- English (UK)

Analysis

When markets fall to materially sell-off on such reliable historical inputs, we must ask why and is it telling us a message about a potential turn in the trend.

I think gold’s resilience could be speaking out.

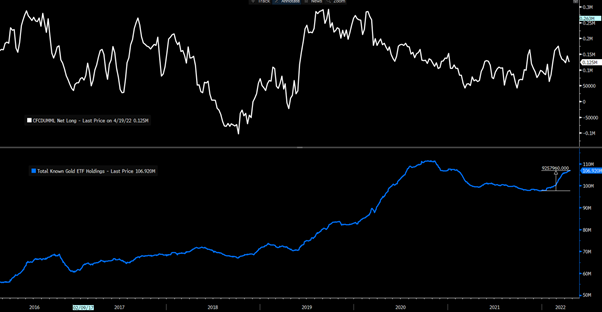

Currently, hedge funds and other professional speculators are seeing a lack of conviction in being long gold and see an opportunity cost here - we can see this in the weekly CFTC futures reports, where net long exposures from managed money has effectively moved sideways for weeks. Many of these are systematic trend-followers, so their involvement may change if and when we see more bullish trend conditions.

- Upper pane – gold futures (managed money)

- Lower pane – known holdings in ETF funds

(Source: Bloomberg)

Our own client flow remains lively in XAUUSD, with scalpers and day trading flow seeing clear two-way opportunities – again, that flow may pick up and attract more momentum-focused traders if we see higher and lower highs over a period and/or greater range expansion.

Gold supported by physical buyers

Where we are seeing support is evident in sizable physical gold buying. We see known holdings in ETF funds seeing solid inflows in 2022, with around 9 million Oz added. COMEX inventory levels have ratcheted up too, so the bullion banks have been building a stockpile. Russia is also buying domestic gold production, while the Chinese gold price trades at a premium to the LBMA gold price – typically a bullish sign.

So, we have physical demand supporting, with funds compelled by gold’s role as a portfolio diversifier - a hedge against inflation, future disinflation/economic stagflation, or something breaking in a central bank policy change – gold plays defence to those forces. These long-term players now need the speculators to see a far more compelling investment case.

The gold technical set-up

We can look at the weekly chart of XAUUSD and see a textbook cup and handle – a closing break of $2k and we could be looking at the start of a new bull trend – as for targets we could be looking for $2400/$2500 over a medium-term. Recall, a trending market also brings in a whole world of systematic trend-following capital which will propel it higher, where momentum funds chase because their rules dictate - they must be long gold futures when the price action, moving averages and flow is moving higher.

We are not there now, but the best tactic (in my view) is to be a buyer of strength, where a body in motion stays in motion – so this pattern certainly is front and centre, but I do want to see the market show greater love for gold than be early.

So, what gets this bull market going?

While the threat of something going horribly wrong from potential policy changes from the BoJ or PBoC is growing, I think gold is telling us the Fed hiking to 3.4% - which is the highest point (or terminal rate) priced by interest rate traders - is going to prove to be too tight and cause a recession. We know the Fed want to rebalance demand to get in equilibrium with supply and that likely means higher unemployment.

Listen to the bond market - Gold is a hedge against recession

The US bond yield curve recently inverted offering a red flag, but the inability for gold to really pullback below $1900 is potentially a reflection that investors 1) see aggressive hikes and balance sheet reduction (QT) perhaps already priced in 2) feel that the moment US Treasuries find real buyers, where bond yields start to fall (price higher) and we see a turn in the USD and it’s on and a new leg higher in gold should emerge – gold will find its place in the portfolio as will crypto.

Investors are already sensing the Fed’s projection of 2.8% GDP in 2022 and 2.2% in 2023 are too optimistic. However, they’re reluctant to really lump into core long gold exposures, until such time we see sufficient economic fragility to truly install confidence in the move higher in US 10yr Treasury yields – and that could be weeks, if not months.

I think the signal for gold has to come from the US and DM bond market – when they see enough evidence that inflation has indeed peaked and the Fed’s actions are truly impacting economics to the point that the US is headed for stagflation, or even a higher probability of recession, where the big money managers go overweight bonds, US Treasury yields will give gold bulls the green light. When growth concerns become the dominant narrative and yields fall on a sustained basis gold should resume its next leg higher.

The signal is coming – it seems a matter of time – gold may have further short-term headwinds which is good for those who trade long and short, but when bond yield trend lower gold should see the momentum funds add length – this is where it will be gold's time to shine – what’s your position? Start trading now!

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.