Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Weekly Market Outlook: US Earnings, Economic Data, and Global Risks

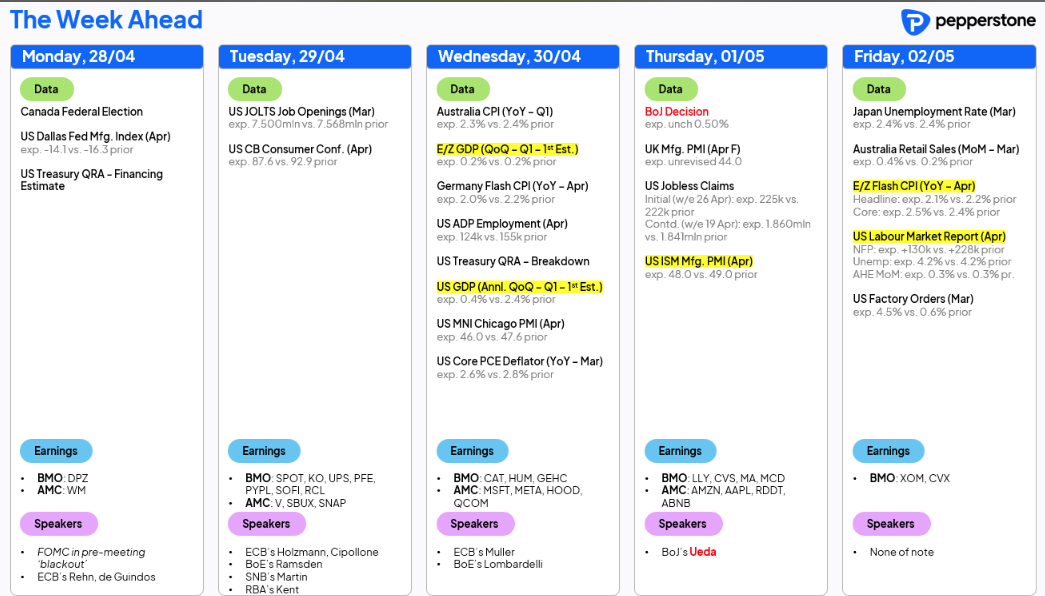

The noise from tariff negotiation remains deafening, but we’re seeing signs that markets have started to reduce their sensitivity to the tariff headlines, driven in part by an increasing consistency in the conciliatory tone. We push deeper into Trump’s 90-pause, with markets in the process of quantifying the potential trough for the effective tariff rate and if current tariff rates remain for a duration how that feeds into deficits and economics.

Many attempt to quantify the risk premium that US assets must now wear given the poor execution of Trump’s policy implementation, and that is no easy task. What is positive for risk though is that markets feel a renewed sense of control – where the collective has seen the response from the US Administration to moves in the US 10-year Treasury, equity and implied cross-asset volatility – to know that Trump et al do have a threshold and a trigger point.

A low bar to beat on US earnings has been helpful, and we’ve seen that with Google having a strong run on a better-than-feared report, and this sets us up nicely for earnings this week from the likes of Meta, Microsoft, Amazon, and Apple. With growth and high beta equity finding the love and outperforming, should these names please a low bar, we could see the NAS100 breaking above 20k and re-testing the 200-day MA (20,582).

US Hard Data is Holding Up....For Now

The incoming US economic data clearly matters as the range of views on the trajectory of the US economy promotes an increased dispersion from market players on the near-term direction for US equity, the USD and Treasuries. After seeing such a deterioration in the survey-based data releases (i.e. soft data), some had positioned portfolios for imminent recession risk. Yet, we have seen no noticeable deterioration in the US hard data economic releases, where last week traders saw better-than-feared US S&P global PMIs, durable goods and weekly jobless claims.

Subsequently, until the market and the Fed see the hard data turn, with deterioration in the US labour market and growth metrics and that may be a 2H25 story, then we have to be open-minded to the possibility that the US economy doesn’t gravitate towards recession and simply muddles through – a clear positive for risky markets.

