- English (UK)

Big Themes for 2024 – Will LATAM FX Outperform Again?

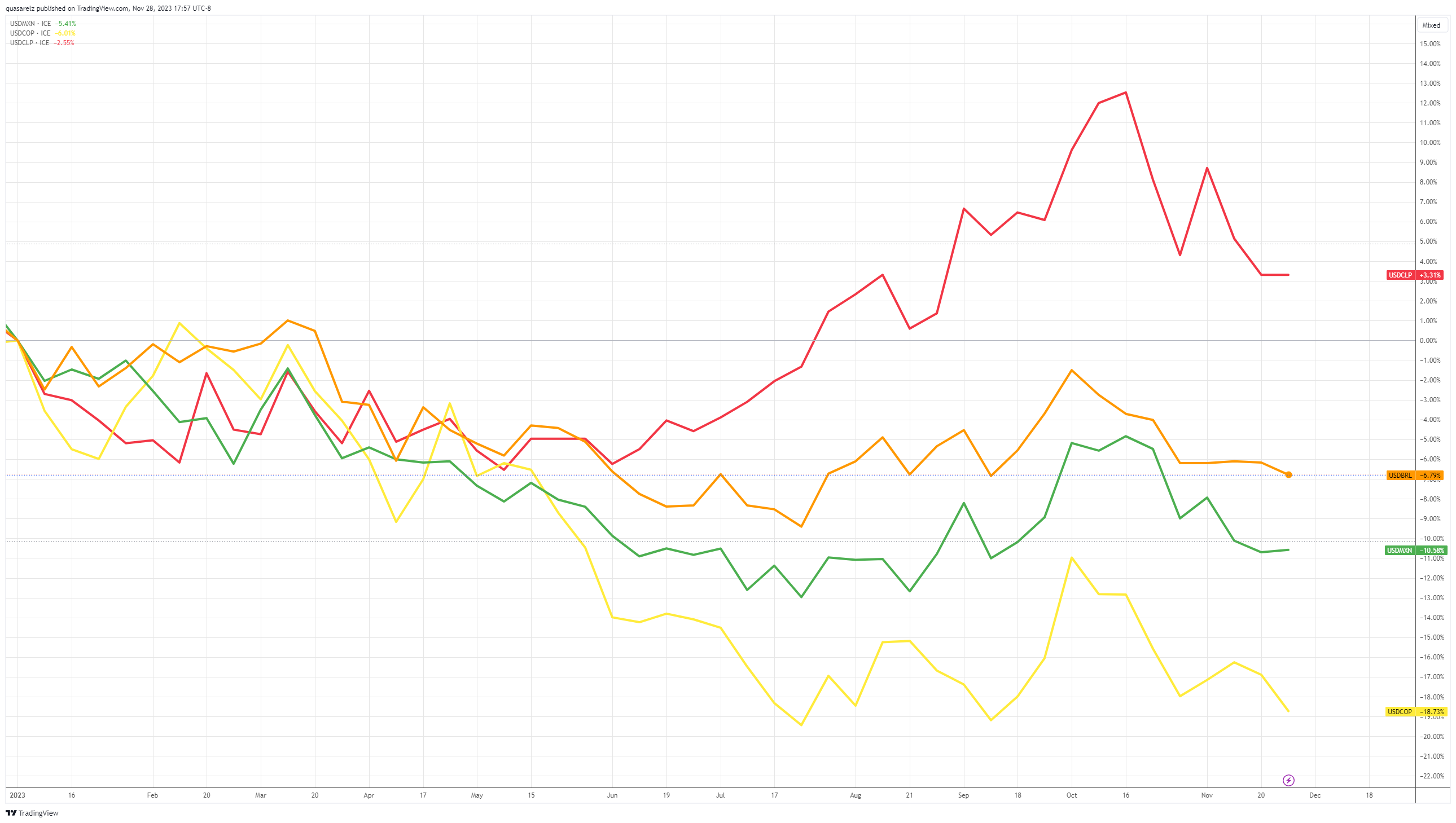

As Chris's mentioned previously on another piece of Big Themes for 2024, some of the big names on the LATAM FX front, like the Colombian Peso or the Mexican Peso, have got to mount double digits recoveries against the US dollar in 2023.

LATAM FX 2023

The big question for 2024 is whether these currencies can sustain, or even exceed, their performance from last year.

