Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

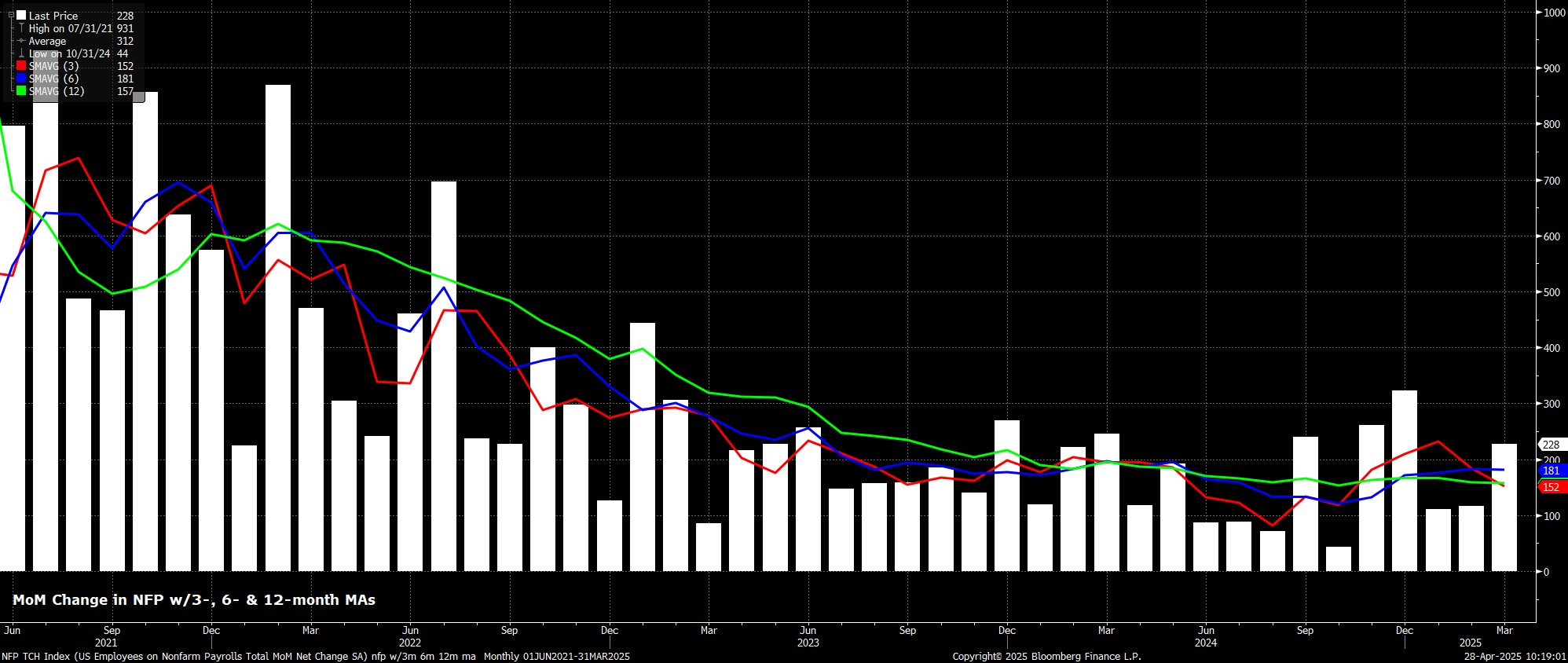

Headline nonfarm payrolls are expected to have risen by +130k in April, a marked slowing from the +228k pace seen in March, though a rate that would be broadly consistent with the breakeven pace of payrolls growth, required for employment growth to maintain pace with the increasing size of the labour force. In any case, the range of estimates for the payrolls print is as wide as ever, from +50k at the low, to +170k at the high. Furthermore, as always, revisions to the prior two months of data are also worth watching closely.

As was the case with the March report, the typical leading indicators for the payrolls print seemingly provide little by way of ‘signal’, given the incredibly cloudy nature of the economic outlook. The NFIB hiring intentions metric speaks to this, pointing to a rather laughable +345k private payrolls gain in April, despite having had a solid track record up to this point in the cycle. I think that’s a predictor we should probably retire, at this stage.

Anyway, both initial and continuing jobless claims were, as near as makes no difference, unchanged between the March and April survey weeks, falling by 9k and 6k respectively. Meanwhile, neither of the ISM surveys has been released at the time of writing, though S&P Global’s ‘flash’ PMI pointed to a smaller employment gain in April than a month prior, while also flagging the first decrease in manufacturing employment since last October.

Meanwhile, a host of other factors could influence the payrolls print this time around.

