- English (UK)

Learn to trade

GGPI switches to PSNY after the merger; traders await earnings results

They have various investment funds under their umbrella. Businesses of this type are known as a SPAC, Special Purpose Acquisition Companies.

Their latest merger is with Polestar, a leading Premium Electric Vehicle Company.

The billionaire, Alec Gores is the brains and founder. His first business, Executive Business Systems, was sold in 1987. He then established The Gores Group (Gores Guggenheim Inc).

The Gores Group has over $4 billion invested in 120+ acquisitions.

News of the merger with Polestar

In September 2021 it was announced that the electric car manufacturer, Polestar, had agreed to go public. This was made possible with a merger between Polestar and Gores Guggenheim. The merger was completed on the 23rd of June 2022.

Through the combination of businesses, they raised $890 million, $640 million from Gores Guggenheim and $250 million from institutional investors.

The Polestar CEO Thomas Ingenlath commented, "Listing on the Nasdaq is an incredibly proud moment for Polestar. We set out to create an outstanding new EV brand with the mission to accelerate the shift toward sustainable mobility."

A New ticker

Gores Guggenheims shares previously traded under the ticker GGPI. From Friday the 1st of July 2022, the new symbol was listed on the Nasdaq Exchange as PSNY. This stands for Polestar Automotive Holding. The company has a market cap of $9.135 billion.

For a list of US Equities click here.

The timeline

- 1987 – The Gores Group is founded

- 1997 - Gores acquires Artemis (NYSE: CSC)

- 1997 – Gores buys the subsidiary, Connection Machines, from the Thinking Machines Corporation

- 1998 – Gores buys the subsidiary, Computer Integrated Manufacturing, from Texas Instruments

- 2000 - Gores buys the subsidiary, The Learning Company, from Mattel

- 2003 - Gores acquires Artemis Anker BV.

- 2004 – raises $400 million for the first fund, GCP I

- 2007 - opens the second fund with $1.3 billion

- 2008 – enters a joint venture with Siemens AG

- 2010 – sells Vincotech to Mitsubishi Electric

- 2011 – the third fund is launched with £2.1 billion

- 2011 – sells Lineage Power to GE

- 2012 – Gore raises $300 million to launch its first small cap fund

- 2013 – Gores have their first Initial Public Offering (IPO). Stock Building Supplies goes public

- 2014 - sells Sage Automotive Interiors

- 2015 - sells Therakos in the company’s largest transaction to date

- 2015 – Gores Holding goes public. Its IPO completes for $375 million

- 2016 – Gores aquires Hostess Brands for $2.5 billion

- 2016 – the company sell Etrali

- 2017 – Gores Holding II raise $400 million

- 2018 - the Private Investment Office is launched. Investing for the Gores family and investors

- 2018 - Gores acquires Verra Mobility

- 2019 – Gores Metropoulos raises $400 million

- 2020 – Gores raise $425 million for Gores Holdings IV

- 2020 - Gores acquires PAE for $1.6 billion (Platinum Equity Portfolio)

- 2020 - Gores raises $525 million for Gores Holdings V

- 2020 – Gores Metropoulos merges with Luminar. Luminar are a global leader is automotive hardware and software technology

- 2020 - Gores raises $345 million for Gores Holdings VI

- 2021 – Gores Holdings Iv merges with United Wholesale Mortgages to become the largest SPAC business combination to date

