- English (UK)

Today the markets are seeing risk winning over but chasing this seems wrong but in this backdrop what you feel and what plays out are often too different things. The S&P 500 has closed +2.3% on volumes some 31% below the 30-day average (in line with the 100-day average), with 1.33m contracts of S&P 500 futures traded, which is pathetic for a 2%+ day. Tech has worked well, with the NAS +3.1%, while small caps have underperformed. Implied vol has dropped a touch, with the VIX index -3.4 vols to 42%, but this still implies daily moves of 2.6%.

Credit has also underperformed, with HYG ETF (high yield ETF) +0.9%, and the HY CDX index -10bp, so, again, the broad quality of the move in risk was fairly poor, so again it hardly compels one to chase this move.

Oil is flying despite a massive 15m barrel inventory build in the weekly DoE crude report. Not just in the June or July contracts, but further down the futures curve as well. This is life in an extreme volatility regime, where you don’t need a lot of news to cause sizeable percentage moves. With implied vol at these levels, it is a market for the bravest of souls - but one thing is for sure, if you have an exposure you don’t leave the screens to sleep as it could be 15% higher or lower in an hour and stop placement is key – it needs to be pushed further out, and the position size needs to be small.

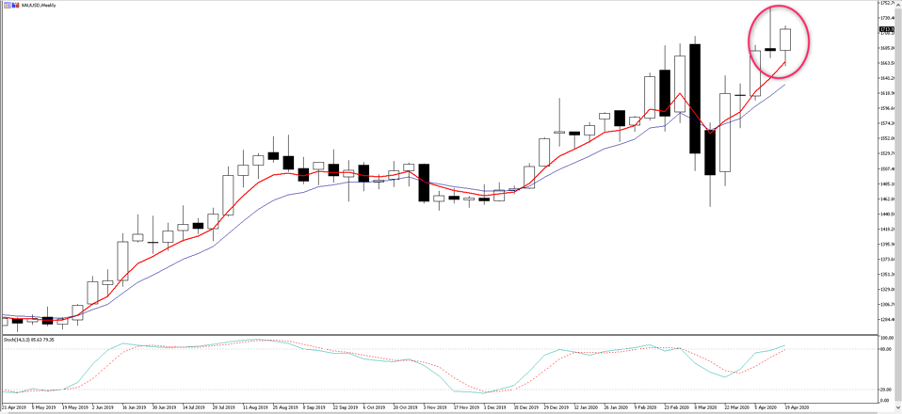

Energy stocks have clearly done well, with the XLE ETF (S&P energy sector ETF) +3.6%, and we’re also seeing small gains in copper and lumber too. Gold has garnered good some attention from clients and rightly so, XAUUSD is breaking out of a bull flag and holds above the 5-day EMA which has now turned higher – let’s see how price reacts into 1735/40. The weekly chart was looking ominous with last week’s candle giving a red flag, but at this stage, the impending bearish price action has been part mitigated and the gold bulls are making a statement.

I had been sceptical to chase this move in gold because ‘real’ US Treasury yields had been moving higher recently, which was part of the reason for a fall in equity indices. However, today we see 5-yr ‘breakevens’ (the bond markets pricing of average inflation expectations over the coming five-years) sitting +12bp (or 0.12%) at 62bp. Inflation expectations are key for the backdrop in markets. If inflation expectations (or ‘breakevens’) are going up faster than nominal Treasury yields, we see lower ‘real’ yields, and this is bullish for gold and stocks…it is a major reason why gold and stocks are working in tandem.

(Blue – real treasury yield, white – gold)

"(Source: Bloomberg)"

So gold is breaking higher, and we see the GDX ETF (gold miners ETF) +6.4%, with futures +2.9% and those who had bought put vol recently may need to reconsider their position.

(FX moves on the session vs the USD)

In FX, we see the USDX up smalls and holding above a positively trending 5-day EMA. It's interesting that we see the USD gaining broadly when real US Treasury yields fell 10bp and equities rallied strongly. I guess this is a function of the EUR holding a 57% weight on this basket of currencies and there seems to be no real conviction with EURUSD. That said, EUR traders will be watching the Eurogroup meeting tonight, where little market-moving news is expected, and the market will likely feed off the togetherness or cohesion between the leaders. In a crisis like this, the very fabric of the EMU is being tested and the last thing we want to see now is EU political concerns and breakup risk becoming a market thematic.

The ECB have announced they will accept junk bonds as collateral for repo, or short-term loans, which comes at a convenient time given S&P and Moody’s review Italy’s credit rating in the near-term. Italy’s 10-yr bond (BTP) will get some focus then and the EUR could be sensitive to this, although, we see relatively low implied volatility in EURUSD, so traders are hardly expecting fireworks – in fact, the options market sees a 45-pip move (higher or lower) on the day.

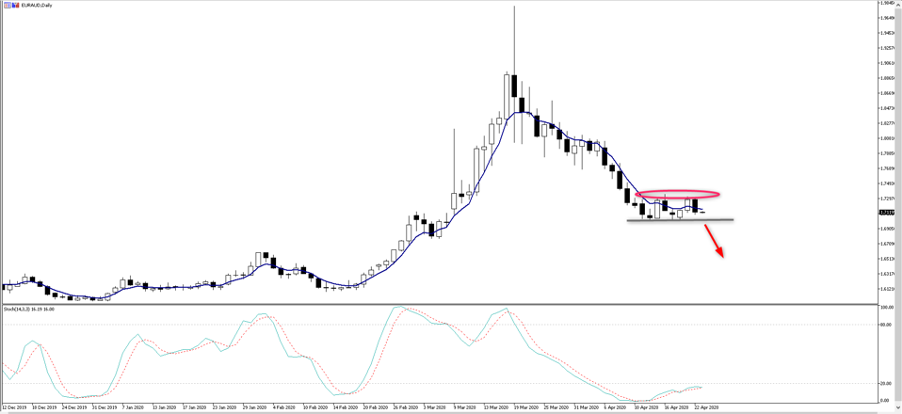

The AUD has worked well in the backdrop of higher inflation expectations and positive risk dynamics. I like the idea of being short EURAUD in small size here, with a stop through 1.7340, with a view to add on a closing breakthrough 1.7014. Today’s Eurogroup meeting poses a small risk, as does Eurozone PMI data (18:00 AEST / 09:00 UK time), but the data will need to eat convincingly to provide any real covering of EUR shorts. Anyhow, good numbers may see stocks rally and the AUD will work well here.

Keeping eyes on the petrocurrencies too, and while we saw a solid move in both WTI and Brent crude, we’ve only really seen love for the RUB. The CAD has found some buyers, while the NOK is the weakest link – AUDNOK longs seem interesting too.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.