- English (UK)

Analysis

FX Outlook: Why the US dollar keeps rising

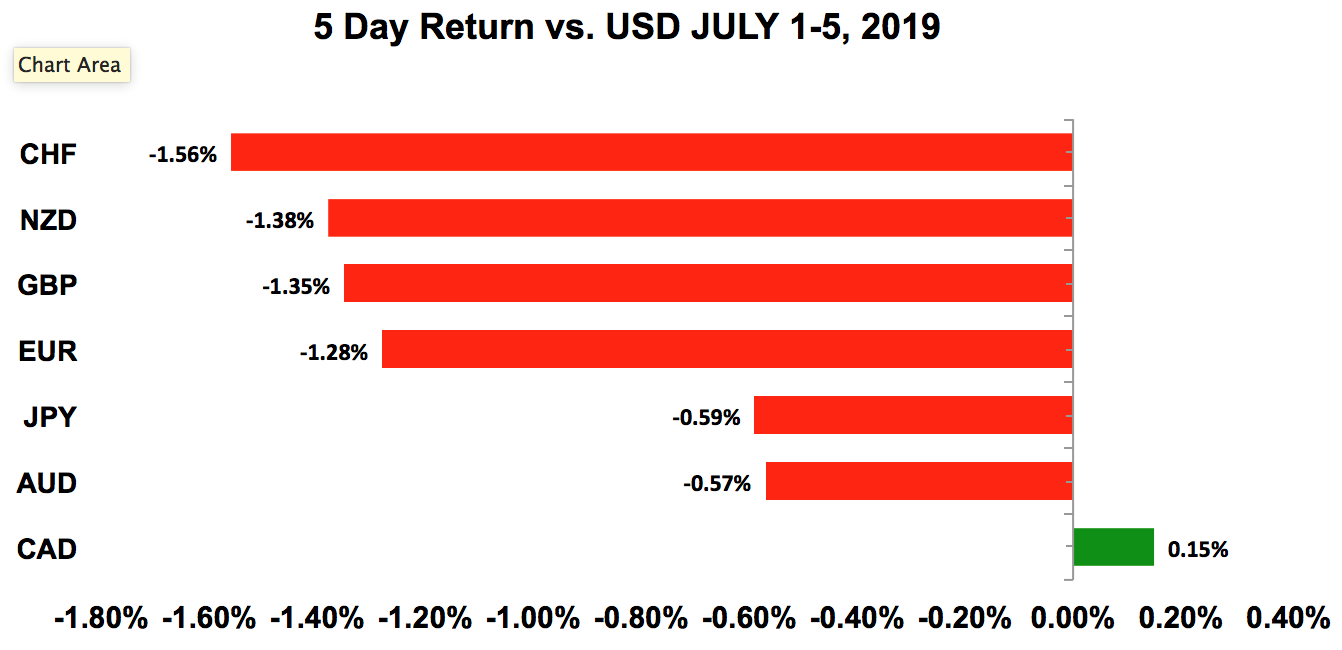

The market’s appetite for US dollars is important, because outside of a Bank of Canada monetary policy announcement, there’s very little market-moving data on the calendar this week. The focus will remain on the greenback. As far as we can tell, sentiment has shifted to the upside. All of the dollar’s gains happened Friday as the New Zealand dollar and British pound were hit the hardest. NZD has been the most sensitive to market swings, while GBP was hit from all sides by softer data. The Canadian dollar was the most resilient, even though the latest jobs report fell short of expectations. Looking ahead, the USD could retain as long as the inflation numbers are decent.

Weekly trade ideas: Don't miss these market-moving opportunities identified by BK Forex.

US DOLLAR

Data review

- ISM manufacturing 51.7 vs 51 expected

- ISM employment 54.5 vs 53.7 previous

- ADP 102,000 vs 140,000 expected

- Trade balance -$55.5bil vs -$54bil expected

- Jobless claims 221,000 vs 223,000 expected

- Factory orders -0.7% vs -0.6% expected

- ISM non-manufacturing 55.1 vs 56 expected

- Nonfarm payrolls 224,000 vs 162,000 expected

- Unemployment rate 3.7% vs 3.6% expected

- Average hourly earnings 0.2% vs 0.3% expected

Data preview

- FOMC minutes: likely to be dovish, but we don’t expect much reaction

- Consumer price report: potential downside surprise given lower gas prices

- Producer price report: potential downside surprise given lower import prices

Key levels

- Support 108.00

- Resistance 109.00

US dollar pops on nonfarm payrolls

All of the US dollar’s gains occurred after nonfarm payrolls. A total of 224,000 jobs were created in June — significantly better than the 160,000 forecast. Frankly, we’re surprised by the sustainability and magnitude of the dollar’s move because the rest of the labour market report was underwhelming. Last month’s weak 75,000 print was revised lower and not higher, the unemployment rate increased, and, most importantly, wage growth held steady at 0.2% instead of rising to 0.3% like economists anticipated. The broad-based rally in the dollar, however, tells us that many concerns were eased by the June jobs report.

