- English (UK)

Analysis

As noted, markets assign a roughly 95% chance to a 25bps increase this week, meaning that attention is unlikely to focus on the decision itself, with the commentary surrounding the expected rate hike of much more significance, while also being a much more likely source of market volatility.

Before discussing that, however, we should note that there is a small, but not insignificant chance, that this week’s 25bps hike may not be unanimous. Chicago Fed President Goolsbee has made some rather dovish remarks of late, and may perhaps dissent in favour of leaving policy unchanged at its present setting. Such a dissent, however, is unlikely to cause major market repercussions, given that the futures curve implies markets fully expect this to be the final hike of the cycle in any case.

While markets, and sell-side economists, all appear to be of that view, it is unlikely that the FOMC themselves lean into such an outlook, primarily to avoid what would be seen as an unwarranted, and undesirable, loosening of financial conditions. Instead, the FOMC’s statement is likely to include a repeat of the tweaked guidance from the last meeting, in that “some additional policy firming may be appropriate”.

Chair Powell is also likely to use similarly non-committal language surrounding a potential pause/end to the hiking cycle at the post-meeting press conference, though may tilt his remarks towards signalling a more data-dependent approach to policy going forward. Recall, between this and the next FOMC meeting, there are 2 labour market reports, and 2 CPI prints due, giving the FOMC plenty more data to digest in future policy deliberations. However, any moderation of prior hawkish rhetoric will likely be caveated with the repetition of the now well-rehearsed line that inflation “remains too high”.

