- English (UK)

Analysis

But after a period of chaotic price action, chinks of light poke through the forest canopy providing a much-needed guide to the entities that price risk and liquidity for a living, which in turn, may see liquidity conditions improve and a relative calm return to markets.

Calling any market ‘calm’ with the VIX closing at 37%, and 1-week implied volatility (vol) in gold and EURUSD at 18% and 25% respectively may seem like an odd call. But certainly, in the case of the VIX index, these levels are well off the week's high of 60% and represent a sizeable discount to the week's average of 44%.

Options Markets Imply a -/+2.2% Move in the S&P500 This Week

By way of a gauge for implied movement in the S&P500 this week, S&P500 1-week ATM implied volatility closed at 35% - again, well off the week’s highs of 64% - where this level of vol implies daily percentage moves in the S&P500 of -/+2.2%, which to many in the day trading community is a sweet spot – not too crazy, but some solid movement in which to execute their strategy in.

It seems unlikely that we’ll see another 700-point weekly high-to-low trading range in the S&P500 futures this week – and while we’ve seen two weeks of ranges of this magnitude and we simply can’t rule out a third, to steal a quote from Fed member Williams “we’ve got the contours of tariff plans now”, and while these comments are portrayed through the eyes of the Fed, we can extrapolate this to the broader markets who gain confidence that we’ve priced in the worst of any further tariff changes.

Reassurances on Friday from Boston Fed president Susan Collins that the Fed is “absolutely” ready and has the tools to stabilise markets if required has also been helpful in lifting sentiment. With the US tax receipt deadline on Wednesday, and significant volatility in the US Treasury market there has been some concern that we could see increased stress building in the US funding markets (the plumbing of the US financial system) - but that hasn’t been the case, and the fact the Fed have a watchful eye on developments here is helpful.

US Q125 Earnings Add Another Volatility Input to US Equity

With US company earnings building in frequency this week (7% of the S&P500 market cap report), market players get to hear first-hand from the US businesses managing supply chains, and modelling the impact of tariffs on margins, investment plans and demand. The market will offer those who refrain from providing explicit guidance a hefty degree of leniency as policy has just been so chaotic and is still subject to change. That said, the companies that do have the visibility to offer more defined and explicit guidance should be well rewarded.

Netflix is the name the trader’s eye most closely this Thursday (report just after the close) - they have form at earnings, with the share price closing -/+8.7% on average over the past 8 quarterly reports, while options pricing implies a -/+5.8% this time around.

Ahead of US Q125 earnings we’ve seen solid buying support below 5300 in S&P500 futures, and 18,470 in NAS100 future and this ‘demand zone’ defines the risk for those building longs in US equity. Short-term traders may look to cut and even reverse positioning should we see prices roll over and trade through these levels - conversely, they may look to add to longs on an upside break of 5520.

US equity futures have re-opened the new trading week with gains of 0.7% to 1%+, despite some confusion as to the ongoing treatment of tech-related tariffs. There was a feeling throughout most of the weekend that we could see NAS100 futures open 2%+, but Trump’s post on Truth Social that “NOBODY is getting off the hook’ and there are no ‘exceptions’, is a factor subtracting from the gains on open.

Trading the Aftermath of Tariff Chaos

Tariffs aside, the market is now focused on the secondary effects of the recent tariff storm – specifically that around the outsized moves in the USD and US 10 & 30-year Treasuries, while we continue to monitor the incoming economic data and market-measures of inflation expectations.

We can assume that stability in US equity can be part explained by the repricing of US recession risk - but still too early to have any conviction on that call and the data set to come in over the coming weeks will help both market players and central banks judge the trajectory of US and global growth and recession risk.

