How to trade the Bank of Japan (BOJ)

Explore the significance of the Bank of Japan’s key policy decisions, their market impact, and effects on other central banks. Stay ahead by learning how to interpret BOJ statements and spot crucial trading opportunities and risks.

Why trade around BOJ meetings?

The Bank of Japan (BOJ) is one of the most influential central banks in the world, significantly impacting forex, stock markets, and bonds. Unlike other central banks, the BOJ follows ultra-loose monetary policies, including negative interest rates, massive bond-buying programmes, and yield curve control (YCC).

The BOJ meetings are widely followed because any change or surprise policy shift can lead to volatility, especially in the Japanese yen (JPY) and related assets. Understanding how the BOJ operates can help you anticipate market movements.

What is the BOJ meeting & why does it matter?

The BOJ holds monetary policy meetings (MPMs) to set interest rates, manage bond purchases, conduct ETF purchases and provide economic guidance. These meetings can impact not only the JPY but also broader market conditions, such as inflation expectations, global risk sentiment, and capital flows. The BOJ meets 8 times a year, roughly every 6 weeks, with the meeting schedule published in advance. You can monitor and track these dates to anticipate potential market volatility.

Where to find BOJ statements & press conferences

To stay informed about the BOJ statements and press conferences, you can utilise the following resources:

BOJ official website

Speeches and statements: The BOJ publishes official speeches and statements from its executives and policymakers. The latest updates can be found here.

Press conferences: Transcripts and summaries of press conferences held by BOJ officials are available here.

Financial news outlets

Reuters provides coverage of BOJ press conferences and policy decisions - Reuters BOJ Coverage.

Bloomberg offers live updates and analyses of BOJ announcements.

Economic calendars

Pepperstone's economic calendar lists upcoming BOJ press conferences and other significant economic events.

Market reactions and trading opportunities

How BOJ decisions affect different assets

BOJ decisions can have a significant impact on various assets, influencing currency values, stock markets, bond yields, and commodities, as these policy shifts affect investor sentiment and market expectations. The table below illustrates how different assets are typically affected by BOJ policy changes:

| Asset class | Impact of BOJ easing | Impact of BOJ tightening |

| Forex (USD/JPY, EUR/JPY) | JPY depreciates | JPY appreciates |

| Japanese stocks (Nikkei 225) | Stocks rally | Stocks decline |

| Bonds (JGBs) | Yields fall | Yields rise |

Which currency pairs are most affected by BOJ decisions?

The USD/JPY pair often serves as an indicator of broader market sentiment towards the yen. When the currency pair breaks through significant levels, like support or resistance, it tends to influence other JPY crosses, including EUR/JPY, GBP/JPY. For instance, if USD/JPY breaks above resistance, it suggests a selling of the yen, which could drive up other JPY pairs, as the weakening of JPY against the USD typically affects other cross pairs.

- USD/JPY -- The most actively traded JPY pair, highly sensitive to BOJ policy.

- EUR/JPY -- Moves based on ECB-BOJ policy divergence.

- GBP/JPY & AUD/JPY -- Affected by global risk sentiment and carry trades (borrowing in a currency with low interest rates and investing in one with higher rates, aiming to profit from the difference).

Specifically on AUD/JPY:

The AUD/JPY pair is a key indicator of global risk sentiment. The AUD, linked to commodities like metals and agriculture, rises during periods of economic growth as investors seek higher returns. Meanwhile, the JPY, widely viewed as a safe-haven currency, typically strengthens when markets are uncertain, as Japanese investors repatriate funds to a safe currency. As a result, the AUD/JPY pair generally climbs when risk appetite is high and falls when risk aversion increases, making it a valuable indicator of market mood.

Preparing for increased volatility

Preparing for increased volatility around BOJ meetings requires a strategic approach. Here are some strategies you can consider using to manage the potential market impact:

1. Stay informed about BOJ expectations

- Economic indicators: Monitor key economic data (e.g., inflation, GDP growth, unemployment) that could influence the BOJ's decisions. If the data suggests inflation is rising, there's an increased probability that the BOJ could tighten policy, leading to JPY appreciation and market adjustments.

- Market expectations: Consider market forecasts and analyst expectations leading up to the meeting. Tools like Fed Funds futures for the BOJ can give insights into how markets expect the BOJ to act (e.g., maintaining accommodative policy or tightening).

- Policy signals: BOJ's official statements or speeches from central bank officials often provide hints about future policy direction. Pay close attention to language that suggests a shift in stance, as that can lead to volatility.