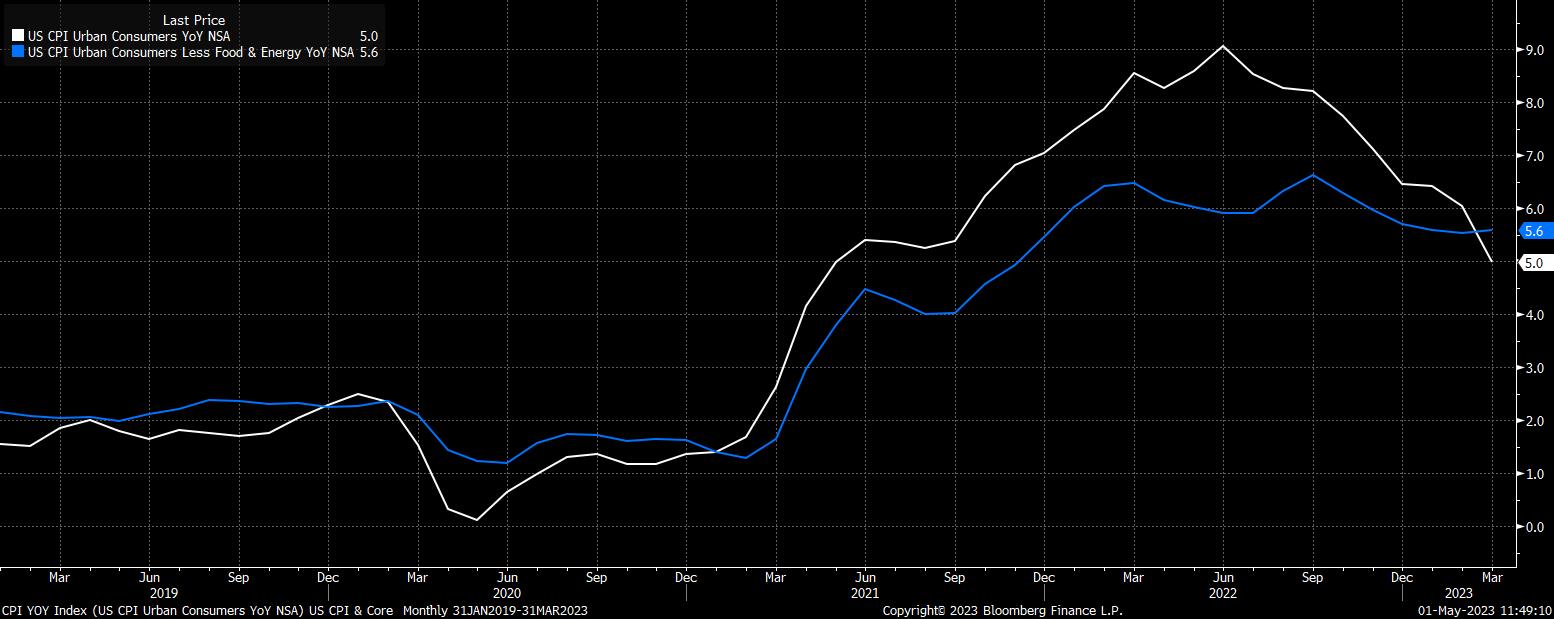

On that note, and although headline CPI has fallen significantly from the 9% level seen last summer, it is the persistent nature of core inflation that is likely to be of concern for policymakers. Excluding food and energy, core CPI has now been consistently above 5% YoY since December 2021, with little sign of rate hikes making a dent in price pressures. A similar trend can be seen in the core PCE deflator, the Fed’s preferred gauge.

It is the persistently high nature of core inflation, along with the remarkable tightness that we continue to see in the labour market, that is likely to deter FOMC officials from an overtly dovish message – either an explicit recognition that the hiking cycle is now at an end, or any sort of endorsement of the market’s pricing of over 50bps of cuts between the terminal rate, and the end of the year.

The FOMC had previously, in short, guided investors to expect rates to be ‘higher for longer’; the ‘higher’ part of that guidance has now been reached, and we prepare to move into the ‘longer’ phase. Although the average duration between the terminal rate and the first rate cut is around 6 months, the inflation backdrop seems likely to prevent such swift loosening this time around. Perhaps, then, one should view market pricing for cuts more as a probability distribution where the risks to the economic outlook tilt firmly to the downside, rather than a defined view on the future rate path.

Of course, the primary risk to the economic outlook comes from the likely sharp tightening of bank lending standards that will be seen in the aftermath of the regional banking issues – both the collapse of SVB and First Republic, as well as the deposit flight seen from other smaller financial institutions. The Fed’s next Senior Loan Officer Survey, due 8th May, will be key to determine the degree to which credit standards have tightened, and subsequently the degree of economic damage that may be inflicted.

On the subject of risks, it is deviations from the aforementioned FOMC base case – a 25bps hike, and largely unchanged guidance – that pose the biggest volatility risks to the financial markets.

For the USD, we sit in an interesting position, with the greenback still rather unattractive in the eyes of most market participants, as the end of the Fed’s hiking cycle looms while others, such as the ECB, look set to continue raising rates well into Q2. That said, we must mention that volatility across G10 FX has been rather muted of late, though this does provide some well-defined levels to watch going into the FOMC.

102.00 has been the limit of upside in the DXY of late, with a closing break above here opening the door to a test of the 50-day moving average for the first time since mid-March. In contrast, a dovish read on the FOMC is likely to see the buck come under renewed selling pressure, with 101.00, and 100.80 the key downside levels to watch. It’s also worth having on the radar the triple-top in EUR/USD at 1.1075, last week’s 1.2585 highs in cable, and the 0.6650 mark in the AUD, were the greenback to come under pressure post-FOMC.

_D_2023-05-01_11-45-58.jpg)

As for equities, a string of strong corporate results, primarily from the ‘big tech’ firms, has helped to propel the S&P 500 back to the 4,200 handle, which has marked the top of the YTD range.

Any hints of dovishness from Chair Powell will likely see the market slice through this level like a hot knife through butter, putting a return to last summer’s 4,325 highs on the cards in relatively short order (though, the bulls might want a strong beat on Apple’s earnings on Thursday to make their case more solid). On the other hand, to the downside, 4100, followed by the 50-day MA at 4,054 are the key levels to watch.

Of course, volatility is likely to be seen elsewhere in addition to FX and equities. Spot gold, for instance, continues to pivot around the $2,000/oz mark, and remains largely a play on both the USD and real Treasury yields. On that subject, it will be interesting to see if the FOMC decision can finally jolt a bit more volatility back into the bond market, where the 2-year has been stuck just above the 4% mark for some time, and the 10-year equally lacklustre around the 3.5% level.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.