- English (UK)

Bulls Take Charge in Gold and Platinum as Key Levels Break and Demand Surges

We’ve also seen an uptick in volumes on platinum, which is thematic of the impressive 6% rally seen on Tuesday – the largest 1-day move since March 2020, with price breaking above its recent range highs to the best levels since May 2024.

Trading Gold: Reviewing the technical setup

The technical setup in gold needs work to get the momentum traders really building bullish positions, but the signs are currently constructive, with price printing three daily higher lows and closing firmly above the 8-day EMA. We also see the differential between the 3- and the 8-day EMAs widening to $10, which is in line with the 20-day average (for the EMA differential), and highlighting the short-term acceleration in price.

We can also see the short-term momentum in price through the 3-day rate of change (ROC) which we see is accelerating higher. The rally from $3120 has run up to $3314, before finding supply at the 61.8% (Fibonacci) retracement of the 6 May to 15 May sell-off. Subsequently, a daily upside closing break of $3316 would see the momentum in price build and put a re-test of the all-time closing high of $3434.68 (printed on 6 May) and the all-time absolute price high of $3499.97 (22 April) in play.

Support can be seen at the rising uptrend at $3234 (best seen on the 4-hour timeframe), while a daily close below the 8-day EMA would suggest taking a more natural short-term view.

Fundamental drivers of the gold price:

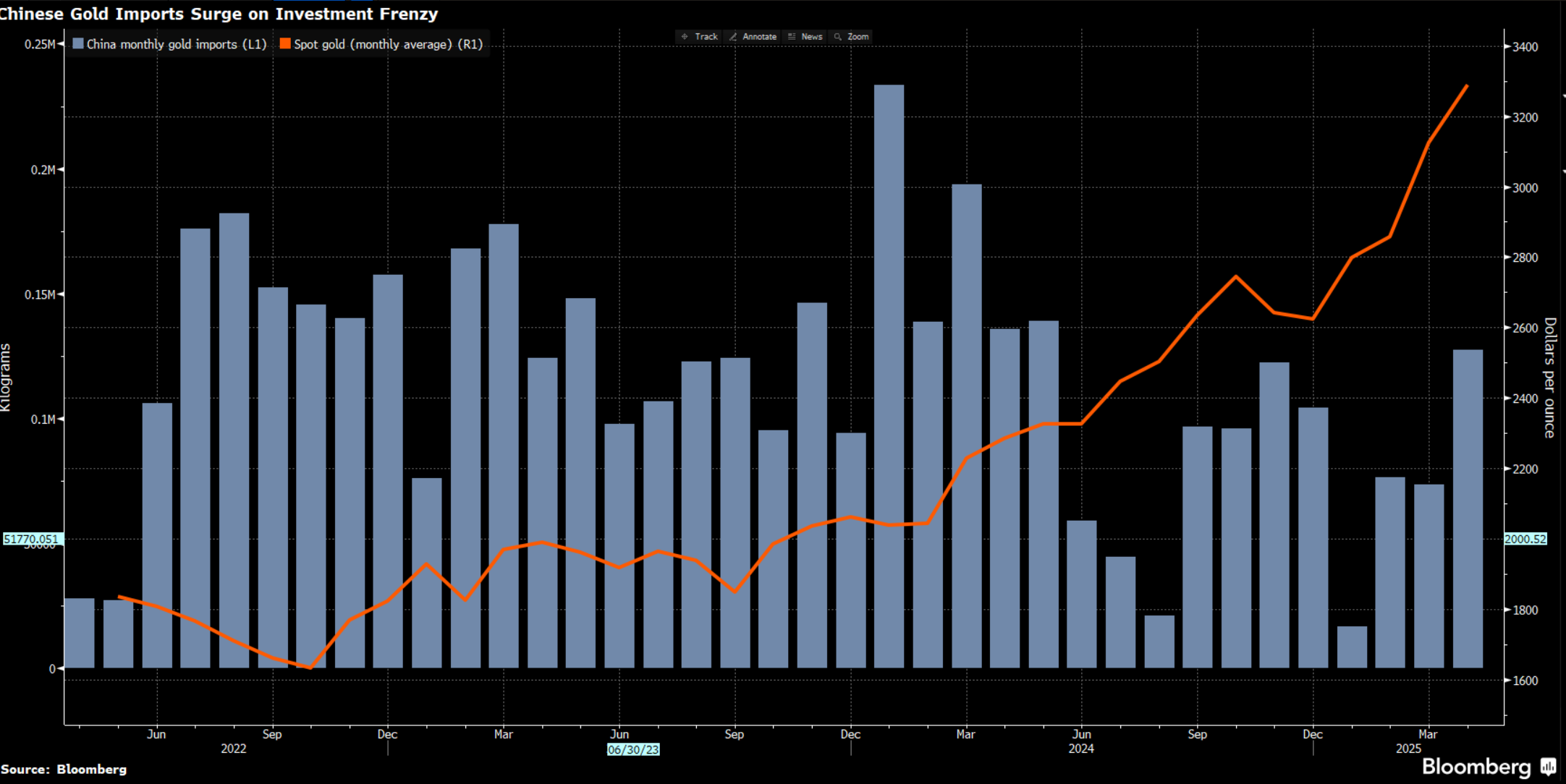

• Customs data released on Tuesday showed China’s imports of gold hit an 11-month high in April – a 73% from import level in March.