The remarkable success of the LATAM FX front in 2023 can be primarily attributed to the carry trade, as investors sought to exploit the advantageous interest rate differential compared to their developed market counterparts. Despite occasional bouts of risk aversion triggered by events such as the banking crisis and the attacks in Israel, 2023 has emerged as a year where risky assets have flourished, buoyed by unwavering support. This dynamic has also extended to the more commonly associated risky currencies like the EM & LATAM FX front.

While there are valid concerns about a potential economic slowdown in 2024, and the diminishing of the favorable differentials that boosted LATAM FX in 2023, especially as some central banks are starting or already in an easing cycle, and how these factors could impact the LATAM FX front, there remain compelling reasons to be optimistic about Latin American currencies in the coming year.

Latin America: A Bullish Perspective

When it comes to the region in general, the Latin America landscape seems to be supported by a supportive global environment, with expectations of a resilient US economy that could lead to Federal Reserve rate cuts, favoring LATAM currencies. Additionally, a potential renewed recovery in Chinese growth and the stabilization of the back end of US rates after volatile periods will contribute positively for LATAM FX. Historically, EM FX currencies generally perform well in periods of time with US growth above the median and during periods of loosening financial conditions, another set of factors that could support LATAM FX next year.

On the Chinese growth story front, LATAM exporting nations like Chile, Brazil, and Peru are poised to reap the rewards of China's economic growth reactivation, owing to their substantial trade linkages with the Asian powerhouse. The geopolitical nature of China's policies suggests continued support for LATAM external accounts into 2024.

LATAM FX Outlook for 2024

Latin American currencies are poised to start 2024 on a strong footing, buoyed by attractive carry trade prospects, manageable current account balances, and relatively subdued political risks. Within the diverse landscape of LATAM currencies, the Mexican Peso (MXN) and Brazilian Real (BRL) emerge as the most promising performers for 2024, while the Colombian Peso (COP) and Chilean Peso (CLP) face less favorable theoretical scenarios for the next year.

Despite this overall positive outlook, the LATAM FX landscape remains nuanced and differentiated. Varying monetary policy cycles across the region will likely lead to divergent currency performances. Mexico and Brazil, with their elevated real interest rates and robust external accounts, warrant a more optimistic perspective. Conversely, countries like Chile and Colombia, which are adopting more aggressive easing cycles and grappling with current account deficits, present a more cautious outlook.

BRL

There are expectations that the BCB will take a cautious approach next year and this in hand should keep real rates high, supporting the case for the Brazilian Real. Even with expected rate cuts, there appears to be no major depreciation risks on the horizon for the Brazilian currency as the BRL is expected to yield the highest carry in the region.

MXN

Mexico's real rates are also expected to stay high next year, making the Peso another frontrunner for the region. During BANXICO’s last meeting, the Mexican central bank's hinted at possible rate cuts next year, but the Peso should remain strong thanks to a healthy economy. The MXN seems a bit overpriced, but its current valuation seems to be backed by the potential benefits of the nearshoring dynamic. When it comes to the presidential election, as of right now, there doesn’t seem to be any major concerns or potential political risks.

CLP

Improved sentiment towards China could benefit the CLP, especially given Chile's close economic ties with China. However, Chile's aggressive easing cycle and likely higher current account deficit are some points of concern. The upcoming constitutional referendum in December is important, but with a more moderate proposal on the table and polls suggesting rejection, it's unlikely to shake the markets significantly.

COP

Among its regional counterparts, the Colombian Peso faces a less optimistic outlook for 2024, with potential depreciation on the cards. Anticipated substantial rate cuts could mirror the trend seen in Chile's CLP, where aggressive easing led to a weaker currency. It's also important to note that Colombia continues to grapple with some of the highest inflation rates in the area. This combination of high inflation and impending rate reductions could significantly diminish the appeal of the COP.

While the sentiment towards the region remains generally positive, it's crucial to maintain a heightened awareness of risks that could impact the LATAM FX front. Key among these risks are the potential for a disorderly sell-off in U.S. Treasuries, the looming threat of a more pronounced economic downturn in the United States, and the persistent challenge of high inflation. These factors pose significant challenges that could adversely affect the currencies in the region.

In conclusion, the LATAM FX market is poised for another interesting year in 2024. With an overall positive outlook, albeit tempered with a degree of caution across various regions and currencies, investors should navigate the emerging markets FX landscape with a nuanced and dynamic approach in the region, capitalizing on high carry opportunities while being mindful of potential risks and policy shifts.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.