- English (UK)

Analysis

With US growth likely at a peak and as good as it gets, gold longs partly flushed out, positioning paired back and sentiment as bearish as we’ve seen for years, could we be seeing a low?

Tactically, I feel it is too early to see a resumption of a lasting bull trend and I am in favour of selling rallies into $1925. However, I am also incredibly enthused by the resilience of gold to ‘only’ decline $100, despite rising US bond yields and a stronger USD.

Unless the investment case radically changes – which I lay out below – the risks are skewed for near-term downside, although there is a growing potential for a reversal and strong rally into year-end.

The technical set-up

Since rejecting the $1981 supply zone on 20 July the ensuing bear trend seems to have hit exhaustion, with gold shorts starting to pair back exposures – there is a risk a short covering could take price into the 38.2% fibo of the $1987 to $1884 decline at $1925, which could offer better levels to initiate swing shorts.

Trading intraday has been a challenge for many day traders as volatility has been so low – Gold’s 30-day realised volatility has fallen to 8.3% and the lowest since July 2021. We also see the 5-day average high-low trading range at $14.11; one of the lowest daily ranges for years. Traders need to adapt to these tighter ranges, and many have traded with a tighter stop and increased position size to accommodate for the low vol.

One can easily justify these sanguine conditions given the investment case for the bulls has been lacking. For gold to reverse higher these dynamics need to shift. Notably:

- The opportunity cost of being overweight gold – market players can get a 5.44% risk-free yield in US 6-month T-bills. Gold has no yield, so in a rising rate environment, gold can often face headwinds.

- There is a similar dynamic in the bond market where US 10y-year ‘real’ rates have risen to 2% - again, there is an opportunity cost of holding a yield-less asset.

- Gold has been a poor hedge – with cross-asset volatility at such low levels and equity markets recently performing so strongly the need to hedge risk in the portfolio has been reduced. However, funds have favoured the USD to hedge potential equity drawdown given its deep inverse correlation with S&P500 futures. Gold has a positive 30-day correlation with the US500 or NAS100.

- The USD effect - Over the past month, the USD has rallied against all G10 currencies – with US data continually coming in hot we see US Q3 GDP expectations sitting above trend at around 2.2%

- With US growth above trend, recession hedges have been unwound. We see this in interest rate pricing, with the market pairing back expectations of Fed cuts in 2024 from 160bp of cuts in June to 110bp of cuts. Traders can see the level of expected rate cuts by looking at the spread between SOFR Dec 2023 and Dec 2024 futures (TradingView code - CME:SR3Z2023-CME:SR3Z2024). Gold – another classic recession hedge – has been shunned.

Positioning

Looking beneath the surface, we can see a solid flush out of bullish gold positioning – longs have been paired right back. But has positioning swung too far, and could this offer an entry to look more favourably at upside potential?

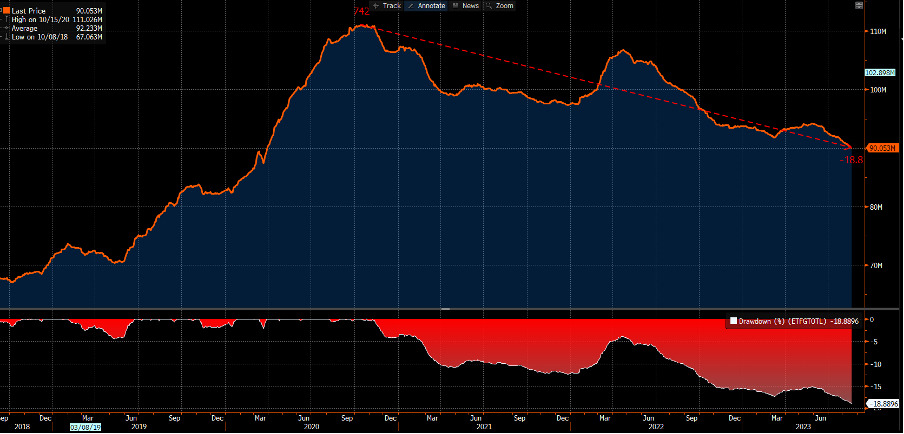

- Total (known) ETF holdings of gold sit at 90.05m – the lowest since March 2020 having fallen 18% since October 2020.

- We see gold positioning in the futures market has been reduced - net long futures positions held by managed money (in the weekly CFTC report) now sit at 29,356 contracts – having been as high as 116k net long contracts in July

- CTA (Commodity Trading Advisor – trend-following funds) accounts are max short gold futures but may need to see the price the futures prices above $1980 to start trimming this position.

- Gold 1-month option risk reversals (1-month call implied volatility – put implied volatility) sits at 0.07 – the lowest level since March. Options traders are shying away from positioning for upside movement.

Are we about to see a turn higher?

As Richmond Fed President Thomas Barkin said on 22 August, the US economy could accelerate further, which could hold big implications for Fed policy and challenge the consensus of easing growth and potential rate cuts. While we continue to watch global growth data points, we could also feasibly see US headline inflation accelerate higher in the August CPI print (released 13 Sept) from 3.2% to 3.6%. This could result in increased expectations of a November rate hike (from the Fed), which could lift the USD and real yields.

Gold would likely face another leg lower in this dynamic, but would also likely see volatility pick up and trading ranges expand – a more compelling dynamic for CFD trader

However, should inflation pick up near-term, resulting in the Fed likely to hike again, it would then accelerate the belief in lower demand and increased recession risk. It is here where expectations of interest rate cuts would increase as higher rates and a higher-for-longer stance from the Fed should accelerate the risk of recession in 2024.

If and when we see growth data points subsequently roll over, resulting in additional rate cuts priced for 2024, then gold could feasibly have a strong rally into year-end. As always, an open mind to changes in economics and the subsequent investment case for gold will serve traders well.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_(1).jpg?height=420)

_(6).jpg?height=420)

_(3).jpg?height=420)