The US dollar could extend its gains this week, but we can’t see how one month of stronger job growth accompanied by no improvement in wage growth can be a game-changer for the Fed. Yes, it reduces the need for an immediate interest-rate cut, but it doesn’t eliminate it. Nearly half of the members of the FOMC feel that easing is necessary this year, and they won’t be swayed by a mixed jobs report. This week’s FOMC minutes should remind us of the extent of the central bank’s dovishness. Their concerns centre around trade and inflation. While the US and China agreed to restart trade talks at G20, only time will tell whether the progress is real. Inflation will take a lot longer to improve, and investors will get a better sense of the extent of the problem with the release of consumer and producer prices this week. If price pressures ease, the expectations for a rate cut will intensify. What the jobs report does imply, though, is that Fed could opt for a one-and-done insurance cut, with no signal of additional easing. As this would be less dovish than other central banks, it’d be positive for the dollar. But we won’t know which way they’ll lean until the FOMC meeting.

AUD, NZD, CAD

Data review

Australia

- RBA cuts interest rates to 1%, and says more easing possible

- PMI manufacturing 49.4 vs 52.7 previous

- PMI services 52.2 vs 52.5 previous

- Building approvals 0.7% vs 0% expected

- Trade balance A$5745mil vs A$5250mil expected

- Retail sales 0.1% vs 0.2% expected

- PMI construction 43 vs 40.4 previous

New Zealand

- Building approvals 13.2% vs -7.9% previous

- QV house prices 2% vs 2.3% previous

- ANZ commodity prices -3.9% vs 0% previous

Canada

- Trade balance 0.76bil vs -1.7bil expected

- Net change in employment -2.2K vs 9.9K expected

- Full-time employment 24.1K vs 27.7K previous

- Unemployment rate 5.5% vs 5.5% expected

- IVEY PMI 52.4 vs 55.9 previous

Data Preview

Australia

- NAB Business Confidence: potential downside surprise given slowdown in China and RBA dovishness

- Westpac Consumer Confidence: Consumer sentiment could be bolstered by lower interest rates and strong labour market

New Zealand

- PMI manufacturing index: potential downside risk given RBNZ dovishness and slowdown in Australia

