- English (UK)

Learn to trade

Some basic information on GGP

Greatland Gold is a publicly listed exploration company with a key focus on tier-one gold and copper deposits. Greatland Gold share price is listed on the London FTSE AIM market under the ticker code of GGP. AIM is an acronym for Alternative Investment Market.

Greatland Gold GGP has a considerable retail base with the main attraction being the company’s asset in the world-class Havieron gold-copper deposit. This is in the Paterson region of Western Australia.

Latest news affecting GGP share price

On the 25thof August 2022, GGP share price devalued more than 7% on the news that it was to raise at least £25million through a private placing. The funds are being utilised to continue its development of the Havieron project. The placement was not offered to the retail marketplace.

Figure 1 Trading View GGP gap open

Precious metal ETFs

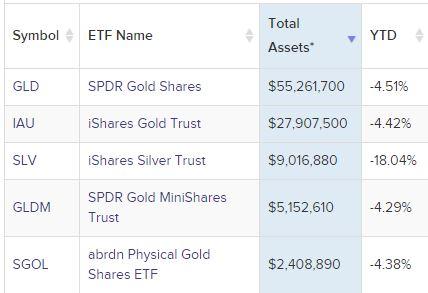

Let us look at the top 5 precious metals Exchange Traded Funds by total assets. Each shows a decline Year to Date of over 4%.

Figure 2 source: VettaFi ETF database 26/08/2022

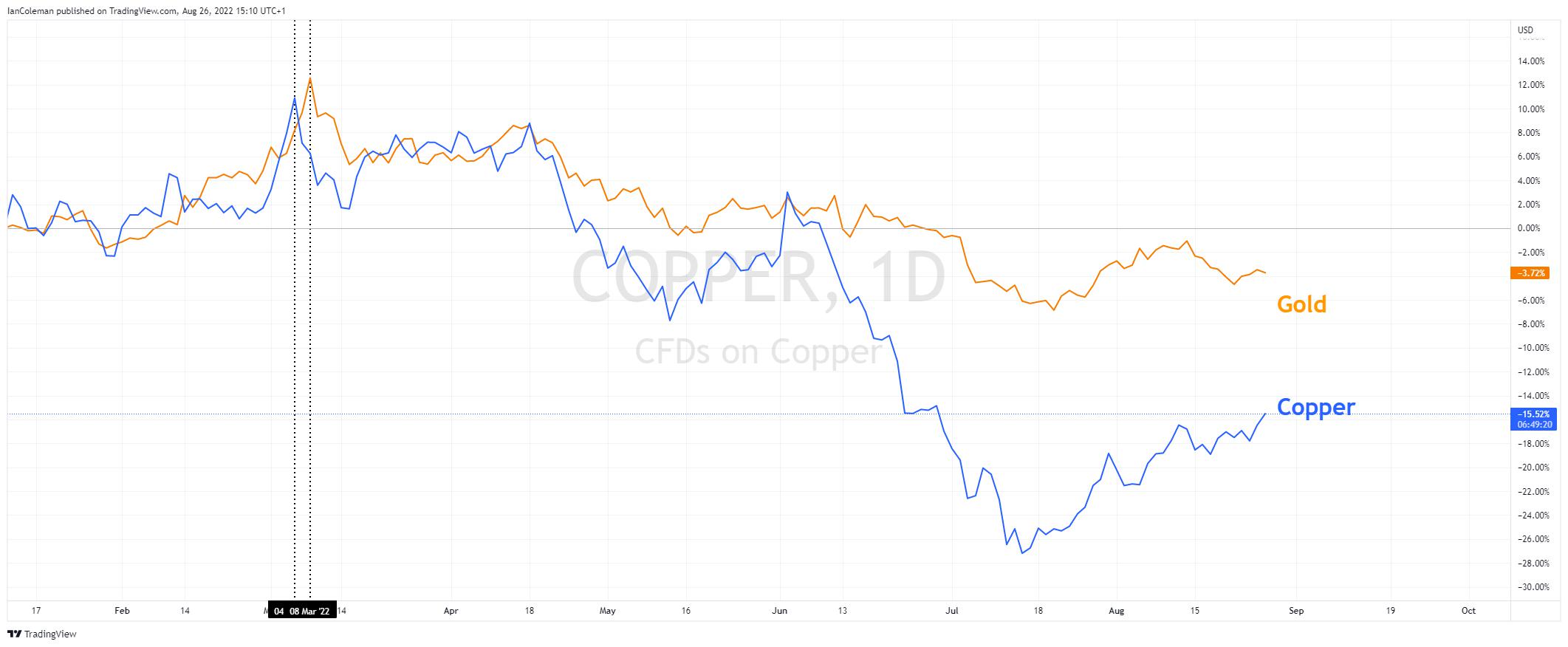

There has also been a notable decline in the price of spot Copper and spot Gold from the March 2022 highs.

Figure 3 Trading View Gold and Copper decline

A look for a technical analysis standpoint

GGP weekly price chart

GGP share price looks to be trading in a solid weekly downward channel. The base of the channel is located at 6.250.

Figure 4 Trading View GGP channel base

GGP daily price chart

The share has a 261.8% extension level at 6.265 (from 13.74 to 10.88). A move to this level and Elliott Wave enthusiasts might consider this to be the end of a 5-wave cycle. They would then look for a corrective move to the upside.

This offers a technical support area at 6.265 (261.8% extension) and 6.250 (trend line support).

Figure 5 GGP 261.8% extension

If you would like to learn more about technical analysis at Pepperstone, click here. Pepperstone offers competitive trading conditions on a vast range of products and through some of the most popular and powerful platforms in the world.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.