Granted, we’ll see a weak US Q1 GDP print on Wednesday (the consensus eyes +0.4%), but this will be a function of companies increasing imports ahead of tariff implementation, with consumption set to come in at 1.2% y/y. Clearly, if consumption proves to come in much weaker, then it would set a poor precedent for when the effects of tariffs do genuinely start to impact, and as such the USD and equity would react.

US Nonfarm Payrolls to Take Centre Stage

Friday’s non-farm payrolls are the marquee risk for the week with the consensus seeing a further cooling with 130k payrolls as the median estimate, with the U/E rate expected to remain unchanged at 4.2%. While we’ll know the outcome of the US JOLTS job openings, consumer confidence and ISM Manufacturing by Friday’s NFP release, the trends here will shape the market’s reaction function towards payrolls and increase the emphasis on the jobs print as a guide on implied US recession risk. The US hard economic data releases seen of late suggest a US economy in transition and that has been enough for traders to manage bearish exposures and add some degree of risk to the portfolio. The change in sentiment was clear, and we can see that in the cross-asset price action and in the flow data, solid inflows into US Treasuries and equity funds.

S&P500 futures have open 0.2% lower upon the futures reopen, but closed on Friday at a 5-day high at 5552 and above the 10 April swing high of 5528, and while US earnings and the data will decide the fate of the tape this week, I see scope for price to push into 5700/50 in this run. NAS100 futures have rallied 18.8% from the April lows and need to find another 2.4% to retrace and cover all the drawdown seen post-Liberation Day.

Traders/funds have reduced portfolio and volatility hedges, with the VIX closing at 24.8% (-5 vols w/w), while covering tail hedges for more extreme moves in equity. US HY credit spreads tightened 36bp w/e, while gold has lost some of the upside momentum, with the selling supported mostly through Asia by insatiable demand from Chinese entities. Short positions in the USD are also being looked at closely, and as we consider the risk premium for holding US assets in this climate, if the tone of tariffs remains conciliatory and the data does hold up, then the fair value on the USD would be seen a touch higher than current levels.

Looking Ahead - Events Outside of the US

Traders monitor risk outside of the US dynamic, with elections taking place in Canada and Australia, while we get inflation prints in Europe and Australia, with China PMIs and the BoJ policy decision.

Locally, the Aus Q1 CPI print (Wednesday) will get strong attention from traders and the RBA and will also likely be seized upon by Anthony Albanese in the final few days of his campaign given the trajectory of inflation can be spun to reach the core of the election data - the cost of living.

Baring a far hotter inflation outcome, if the consensus call for Q1 trimmed mean CPI (of 0.7% q/q / 2.9% y/y) is realised then we must think the RBA will see inflation tracking firmly to its June quarter forecast (of 2.7% y/y) and put them in a strong position to cut rates on 20 May. Aus swaps see a 25bp cut as a done deal, with the additional 15% implied for a 50bp cut at the May meeting seemingly a hedge against a renewed deterioration in global risk markets, resulting in the possibility of emergency policy management. Clearly, if equity continues to push higher and volatility further normalises, then one can assume Aussie swaps will price out any chance of a 50bp cut.

Options pricing implies little Election Volatility Risk With over 2m Aussies having now voted in the Australian Federal election, the betting markets see the ALP either just sneaking in the required 76 seats for an outright majority or falling just short and needing the support of various independents. The ASX200 index options term structure offers little evidence that traders see the election as a volatility event, and that is certainly also the case for AUD options. The number of seats matters though for both the ALP and the LNP, and if either party falls below 70, the closer we run towards painful negotiations and potetnail spending concessions, or even fresh elections. Should the ALP even look like they have to engage with the Greens, then I would argue that sanguine vol pricing in ASX200 equity would be mispriced.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.