Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

WHERE WE STAND – The Easter break is over, back to the grindstone we go.

Back we go, though, to a market that is trading on the back of almost entirely the same themes that it was prior to the long weekend. Namely, a distinct lack of desire to take on risk, and notable concerns over the investability of the United States.

This latter concern, naturally, goes hand in hand with he former, though has increasingly come to the fore of late, not only amid ongoing incoherence from the Oval Office on the trade front, but also as President Trump has ramped up his attacks on Fed Chair Powell.

Late last week, we again heard Trump bemoaning how Powell is “always late and wrong”, and that his termination “cannot come soon enough”, with the President later repeating his belief that if he asked Powell to resign, he would do so. This nonsense continued yesterday, with Trump calling Powell “Mr Too. Late” and a “major loser”. Slinging around playground insults is, frankly, unbecoming of the leader of the free world.

To be clear, Powell has said on numerous occasions that he would not leave post if asked, while it – under current law – remains impossible for the President to fire a Fed Chair, without “cause” to do so, generally seen as a term covering illegal activities.

Though Powell’s departure before the end of his term next May remains a slim possibility, even the mere mention of such a prospect has been more than enough to stir even greater fear among market participants, who were already taking a dim view of the dollar’s haven, and reserve, status, given the frankly shambolic nature in which the White House have been conducting themselves of late. Incidentally, though, if Powell were to leave his post prematurely, the trade is probably the easiest call I’ll ever have to make – sell equities, sell Treasuries, sell the USD, buy vol, and don’t look back.

While we’re, clearly, not at that stage yet, market participants are, logically, continuing to trim their exposure to US assets, with little-to-no signs emerging of the Trump Admin changing course, on trade, attacks on the Fed, or anything else besides.

As that desire to trim US exposure increases, gold remains the only real haven offering shelter from the storm, with the yellow metal continuing to shine, bursting north of $3,400/oz for the first time yesterday. I remain a gold bull here, with the ‘barbarous relic’ still having the best prospects of any asset for the time being, most obviously due to its relative immunity from the whims of President Trump’s social media account. Still, we’ve come a long way in a short space of time, so pullbacks can’t be ruled out, though I’d be viewing such retracements as buying opportunities.

Outside of gold, ‘sell everything’ kinda sums up the way in which markets traded as the new week got underway.

Equities, on Wall Street, slumped across the board, with both the S&P and Nasdaq ending around 2.5% lower. I remain bearish here, in the short-term, particularly while there remains precious little sign of any trade deals being struck, despite the 90-day pause in ‘reciprocal’ tariff measures. No news is bad news on this front.

While agreement of some deals, which would provide a blueprint for other nations to follow, would certainly be welcome, indices are also trading at a valuation which remains far too lofty considering the hit to both economic and earnings growth which looms large on the horizon. Rally selling remains my preferred strategy, even if the lows, around 4,800 in spoos, are probably in for the time being.

Treasuries, meanwhile, did not trade as they ‘should’ on such a risk averse day, with selling pressure intense at the long-end of the curve, as 30-year yields rose 10bp on the day, seeing the curve as a whole twist steepen, with the 2s10s printing its widest since Q1 22. At risk of banging this drum one too many times, Treasuries and equities selling-off together is hardly a vote of confidence in the country in question, and is a classic sign of capital flight out of that very economy.

That is even more so when the currency tumbles in line with those two moves, as we saw yesterday, with the greenback shedding over 1% against most peers, as the DXY slipped to 3-year lows below the 98 figure. I still like the USD lower here, as there remains little to like about the US economy as it teeters on the brink of stagflation, as the buck displays no haven properties whatsoever, and as capital flight from the US gathers pace.

As I’ve mentioned before, though, this sort of move probably won’t take place in a linear fashion, though rallies present fresh selling opportunities. Regime changes take months to pan out, not just a few trading sessions.

LOOK AHEAD – European traders return from the long weekend to a relatively barren economic docket today.

