- English (UK)

Traders have massaged extended positioning ahead of Jay Powell’s speech today at Jackson Hole and have lightened up on USD shorts, as they have long positions in US tech and US 2-year Treasuries. The impact of this has spilt over into a small win for those in short gold exposures. Again, there’s little to read into the move lower other than a slight position adjustment after clear exhaustion in the price action.

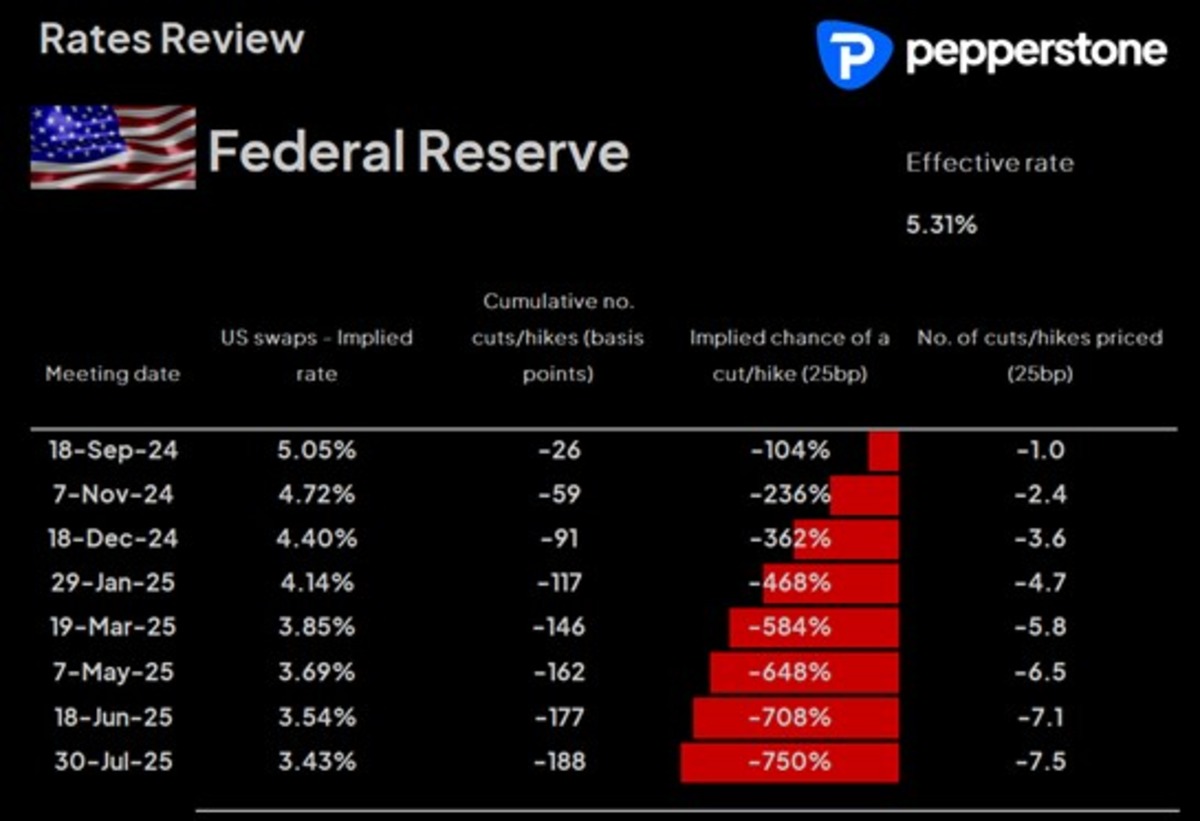

US interest rate swaps pricing

US interest rate traders have massaged expectations for the September FOMC meeting, with US swaps now implying 26bp of cuts for the September FOMC meeting. Granted, yesterday’s July FOMC meeting minutes read dovish, and many felt they opened the door to a 50b cut, but a 25 bp cut to get the easing cycle cranking up is the correct pricing in my view. The data flow seen through US trade backs that call, with US existing home sales rising for the first time in 5 months, S&P Global services PMIs coming in at a strong 55.2 and the weekly jobless claims at 232k.

The Kansas City Fed president Jefferey Schmid also detailed that the BLS revisions to prior nonfarm payrolls don’t affect his thinking, and one can assume that is the case for all Fed members. Still, when the Fed are data-dependent it doesn’t fill market players with any confidence that they are setting policy to highly inaccurate data.

