- English (UK)

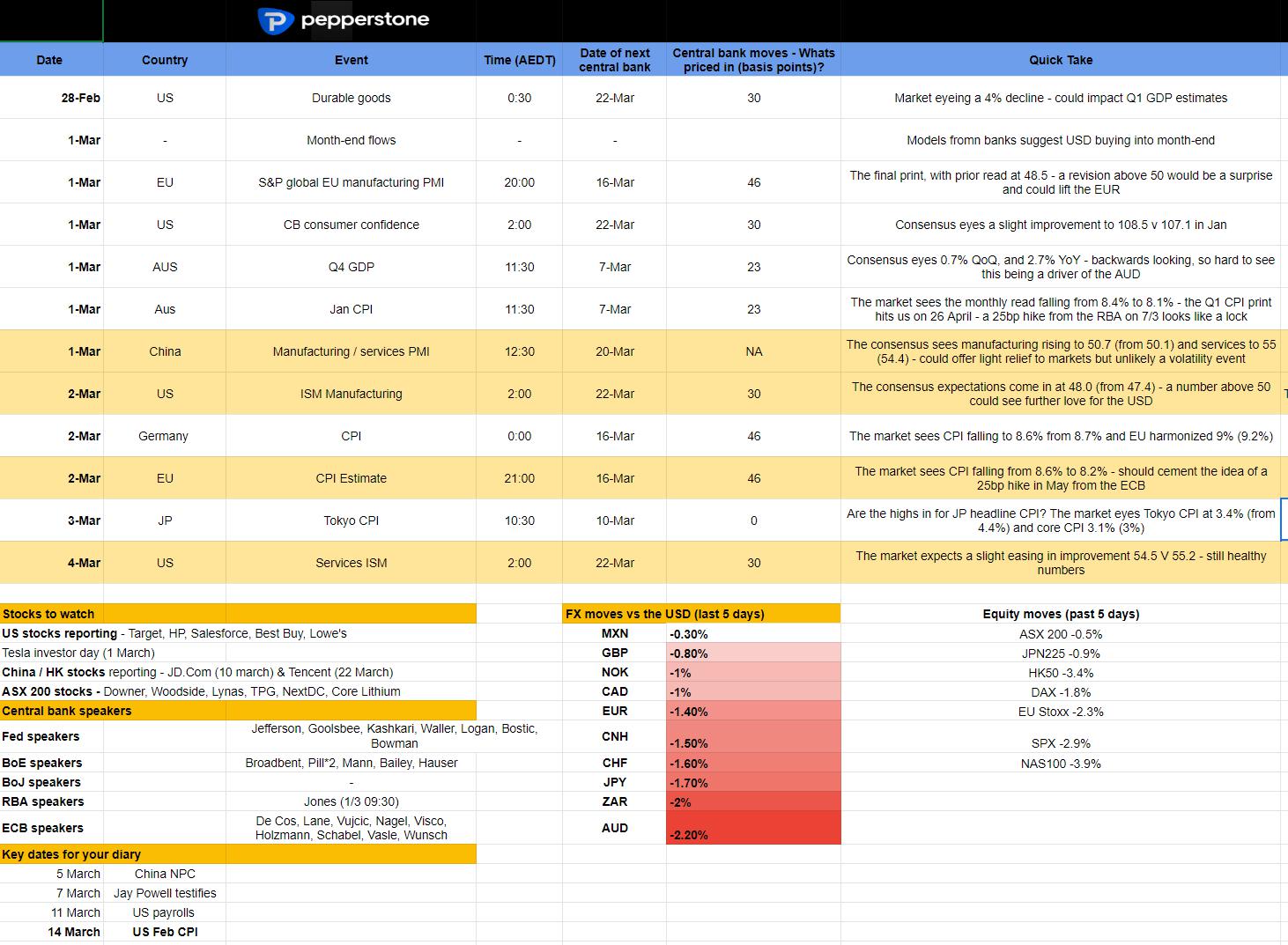

Rates and bond markets continue to get the lion’s share of attention – the US is always in the markets headlights, but this week we focus more intently on Europe, where we get flash CPI prints in France, Spain and Germany before the Eurozone brings it home on Thursday – market pricing has the ECB hiking by 50bp in both March and May (there is no April meeting), before a step down in June to 25bp – we reach a peak of 3.75% later this year.

Notably, we’ve seen upside breakouts in German, French and Italian 2-year govt bonds, and 5-yr debt is on a bearish trend. We’d need some punchy upside surprises in EU inflation to see terminal ECB pricing closer to 4% and the market is quietly confident on its peak pricing after the recent shift in expectations – for those prepared to listen, the raft of ECB speakers could influence, where speeches from ECB members Lane (28 Feb) and Schnabel (2 March) get the attention.