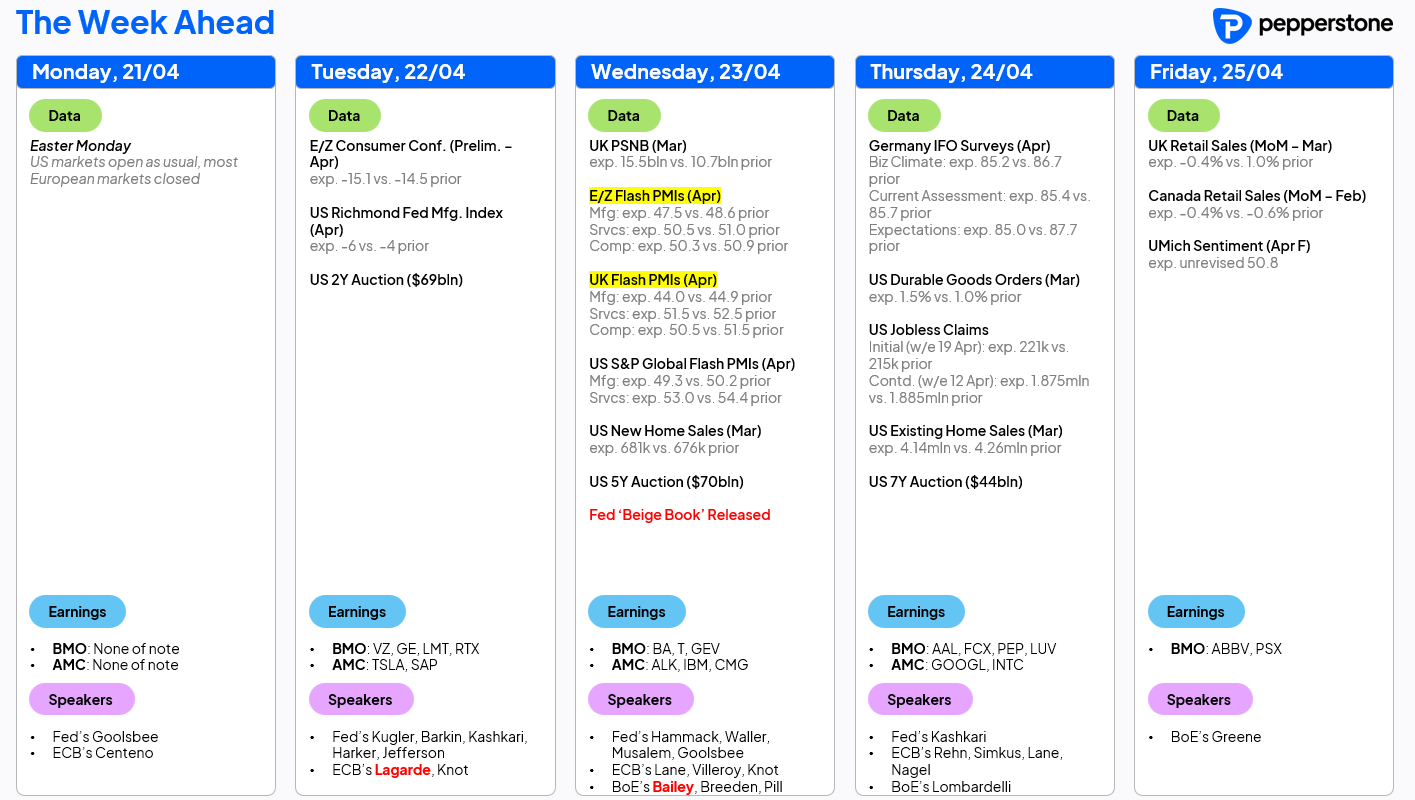

That said, the week to come is likely to be a busy one, with Wednesday’s ‘flash’ PMI surveys standing as the most notable scheduled risk event. These surveys are likely to paint a relatively grim picture given the huge degree of prevailing uncertainty seen this month, though ‘soft’ data has, thus far, tended to over-exaggerate the degree of economic downside compared to equivalent ‘hard’ data points.

Besides that, this week’s data calendar is uninspiring. That adjective is also likely to sum up the general tone of speeches from the annual IMF/World Bank ‘spring meetings’ taking place this week, which will result in a ton of central bankers making remarks, most notably ECB President Lagarde today, and BoE Governor Bailey tomorrow.

Meanwhile, in the equity space, 27% of the S&P 500 are due to report earnings this week, marking the second busiest week of Q1 reporting season. Notable firms reporting include ‘magnificent seven’ names Tesla (TSLA) and Alphabet (GOOGL), plus names such as Boeing (BA) and Intel (INTC).

The full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.