2. Consider market sentiment and technical analysis

- Pre-announcement trends: Often, markets may 'price in' expectations ahead of the BOJ meeting. Use technical analysis to identify any key levels of support or resistance in major JPY pairs (USD/JPY, EUR/JPY) to guide decisions.

- Volatility indicators: Keep an eye on volatility indicators to gauge market sentiment and prepare for potential large moves.

- Monitor market reaction: Once the BOJ decision is announced, pay attention to how markets react. Sometimes, the immediate reaction may be a short-term knee-jerk move, followed by a reversal or consolidation, which could offer trading opportunities.

3. Post-meeting strategy

- Analyse the BOJ's statement and market reaction: After the meeting, assess the language used in the BOJ's statement and how the market reacts. Sometimes the actual decision is less important than the market's interpretation of the central bank's tone and forward guidance.

- Look for follow-through: After a large move in the JPY or other Japanese assets, watch for follow-through or a reversal. Market reactions can continue for hours or even days after the meeting, so it's crucial to track developments and adjust your strategy accordingly.

Historical examples of BOJ policy shifts moving markets

Over the past few years, several key policy shifts by the BOJ have had notable impacts on global markets. Here are a few examples:

1. Negative interest rate policy and asset purchases (2020)

Policy shift: The BOJ maintained ultra-low interest rates at -0.1% and expanded its asset-buying programme in response to the COVID-19 pandemic.

Market impact: The JPY weakened against major currencies, and global capital flows shifted to higher-yielding assets, pushing up equity markets and driving global liquidity.

2. Increase in ETF purchases (2020-2021)

Policy shift: The BOJ continued aggressive purchases of exchange-traded funds (ETFs) to stabilise and support the economy.

Market impact: This boosted Japanese equities and encouraged risk-on behaviour in global markets, supporting higher asset prices worldwide.

3. Yield curve control adjustment (July 2022)

Under YCC, the BOJ targets specific yields on government bonds to keep borrowing costs low and stable, using bond purchases to maintain those targets.

Policy shift: The BOJ allowed 10-year JGB yields to rise to +0.25% as part of a slight shift in its yield curve control policy.

Market impact: The JPY appreciated sharply, and global bond yields rose as investors adjusted expectations for future BOJ policy.

4. BOJ's steady policy amid global inflation (2022-2023)

Policy shift: The BOJ maintained its ultra-loose policy despite rising global inflation, leaving rates at -0.1% and continuing asset purchases.

Market impact: The JPY remained weak, contributing to USD strength, and global markets reacted to the policy divergence between the BOJ and other central banks tightening rates.

5. Potential shifts in asset purchases and inflation targeting (2023)

Policy shift: There was ongoing discussion of potential adjustments to asset purchases and inflation targets as Japan's inflation rose modestly.

Market impact: The JPY's weakness persisted, and global markets adjusted to Japan's differing approach to inflation, particularly in comparison to tightening actions by the Fed and ECB.

6. BOJ's ongoing ultra-loose policy amid global economic uncertainty (2025)

Policy shift: The BOJ's actions are expected to influence global markets as Japan continues to maintain its stance of monetary easing. Potential adjustments, such as new forms of intervention or subtle shifts in inflation targets, will be closely monitored by global investors.

Market impact: Any further modifications or extensions of BOJ policy in 2025 will likely continue to have a notable impact on global foreign exchange markets, especially regarding JPY and global bond markets.

Risk management trading strategies

What are the key risk factors when trading around BOJ events?

Trading around BOJ events carries risks such as unexpected policy shifts, currency volatility, and market misinterpretation of BOJ statements. Thin liquidity during announcements may amplify price swings, and changes in asset purchases or yield control can impact global bond yields. Geopolitical and economic factors, along with potential policy fatigue, may further increase market uncertainty.

How can traders manage overnight risk if the decision happens during off-hours?

Traders can manage overnight risk around a BOJ decision by using several risk management strategies:

- Use stop-loss orders to limit downside risk.

- Hedge to protect against large moves.

- Reduce position sizes before the event to minimise exposure

- Monitor overnight trading and price action in other markets.

Is it better to trade before or after the BOJ announcement?

Trading around the BOJ announcement involves different types of risk. Trading before the decision can offer the potential to catch sharp market moves in the immediate aftermath, but it also carries higher uncertainty. Therefore, this approach requires thorough preparation: analysing economic data, understanding market expectations, and closely monitoring central bank signals to form a well-informed view. Some traders may pre-position based on probable outcomes, aiming to benefit from rapid reactions as the news breaks.

