- English (UK)

Analysis

WHERE WE STAND – Something of an inconclusive US labour market report on Friday leaves participants with perhaps more questions than answers as the new trading week gets underway, with just two ‘proper’ weeks left until the festive period begins in earnest.

The US economy added 227k jobs in November, marginally above consensus expectations, and agonisingly close to my own guesstimate of +235k. Added to this, the prior two prints were revised higher by a net +56k, taking the 3-month moving average of job gains to its highest level since May. Of course, a significant chunk of the job gains seen in November were an unwinding of the weather- and strike-related job losses that occurred a month before.

Meanwhile, average hourly earnings continue to grow at a solid clip, which should keep the pace of consumer spending resilient, albeit one that doesn’t particularly threaten sustainable achievement of the 2% inflation target over the medium term. Growth of 0.4% MoM, and 4.0% YoY, was unchanged from the pace seen in October, but I’d imagine some of the FOMC’s hawks would probably want this to cool sooner rather than later.

It is, though, the household survey where there is more cause for concern, though a pinch of salt is required given the volatility of the survey this cycle, and falling response rates. In any case, unemployment rose to 4.2%, just shy of the cycle high 4.3% seen in July, while participation slipped to 62.5%, its lowest level since May.

So, the nub is – a solid rebound in payrolls, strong earnings growth, coupled with rising unemployment.

A bit of a head-scratcher, then, for market participants and policymakers alike to grapple with. I’d argue, however, that the rise in unemployment should be enough to cement the case for a 25bp December Fed cut, if only for the reason that it solidifies the idea that the ‘path of least regret’ points in such a direction. If policymakers are concerned about stalling disinflationary progress, or potential upside inflationary risks in the early days of a Trump presidency, then they can perhaps ‘skip’ the January meeting instead.

Participants, by and large, took the jobs report in their stride, with the figures of course dropping at a rather odd time of year, where liquidity is thin, and volumes considerably lighter than usual.

Stocks ended the day in the green, with the tech-heavy Nasdaq leading the way higher, while the benchmark S&P 500 notched its 57th all-time closing high of the year. With just 16 trading days to go, 1995’s record of 77 ATHs in a calendar year shan’t be beaten, but the bulls should nevertheless remain in control, as the economic and policy backdrops remain supportive, leaving dips as buying opportunities, albeit with conviction perhaps dwindling as the year draws to a close.

The dollar, meanwhile, was choppy but ultimately a touch softer post-NFP on Friday, though this wasn’t enough to stop the buck from notching a weekly gain – its 9th in the last 10 against a basket of peers, incidentally. I remain a firm believer in the case for further USD upside, as risks around the FOMC outlook become increasingly two-sided into 2025, and as the US economy continues to vastly outperform that of peers. Some haven demand amid renewed geopolitical risks, particularly weekend developments in Syria, might also provide further help to the bull case, at the margin.

LOOK AHEAD – A quiet start today to what will be a busy week ahead, with the data docket for the next 24 hours or so bringing relatively little of interest. We should, though, all be thankful that the FOMC are now in the pre-meeting ‘blackout’ period.

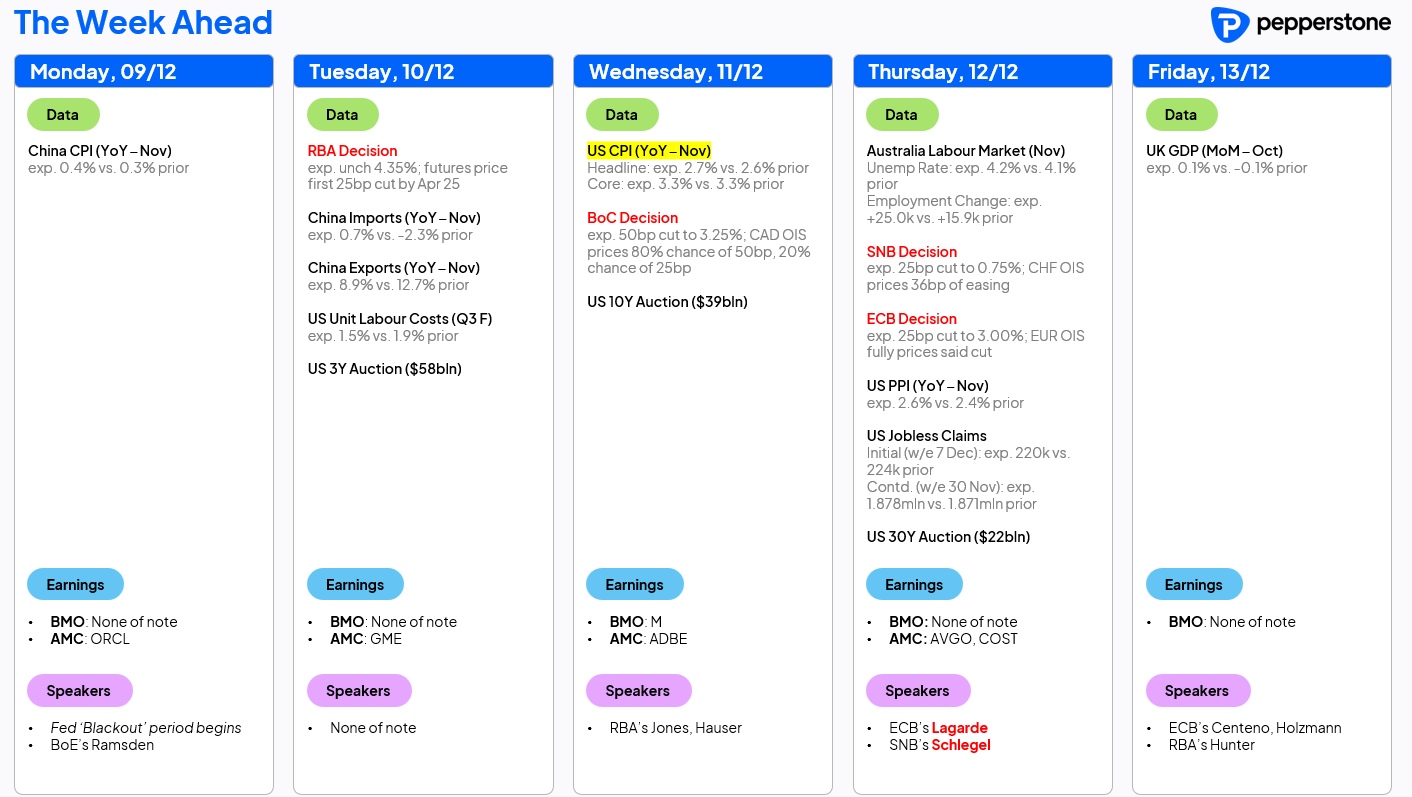

In any case, another hectic week awaits – four G10 central banks are due to announce decisions, with the BoC, SNB and ECB all set to deliver rate cuts, while the latest US CPI figures highlight the data docket. A full calendar for the week ahead is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.