Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

A Traders’ Week Ahead Playbook: Navigating Volatility Amid Trump’s Tariff Moves

We all knew tariffs on Mexican, Canadian and Chinese imports were coming. Still, there was conjecture on whether they would be pushed back to a later date, with claims of 'progress in the negotiations', or whether the levels previously stated would be staggered or to include carve-outs and exceptions.

Trump’s additional 25% tariffs on Mexican and Canadian imports and 10% to the current tariff rate on Chinese imports (with limited carve-outs), could be seen as representing the most hard-lined approach of all the possible scenarios we had considered. Barring any last-minute reprieve seen before tomorrow’s start date for the new tariff rate, it feels a low probability that the punchy tariffs set on these three nations will be reduced anytime soon.

Trump has also stated that he is unphased by the impending market reaction and given the S&P500 is near ATH’s, and US economics remain upbeat, Trump does have the increased capacity to go after his cause. Subsequently, while the level of tariffs is expected to see some de-risking, drawdown (of risk positioning) and to promote higher FX and cross-asset volatility, the base-case at this stage is that this won’t trigger a full-blown risk aversion move, or a 10%+ decline in the S&P500.

A counter-tariff response is not priced into markets

What makes the issue more of a concern for risky markets, and an increased challenge for market participants to price is the fact that the Canadians were so quick to counter, placing 25% tariffs on $107b of US imports, with Trump – feeling he has pocket aces - going on to say that he may now look to double the tariffs. Talk of recession risk in Canada will surely increase and should also raise the prospect that the Mexican central bank will cut the overnight rate by 50bp when Banxico meet on Thursday.

However, the market now looks further afield, with China the far bigger issue for global markets, and we’ve already heard that they will come back and counter, although we have limited clarity on what that looks like. Tariffs on EU imports are also coming, and could be known soon enough and again, it’s the potential response and reprisal that becomes a challenge for markets to price risk and certainty to.

Market moves on the Monday re-open

For now, we expect US and EU equity futures to come under selling pressure on the re-open, with USDCAD eyeing a clean upside break of 1.4700. While we also expect solid activity in CADJPY, USDMXN and USDCNH. Risk FX (AUD, NZD and EUR) also likely to trade weaker.

China comes to the end of its Lunar New Year celebrations this week, so we consider how the PBoC manages the daily CNY fixing rate, as this could determine the extent of FX vol in G10 FX, with further gains in USDCNH likely to put a bid in other USD pairs.

The weekend tariff announcement may not be taken well by US equity futures, or risk FX on open, but it certainly validates the recent moves to ATHs in gold and the tightness we’re seeing in the physical gold market, through positioning, flow data and lease rates. US Treasuries may find buyers, and result in diverging paths, with UST yields moving lower amid a stronger USD, with the JPY and the CHF also likely set to benefit.

We also need to consider the incoming US data this week, as it could have implications for market pricing and broad sentiment. Naturally, when we have a cloud hanging over the market in the form of tariff uncertainty, one suspects markets will be more sensitive to a miss on the economic data front than a beat, as we try to model the impact tariffs will have on future inflation, company margins and demand.

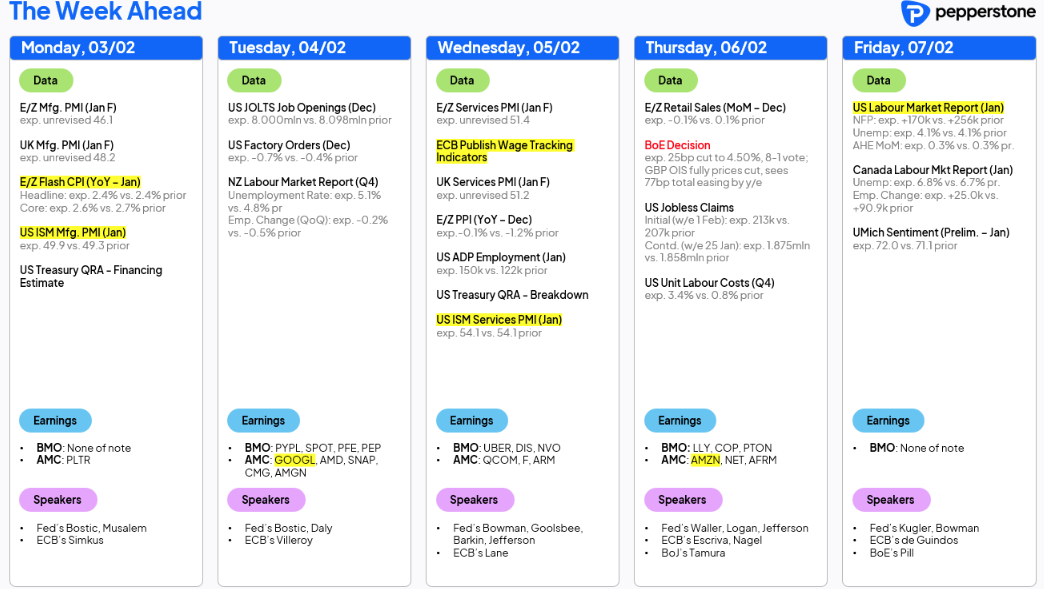

On the earnings side, it may be too early for any of the US companies reporting this week to offer real insights on trade policy for markets to work with, but we could feasibly hear something generic and along the lines of “We are looking closely at the tariff news flow, and it could offer challenges”. Amazon and Alphabet are the two big US names to report this week, and while they could offer opportunities for single stock traders, the earnings may get overshadowed by the macro developments.

US NFP offers further USD upside risk

US nonfarm payrolls (NFP) will be the marquee data risk this week, with the median expectation (from economist's) calling for 170k jobs, with an unchanged unemployment rate of 4.1%. One could argue that there are upside risks to the consensus NFP call, given the last five NFP prints in January have averaged 328,000 jobs and have been a clear outlier month.

If the USD does push higher through the week, a solid NFP would only give the trade additional legs. Interestingly, we also see Canada’s employment data out at the same time as the US NFP release and given the likely rising concerns on the future Canadian economic state, FX traders will not take kindly to a weaker Canadian jobs print.

US NFP aside, through the week we also navigate the US ISM manufacturing and services reports, as well as the JOLTS job openings release. We also hear from a raft of Fed speakers, and while we understand that the Fed is on hold for a period, any context on how the respective Fed speakers see tariff risk impacting their judgment could be of interest. We also see the BoE meeting on Thursday, with a 25bp cut firmly expected by economists and GBP swaps traders. The ECB is set to enlighten the market later in the week where they model the policy neutral rate - a factor which could cause some ripples in EU rates pricing and by extension the EUR. In Australia, we get retail sales (for Dec) although this shouldn’t move the dial too intently on the AUD, given the currency will used predominantly as a risk proxy this week.

Anyhow, keep an open mind to the price action and while the noise this week will intensify, this week could offer increased challenges to risk - Conversely, the buy-the-dip crowd may work their magic soon enough.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.