Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

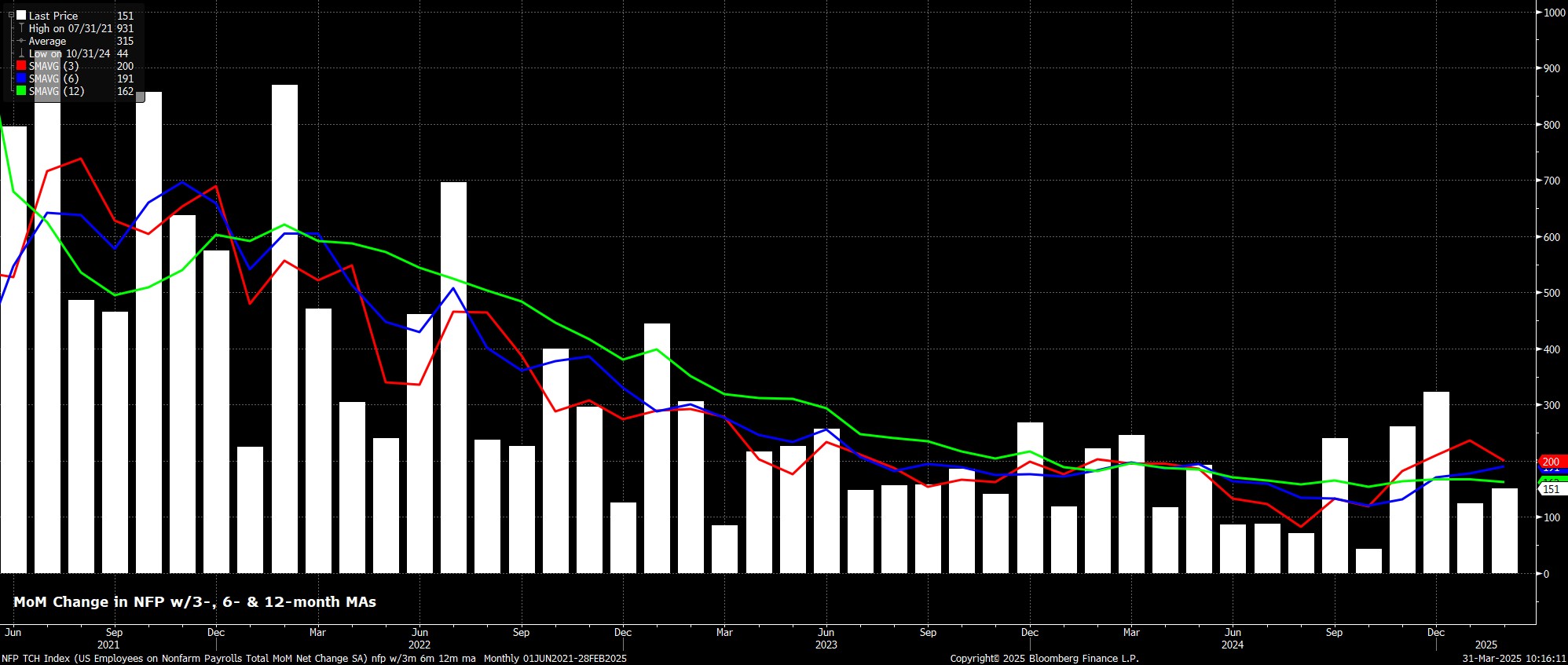

Headline nonfarm payrolls are set to have risen by +138k last month, a modest slowdown from the +151k pace seen in February, and considerably below the 3-month rolling average of job gains, which currently stands at +200k. Such a pace would, though, be above the breakeven rate of around +100k, required for job gains to keep pace with growth in the size of the labour force. As always, though, the range of estimates for the payrolls print is relatively wide, between +80k at the low, to +185k at the high.

Leading indicators for the payrolls print likely provide little by way of signal this time around, particularly given the extremely elevated degree of uncertainty currently clouding the US economic outlook.

Initial jobless claims were practically unchanged between the February and March survey weeks, while continuing claims rose by a very modest +9k over the same period. Meanwhile, at the time of writing, neither of the ISM PMI surveys have yet been published, nor has the ADP employment report, though these days the latter can be safely ignored. Lastly, the NFIB small business hiring gauge points to a headline NFP print of around +340k, of which 300k would be private payrolls – at best, this seems outlandish.

