- English (UK)

FX Outlook: Brace for a big month in FX

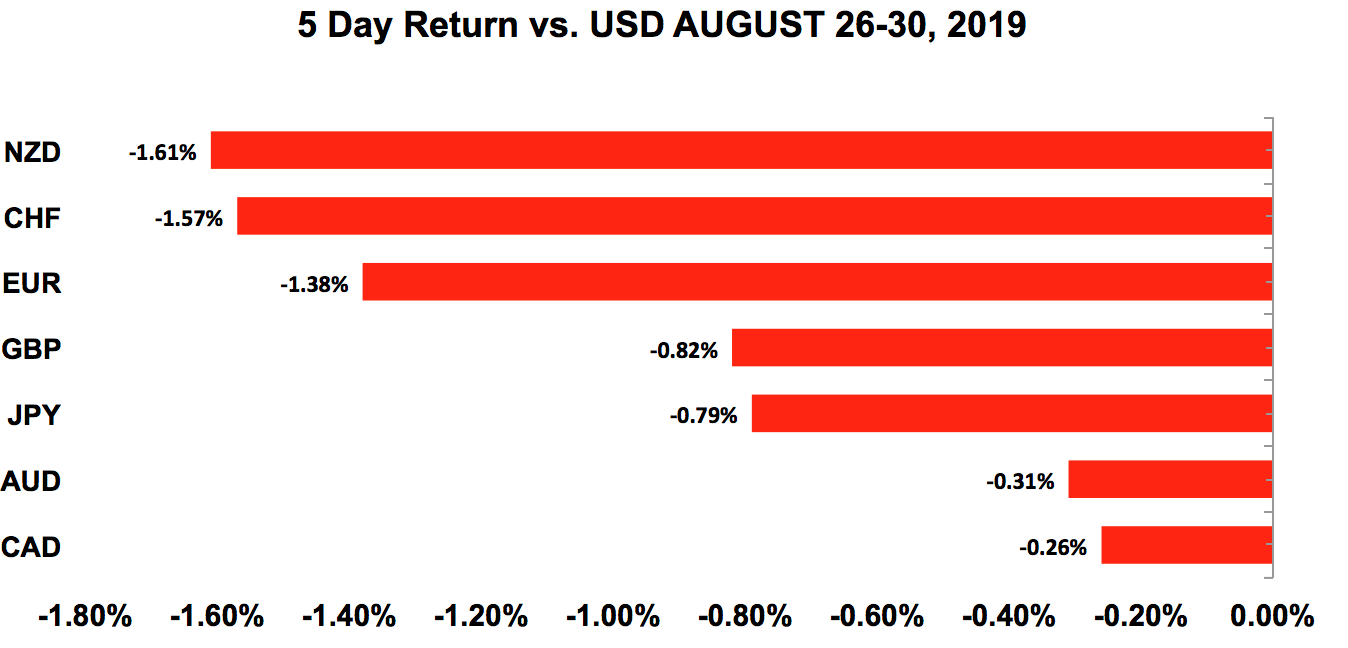

Despite US President Donald Trump’s repeated efforts to talk down the US dollar, the fact that the trade-weighted dollar index ends the month near two-year highs tells us that the greenback is strong. The Australian and New Zealand dollars weakened the most in August, as money flowed into the Japanese yen and Swiss franc. These moves are consistent with the selloff in stocks at the start of the month and a general sense of risk aversion. As we look to the month ahead, concerns about recessions and the unpredictable relationship between the US and China, along with the rapidly changing dynamics of political manoeuvring in the UK, are all things that could trigger big moves in currencies. There’s also internal conflict within many central banks on whether further easing is needed. The actions they take or guidance they provide in September will have a profound impact on FX.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- Durable goods 2.1% versus 1.2% expected

- Durable goods ex transportation -0.4% versus 0% expected

- S&P house prices 0.04% vs 0.1% expected

- Consumer confidence index 135.1 vs 129 expected, present stronger, expectations lower

- Q2 GDP revisions 2% vs 2% expected

- Q2 GDP price index 2.4% vs 2.4% expected

- Personal consumption 4.7% vs 4.3% expected

- Trade balance -72.3bn vs -74.4bn expected

- Pending home sales -2.5% vs 0% expected

- Personal income 0.1% vs 0.3% expected

- Personal spending 0.6% vs 0.5% expected

- PCE deflator 0.2% vs 0.2% expected

- Revisions to University of Michigan Consumer Sentiment Index 89.8 vs 92.3 expected

Data preview

- ISM manufacturing: potential upside surprise as Empire State index improved and Philly Fed index beat

- ISM non-manufacturing: service sector could be negatively affected by recession fears

- Non-farm payrolls: intensification of trade war, market selloff and recession fears could slow hiring

- Fed Beige Book: likely to be more cautious given recession fears

Key levels

- Support 106.00

- Resistance 107.00

How realistic is a Fed rate cut in September?

