- English (UK)

Analysis

Tariff Threat Leaves Markets Stuck Between A Rock And A Hard Place

WHERE WE STAND – Broad-based dollar weakness was the general theme of proceedings as the trading week drew to a close on Friday, as participants continue to digest President Trump’s reciprocal tariff plans, while also mulling softer-than-expected January retail sales figures.

As noted last week, the hope and the betting among market participants is that, with the aforementioned reciprocal tariffs not coming into effect until April at the earliest, there is plenty of time for negotiations to take place, and for the Trump Administration to win concessions, consequently seeing those tariffs either watered down significantly, or never actually being implemented at all. While that could prove, in time, to be folly, we have seen that script followed at least 3 times already since inauguration day, hence the smart money being on this proving to be a fourth such occasion.

In any case, tariff news will continue to hang over financial markets like the ‘sword of Damocles’ for the next six weeks or so, and we seem to be in an environment where no news is bad news for the dollar. While I still think it tough to sit in short USD positions amid the tariff threat, and broader heightened nature of policy uncertainty, it seems like the environment is one where the buck needs some news (either solid macro, or more tariff threats) to rally, else it will just meander lower for the time being.

This dynamic, obviously, isn’t helped by the US data calendar being devoid of anything particularly interesting until the start of next month. Perhaps we will also see FX vol drift lower over that time period, particularly as the process of calculating reciprocal tariffs will be incredibly drawn out and laborious, especially with the Trump Admin. taking into account things like VAT, and non-tariff barriers.

Markets are, effectively, stuck between a rock and a hard place – not wanting to be short USD amid the tariff threat, but not wanting to be long USD in case those tariffs never actually get enacted. Welcome to purgatory, I guess.

Anyway, away from all the tariff to-and-fro, Friday’s US retail sales print was decidedly grim, as headline sales fell 0.9% MoM to kick off the year, and the control group metric slid 0.8% MoM, both being the biggest declines since March 2023. Perhaps there’s some impact coming through here of the decidedly cold snap that the States experienced last month, but nonetheless the figures are a bit of a dent in the long-running narrative of ‘US exceptionalism’. Still, one swallow doesn’t make a summer, likewise one dismal data point doesn’t sound the death knell for the US economy.

The data did, though, give the buck a further kick lower, in turn taking cable north of $1.26 to fresh YTD highs, and allowing the EUR to reclaim the $1.05 figure into the close. The Aussie & Kiwi also touched YTD bests. Fading these moves seems reasonable to me, particularly the upswing in cable, with the quid trading at 1.26 likely to prove a Valentine’s Day gift to the bears, as this week’s busy slate of data releases reinforces the ‘stagflationary’ backdrop facing the UK economy.

Elsewhere, Treasuries continue to rally, as inflation expectations re-rate lower amid the delay in imposition of reciprocal tariffs, and hopes that they indeed never come to fruition. Last week’s hot CPI figures have been almost entirely shrugged off, even though the FOMC are now likely to be on pause for the first half of the year, with the USD OIS curve now not fully pricing a 25bp cut until September – pricing that seems reasonable, to me. There is still probably value in being long bonds, however, with yields likely to drift lower, as that aforementioned purgatory continues.

Stocks, on the other hand, seem to have regained their composure, with the Nasdaq 100 ending last week at a record high, and the S&P not far off that milestone itself. I remain of the belief that the path of least resistance for equities leads to the upside, albeit in choppy fashion as markets adjust to an environment where the comfort blanket of a ‘Fed put’ is no longer present, and where Trump tape bombs could be right around the next corner.

