- English (UK)

The ASX200 is the outlier here, where SPI futures sit 0.3% lower from the ASX200 cash close (at 16:10 AEST), and while we have the RBA meeting to navigate, the index will take its steer from the Nikkei and to a lesser extent the HK50.

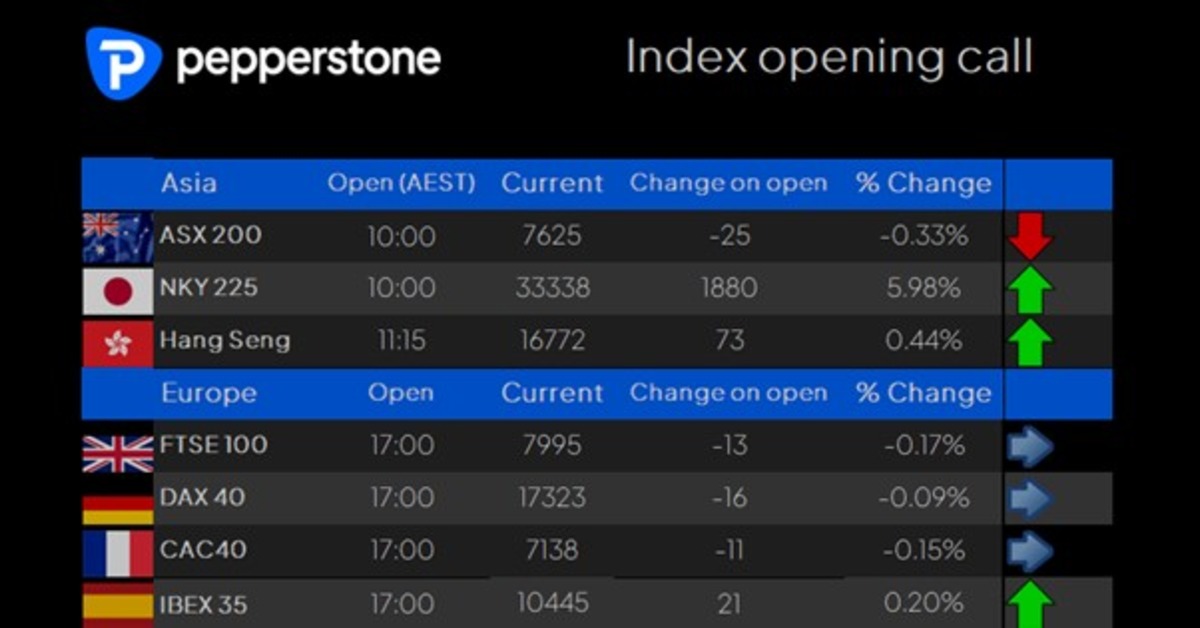

Pepperstone’s index opening calls

The implied volatility in the NY225 sits at an incredible 70% - well above levels seen in 2020, and while our opening call for the Nikkei 225 suggests an open some 6% higher, this level of implied volatility almost guarantees fireworks in the price action. What happens after the open will therefore be well worth putting on the radar, and we question if the domestic and international market players build long positions into the expected positive open or use the pop for exit liquidity – S&P500 and NAS100 futures will likely track the NKY225 and moves in the JPY closely.

Use intraday momentum to frame the directional bias and while the more aggressive souls buy dips, I prefer to buy a potential rip after the dip, in the ‘hope’ that the move can be sustained.

After such a furious shake-out of leveraged positioning, with Japanese banks absolutely taken to the cleaners, it will take the bravest of investors to buy into these names with any conviction. However, while we’re already calling the index higher, a potential rip-your-face counter rally today could get attention from the fast money traders – so, the tape in the Japanese banks could dictate confidence around the region, and if we see that move spill over into better buying of the ASX200 listed banks then the ASX200 should close in the green.

US equity closed lower (S&P500 and NAS100 closed -3%, Russell 2k -3.3%) and while these were significant percentage changes, one could argue the moves were not as bad as feared. S&P500 futures traded to 5120 (-4.8%) at its low, but after buyers made their moves, futures closed 2.5% above that level. NAS100 futures traded into 17,400 on two occasions and found good buying support below the 200-day MA (17,773) and we see the index 4.5% off the intraday lows.

So, it could certainly have been worse, but the storm clouds have not fully made way for sunny days just yet. Just 4% of S&P500 companies closed higher on the day - CTA’s (systematic trend-following funds) have flipped to a short position and any move lower would see them add to holdings - while volatility-dynamic funds would have more equity to liquidate as index realised volatility rises.

We also see the VIX index at 39%, and while the S&P500 implied volatility gauge did push to an incredible 65% just before the opening of US equity cash trade, a 39% VIX volatility equates to daily moves in the S&P500 of -/+2.4% (-/+5.5% weekly moves).

We also saw 3.26 million S&P500 put options traded on the day vs 1.2 million calls, as one would expect in a market that fell 3% – and with options dealers holding a large short gamma position the potential hedging flows that come from a big move in the index will only add to the volatility, and the result in moves that can't readily be explained by the news flow.

Adapting to a high volatility world - Protect ya neck

While the tactical macro traders will often have a structural directional view, in this high volatility regime the more price-sensitive short-term traders need to refrain from having an ingrained bullish or bearish bias – where holding an open mind and an agility to react dynamically to the intraday swings that present themselves will serve traders well. When we see a VIX at 39%, and with the S&P500 daily high-low trading range averaging 168 points (5 days), this market environment means we can easily see 1-2% reversals without news – so we adapt, we take on more risk (trade with a wider stop), and in turn reduce the position size in the trade – it also means being in front of the screens, and refraining from carrying over positions when the urge to eat or even sleep kicks in.

On the day, I will be putting both USDJPY and MXNJPY front and centre, and if we see buyers in both pairs, then risk in Asia could rip. I’d also want to see the NAS100 futures push above 18,390 (the day high), and break the 100-day MA, with a growing rate of change and good volume in the buying and I would be jumping on for the ride.

However, volatility works both ways and if USDJPY finds sellers and rolls towards ¥143, then we could be looking at another ugly day at the office.

The RBA meeting in focus

In the session ahead, we get the RBA statement and Statement on Monetary Policy, with Governor Bullock speaking shortly after (15:30 AEST). There is little chance we get a move on rates, and the prospect that the statement maintains a hawkish bias is high.

Aussie swaps price a 25bp cut for the December meeting, so it feels a tall order that the statement will meet this pricing and therefore one could argue there are small AUD upside risks through the meeting. Gov Bullock will be probed on developments in the US and global economy, but while she will no doubt say the RBA is monitoring these developments, it is still too early for her to give a definitive view. AUDUSD has seen huge buying interest below 0.6480, and a daily close below here would suggest looking more closely at momentum short positions.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.