- English (UK)

ECB July 2025 meeting preview: No rate change expected amid trade tensions

Policy Decision: No Surprises Expected

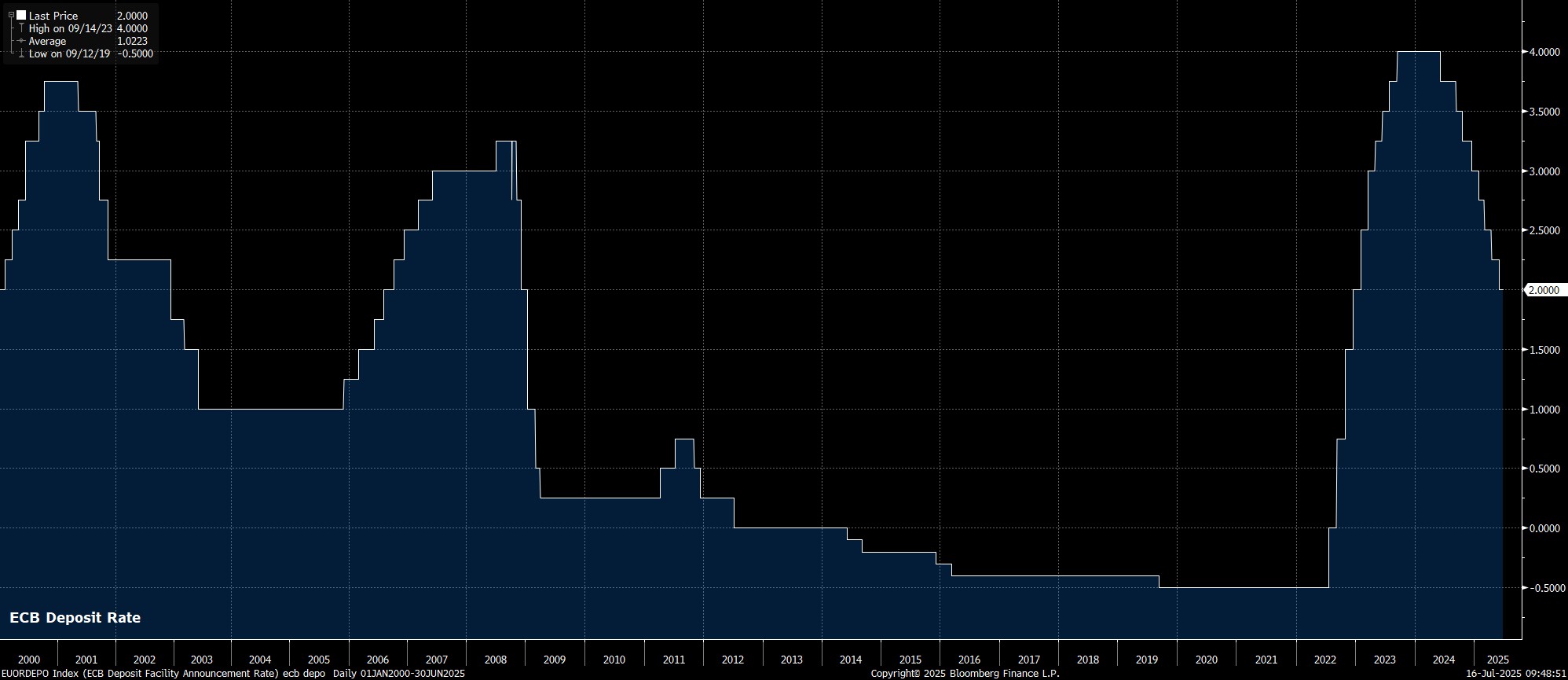

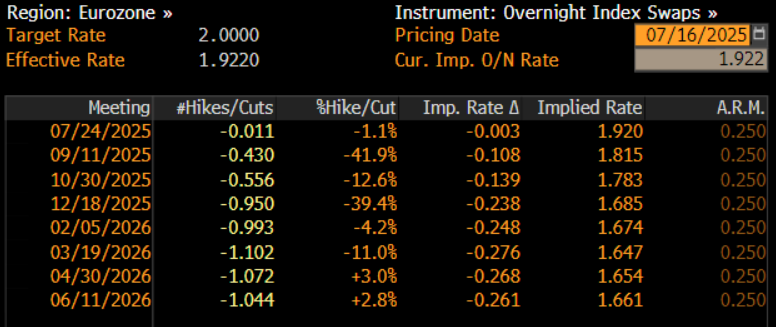

As noted, there are unlikely to be any fireworks at the conclusion of the July Governing Council discussions, with the deposit rate set to be maintained at 2.00%, likely via a unanimous decision, in contrast to the lone hawkish dissent from Austrian representative Holzmann last time out. Money markets, per the EUR OIS curve, price no chance of any action this time out, though do see a 4-in-10 chance of a 25bp cut at the next meeting in September, while fully discounting such a rate reduction by the end of the year.

Policy Statement: Repetition Expected

Along with that decision to hold rates steady, the updated policy statement is likely to be a ‘copy and paste’ of that issued last time out. Consequently, the GC will likely reiterate that a ‘data-dependent’ and ‘meeting-by-meeting’ approach remains appropriate, while also refusing to make any ‘pre-commitment’ to a particular policy path.

Guidance of this ilk, with which all market participants are now familiar with it having been in place for much of the cycle, remains suitable, as policymakers seek to preserve as much optionality as possible in terms of future rate shifts, given the incredibly uncertain and cloudy economic outlook.

Economic Backdrop: Trade Risks in Focus

While there are no new staff macroeconomic projections due this time round, recent ‘sources’ reports indicate that policymakers will discuss a scenario worse than that outlined at the June meeting, principally reflecting the Trump Administration’s recent threats to impose a 30% tariff on EU imports, if a trade deal isn’t reached by 1st August. Negotiations on that front continue, while tariff levels and deadlines also remain highly fluid, leaving policymakers reluctant to act on tariff threats alone, given the relatively high probability that they will eventually be walked back.

Looking Ahead to September