Risks around the NFP figure are numerous, and two-sided in nature.

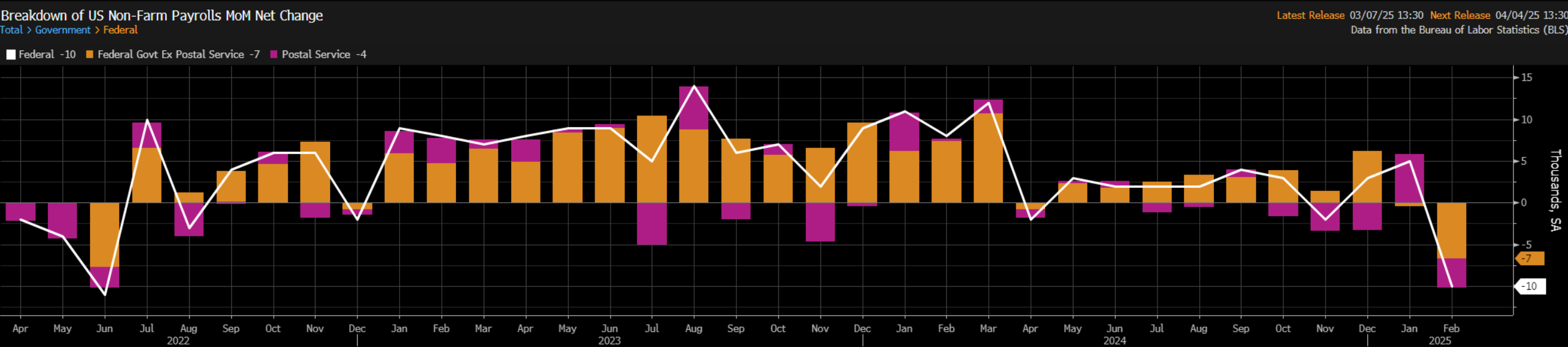

To the downside, the aforementioned economic uncertainty, chiefly the ever-changing nature of US trade policy, raises the chances of businesses altering, or even halting, hiring plans until they are able to make more concrete forecasts about their future prospects. Furthermore, ongoing efforts to reduce the size of the federal government pose a risk to the payrolls figure, not only amid an ongoing hiring freeze, but also as Elon Musk’s DOGE continues to layoff federal workers. Another important consideration when it comes to DOGE is the potential for spill-over effects, leading to federal contractors also being laid off, and further depressing payrolls growth.

Meanwhile, to the upside, the return of striking workers may be a modest boost to headline employment growth, though probably not to the tune of more than 10k or so. There is also the continued return of workers from wildfires in California to be considered, though this has seemingly progressed considerably slower than most had foreseen.

Staying with the establishment survey, earnings growth is seen unchanged from the February pace, at 0.3% MoM, and at 4.0% YoY. Work-week hours are also expected to have held steady, at 34.1.

Data of this ilk would reinforce the FOMC’s now-longstanding view that the labour market is not presently a source of considerable upside inflation risks, and would likely be of relatively little concern to most policymakers.