In many ways, nothing matters more to US-dollar traders than the potential for an interest rate cut this month. Fed fund futures are pricing in 100% chance of 25bp in September, and 80% chance of another move in December. With 10-year Treasury yields falling to two-year lows last week, bond investors are in sync with these expectations; however, currency traders aren’t. The US dollar is strong, with the greenback extending its gains against the euro, Japanese yen and Australian dollar last week. The dollar Index is trading at two-year highs. Last week’s economic reports were mostly better than expected with durable goods, consumer confidence and personal spending numbers beating expectations. Yet none of these reports are meaningful enough to affect the Federal Reserve’s outlook for the economy and monetary policy. This week’s reports, on the other hand, will.

While the market sees a cut in September as guaranteed, Federal officials have gone out of their way to downplay the need for easing. Fed Chairman Jerome Powell’s Jackson Hole speech last month was a big disappointment. He refrained from mentioning the possibility of easing and simply said they’re watching carefully to see how the US is impacted by the events since July. USD/JPY sold off because traders latched on to his warning that the economy faces “significant risks.” But if the Fed shared the market’s confidence in the need for easing, he’d have set expectations for a move. Also, recent comments from many policymakers (including as Federal Reserve Bank of Cleveland President Loretta Mester, Fed Bank of Boston President Rosengren, Fed Bank of Kansas City Esther George, Fed Bank of San Francisco Mary Daly, and Fed Bank of Philadelphia President Patrick Harker) suggest that they may not support another rate cut. Rosengren said the US is in a good spot right now and there’s no need to take action if their outlook stays on track. Daly said she supported the July cut but sees the labor market and consumer spending as strong. George seems to agree — she isn’t ready to provide more policy accommodation without seeing evidence of a slowdown.

The bottom line is that while President Trump and the market want the Fed to be proactive, US policymakers aren’t sold on the idea. That makes this week’s ISM and jobs reports so important. The Fed is data-dependent, so if service sector activity and job growth slow, they’ll need to give the market what they want. However, if the data beats, then we can’t rule out a surprise hold in September. USD/JPY rebounded last week after China came out with some encouraging rhetoric noting that it didn’t want to exacerbate the trade tensions and that it was preparing for bilateral meetings in September. The unpredictable relationship between the US and China makes it difficult to trust the rally unless one side starts to withdraw tariffs.

AUD, NZD, CAD

Data review

Australia

- Building approvals -9.7% vs 0% expected

New Zealand

- Trade balance -685m vs -254m expected

- ANZ Business Confidence -52.3 vs -44.3 previous

- ANZ Consumer Confidence 1.5% vs -5.1% previous

- Building permits -1.3 vs -3.9% previous

Canada

- Q2 GDP 3.7% vs 3% expected

- June GDP 0.1% vs 0.2% expected

- Q2 current account balance $9.75bn expected

Data preview

Australia

- RBA rate decision: recent comments from the Reserve Bank of Australia have been dovish, but data hasn’t been terrible

- PMI manufacturing: could be negatively affected by slowdown in China

- Retail sales: weaker numbers expected given sharp drop in retail component of PSI

- PMI services: will have to see how PMI services fare, but weaker conditions possible

- Q2 GDP: will have to see how retail sales fares, but trade balance was stronger

- Trade balance: potential weakness given slowdown in China

New Zealand

- No major data releases

Canada

- Trade balance: potential upside surprise given rise in IVEY PMI index in July

- Labour market report: Employment numbers are difficult to predict this month because IVEY was released after the data. Also, last month’s numbers were very weak, so an upside surprise is possible.

- IVEY PMI: potential downside surprise given market volatility

Key levels

- Support AUD .6700; NZD .6300; CAD 1.3200

- Resistance AUD .6800; NZD. 6400; CAD 1.3350

Will RBA and BoC signal easing?