Canada

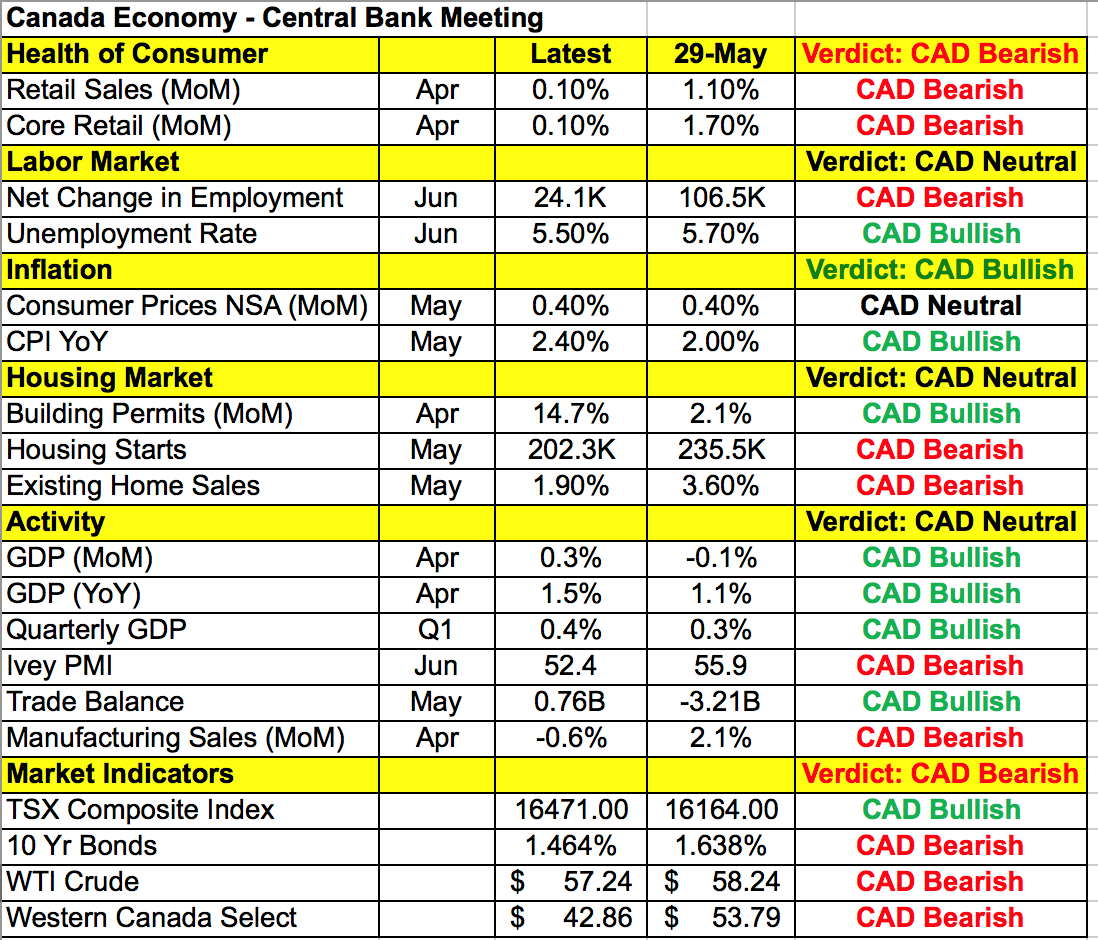

- Bank of Canada rate decision: The central bank’s bias is hard to predict, because data has been strong but global growth is slowing

Key levels

- Support AUD .7050; NZD .6700; CAD 1.3200

- Resistance AUD .6950; NZD .6600; CAD 1.3050

How low will RBA go?

Last week was a challenging one for the commodity currencies. The Australian, New Zealand and Canadian dollars, traded higher before US nonfarm payrolls, only to give up all of their gains on one data release. This goes to show how much the market’s appetite for US dollars can impact other currencies. The Reserve Bank of Australia lowered interest rates for the second time this year to a record low of 1%. Normally, interest rate cuts are negative for a currency, particularly if it’s accompanied by plans to ease further. But in the case of the Australian dollar, the market had already priced in last week’s move along with another quarter point cut in August. So, the initial knee-jerk decline was short-lived.

Investors are just beginning to realise how the RBA’s monetary policy bias differs from other countries. The RBA is one of the most dovish central banks. After cutting interest rates twice this year, they made it clear that they’re open to easing again. According to RBA Governor Philip Lowe, the risks to the global economy are tilted to the downside and, given the circumstances, “the board is prepared to adjust interest rates again, if needed, to get us closer to full employment and achieve the inflation target.” Data has been mixed with manufacturing and service sector activity slowing, but the trade surplus improving. Retail sales increased but less than anticipated. With interest rates already at a record low of 1%, we don’t see the RBA taking rates much lower than 0.75%. Even with their dovish guidance, the RBA acknowledged improvements in house prices, infrastructure spending and resources investment. The central bank also wants monetary stimulus to be accompanied by fiscal changes. Does this mean AUD/USD has bottomed? Certainly not, because there could still be another rate cut this year. Until the RBA shifts to neutral, there’s scope for a renewed decline in the Australian dollar.

Over the past few months, the New Zealand dollar has been the most volatile high-beta currency. When risk appetite was improving and the market turned against the US dollar, it enjoyed the strongest gains. But when appetite for the greenback returned, it was hit the hardest. Despite the lack of economic data, the New Zealand dollar fell sharply last week. Manufacturing PMI numbers are scheduled for release this week. With the greenback regaining its rise, we could see a deeper correction in NZD/USD.

Meanwhile, Friday’s US and Canadian jobs report marked a turning point for the Canadian dollar. After falling for eight out of nine trading days, USD/CAD rebounded as the market learned that in June, more than 2,000 jobs were lost in Canada compared to a forecasted growth of 10,000. Despite the currency’s slide, the data wasn’t exceptionally weak because full-time jobs increased and wage growth accelerated. The Bank of Canada meets this week, and, as the last man standing, everyone’s wondering if their central bank will finally turn dovish. When they met in May, the BoC put on a brave face and described their recent slowdown as temporary. Since then, we’ve seen the first signs of weakness in Canada’s economy. But it’s too early to tell whether this is a slowdown or normalisation. Retail sales barely grew in April, but that was after very strong spending in March. Jobs were lost in June, but May was a record-breaking month for the labour market and wages growth accelerated. As these are tentative signs of slowing, we think the Bank of Canada may want more evidence before turning dovish. So, if they maintain their positive outlook and say the recent data misses are temporary, USD/CAD will resume its slide towards fresh 1.5-year lows. However, if the tone of their monetary policy statement is more cautious, we could see the beginnings of a longer-term bottom in USD/CAD.