- 2021 - Gores raises $550 million for Gores Holdings VII

- 2021 - Gores raises $345 million for Gores Holdings VIII

- 2021 - Gores raises $275 million for Gores Technology Partners

- 2021 - Gores raises $460 million for Gores Technology Partners II

- 2021 – Gores Guggenheim raises $800 million

- 2021 – Gores Holding V combines (merges) with Ardagh Metal Packaging

- 2021 – Gores Holding Vi combines (merges) with Matterport

- 2022 – Gores Metropoulos combines (merges) with Sonder

- 2022 – Gores Guggenheim merge with Polestar

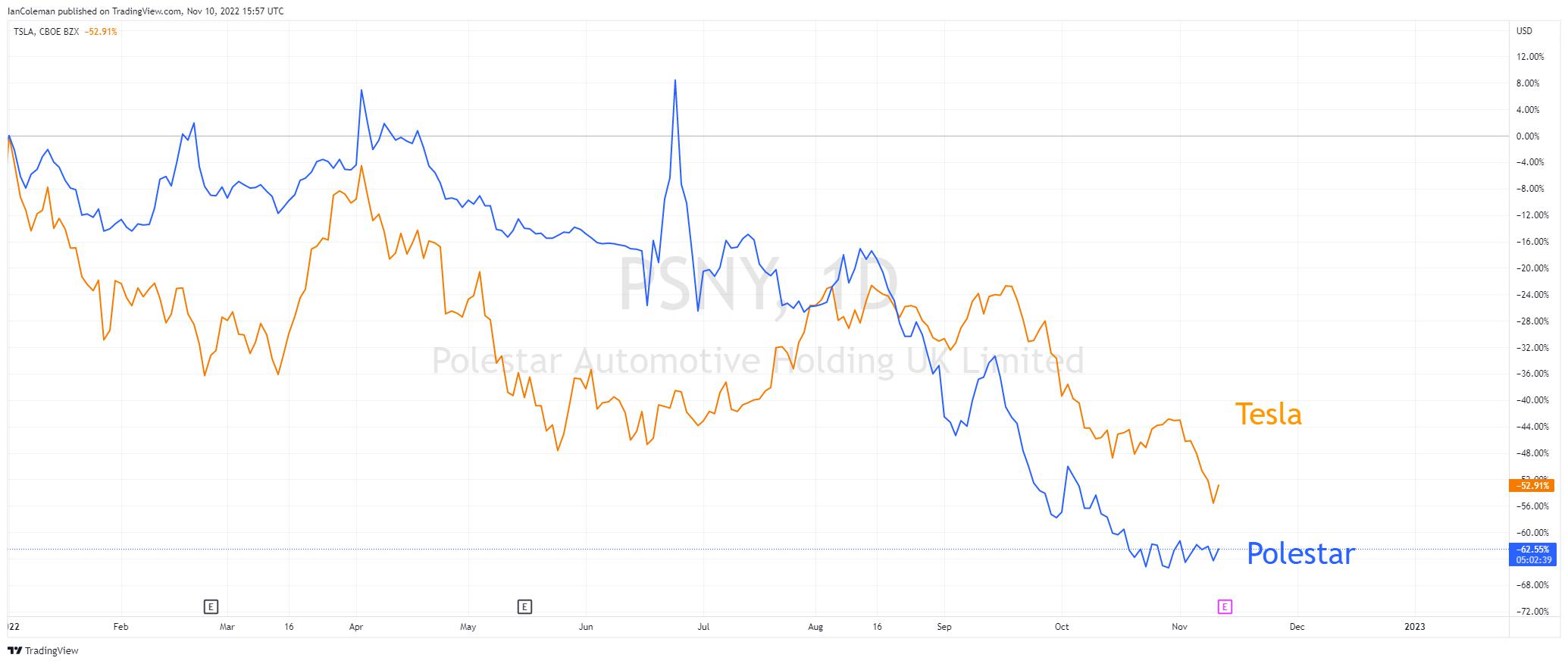

Polestars performance against Tesla

Although the Electric Vehicle arena has seen volatile price movements since the start of 2022, mainly due to the cost of parts and inflation, Polestar is mildly underperforming against its main rival Tesla (Polestar -62.64% Tesla – 52.84%).

Earning Report

PSNY earnings report is due on Friday the 11th of November 2022. Revenue expected at $675.895 million. Earnings -0.142.

A look from a technical perspective

The shares have been trading sideways for the last 13 days. This could be just a consolidation period before the financial release.

From a technical perspective, we are trading within a bearish channel formation with lower lows and highs. We are possibly forming a flag pattern. A break of the previous low at $4.00 and the measured move target for the flag formation is seen at $2.81.

Figure 1 forex calendar CPI 9

Summary

The market awaits the earnings report. The technical outlook is mildly negative with a break of $4.00 offering more downside bias.

Trading with Pepperstone

Pepperstone offers CFD trading in a variety of US equities including Tesla Motor Inc. For more information about trading through a regulated broker, click here.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.