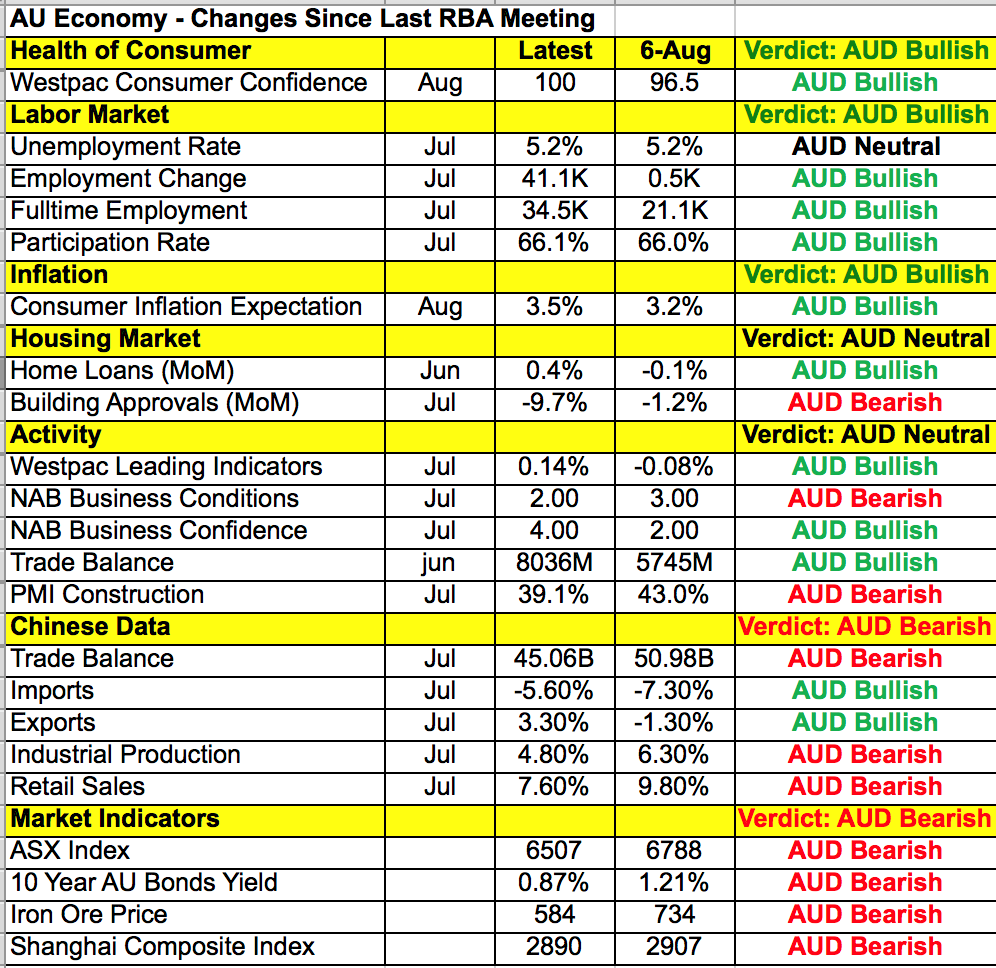

This is a big week for the Australian and Canadian dollars. The Reserve Bank of Australia and Bank of Canada have monetary policy announcements. While no changes are expected from either central bank, the market hopes that they’ll signal an intention to ease. Unlike the Reserve Bank of New Zealand and European Central Bank, which have been unambiguously dovish, the RBA and BoC are less inclined to act. At their last monetary policy meeting in August, the RBA shrugged off US-China trade tensions and said not only do they feel that the economy should return to trend growth next year, but Chinese stimulus will support Australia’s export sector. Since then, data validated the RBA’s positive outlook. The labour market improved in July, inflation expectations are up, business and consumer confidence increased and the trade surplus widened. This means that so far, all the concerns about weakness in China spilling over to Australia are unfounded. With that said, Australia can’t be immune to China’s troubles for much longer. Most of the Chinese tariffs have been on commodities, with the result that food prices in China are rising at an alarming rate just as growth is slowing, which will no doubt squeeze the Chinese consumer going forward. Last week, RBA Deputy Governor Guy Debelle admitted that threats to the world are “significant risks” to Australia, and their lower bound in rates (0.25% - 0.5%) are similar to their overseas peers (Australia’s rate is currently 1%). This implies that despite recent data improvements, Australia is warming to the idea of lowering rates again and if they make this clear, AUD/USD could fall to fresh 10-year lows. If they remain neutral, we’ll see an initial squeeze higher. But the sustainability of the rally hinges on GDP, trade and PMI.

