Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Markets brace for trade shocks and data deluge amid haven demand surge

WHERE WE STAND – A risk-averse end to the week on Friday, with haven demand notable across the board, as participants once more trimmed exposures into the weekend, cognisant of potential gapping risks.

Friday, on the whole, was a day that lacked significant catalysts, at least those that materially moved the needle in terms of the broader outlook.

Of course, there was plenty of noise on the trade front, amid reports that the EU are thinking up concessions in an attempt to squirm out of the US’ reciprocal tariffs once they are imposed, and after news that President Trump, and Canadian PM Carney, plan to meet after the Canadian election at the end of next month. This is, though, pure noise, with signal on the tariff front remaining elusive at best, and uncertainty in this area only likely to increase into the new trading week.

We continue to move towards ‘Liberation Day’ on 2nd April with little-to-no concrete idea of how Trump’s reciprocal tariff plans will play out, and with many more questions than answers. The key issue for participants is likely to be whether the Admin include VAT in their calculations for reciprocal levies. While to do so would be economically nonsensical, such a move has been touted on many occasions, and would likely result in a substantially higher levy on trading partners such as the UK and EU than would otherwise be seen. In turn, heightening downside growth, and upside inflation risks.

On the subject of inflation, Friday’s UMich US consumer sentiment survey attracted some attention, with the headline metric falling further to 57.0, and 5 to 10-year inflation expectations rising to a multi-decade high 4.1%. I’d take this with a HUGE pinch of salt though, as the survey not only has a tiny respondent pool, but is also incredibly skewed by political allegiance. GOP voters appear to be expecting some kind of economic nirvana, while Democrat voters foresee Zimbabwe-esque hyperinflation. As usual, the true outlook probably lies somewhere in between those two extremes.

Despite the quirks (to be polite) of the UMich survey, it probably didn’t help sentiment much into Friday’s close, with both the S&P and Nasdaq losing over 2% on the day. I retain my preference for rally selling, with markets continuing to grapple with incredible uncertainty on the trade front, and both economic and earnings growth expectations still rather too lofty.

Furthermore, there seems a degree of complacency that all will be ‘fine and dandy’ on the trade front after Wednesday. I’d argue the opposite, as it is only after ‘Liberation Day’ that nations will either double-down with tit-for-tat retaliatory tariffs of their own, or seek to escape those tariffs that have been imposed. Either way, uncertainty on the policy front seems likely to continue to ratchet higher from here, with cross-asset vol likely to go the same way.

At least the monetary outlook is relatively certain, with the FOMC firmly on the sidelines for the time being. Friday’s core PCE print, at 2.8% YoY, was a touch hotter than participants had been expecting, though was bang in line with the figure flagged by Chair Powell at his March presser. As such, the data caused little by way of significant reaction, with Treasuries bid across the curve, led by the belly, for the entire day, almost entirely a function of the aforementioned haven demand into the end of the week.

The risk/reward of Treasuries continues to favour longs for me, particularly as growth expectations continue to falter. That said, I still believe all this talk of ‘stagflation’ Stateside is massively overblown, with GDP growth somewhere around 2% likely to be seen this year, and with the Trump Admin’s efforts to reallocate resources to the private sector, and trim government inefficiencies, likely to be a boon for the economy in the longer-run.

In the here and now, though, gains across the Treasury curve posed a modest headwind to the greenback as the week drew to a close, with the DXY probing the 104 figure to the downside. In truth, though, it was a relatively dull end to the week across the G10 FX space, though I was at least pleased to see the EUR reclaim the 1.08 figure, putting us back on the right path to the strike price for my free lunch at 1.10!

Lunch aside, I still favour fading USD upside, even if it seems that other G10s are going to need a fresh catalyst – perhaps on the geopolitical front – to get moving once again, as the market struggles to find a narrative to latch onto. Clearly, though, the buck isn’t attracting the haven demand that it once would’ve done, with the JPY and CHF standing as much better options, when the greenback is the most exposed of all currencies to the nonsense and incoherence coming from the Oval Office.

That haven demand has continued to drive upside in gold, with the yellow metal still shining, as spot rallies towards $3,100/oz. I remain happy to ride this momentum wave to the upside, with bullion’s salad days unlikely to come to an end any time soon. The rally isn’t quite indestructible, but the bulls continue to believe in their soul for now.

