- English (UK)

Analysis

When many other G10 central banks are already priced for an extended pause, the Fed potentially going again in November is supporting the USD.

EU CPI garners interest, where a weaker print could see increased expectations the ECB go on an extended pause, with EURUSD possibly breaking trend support. China remains front and centre – we’ve seen a slight improvement today in China July industrial profits (-15.5% vs -16.8% in June) but now we look at PMI data, as well as headlines on fiscal support/yuan funding costs/property company solvency.

It seems clear that the US exceptionalism story hasn’t gone away – the US remains the best house in the street and the USD is favoured higher. GBPUSD is breaking down, and I favour shorts here, with EURUSD to be sold on rallies or through trend support. The MXN is the powerhouse, with EURMXN biased further lower.

Tactically, I like equity lower, but the set-ups and flow aren’t there at present, and I’d like the VIX index around 20% before having greater conviction on shorts. Gold remains focused on the USD and real rates, although XAUAUD and XAUJPY have been working for those wanting to take gold longs – buying any market in the perceived weakest currency can offer double bubble, although adding an FX leg to the trade can make life more problematic.

The marquee event risks for traders to navigate:

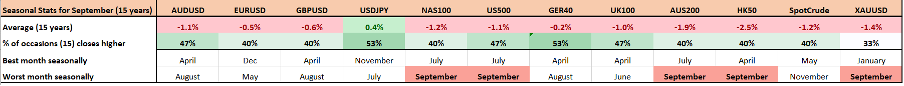

Month-end flows – Month-end rebalancing flows may influence price action this week, with sell-side banks suggesting these flows could support the USD. Looking forward and the seasonals, over the past 15 years, Sept is the worst month for US500, NAS100, AUS200, HK50 and gold returns. The DXY has rallied in the past 6 consecutive September’s. Let’s see if past performance is any guide this time around as we move past the US and EU/UK summer holiday period and the big hitters come back to their desks.

Seasonal factors – core markets

US core PCE inflation (31 Aug 22:30 AEST) – the consensus is eyeing headline PCE inflation at 3.3% yoy (from 3%), with base effects kicking in. Core PCE is expected at 0.2% mom & 4.2% yoy (from 4.1%). We await the Aug US CPI print on 13 Sept, where expectations are we see headline CPI rise to 3.6% (from 3.2%). While expectations are low for a September Fed hike, a hike in the November meeting is priced at 62% and the PCE inflation data may affect that pricing, with the USD may be sensitive to changes in interest rate expectations.

US nonfarm payrolls (1 Sept 22:30 AEST) – The consensus from economists sits at 168,000 jobs (the analyst's range sits between 230k to 120k), with the U/E rate eyed at 3.5% (unchanged). Average hourly earnings (AHE) are expected at 0.3% MoM/4.3% YoY. The 6-month payrolls average comes in at 223k and 12m average at 280k. The US 2-year Treasury is a big USD driver at present, and further moves in yield towards 5.11% would keep the USD bullish momentum going.

US ISM manufacturing (2 Sept 00:00 AEST) – the consensus is we see the index at 47.0 (from 46.4). Some improvement is therefore expected, but the manufacturing index is still likely to show contraction (below 50.0 is contraction). It’s hard to know if the market will run with this manufacturing data point, as its influence on volatility is rarely consistent. US rates markets see very little chance of a hike in the Sept FOMC, but 15bp for November, and this data point will unlikely alter that with inflation and jobs taking the limelight.

EU CPI (31 Aug 19:00 AEST) – The market sees EU headline inflation coming in at 5.1% (from 5.3%), core CPI eyed at 5.2% (from 5.5% in June). The market prices 9bp of hikes (a 36% probability) for the 14 Sept ECB meeting, and 18bp by December - this EU CPI print could impact this pricing. EURUSD finds buyers at trend support (drawn from the March lows), but rallies are to be sold in my opinion – with real risks EURUSD heads towards the May lows (1.0635).

Aus (monthly) CPI inflation (30 Aug 11:30 AEST) – The consensus is we see the monthly inflation read come in at 5.2% (from 5.4%). While we await the Q3 CPI on the 25 Oct, a 5.2% headline CPI print will reinforce expectations that the RBA sit on their hands at the 5 Sept RBA meeting, where the market currently prices no chance of a hike from the RBA at this meeting. We also get the July retail sales report on Monday (11:30 AEST) with expectations of a 0.2% increase MoM, but I wouldn’t expect this to result in AUD volatility unless it’s a big miss/beat. AUDUSD favoured lower for a re-test of 0.6360.

China Manufacturing and Services PMI (31 Aug 11:30 AEST) – The market looks for the manufacturing index at 49.1 (from 49.3), and services at 51.0 (51.5) – while transparency in the data flow is becoming more problematic for traders to price risk, this could be a key piece of data this coming week. Unless CNH forward points move higher again and traders lose positive carry in USDCNH longs, I like USDCNH higher on the week, although AUD could be a more effective play on China this week.

Banxico (Mexican Central Bank) inflation report (31 Aug 04:30 AEST) – In the August policy meeting Banxico guided inflation at 4.6% in Q423 and 3.1% in 2024. Core inflation is eyed at 5% in Q4. The market prices 6 rate cuts in Mexico over the coming 12 months. Despite expectations of easing, EURMXN has been a solid momentum short of late trading to the lowest levels since 2015. The MXN remains the standout major currency in 2024. MXNJPY has gained an incredible 23.1% in 2024.

Fed speakers – Barr, Bostic, Collins, Mester

BoE speakers – Ben Broadbent (27 Aug 02:25 AEST) & Huw Pill speaks (31 Aug 17:15 AEST)

RBA speakers – RBA gov Bullock (29 Aug 17:40 AEST)

BoJ speakers – Tamura (30 Aug 11:30 AEST) and Nakamura (31 Aug 11:30 AEST)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)

_(1).jpg?height=420)