Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Markets unravel amid trade war fears and recession warnings

WHERE WE STAND – There is no good news. The markets are getting ugly. Things will probably get uglier still.

Everything Looks Ugly; Everything Will Probably Get Uglier

Yep, this morning’s note is going to be a depressing one. At this point, I’m quickly running out of adjectives to describe how gloomy sentiment is becoming, and how grim the economic outlook now appears. Plus, both of those are likely to get considerably worse, before improving.

The US economy is barrelling rapidly towards recession, and will probably end up taking most of the rest of the world with it. Concurrently, inflation is going to ramp substantially higher for the next couple of quarters, at the very least. Here we are then – stagflation.

Tariffs are, of course, the root cause of all this. ‘Liberation Day’ will probably go down as one of the biggest, and most obvious, policy mistakes of the last few decades. Not only were the ‘reciprocal’ tariffs calculated in a way that defies all logic, as well as being at the hawkish end of market expectations, they are nothing but bad news, creating higher prices for the US consumer, and higher costs for US businesses.

The only thing that’s been liberated is the United States from an economy that was, until Wednesday, the envy of the world. Worst of all, this whole saga is completely unnecessary, and little short of economic suicide.

It’s not just the US that is throwing tariffs around like Oprah giving away cars. China came out swinging on Friday with a 34% levy on imports of US goods, while the EU and a whole host of other nations are also seeking to impose their sizeable retaliatory measures. I’ll give the UK government some rare credit here, for plotting a much better course of action, duly accepting the tariffs that have been imposed, and working diplomatically towards a possible UK-US trade deal. Just because you’ve watched the Orange Man shoot himself in the foot, it doesn’t mean that you need load a gun of your own and do the same thing.

That folk are, probably speaks volumes about the dire state of political leadership right now. For investors, though, it changes the game from one where we worry primarily over the US economy, to one where we must now deal with what will almost certainly become an all-out, tit-for-tat, global trade war. For the avoidance of doubt, there are no winners – at all – from that happening.

Markets, unsurprisingly, have thrown a bit of a tantrum as the fallout from all this becomes increasingly clear, and participants seek some degree of shelter.

As such, stocks have slumped across the globe, with the S&P on Thurs and Fri putting in its worst 2-day decline, just over 10%, since the pandemic 5 years ago, while the Nasdaq 100 has fallen into a bear market, down over 20% from its record high. At the same time, haven demand has seen Treasuries, and other Govvies, rally hard, with the 2-year Treasury on Friday briefly dipping below 3.50%, and 10s now trading with a 3 handle. The dollar, meanwhile, has taken a battering, being the asset that is the most exposed of all to Trump’s tariff incoherence, with the JPY and the CHF standing as the FX havens of choice, while high-betas such as the AUD and NZD face mounting headwinds. Gold has also faced headwinds, though this owes to tariff risk premium being unwound after bullion imports were exempted from tariffs, and isn’t representative of a lack of haven demand.

For clarity, my market views remain broadly unchanged – further equity downside is probably in store as growth expectations fall, and policy uncertainty persists; Treasuries should continue to perform well, with haven demand providing a helping hand, though we have come a long way, and Fed expectations seem overly-dovish; the USD remains unattractive, with fading strength my preferred play as the economy rolls towards a sharp slowdown; and, gold remains my haven play of choice, with the bulls still by and large in control of proceedings.

This all brings us to the question of what comes next in this saga.

In the short-term, given how violent and impulsive last week’s equity declines were, there is the potential for a bounce in riskier assets, particularly if the tone of tariff news flow doesn’t further deteriorate in coming days.

For that bounce to be durable, and not ‘dead cat-ish’ in nature, something fundamental will have to change.

The FOMC, though, don’t seem likely to be riding to the rescue any time soon. Fed Chair Powell, on Friday, noted the Committee’s “obligation” to ensure inflation expectations remain well-anchored, while reiterating that they need not be in a hurry to adjust policy. As opposed to participants focusing on the growth hit tariffs will cause, Powell is understandably focusing on the upside price risks that they will also produce. Clearly, the strike price for the ‘Fed put’ is a fair chunk lower than where the S&P currently trades, with market expectations for 100bp of easing this year seeming far too punchy.

Logically, then, we turn to the Oval Office for a potential solution. Nobody should get their hopes up on this front, though. Trump has been touting protectionist rhetoric on trade for at least the last 4 decades, having referenced tariffs in numerous interviews in the 80s and 90s. I find it hard to believe, then, that someone who has held those strong views for 40 years, would capitulate on the ‘Liberation Day’ tariffs after less than a week. A whole host of weekend media comments from Bessent, Hassett, and Lutnick also point to there being no desire to change tack.