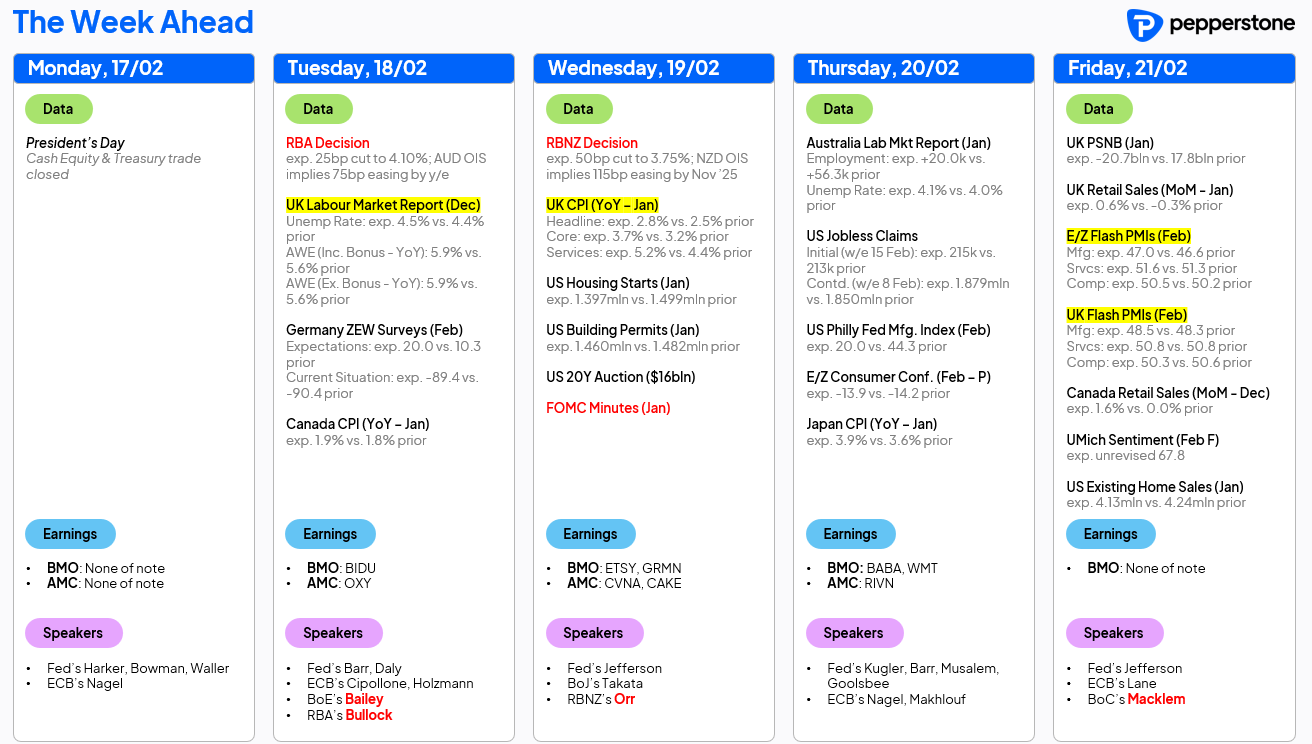

LOOK AHEAD – A quiet start to the week likely on the cards, with US participants away in observance of Presidents’ Day, and the docket otherwise empty. The remainder of the week, in truth, also brings little by way of excitement, at least in terms of the calendar, amid a dearth of top-tier macro events over the next few days.

Highlights, to use the term loosely, include expected cuts from both the RBA, and RBNZ, though both moves are fully discounted, along with a busy data docket here in the UK, with jobs, inflation, retail sales, and public borrowing figures all due. None of this is likely to move the needle much, however, as stubborn price pressures prevent the Bank of England from easing more rapidly, or in larger clips. The latest ‘flash’ PMI figures stand as the most notable macro event across DM, with Friday’s data likely to show continued signs of a turnaround in the eurozone, along with a further loss of economic momentum in the UK.

Lastly, next weekend brings federal elections in Germany. While typically a bit of a non-event for markets, things could be different this time around, with focus falling primarily on how protracted coalition negotiations for a likely CDU/CSU-led government will prove to be, as well as whether there is a surge in support for the far-right AfD, and/or far-left BSW parties.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.