EURO

Data review

- German PMI manufacturing revisions to 45.0 from 45.4

- EZ PMI manufacturing revisions to 47.6 from 47.8

- GE unemployment change -1K vs 0K previous

- EZ unemployment rate 7.5% vs 7.6% expected

- German retail sales -0.6% vs 0.5% previous

- EZ PPI -0.1% vs 0.1% previous

- German PMI services revisions to 55.8 from 55.6

- EZ PMI services revisions to 53.6 from 53.4

- German PMI composite unchanged at 52.6

- EZ PMI composite revisions to 52.2 from 52.1

- EZ retail sales -0.3% vs 0.3% expected

- German factory orders -2.2% vs -0.2% expected

Data preview

- German industrial production and trade balance: decline in manufacturing activity signals weaker industrial production and trade

- EZ industrial production: will have to see how German IP fares, but softer numbers are likely

Key levels

- Support 1.1150

- Resistance 1.1300

ECB won’t cut in July, but summer easing is on the table

One of the biggest stories last week was the report that European policymakers are in no rush to lower interest rates. EUR/USD shot higher immediately after the comments hit the wires. But the rally fizzled as back-to-back data misses harden the case for easing. German retail sales and EZ producer prices fell for the third month in a row, while weaker manufacturing activity offset stronger services. The problem for the euro is that while the European Central Bank may not be considering an immediate rate cut, more accommodation is in the euro’s future. As a result, the single currency broke to the downside, opening the door for move below 1.11.

The European Union also nominated International Monetary Fund Director Christine Lagarde as Mario Draghi’s replacement. As the former finance minister of France and current head of the IMF, she has experience with lending and financial crises but not in the role of a central banker. The fact that she’s a politician and not an economist raised immediate concerns, but she’s respected by her peers and brings much needed political savviness to the central bank at a challenging time for the region. The initially negative reaction in the euro, as minor as it may be, suggests that investors would have preferred a current member of the governing council, like Bundesbank head Jens Weidmann or Bank of France Governor François Villeroy de Galhau because they have a more intimate understanding of the current issues facing the central bank. But at the end of the day, she’s a solid choice, widely respected by her peers, and has strong credibility. Looking ahead, there are no major eurozone economic reports scheduled for release. So, the euro should continue to the weaker outlook for the EZ versus the US weighs on the currency.

BRITISH POUND

Data review

- Mortgage approvals 65.4K vs 65.5K expected

- PMI manufacturing 48 vs 49.6 expected

- Nationwide house prices 0.1% vs 0.2% previous

- PMI construction 43.1 vs 49.2 expected

- PMI services 50.2 vs 51 expected

- PMI composite 49.7 vs 51 expected

Data preview

- Industrial production and trade balance: will most likely be weaker given drop in manufacturing PMI

Key levels

- Support 1.2500

- Resistance 1.2600

Sterling buckles under pressure of Brexit

Last but not least, sterling continues to underperform other major currencies as the fear of a no-deal Brexit or prolonged uncertainty weighs on the economy. Service, manufacturing and construction sector activity slowed significantly in June, with the manufacturing and construction sectors contracting while service sector activity stagnating. The leading Tory candidates are pushing for a no-deal Brexit, which is the nightmare scenario for the central bank and a serious concern for UK businesses. Last week, Bank of England Governor Mark Carney said he’s worried about the uncertainty surrounding Brexit and rising threats of protectionism. With three months to go before the UK is scheduled to leave the European Union, the possibility of a no-deal Brexit is growing by the day. There won’t be any real clarity until the next Tory leader is selected. But if data continues to worsen, the BoE may have to consider easing. Carney has already indicated that stimulus is likely if the EU and UK can’t agree to the terms for leaving the Union. But based on sterling’s recent performance, investors are betting that the central bank may have to act regardless of whether the Withdrawal Agreement is accepted, especially if the exit date is extended beyond October. Industrial production and the trade balance will be released this week. Given the softness of PMI, weaker numbers could give investors a reason to drive the currency even slower.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.