That’s not to say that deals won’t be cut, tariffs reduced, and some countries excluded entirely; but, on the other hand, those countries who get on Trump’s ‘wrong’ side will see their levies increased.

One must also consider that there is a lot of room for things to get worse, from a markets perspective. The VIX trades at ‘only’ 45, the S&P isn’t in a bear market yet, there are few signs of stress in HY credit, there have been no obvious indications of capitulation, and central banks aren’t even mulling any sort of policy response. In terms of classic signs that could signal the end of the current turmoil, I can’t say I see many right now.

Overall, a policy pivot, from either the White House, or the Fed, is what the market craves. Neither, for the time being, seems especially likely, leading to more economic, and market, pain being on the cards.

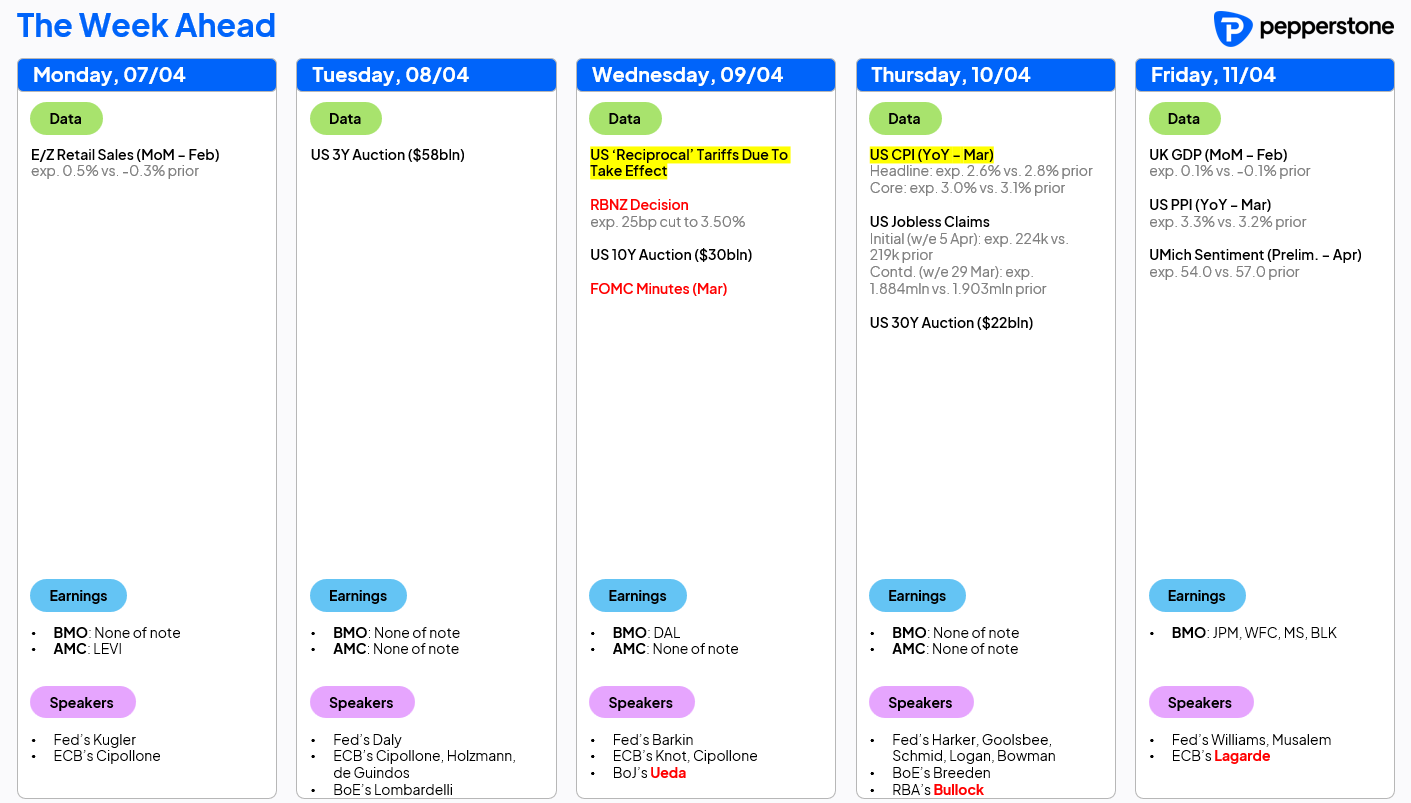

LOOK AHEAD – Below is the week ahead docket.

In all honesty, not much, if any, of it matters – like Friday’s NFP report which was completely ignored, the data is hopelessly stale, referencing a period before a wrecking ball was taken to the global economy.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.