- English (UK)

Analysis

The 6 July RBA meeting playbook – will the RBA meet the markets aggressive rate hikes schedule?

All things equal, I feel the RBA’s actions would be slightly AUD positive, although these actions should be more than offset by the current aggressive interest rate pricing. Therefore, taking this into account, I see modest downside risks for the AUD on this ground and the question then becomes, will the RBA meet the timetable priced by the rates markets?

While many clients trading the AUD, our AUS200 index or interest-rate sensitive equities (such as banks) typically hold positions for a matter of hours, many for minutes, it’s time to put the 6 July RBA meeting on the event risk radar.

From a financial markets psychology perceptive we know there'll be many other factors affecting sentiment towards the AUD between now and 6 July - specifically US data, Fed speakers or news from China. However, domestic factors may play a more prominent role in influencing Australian-centric assets and when a consensus forms it can lead to herd-like behaviour where trends in price develop.

Given the RBA have made it clear they will make a significant announcement on monetary policy at this meeting it’s logical to think this meeting could be a volatility event. So depending on what is said it could form trending conditions, specifically in the AUD crosses (think AUDNZD and AUDCAD) and interest rate sensitive stocks, in this period ahead.

I will display the weekly implied volatility matrix on our Telegram channel tomorrow to show the expected movement over the meeting, but I expect it to lift as traders’ bet on volatility.

Trading considerations

Consider that the tradeable interest rate markets price in a hike of 15bp (from the RBA) by July 2022 with the cash rate expected to reach 1% (four rate hikes) by July 2024. While the Commonwealth Bank has garnered headlines with its call for the first RBA rate hike in November 2022, recent narrative from the RBA suggests current market pricing is too aggressive for a relatively dovish central bank, especially one that will likely end QE in 2022.

While the obvious risks are they will hike earlier than its guidance for 2024, from a pure interest rates pricing standpoint, the risks to AUD upside seem limited.

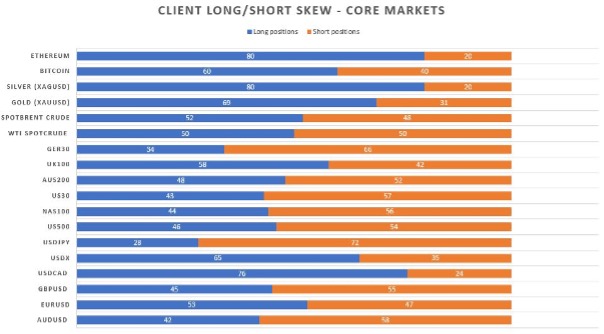

We also see positioning among clients modestly short of AUDUSD and expecting a grind lower. This is in-fitting with other commodity currencies such as NZDUSD and USDCAD. Conversely, we see hedge funds are long $1.9b AUDUSD futures (source: weekly CFTC report), but not at levels which suggest significant position risk going into the RBA meeting.

The key focal points?

The three key factors will be whether the RBA choose to:

- Given its current asset purchase program (QE) ends in September the market will be expecting an extension of the program – will it be extended by a set amount per month and over a defined duration or a more flexible approach?

- Change its 3-year Aussie government bond (ACGB) yield curve control (YCC) target from the ACGB April 2024 maturity to the ACGB November 2024?

- Offer clues on a preference for an interest rate hike before it allows its balance sheet to decline (bonds mature) and excess cash to exit the system, or will this happen concurrently?

On point 1, given the run of better economic data and the Federal Reserve turning somewhat more hawkish, the consensus is of the belief we see a more flexible approach to bond purchases adopted, with RBA extending the envelope for asset purchases by $50b to $100b over a six-to 12-month period – the pace of bond purchases could vary month-to-month depending on underlying economic conditions.

Others see an even more flexible approach, where the RBA would buy say $5b per week for an ongoing basis.

The market has discounted a new round of QE. Nuance therefore matters and the greater the flexibility to reduce (taper) the pace of asset purchases (depending on economic conditions), married with an optimistic outlook, could promote AUD buyers.

Recall, the RBA is capping the 3-year govt bond yield by purchasing the April 2024 maturity in unlimited size. So, on Point 2 it seems unlikely but not impossible, that we see the RBA roll its 3-year bond yield target from the April 2024 maturity to November 2024 – if they do change targets the AUD will be savaged 75-100 pips off the bat. Given interest rates pricing for 2024, if the RBA push out the target to the November 2024 maturity, it will signal they won’t hike until late 2024. A less flexible and more rigid framework will be a surprise and pit the RBA as the most dovish central bank of G10 central banks.

The consensus is that they'll maintain the current maturity target. If this is true, it would be modestly AUD positive and play into my view that they will look to exit YCC in 2022 and allow full price discovery in the bond market without having to cap bond yields.

On Point 3, this is perhaps not a theme for now. However, it will be the primary focus in early 2022 given the experience in the US in late 2018, where the markets forced the Fed to alter its program of rate hikes and liquidity reduction. Allowing cash (liquidity) to exit the system should be seen as a quasi-tightening of financial conditions and married with a lift in the cash rate will require a strong economy as they effectively double the tightening. Perhaps on balance we may see rate hikes while the RBA install measures to keep liquidity abundant.

Summary

So, certainly an event for the radar and one where trends may develop ahead of the meeting as these expectations form consensus – perhaps the AUD vs EUR, NZD and CAD are the best place to trade this.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.