With rate cut expectations gently eased back we’ve seen the US 2-year Treasury rise 8bp to 4.00%. The USD has taken inspiration from the sell-off in Treasuries, with gains across the G10 and EM FX spectrum. I’m not sure this will surprise too many, as the move in the USD was overcooked, and while we’ve seen a pronounced USD rally moves against the BRL, MXN, ZAR, and NOK, with EURUSD pulling to 1.1100 and USDJPY into 146.52, it seems too early to say the USD has truly put in a low. I am open to the idea that it might have, but the technical set-ups and price action will give me greater certainty in the days ahead.

It certainly feels like the risk going into Powell’s speech has become more two-sided and I expect Powell to align well with current market pricing.

Gold has sold off in sympathy to the move in the USD and rates and closed -1.1% - a move that clients have picked well. The bulls, however, will walk away from today’s battle with a few minor bruises, but they will feel that all is not yet lost, where on the daily timeframe we see price holding both the 5-day EMA and the former breakout high at $2483.

Crude has also seen a solid technical counter rally off key support and has held the August range lows well. A 1.8% rise in gasoline would have offered inspiration to the crude buyers, but, in both crude and gasoline, it’s hard to believe that the move was anything more than technical. If the crude buyers really wanted to make a statement, we’d have seen price close above Wednesday’s highs of $74.16 (WTI crude) and that wasn’t the case. Clearly, crude could kick further higher, but conversely if price does roll over and head back to test Wednesday's low of $71.46 then I see every chance it breaks down and crude could be targeting $68.

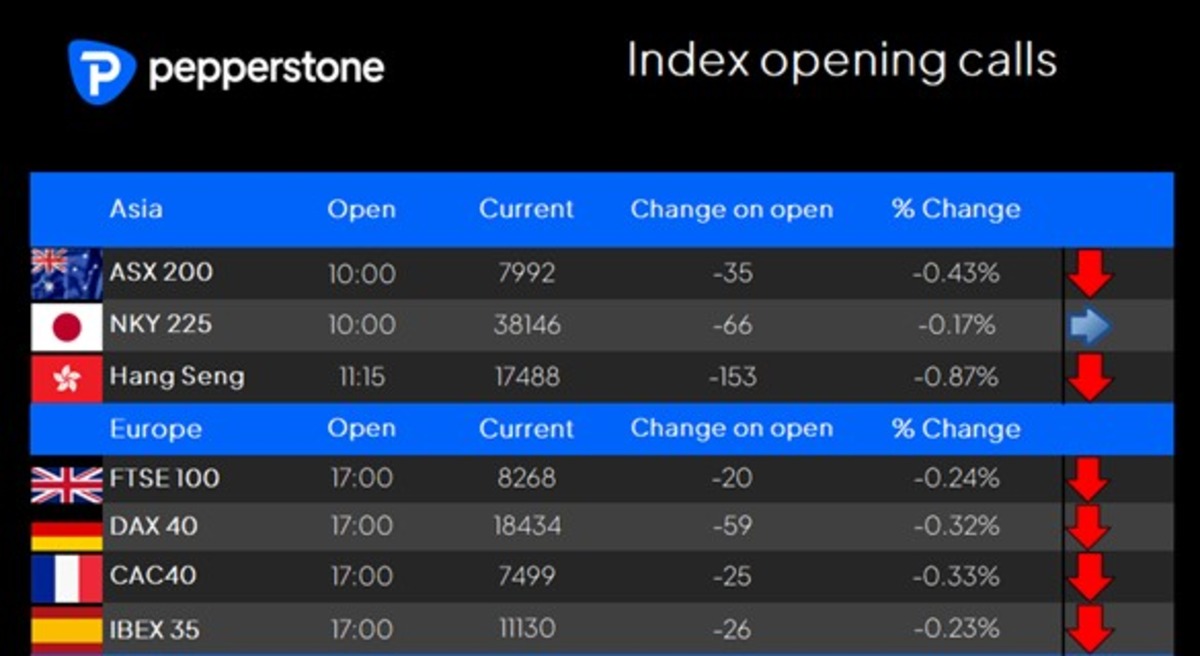

US equity has provided Asia with a poor lead and our opening calls suggest the ASX200, HK50 and NKY225 head into the final day's trade on a soggy note. The selling we’ve seen in the S&P500 has been centred on tech and discretionary names, with some punchy moves lower in Nvidia, Tesla, Amazon, and Microsoft and this has seen a more pronounced sell-off in the NAS100.

The sellers took this one home though, with the S&P500 cash index closing not far off session lows, although cash equity volumes were once again poor and some 20% below the 30-day average. Technically, we’ve seen S&P500 futures hold the 1 August swing highs, so it's too early to offer a higher probability that this sell-off has lasting legs.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.