US-China trade headlines will also have a significant impact on the Australian and New Zealand dollars. The relationship broke down completely two weeks ago, but over the past week soothing rhetoric is coming from both sides. Trump talked about productive “calls” with China, and China said they didn’t want to escalate trade tensions and are preparing for bilateral meetings this month. Of course, the standoff between China and the US remains fluid and still highly unpredictable given the mixed messages this summer. But the conciliatory tone out of Beijing suggests that there’s a growing internal pressure to ease the conflict as the economic burden is clearly starting to take its toll. While markets hold out hope that the war of attrition between China and the US may have finally pushed both leaders to consider a more flexible negotiating posture, we advise traders to remain sceptical until one side suspends tariffs and, ideally, a trade deal is signed and delivered.

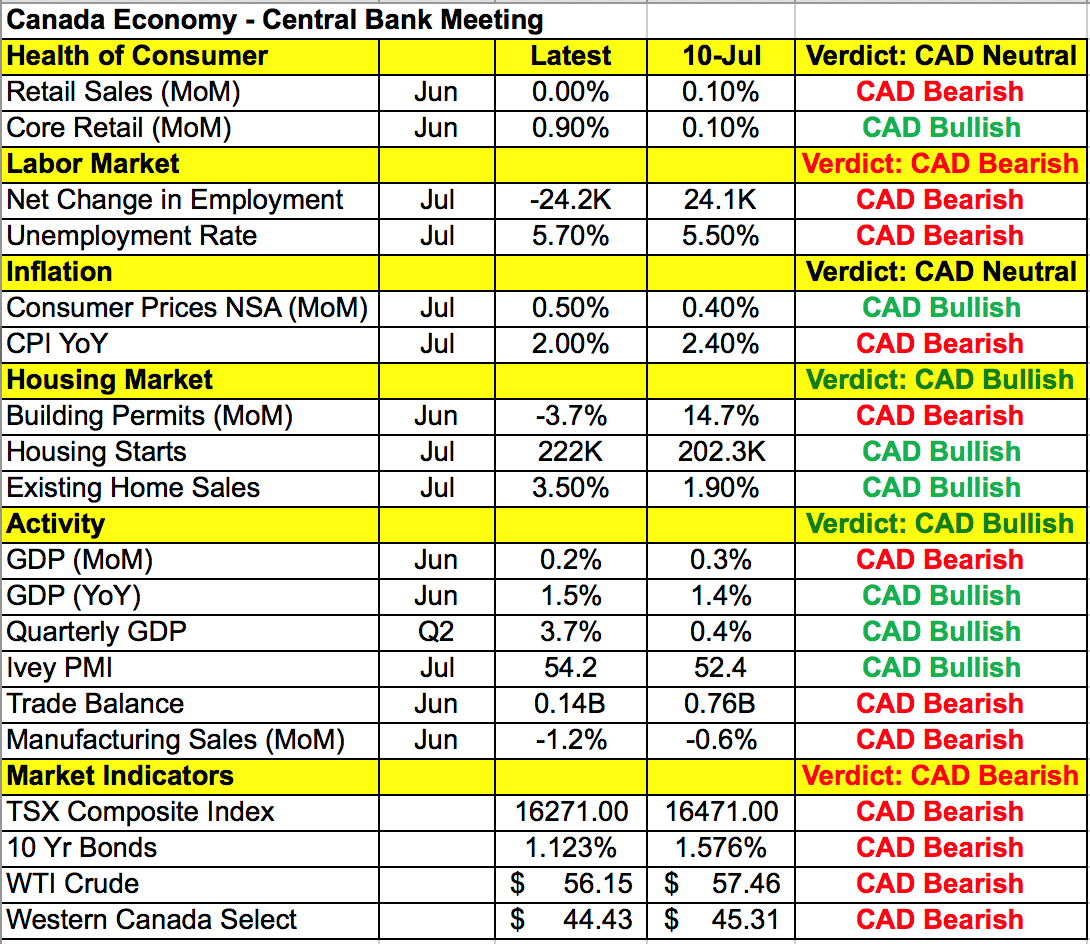

The Bank of Canada is also sitting comfortably on the sidelines, but the market is pricing in 75% chance of a rate cut before the end of the year. Data from Canada hasn’t been terrible, but we’re beginning to see initial signs of weakness. Retail sales stagnated in July, but ex autos spending was strong. Labour market conditions weakened, but this week’s employment report should show an improvement. Inflation hovers around the central bank’s target, and manufacturing activity is steady. With that said, a lot has changed since their policy meeting in July and, like Australia, Canada isn’t immune to US and China troubles. Expectations are building for a dovish BoC statement this week, and if the BoC hints of a rate cut, USD/CAD will break out of its three-week-long range and make a run for 1.34. However, if they keep their outlook unchanged, the relative strength of Canada’s economy compared to the rest of the world should drive USD/CAD below 1.32.