EURUSD has its eyes on the 6 Jan swing of 1.0481, where the trend looks decisively weak - I am neutral or selling bouts of strength, but the risks are still for a modestly stronger USD – I want price to close above the 5-day EMA to offer higher conviction on EURUSD longs. EURAUD and EURJPY have been the better way to express EUR longs, and with Tokyo CPI due this week and likely to fall, could this be the leading indicator for national CPI that validates both Kuroda and incoming gov Ueda’s dovish stance? Has headline inflation indeed peaked in Japan – watch JPY exposures, but EURJPY is eyeing a bullish break.

In the US growth is a more dominant theme in the data flow this week, with the ISM manufacturing and services data getting some focus – after the core PCE shock on Friday (+4.7%) we’ve seen peak pricing for US rate expectations move to 5.4% by Sept, and new cycle highs in US 2yr yields (at 4.81%), with a breakout in the trend in 5yr Treasuries too – US real rates (TIPS) are at the backbone of this and the move into 1.71% has largely been the factor supporting the USD, where the DXY has gained for 5 straight days (+1.3% WoW), while making it 4 weeks of gains in a row.

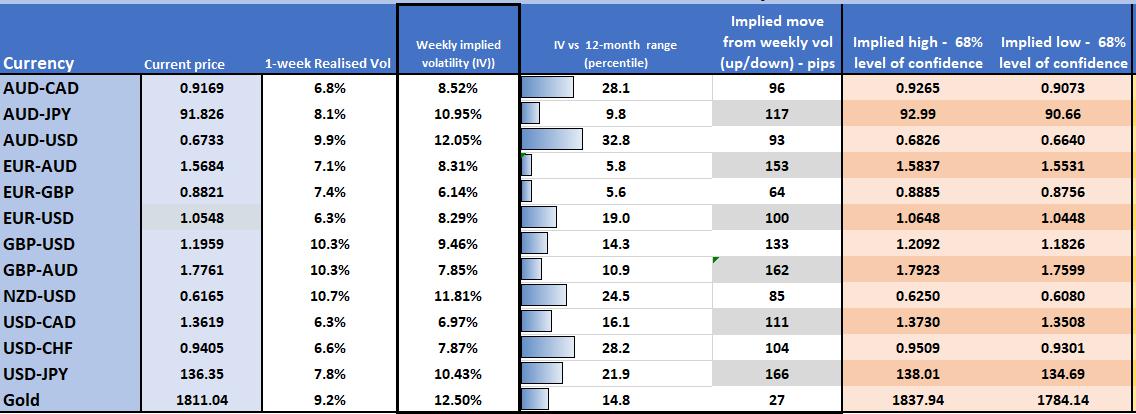

(FX and XAU 1-week implied volatility matrix)

Looking at FX 1-week implied volatility (derived from options pricing) we see expected moves in the USD pairs for the week ahead at subdued levels, and many are below the 20 percentiles of the 12-month range. Options traders are betting we get a grind in price rather than an explosive move – we’ll see, but it does suggest I can take stops in and define my risk profile accordingly – perhaps this vol structure is a function of increasing confidence that the repricing in rates has largely played and consolidation is the likely path.

Positioning is key here and it's worthy of note that the market is heavily short rates here, so further pushing up yields markedly could become tricky – USD longs in the insto world have risen but are not yet extreme, while Pepperstone clients now hold a decent core USD short position, believing in a turn around this week.

(AUDUSD daily – H&S in play)

AUDUSD was the weakest G10 FX pair last week, falling 2.2% and giving real structure to the head and shoulder pattern on the daily (target 0.6750) – while real money accounts still hold a decent long in AUD and that still could be reduced, many have pointed to AUDUSD beta vs equity indices, and notably, the HK50 which can’t find a friend and tests the 200-day MA – a simple overlap of the two variables suggests this to be true. However, I’d also be looking at USDCNH, where AUDUSD tracks the inverse. While AUD longs will be keen to see China PMI data show firm expansion for February, USDCNH is where to look, and the FX cross is in beast mode and eyes a test of 7.000 - where the USD appreciation in this FX cross is clearly resonating with USD buying in G10 FX.

Our equity flow beefed up on Friday, although the net position in US500, NAS100 and US30 continues to be neutral – there is a heavier skew in EU equity indices, with 68% of open positions in the GER40 held short now. The NAS100 also sits on the 200-day MA, where a break suggests shorts for 11,600. The US500 also needs to find inspiration from somewhere and one feels like it needs to come in the form of weaker inflation data – perhaps lower EU/Japan CPI prints could hold some sway this week Perhaps, but there are real risks EU CPI surprises to the upside. Tesla’s investor day could also be a focal point, but for the index to find a better trend then we need Apple, Alphabet, Microsoft, and Amazon to head higher.

The clouds of uncertainty remain with us – the market’s consensus view that inflation would head lower through the year has clearly been challenged and this has seen a repricing in rates and short-end bond yields – the USD has been a place of refuge while chipping away at shorts in equity markets and gold has worked – more of the same this week?

What’s on the calendar this week?

*if this doesn’t come out well on email, click on the Twitter link

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.