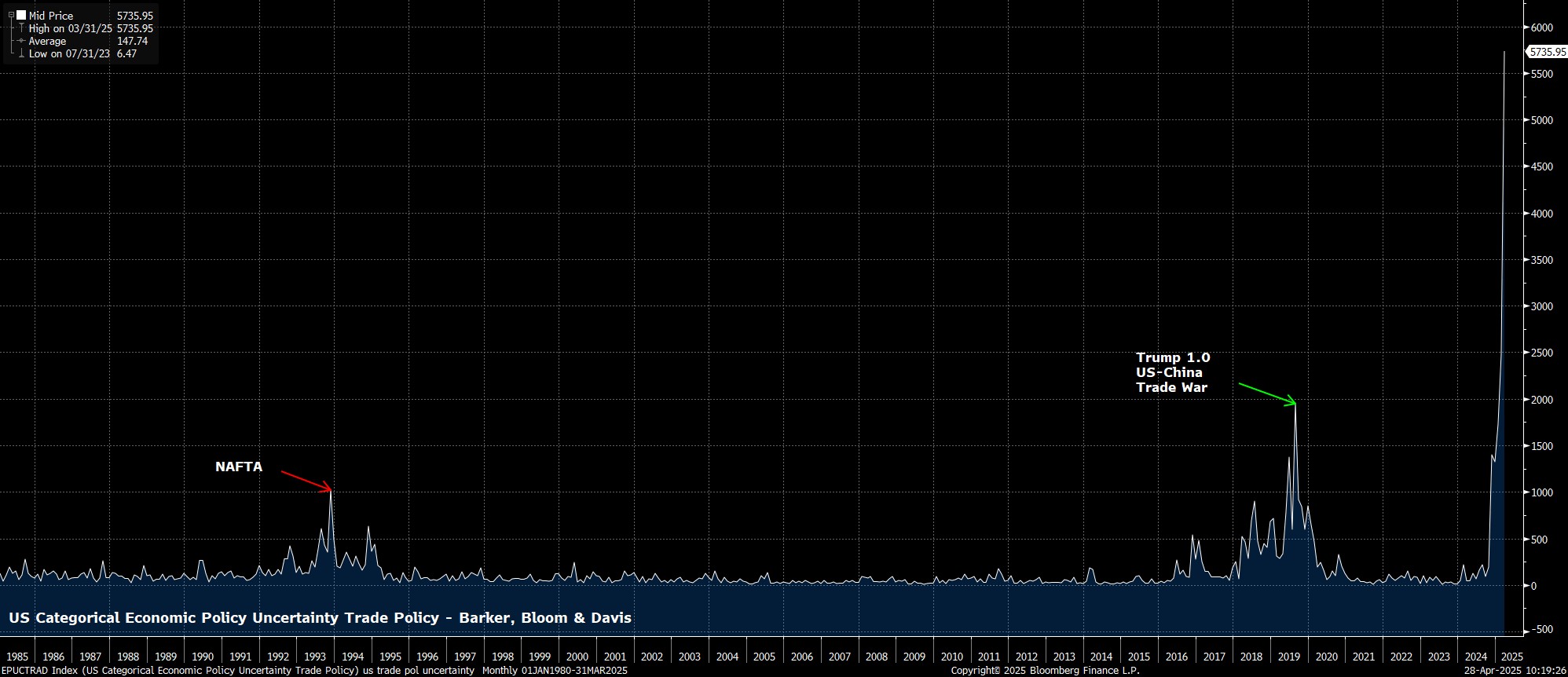

The timing of the survey will be of pivotal importance here, with the data, as always, having been collected in the week containing the 12th of the month. That timing means that, while the survey will have taken place after President Trump announced a 90-day pause on most ‘reciprocal’ tariff measures, it will likely not capture any economic relief that said U-turn may have provided, given the tight timeframes involved. The survey will, though, likely account for the 145% tariff imposed on China, which took effect on 9th April, and effective trade embargo that is now in place between the two nations.

As for other factors to be borne in mind, there is the continued issue of DOGE-related cuts to the size of the federal government. The precise impact of said cuts remains difficult to quantify, particularly considering that the volume of cuts announced in public, appears not to balance with the actual quantity of cuts that is being delivered. Furthermore, it remains to be seen when exactly the bulk of these employment cuts actually hits the jobs report, with many employees on severance packages that run until Q3. In any case, perhaps the more important issue here is the ongoing federal hiring freeze, which will naturally pose a headwind to payrolls growth.

Other potentially important influences on the payrolls print this time around include the spell of good weather seen during the majority of the month, which is in particular likely to boost employment in the construction sector. In addition, employment in the logistics sector will be an important gauge of the early impacts that tariffs may be having on the US economy, while attention should also be paid to the leisure and hospitality space, for any signs of consumers tightening their belts, and reining in spending, as the degree of economic uncertainty continues to mount.