On the other hand, trading after the announcement allows for a more informed response. With confirmed policy details in hand, you can react to real outcomes rather than speculation. Many traders prefer to observe the initial market reaction first and then evaluate whether there's momentum for a sustained move. This can help reduce exposure to unexpected volatility or false breakouts.

In both cases, careful research and risk management are essential. To ensure that your exposure aligns with your risk appetite and trading objectives, you should rely on stop-loss orders, hedging, algorithmic tools, and tailored position sizing.

Risk management checklist for USD/JPY & BOJ-related events

This checklist is designed to guide you through managing risk when tracking USD/JPY and BOJ-related events, with a focus on market volatility and potential risks associated with currency movements and economic announcements:

1. Position sizing & leverage

✔ Risk per event: Limit exposure to a manageable position to avoid undue risk from sudden price movements.

✔ Leverage awareness: Understand the impact of leverage on your exposure, especially with volatile pairs like USD/JPY, where small price changes can cause larger percentage moves in your portfolio.

✔ Size adjustments: Adjust exposure size based on the volatility anticipated.

2. Stop-loss & take-profit considerations

✔ Set risk boundaries: Clearly define the maximum loss you are willing to accept based on technical levels or volatility (e.g., average true range (ATR)) to avoid drastic movements.

✔ Take-profit strategy: Set realistic exit points based on market conditions and previous price action.

✔ Trail risk: As markets can be volatile after major economic events, consider using a trailing stop to lock in profits or limit further losses.

3. Market conditions & risk exposure

✔ Pre-event market volatility: Be aware of higher market volatility during and after BOJ policy decisions, especially if unexpected measures are taken. Avoid unnecessary exposure during unpredictable periods.

✔ Key levels: Identify significant support/resistance levels in USD/JPY, as these can act as points of resistance or support during high-impact events, and make sure to adjust risk accordingly.

✔ News flow: BOJ announcements can cause rapid price changes in USD/JPY. Prepare for potential slippage or unpredictable market responses.

4. Economic & event risks

✔ Monitor economic calendar: Track relevant BOJ events, such as rate decisions, press conferences, and economic data releases (e.g., inflation reports) to gauge potential market impact.

✔ Pre-event preparation: Reduce exposure to high-risk pairs like USD/JPY leading into BOJ announcements to limit potential surprises.

✔ News-driven risk: Be cautious of market reactions after BOJ speeches or economic data releases, as the market might overreact or price in expectations that don't materialise.

5. Emotional & psychological awareness

✔ Emotional impact of high-volatility events: Sudden movements around BOJ decisions can be stressful and lead to emotional trading decisions. It's crucial to remain calm and follow a disciplined approach to avoid impulsive actions.

✔ Avoid overreaction: If you experience a loss due to unexpected volatility, take a step back to reassess rather than trying to recover immediately. Emotional reactions can lead to higher risk exposure.

✔ Limit overexposure: Set daily or weekly risk limits to ensure you don't get overly exposed during volatile periods, especially if you feel the urge to "chase" a market move.

6. Regular review & adjustment

✔ Post-event analysis: After major events, like BOJ policy changes, review how the market reacted. This allows you to adjust your risk approach based on evolving patterns and how the market is interpreting central bank signals.

✔ Practice: Practise trading BOJ events in a demo account before using real capital

✔ Adapt to market conditions: Be flexible in your approach to USD/JPY, adjusting risk management strategies based on current volatility levels and broader market trends.

✔ Keep a trading journal: Document your experiences and reactions during BOJ events to better understand the effects on market sentiment and improve your risk management going forward.

Comparing BOJ to other central banks

How does BOJ policy compare to other major central banks?

The BOJ has historically maintained an ultra-loose policy to combat deflation, whereas the Federal Reserve (Fed), European Central Bank (ECB), and People's Bank of China (PBOC) adjust their strategies based on inflation, employment, and growth objectives. The table below outlines key differences in their approaches:

| Central Bank | Interest Rate Policy | Inflation Target |

| Bank of Japan (BOJ) | Negative rates, YCC | 2% (struggles to reach it) |

| Federal Reserve (Fed) | Rate hikes to fight inflation | 2% |

| European Central Bank (ECB) | Gradual hikes, QT | 2% |

| People’s Bank of China (PBOC) | Looser credit policies | No strict target |

Why BOJ maintains negative interest rates

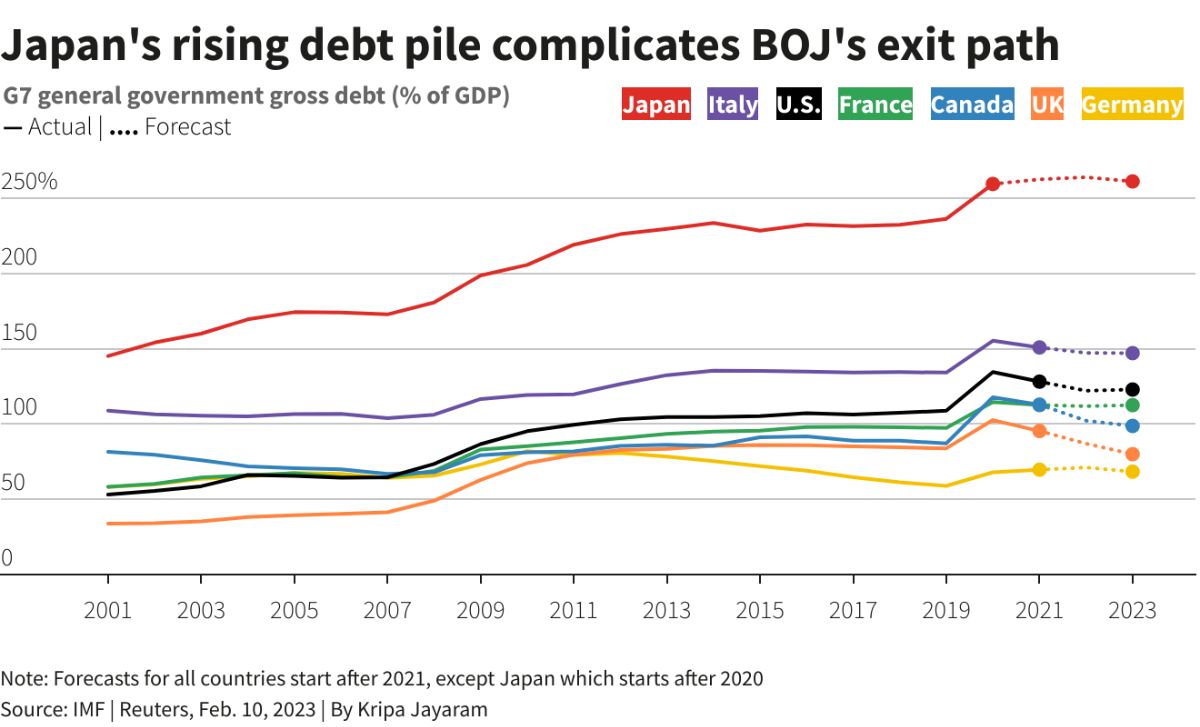

Japan’s ageing population and large government debt pile heavily influence the BOJ’s ultra-loose monetary policy. With a shrinking workforce and rising social security costs, economic growth remains sluggish, making it difficult for the BOJ to raise interest rates without impacting consumption and investment.

Negative interest rates—a policy in which financial institutions are charged for holding excess reserves at the central bank—are used to encourage lending and spending rather than saving. Additionally, Japan’s government debt exceeds 250% of GDP, meaning higher interest rates would drastically increase debt servicing costs. As a result, the BOJ is forced to maintain low or negative rates and continue its large-scale bond-buying programmes, which involve purchasing government bonds to lower yields and reduce borrowing costs and consequently support economic stability.

https://www.reuters.com/markets/asia/japans-debt-time-bomb-complicate-boj-exit-path-2023-02-10/

How BOJ policy affects the carry trade

The JPY is a key funding currency due to the BOJ's long-standing ultra-low or negative interest rates. In a carry trade, traders borrow in JPY to invest in higher-yielding currencies like USD or AUD, profiting from the interest rate differential. The BOJ's dovish policies make JPY an attractive funding currency, while tightening signals (like rate hikes) prompt unwinding of carry trades, causing JPY appreciation. Sudden BOJ policy changes can lead to significant market volatility in JPY pairs.

Does the BOJ influence other central banks' policy decisions?

The BOJ does not directly influence other central banks' policy decisions, but its actions can have indirect effects on global monetary policy. As a major central bank, the BOJ's policies - especially regarding interest rates, yield curve control, and liquidity measures - impact global financial markets, exchange rates, and capital flows.

For example:

- A shift in BOJ policy can affect the JPY's value, influencing trade competitiveness and prompting responses from other central banks.

- Japanese investors, significant holders of global bonds, may reallocate capital based on BOJ rate changes, affecting yields elsewhere.

- BOJ easing or tightening may impact global inflation expectations, influencing the Federal Reserve, European Central Bank, and others.

While the BOJ primarily focuses on domestic conditions, its policies can generate ripple effects that other central banks sometimes have to consider when making decisions.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.