• Strong demand from both Chinese institutions and retail for physical gold has seen the PBoC lift import quotas for Chinese commercial banks who, in turn, allocate the gold to the would-be buyers.

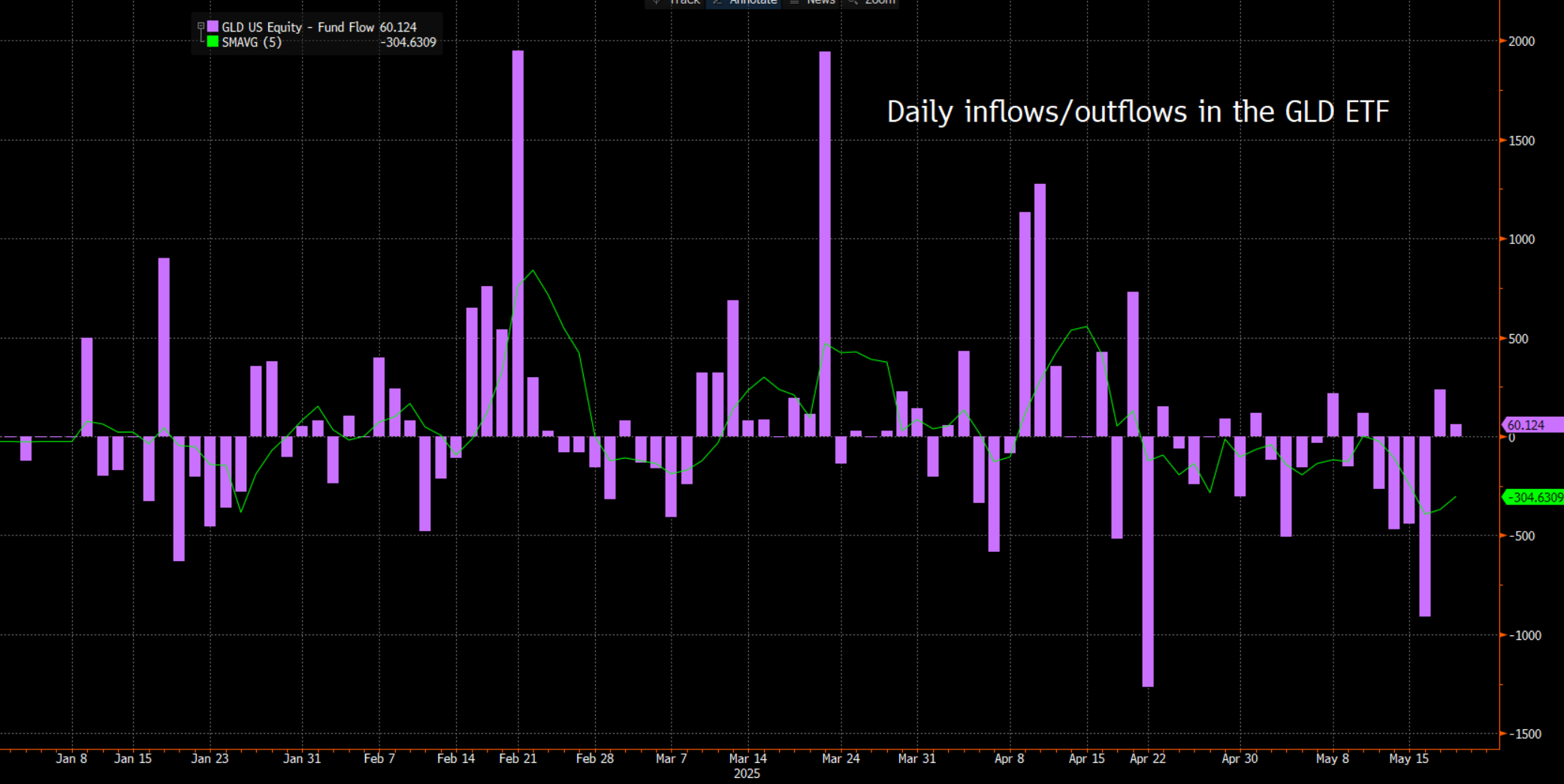

• While not technically a fundamental driver, I am watching the daily inflows (see the chart above) into both Chinese and US gold ETFs, as well as gold futures volumes traded on the CME and Shanghai futures exchanges. The recent flow data shows net inflows have been light of late, but if the net inflows pick up again – like we saw through April – then it could push the gold price higher.

• Geopolitical factors may play an increased role in driving the gold price – media reports that Israel is planning to strike Iranian nuclear facilities could see gold sought as a hedge against renewed geopolitical tensions. The oil price is a good guide here, with concerns building that should Israel make a move, Tehran may respond by cutting off the Strait of Hormuz.

• The US fiscal position – granted, rising US debt levels and increased deficits are not a new issue, but if US 10-year Treasury yields rise through 4.60% and the 30-year Treasury through 5% and if driven by a rise in term premium and higher inflation expectations it may well prove to be a USD and equity negative and push the gold price higher in response. Higher bond yields are often a headwind for the gold price, but more so if the rise in yields is driven by improved growth dynamics and less so on right tail risk (inflation) and higher term premium.

• Trade tariffs – we’re some way from the set deadlines for the 90-day pause, but as we get closer to the deadlines (9 July on most nations, 14 Aug for China), we may see gold working as a hedge against the possibility that the pause is not rolled over or even break down.

So, for now the momentum seems to be building and I am skewed long of gold and platinum, but I know my risk and prepared to alter the view if the exit rules are triggered.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.