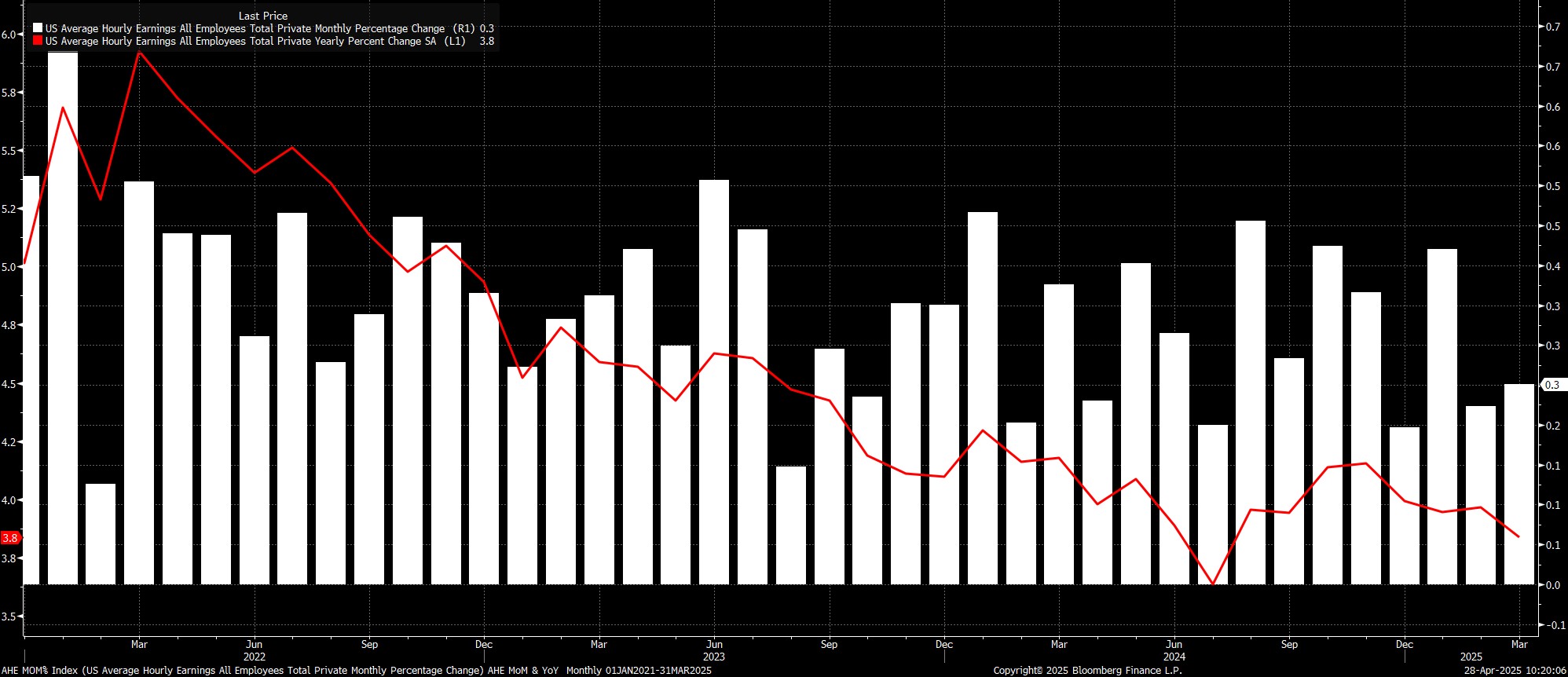

Remaining with the establishment survey, data should point to the pace of earnings growth remaining contained. On an MoM basis, average hourly earnings are seen rising 0.3%, unchanged from the pace seen in March, though such a rate would drag the annual pace 0.1pp higher, to 3.9% YoY.

Still, data in line with these expectations would again serve to reinforce the FOMC’s longstanding viewpoint that the labour market isn’t a source of significant upside inflation risk. Those risks, though, are of course prevalent, stemming principally from increased costs as a result of tariffs being passed on to the US consumer in the form of higher prices.