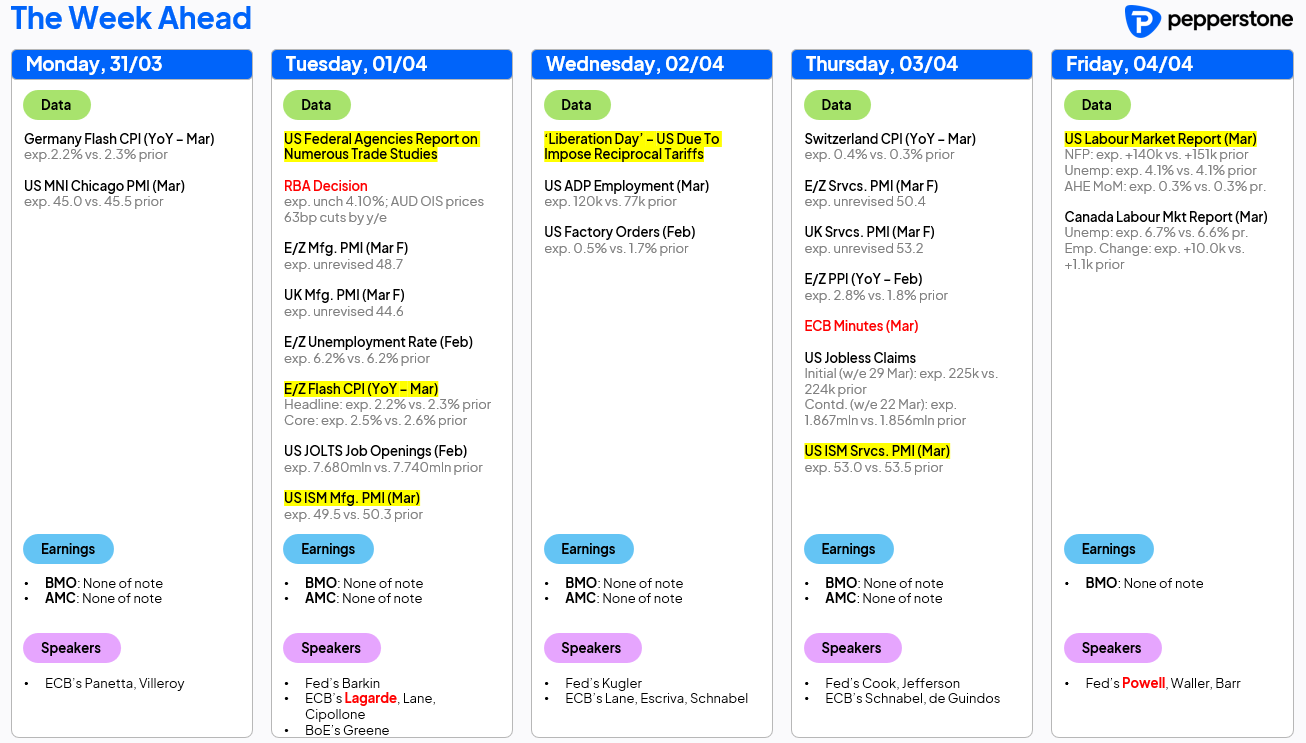

LOOK AHEAD – Brace yourself, because a busy old week lies ahead.

Of course, news on the trade front will likely dominate, with various federal reports into overseas trade practices due to report to Trump on Tuesday, before the ‘Liberation Day’ tariff announcement on Wednesday. As covered above, this all seems much more likely to be the beginning of this saga, rather than the end.

Away from trade headlines, there’s a busy data docket up ahead. That docket is, of course, highlighted by Friday’s US labour market report, where headline nonfarm payrolls are seen having risen by +140k last month, as unemployment holds steady at 4.1%. While the jobs data is unlikely to materially alter the FOMC policy outlook, the market is unlikely to forgive a downside surprise, which will serve only to further heighten jitters over the US economy. The two ISM PMI surveys (Tues and Thurs) will help to shape expectations for the NFP print, though as always the ADP figure can be ignored.

Elsewhere, Tuesday’s ‘flash’ inflation figures from the eurozone could be a market-mover, as debate among ECB policymakers grows as to whether they should cut, or pause, at the April meeting. The EUR OIS curve, incidentally, sees an 85% chance of a cut in a few weeks’ time. On that note, the RBA should hold rates steady at their meeting on Tuesday, though further cuts down under are on the cards. The central bank speaker slate is also busy, highlighted by Fed Chair Powell on Friday night – I’d like a word, please, with whoever scheduled that.

Finally, the corporate earnings slate is barren, ahead of Q1 earnings season getting underway with the banks from 11th April, while the London-NYC time difference has now been restored to the usual 5 hours, after UK clocks shifted forwards this weekend.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.