- English (UK)

Analysis

If you’ve got EUR exposure, be aware this is a news-driven market and with EURUSD overnight implied vols at 52-week highs it could potentially get a little wild out there.

I talked up the idea of momentum trading yesterday and where a momo move can morph into a trend – traders should know the difference between momentum and trending markets – momentum is a vector, meaning in this case it looks at the magnitude in the relative change in price (over a period) of an instrument AND the direction. Today, we look at levels to fade EURUSD strength, as I believe you can and, in many cases, should run multiple strategies – diversification in positions is great but diversification in strategy can be even more powerful.

EURUSD Daily chart

(Source: TradingView - Past performance is not indicative of future performance.)

There's many ways to trade mean reversion – one that seems to be working for now is to use a regression trend (I’ve used TradingView) – it's not so much using a ‘mean’ in a statistical sense but a line of best fit through a trend. Using the current trend from early February we see price working nicely within the regression channel, which adopts (as the default setting) 2 standard deviations of the line of best fit. These relationships obviously do eventually break down, but for now, I would maintain a view that it holds and will fade extremes - buying into 0.9930 and initiating shorts into 1.0460, which also happens to be the 50-day MA, a variable many use as a trend filter.

The options implied vol also tells me that a move above 1.0400 today would be statistically extreme and the prospect of getting there seems remote – still, this is where the conviction is.

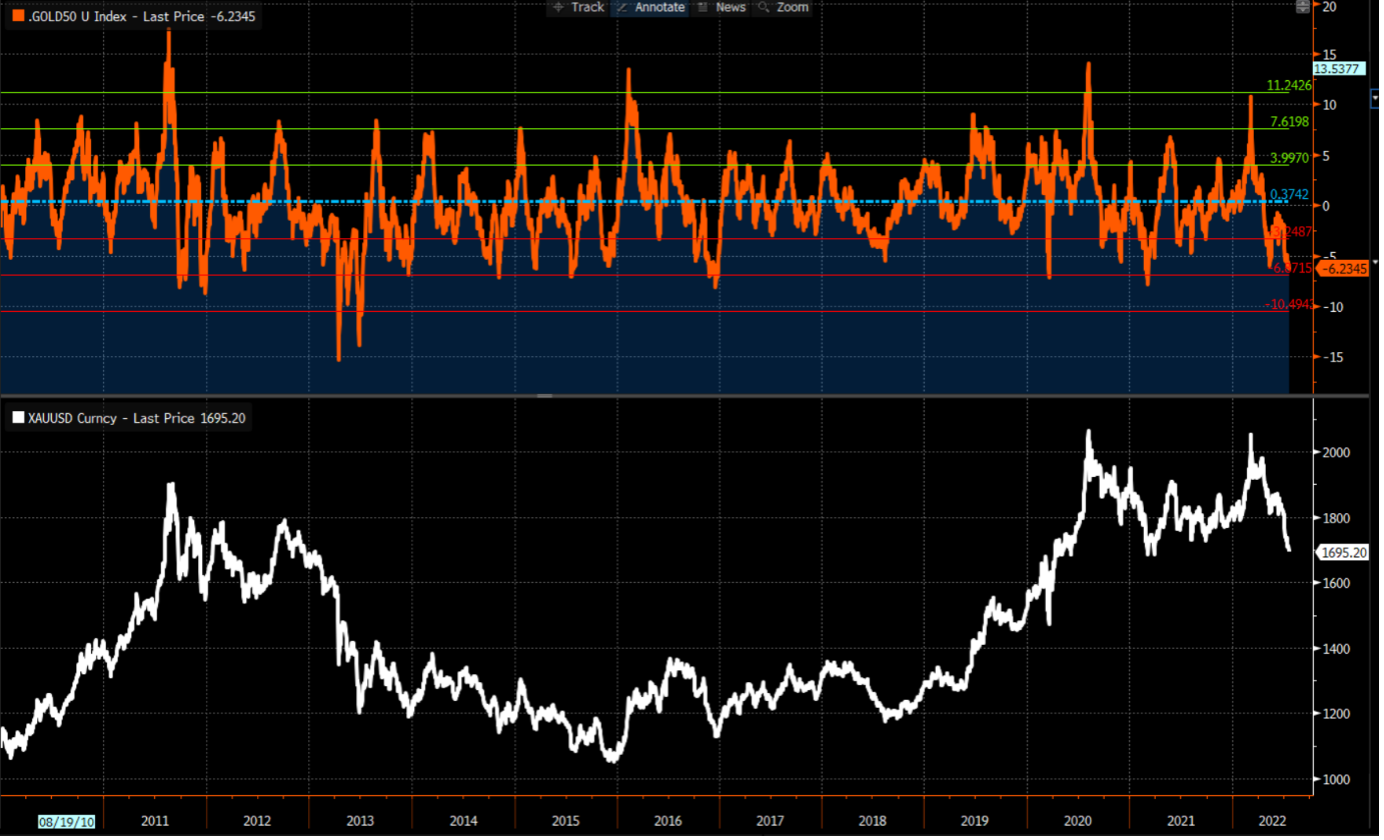

Another trade I like that involves mean reversion is Gold (XAUUSD) – while price is trending lower, if I look at the percentage difference between price and the 50-day MA, we see this currently at 6.2%. This is two standard deviations from the long-term average (the blue horizontal line – see the Bloomberg chart below). Typically, when the price gets below the 2 std dev level we see a reversion to the 50-day MA, and this has been caused by price reversing rather than consolidation that leads to the MA playing catch-up.

Gold (XAUUSD) chart

(Source: Bloomberg - Past performance is not indicative of future performance.)

We’re not there yet, but I feel a further flush out to 1680/78 (the August 2021 lows) could be the level that this move is overcooked. One for the radar and you can trade the possibilities with Pepperstone.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.