases and goodwill measures are taken, there’s growing speculation that a trade deal could be reached. The US decided to postpone the increase in tariffs from October 1 to October 15, and in response China announced plans to exempt US pork and soybeans from new tariffs. Towards the end of last week, there was a lot of talk of an interim deal. While the US President is open to the idea, it isn’t clear how serious he’s considering it because he prefers a broader deal, saying: ”There’s no easy or hard. There’s a deal or there’s not a deal. But it’s something we’d consider, I guess.” Aside from trade headlines, there’s a lot of market-moving data that could affect how the commodity currencies trade, including Australia’s employment report, Q2 GDP from New Zealand, Canadian CPI and retail sales.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.