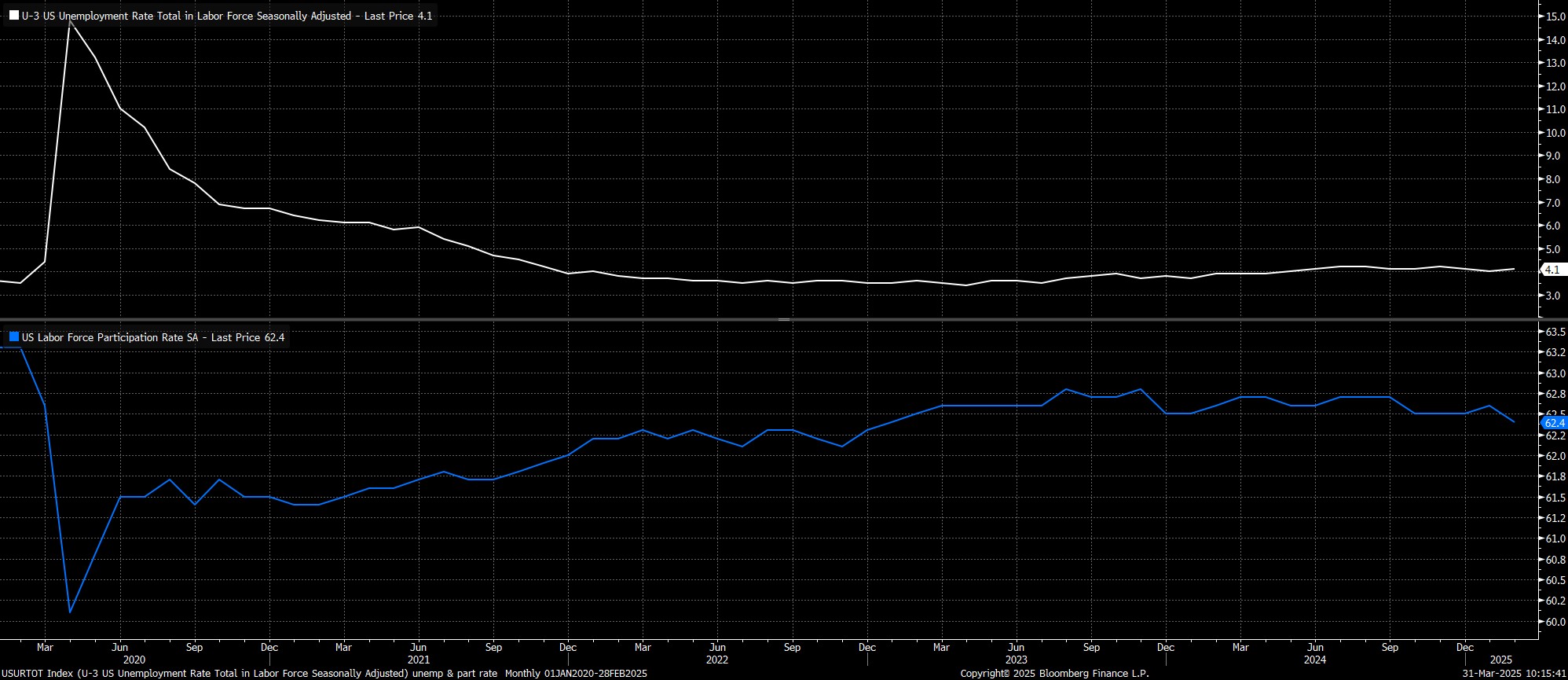

Turning to the household survey, headline unemployment is expected to have held steady at 4.1%, after last month’s unexpected uptick. The unrounded February unemployment rate, though, stood at 4.1395%, meaning that a further rise to a rounded 4.2% could well be on the cards this time around.

Meanwhile, labour force participation is also expected to have held steady, at 62.4%, again consolidating the unexpected drop seen in February; that drop, in fact, was all that prevented joblessness from rising a further 0.3pp last time out. In any case, while a rebound in participation could lead to a chunky rise in the U-3 rate, it remains important to recognise that considerably slower immigration is likely to constrain the pace of growth in the labour force as the year progresses.

In any case, the HH survey still needs to be accompanied by something of a health warning, with the BLS continuing to grapple with data volatility, and difficulty in modelling both the aforementioned immigration impacts, and a declining survey response rate.

The broader implications of the March labour market report could be somewhat limited, at least in terms of the Fed policy outlook.

For the time being, at least, the FOMC are clearly happy to sit on the sidelines, taking a ‘wait and see’ approach, as policymakers believe that policy remains ‘well positioned’, and seek additional data to gauge the impacts of President Trump’s trade policies. Furthermore, for many on the Committee, focus tilts much more towards the inflation side of the dual mandate at the present time, owing primarily to upside price risks stemming from the aforementioned tariffs.

From a market perspective, however, the jobs report could be more significant, even though the figures will drop just after ‘Liberation Day’, and the imposition of reciprocal tariffs on many – if not all – US trading partners.

The report itself, though, presents asymmetric risks, amid increasing concerns over a sharp slowdown in US economic growth. Naturally, any softer-than-expected figures are likely to further exacerbate said concerns, leading to a broader bout of risk aversion. On the other hand, though, any upside surprise seems unlikely to entirely allay concerns over the economy, instead simply leading participants to believe that such a slowdown has merely been delayed, and leading to elevated uncertainty persisting for the foreseeable future.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.