This, hence, leads us to September as the next ‘live’ ECB meeting, at which point policymakers are likely to possess some degree of increased certainty on the global trade landscape, and any potential US-EU trade agreement that may or may not be made. In any case, risks to the growth outlook will likely remain tilted to the downside, while policymakers should also remain confident that headline inflation will remain at the 2% target for the remainder of the year, even if an undershoot of said level is increasingly likely in 2026.

Lagarde’s Likely Message: Stay the Course

Meanwhile, at the post-meeting press conference, President Lagarde is highly likely to simply repeat recent rhetoric, seeking not to ‘rock the boat’ before policymakers slip away for their traditional summer break. Consequently, Lagarde will probably reiterate that the ECB is ‘getting to the end of the cycle’, while also stressing that policy is in a ‘good place’, both of those being remarks which, rather explicitly, hint at the ECB being done and dusted when it comes to interest rate reductions. Unlike Vice President de Guindos, Lagarde is unlikely to make any explicit comments on the value of the euro, or specific levels at which the market trades, instead noting that the currency’s recent appreciation is more a reflection of the market’s assessment of the strength of the eurozone economy.

Conclusion: Summer Pause, Not a Full Stop

Taking a step back, the ECB are near-certain to stand pat at the July policy meeting, as policymakers seek to gently cruise into their summer break. While the Governing Council may take a break, economic developments won’t, particularly as US-EU trade negotiations continue in earnest, and as concerns persist over the valuation of the euro.

As noted, unless forced by external factors, the ECB would like to wrap up the easing cycle here, and hold the deposit rate steady for some time. That said, it remains plausible that the Governing Council are convinced into delivering another cut, possibly in September, were the euro to strengthen further, or in the event that a US-EU trade deal weren’t reached.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.