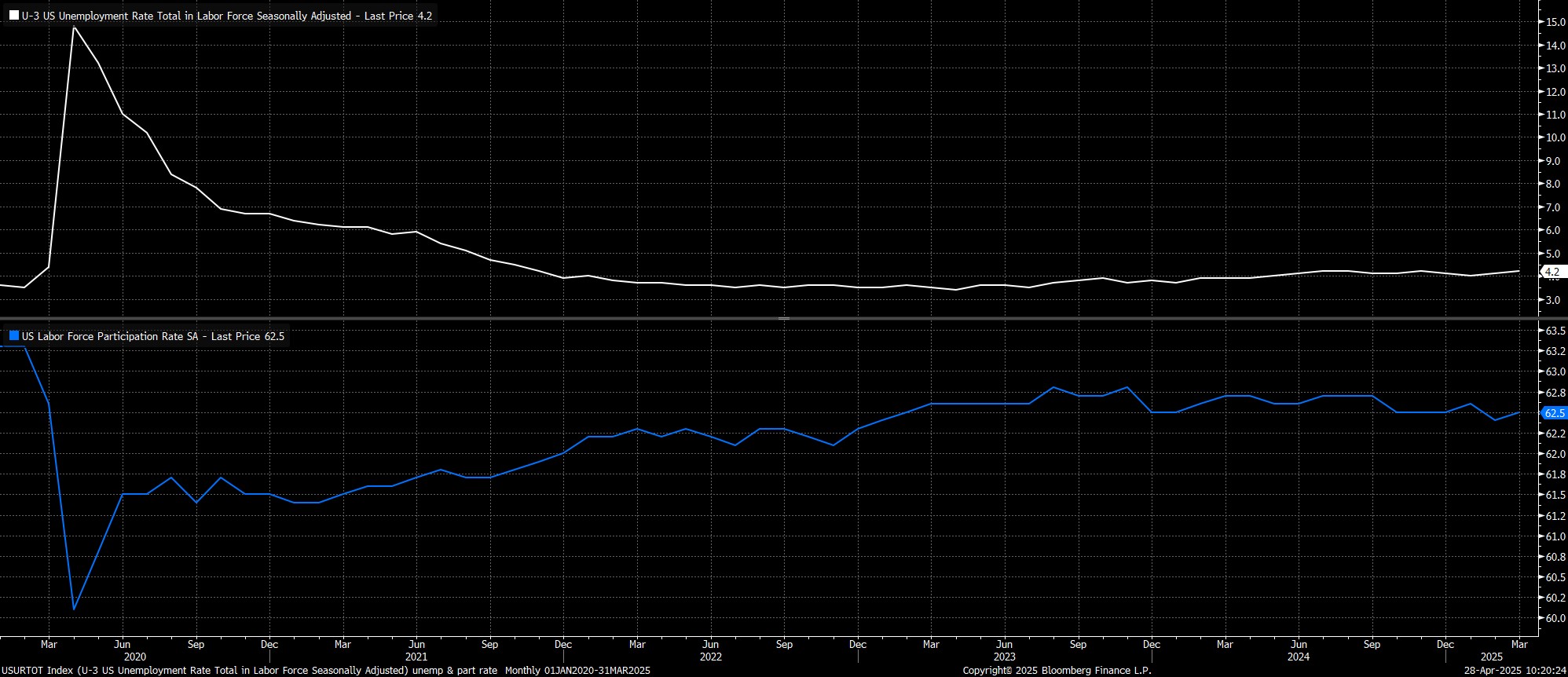

Turning to the household survey, headline unemployment is set to have held steady at 4.2% in April, having risen by 0.1pp in March, while labour force participation is also set to remain unchanged, at 62.5%.

That said, the uptick in unemployment seen last time out actually came by virtue of ‘good’ reasons, stemming from an increase in participation (i.e., more people seeking work) as opposed to a rise in layoffs. Furthermore, unemployment was a ‘low’ 4.2% in March, with the unrounded rate at 4.1520%, thus leading to the possibility that even a modest shift in labour market conditions sees headline unemployment round back down to 4.1% this time around.

In terms of the broader implications of the labour market report, from a monetary policy perspective, they are likely to be relatively limited.

The FOMC have signalled that they are firmly in a ‘wait and see’ mode for the time being, seeking to assess the inflationary impulse that the aforementioned tariffs are likely to cause, and likely wanting to be sure that said impulse will indeed prove temporary in nature, before embarking on further rate cuts.

That said, a handful of policymakers have made increasingly dovish remarks of late, including non-voter Hammack, who flagged the possibility of a June cut in the event of “clear and convincing data” pointing to it being necessary. That caveat, though, suggests that the FOMC would need to see more than one soft data point before springing into action, with policymakers loath to over-react to a single report, especially with the May jobs data due before the June policy meeting.

From a market perspective, the April jobs report presents asymmetric risks, akin to those seen in the run-up to the prior set of figures. As such, a better-than-expected data slate is unlikely to provide much by way of long-lasting relief, being more a case of slowdown ‘delayed’, than slowdown ‘averted’. In contrast, a softer than expected report would only serve to crystallise those very growth worries that have become so pervasive of late, especially with conditions set to worsen further as the second quarter progresses, and the full impact of tariffs becomes clearer.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.