- English (UK)

Markets Face Crucial Week as US Data, Tariffs, and Powell Take Center Stage

What eventuates this week in markets is clearly anyone’s guess and will require a truly nimble and agile approach to trading.

Of course, no one knows the near-term direction of markets or the extent of impending movement, and we can only think in probabilities and the distribution of risk - where we account for the known event risk, positioning, technicals, volatility and flow-based effects. Taking that into account, what went down in markets on Friday suggests that the skew in the distribution of risk is for further lower levels in risky assets early this week, and for higher cross-asset volatility.

Adding fuel to the risk off move on Friday was the consideration of gapping risk on the Monday open, with many choosing to cut back on risk or to run hedges through weekend. There would have also been rebalancing/non-speculative flows playing out ahead of month- and quarter-end.

However, the real damage to markets took place just after the US cash equity open and we consider three big factors that impacted:

- Increasing Stagflation Risk - The combination of weaker US real personal spending data married with a hotter US core PCE print and Uni of Michigan survey of 1- & 5-year inflation expectations, fed the stagflation beast. US 2-year inflation swaps have pushed to 2.85%, and the highest level since March 2023.

- Further fallout from the more aggressive 25% tariff on US auto imports, which is expected to boost US car prices by 5% on average and add around 30bp to US core PCE inflation by year-end.

- Ongoing concerns around the AI trade, given the Alibaba chairman’s comments warning of a bubble in data centres, married with the ongoing lack of evident ROI from the huge CAPEX spend. As Fed member

Mary Daly (a non-voter in 2025, neutral stance) opined in late US trade (on Friday), “100% of the focus is on inflation”. Assuming that is a view shared by others within the Fed’s ranks it leaves the Fed constrained and the market feeling a new sense of vulnerability.

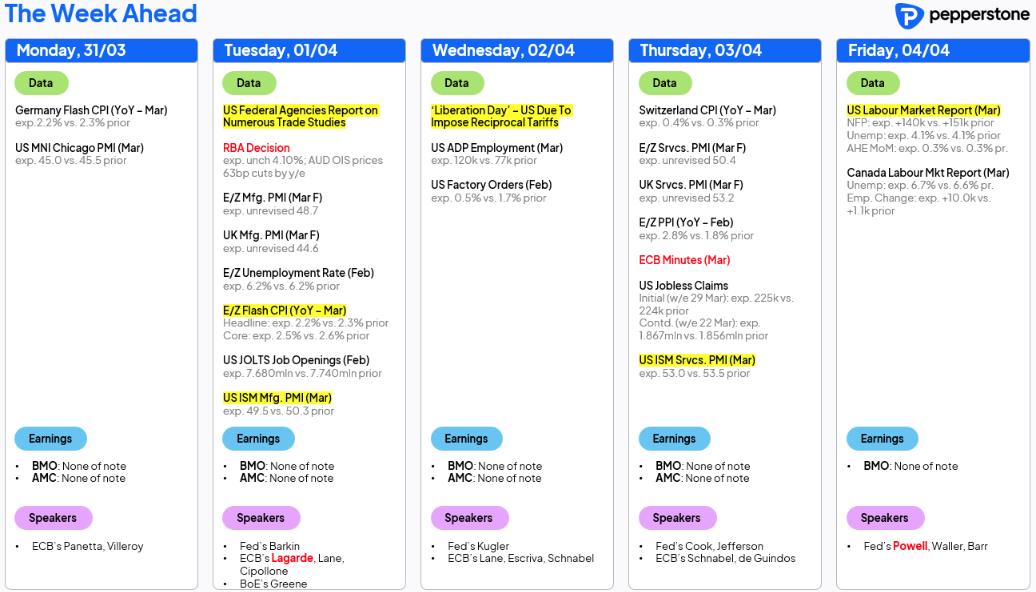

A Big Week for US Data: ISM Manufacturing & Services, NFP and Jay Powell Speaks

Given this dynamic, the US economic data due to drop this week will be firmly under the market’s microscope. JOLTS job openings, ISM manufacturing and services report and US nonfarm payrolls report will all be front of mind, and all have the potential to move markets.

On the ISM surveys, many will be looking at the extent of a higher ‘Prices Paid’ and a weaker ‘New Orders’ sub-components (in both surveys), as this growing divergence plays into the stagflation narrative, and we’ve already been alerted to this in some of the regional PMI surveys. The US nonfarm payrolls (NFP) is expected to show a slowdown in hiring with 138k net jobs created in March, while the unemployment rate is expected to remain at 4.1% and Average Hourly Earnings also unchanged at 4%. The bear case for risk and the USD would be weaker hiring (say below 110k), an unemployment rate at or above 4.1% and a lift in average hourly earnings.

From a risk management perspective, I would argue that US equities and the USD would sell-off more aggressively on a poor NFP print, than any positive reaction to a hotter NFP print.

Watching the USD, Credit and Funding Markets

We look forward as market participants, but it often pays to review the past as there can be important intel to take forward into the new trading week. Firstly, I would point to the fact that the USD holds little safe-haven qualities that have been prevalent in previous 2% selloffs in the S&P500, and a sharp widening in credit spreads. With the US economy at the heart of the markets concern and with US Treasury yields lower on Friday by 8-11bp across the curve, the USD found few friends, albeit a -0.3% decline for the DXY does certainly not constitute a collapse.

Secondly, a new concern for broad markets is the widening of US high-yield credit spreads, which widened +18bp on Friday and have risen to the widest levels since August 2024. The bigger picture shows that spreads are still not at alarming levels, however, the move since mid-Feb has been aggressive, and further deterioration will likely weigh on equity sentiment.

US and global (notably Japanese) funding markets won’t get the level of attention that the Trump tariff headlines over US “Liberation Day” (Wednesday) will. But as we roll into quarter-end and fiscal year-end in multiple countries (for example, the UK, Japan and Singapore), we could see increasing signs of stress in the funding channels, even if due to seasonal factors.

Eyeing the Technicals: New Cycle Lows for the S&P500 and NAS100?

Both NAS100 and S&P500 futures closed on their respective lows on Friday, which rarely offers a positive read-through for price action in the days following. After the emphatic rejection of the 200-day MA last week, both US equity futures and cash markets filled and breezed through Friday’s price gap, raising the probability for a test of the 11 March lows.

A closing break through 19,139 (NAS100 futures) and 5509 (S&P500 futures) would be significant, and with increasing demand for equity volatility (the VIX closed +3 volatilities at 21.65%), if the buyers remain sidelined, the combo of renewed systematic and passive selling flows, and increased short selling activity would see the downside momentum build.

Fed Chair Powell will be speaking 3 hours after the US NFP print drops and his outlook on the US economy could be a landmine for markets to navigate. Specifically, if we were to see new cycle lows in US equity indices and the VIX above 25%, then Jay Powell’s choice of wording in his address could be critical, and the market would not take kindly to any narrative that pushes back on the prospects for rate cuts at the June FOMC meeting - a factor that is 89% implied in US swaps pricing.

It's Hard Not to Be a Gold Bull

Gold looks like the real winner from the market’s inability to efficiently price economic or tariff risk. With the Fed focused more intently on the upside risk to inflation, the markets go-to circuit breaker remains constrained, and up until Friday there had been limited conviction that US Treasuries work effectively as hedge - so this really put gold, and volatility (long VIX, puts) as the primary hedges for risk.

Through the trading week, market participants also navigate EU CPI (Tuesday), and the RBA meeting (policy unchanged), although these will likely be non-events relative to the impact that could stem from the US data and the reaction to the tariff announcements.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.