EURO

Data review

- German IFO Report 94.3 vs 95.1 expected

- Q2 GDP unrevised at -0.1%

- GE unemployment rate 5% vs 5% expected

- GE unemployment change 4K vs 4K expected

- EZ economic confidence 103.1 vs 102.3 expected

- GE CPI -0.2% vs -0.1% expected

- GE CPI YoY 1.4% vs 1.5% expected

- GE retail sales -2.2% vs -1.3% expected

Data preview

- EZ PMI revisions: revisions are difficult to predict, but changes can be market-moving

- EZ retail sales

- German industrial production: will have to see how factory orders fare

- EZ GDP revisions: revisions to GDP are difficult to predict, but changes can be market-moving

Key levels

- Support 1.0900

- Resistance 1.1100

Euro breaks 1.10 and hits two-year lows

Investors sold euros against the US dollar every day last week. There’s zero demand for euros because every piece of incoming data signals that a recession is coming. According to the latest reports, German retail sales fell, business confidence is lower, inflation is easing, and job losses were reported for the fourth month in a row. Last month Germany’s central bank the Bundesbank said they could fall into a technical recession in Q3. Growth has been weak for the past year, with the economy growing only one out of the last four quarters. The drop in retail sales report indicates that the manufacturing recession in Europe's most important economy is starting to spread into consumption. Pessimism is deepening and, based on the region’s economic outlook alone, there’s very little reason to be long euros.

EUR/USD broke below 1.10, dropping to its lowest level in two years. Although further losses are possible, the currency pair is deeply oversold and the risk of tariffs on Europe diminished after the G7 Summit. Italy’s political situation appears to have turned a corner, as well. Two weeks ago, Italy’s prime minister resigned and called for snap elections. On Thursday he rose victorious when he was chosen to lead the new coalition. In the last government, Giuseppe Conte was overshadowed and pressured by his deputy Matteo Salvini. With Salvini’s downfall, the hope is that Conte II will be able to lead a “more united, inclusive” Italy.

BRITISH POUND

Data review

- No major economic reports

Data previews

- PMI manufacturing: potential upside surprise given rise in CBI index

- PMI services and composite: will have to see how PMI manufacturing fares, but softer numbers likely given Brexit and market uncertainty

Key levels

- Support 1.2000

- Resistance 1.2200

BoJo suspends Parliament, GBP in trouble

The biggest story in the UK right now is Brexit. With each move made by Prime Minister Boris Johnson, the country is getting closer to leaving the EU with no deal. Last week Johnson had the Queen approve a plan to suspend Parliament until October 14. Johnson argued that the move — which wouldn’t allow Parliament to return until the Queen's speech on that date — was ostensibly about working through in the domestic agenda. But the primary effect was to cut off any attempts by MPs who oppose the no-deal Brexit to pass any legislation that would hamper the prime minister’s actions. Several analysts have pointed out that this action will almost certainly result in a no-confidence vote and will, therefore, cause early elections. One of the scenarios bandied about is that even under a no-confidence vote, Johnson will dissolve Parliament and simply hold an election between November 1 and 5 — past the Brexit deadline, thus effectively forcing a default Brexit. Such a move, however, is almost certain to find challenges and at a very minimum is likely to see Article 50 suspended for another six months, thus providing an extension to negotiations.

Still, given the rapidly changing dynamics of political manoeuvring and the very short timeline, there’s every possibility that a no-deal Brexit could take place if the Opposition fails to muster an effective legal challenge. One of the factors in Johnson's favour is that he’s blessed with an extremely weak opponent in the form of Jeremy Corbyn, who looks more hapless with each day’s passing. It's precisely due to this disarray that Johnson's gambit may succeed. For now the markets remain clearly nervous but not panicky. Cable dropped through the 1.2200 level but is finding support near the figure. Generally, the broad market bet remains that UK and EU will come to some sort of compromise that will involve a customs union. But if a no-deal Brexit becomes the likely outcome, sentiment will shift rapidly and Cable could quickly tumble to 1.2000 and below.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.