Data and Event Risk to Monitor This Week

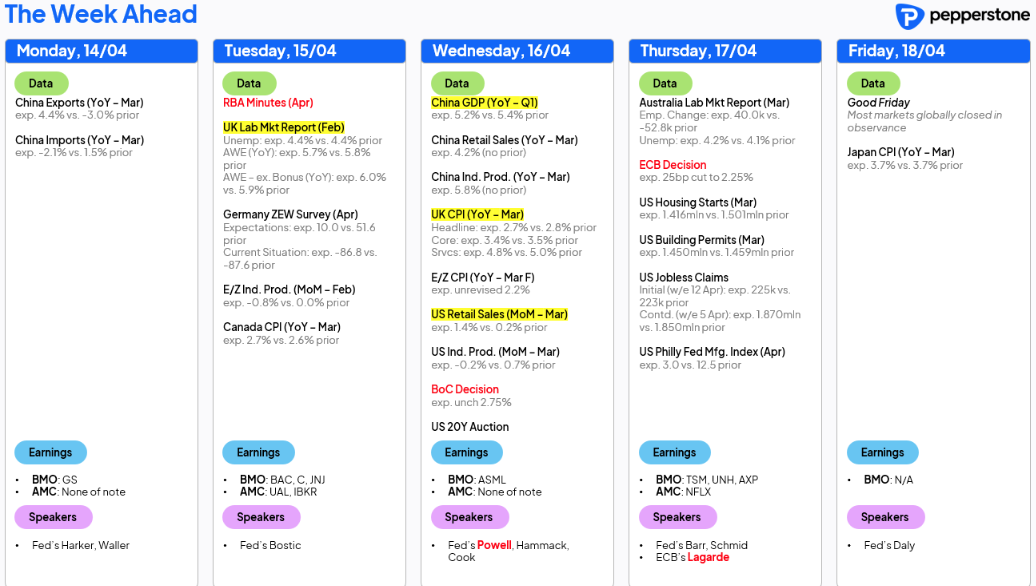

By way of key US and global data and known event risk to navigate and for the markets to further price the trajectory of the US and global economy, US retail sales (Wednesday) could move the dial, although it represents data captured through March and so is a touch stale. NY ‘Empire’ manufacturing is due on Tuesday and represents data from April, so it captures more of the recent mood, while we also hear from 9 Fed speakers, including Chair Powell.

The ECB will almost certainly cut rates by 25bp to 2.25% at its meeting on Thursday, an outcome 94% priced by EUR interest rate swaps, while we get China’s trade data for March, Q1 GDP, retail sales, industrial production and property investment data through the week. In the UK we see employment data and CPI which should reconcile to the view that the BoE are set to cut rates on 8 May. In Australia, the March employment report will play into the debate as to whether the RBA cut rates by 25bp or 50bp at the 20 May RBA meeting, with AUD swaps currently implying a 50bp cut at 38%.

Important Questions Being Asked of the USD

The disdain to hold USDs remains front and centre to markets, with the USD expected to be sensitive to any downside surprise in the US retail sales report. There has been increased focus on the huge divergence seen between the USD pairs and relative interest rate and bond yield spreads, highlighting that what was a fiscal issue is now a current account issue, with global capital migrated from the US and into other jurisdictions. The questions being asked of the USD are not 1-day affairs either, and represent potential major structural changes afoot, with market players questioning the sustainability of the USD as the global reserve currency, and the use of the ‘USD smile theory’ as a guide for understanding the USDs current investment regime.

Gold seems to be the clear beneficiary of the debates raging around the USD, and we've witnessed the gold price in absolute beast mode. Given the sheer pace of the recent move in gold, it’s no surprise to see gold 1-week implied volatility at 25% - the highest level since 2022 - with options traders paying up for the potential movement on offer. While we're seeing a few gold sellers on the re-open, many who work off the higher timeframes say gold is simply too hot to short, but also too overbought to chase.

The move in EURUSD to 1.1473 received the greatest level of attention from clients but we’ve seen strong interest in trading the trend in GBPUSD, AUDUSD, USDCHF and USDJPY. With so many of the classic fundamental USD inputs having absolutely no relationship with the FX spot rates, the price action is all that matters and should be respected. It feels like there is far more to explore.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.