- English (UK)

Analysis

We look back at the big themes that have driven cross-asset volatility and the conditions through which we’ve all had to adapt our trading –these include persistently high inflation, a worrying spike in the cost of living and aggressive rate hikes – yet resilient growth. We can also look at more regional-focused issues – a UK gilt tantrum driven by the Truss govt’s unfunded mini-budget, the invasion of Ukraine, the MOF/BoJ intervening to buy JPY and China’s Covid Zero policy.

The culmination of these factors created huge cross-asset volatility, decade-long market regime changes and lasting trending conditions.

Looking into 2023

Markets live in the future, and we look forward to the key themes that could cause volatility throughout 2023 – what’s important is not just to fully note these macro factors, but to understand the trigger points that offer a higher conviction of when to express the themes – taking this further, knowing the markets/instruments and strategies to express the theme is obviously advantageous.

These themes could alter market volatility, range expansion and market structure - so regardless of whether you’re purely automated or discretionary, it can pay to be aware.

While there are many more, these are five potential themes that I am looking at closely for 2023 that if triggered would affect the markets we trade.

1 - High inflation worries morph into growth concerns and a higher probability of a recession

US and global inflation in decline

- Market pricing (i.e. the inflation ‘fixings’ market) of future inflation shows US CPI inflation expected to fall to around 3% by year-end

- US M2 money supply has fallen from 26% to 1.3% - US headline CPI typically lags by 16 months

- Manufacturing PMI delivery-lead times and supply chain data suggest inflation falls hard in 2023

- Unit labour costs falling to 2.1%

US CPI (blue) vs M2 money supply leading by 16 months

Growth – while the consensus from economists is that the US economy narrowly avoids a recession, and EPS expectations have not been revised down to reflect recessionary conditions - the markets see a higher probability of this outcome – I back the markets, where we see:

- All parts of the US yield curve are inverted – US 2s vs 10s are the most inverted since 1981

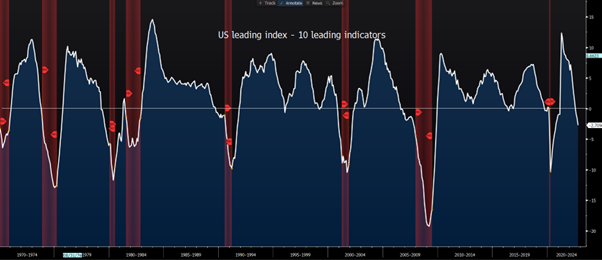

- The US leading index (measures 10 key economic indicators) has turned negative and falling fast – this has an exemplary record of predicting US recessions

- Comments from the CEOs of Goldman Sachs and BoA warning of tougher times ahead

US leading index – red areas represent a US recession

Themes to trade as we price in a recession

- Consensus EPS expectations are cut by around 20% (from the highs), in turn, lifting PE multiples – traders will assess the trade-off between earnings downgrades vs a lower discount rate

- Steeper yield curves are a trigger – while now is not the time to put on curve steepeners, when short-dated US Treasury bond yields do fall/outperform, we’ll see a steeper yield curve – this could be the trigger for a sharp equity rally, led by financials

- As the US data deteriorates, we will likely see equity market drawdown, US treasury buying and selling of risk FX - it’s when central bankers acknowledge that growth is a greater concern the market will feel validated in its pricing of rate cuts – it’s here we see a risk rebound, broad USD selling and housing + lumber outperforming

- As bond yields fall, we should see solid outperformance from the JPY and CHF and EM assets

- USD initially works selectively vs global FX, but then reverses as conviction of the Fed cutting impacts and traders look ahead to a trough in the global growth slowdown

- Gold and silver rally hard as a hedge vs recession risk

2 - Central bank policy – assessing the potential for rate cuts

Rates pricing from June 23 to Dec 23

3 - China reopening and China's market outperformance

We’ve already seen a plethora of measures announced and Chinese markets have rallied hard – China is the elephant in the room when it comes to the global growth outlook for 2023 – a weak 1H23 seems likely but this will then followed by far stronger growth in 2H23 – after a poor 2022, Chinese assets could really outperform in 2023

- Long HK50 / short NAS100 could be a trade to look at if markets de-risk on a higher probability of a US recession

4 - BoJ policy recalibration – time for the JPY to fly

BoJ chief Kuroda steps down in April but there are already plans for a review of BoJ policy – it feels inevitable that we’ll see a 25bp lift to the BoJ’s YCC target to 50bp – we’ve already seen signs that Japanese banks/pension funds are moving capital back to Japan to get a more compelling return in the JGB market – but could a major policy change cause tremors in global bond markets and promote significant inflows into the JPY?

5 - Politics & Geopolitics – great for volatility, bad for humanity

Obviously one of the most important issues in 2022, not just for markets but humanity - always a hard one for traders to price risk around

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.