Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

A Traders’ Week Ahead Playbook – Would the real Kamala Harris please stand up

Joe Biden has formally exited the presidential race and has backed his VP Kamala Harris as the nominee, but the process from here still clouds the markets judgment and will either centre on the party rallying around Harris, or see a more open process, with other candidates (should they formally enter the race) going through a two-step voting process at the Republican National Convention on 19-22 August.

Harris is the huge favourite to get the gig, notably as this offers the smoothest transition and the outcome that will presumably sit best with party donors. Reports that both Gavin Newsom and Gretchen Whitner have said they don’t plan to challenge increases the prospect of the party rallying around Harris, but others (such as Hilary Clinton) may still play their hand.

The Democrats need to show a united front

I am not a political expert but understand that traders are risk managers, and that politics has a significant connection with the financial markets. However, one suspects senior Democratic leaders would likely look to unite the party behind Harris, and we’ve already seen Dem Senator Stabenow endorse Harris, with reports that Gov Wes Moore will too. Unity has been scarce in the Dem’s current campaign and a galvanized party into the conventions would clearly be advantageous.

While nothing in this race is certain given prediction markets place Harris’s odds of being the Democratic nominee above 80%, it suggests most market players will look to price election risk and the playbook from a Trump vs Harris campaign. Recent polls had Trump marginally beating Harris in November, however, things could change on her first address to the nation and how ‘presidential’ she sounds. Still, while Biden stepping down is certainly not unexpected, it does add a layer of confusion, but one can imagine a softer USD and a slight pullback in the stocks that benefited from a clear Trump win and a Republican ‘Red Wave’.

Setting the platform for the new trading week

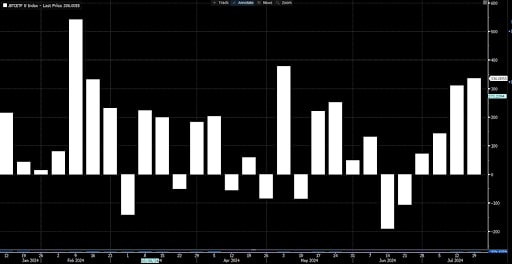

These developments aside, and setting the platform, we move past a week where tactical/discretionary traders have played defence, although this bias was more pronounced in FX and equity markets, where gold and US Treasuries closed the week lower. Bitcoin also diverged from the negative moves seen in equity, gaining 5% w/w, with the third largest weekly inflow into the broad suite of BTC ETFs - where the underlying momentum has seen Bitcoin breach of 68k and suggests we could see another tilt at 70k.

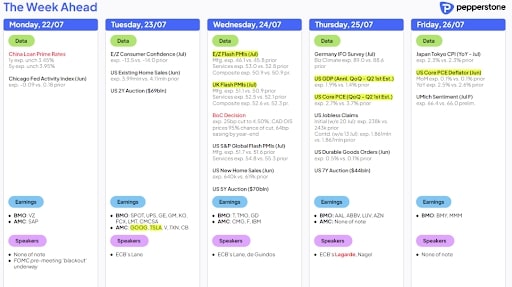

Weekly inflows ($ value) into the BTC ETFs:

US election developments, global IT disruptions and a broad pick-up in cross-market volatility have resulted in the unwind of FX carry strategies. Subsequently, along with the USD, it was the ‘funding’ currencies (CHF, EUR, and JPY) that outperformed, with cyclical (AUD, NZD, and NOK) and high beta Latam plays all sold off hard.

As we move into the new week, unless we see a marked pick-up in sentiment the probability of these moves spilling over looks elevated - short NZDCHF and MXNJPY screen well for further downside, although Mexico’s CPI print (due on Wednesday) does add risk to MXN positions this week.

In equity, it was the NKY225 and EU equity indices that underperformed the broader developed market equity complex, with upbeat selling activity into the back part of the week. The NAS100 closed -3.7% w/w and I look for a break of the 50-day MA and 24 June swing low to naturally increase the probability of further liquidations pushing the tech-index into 18,900.

A solid flush out of well-owned tech plays

The S&P500 has seen a solid flush out of extended and concentrated positioning in some incredibly well-owned areas of the market, with the S&P500 tech sector losing -5.1% w/w, for the second worst week since 2022. Politics aside, we look ahead to the ramp-up in US and EU corporate earnings reporting, and notably numbers from Tesla, Alphabet, and IBM, which could see increased volatility at a single stock level, with the options market implying some sizeable moves in the respective names on the day of the report.

My colleague Michael Brown put some thoughts on earnings from the Mag 7 names – click here

I wouldn’t be stepping in to buy S&P500 (or NAS100) just yet and would want to see how price reacted at the 50-day MA (5409), given it has acted as a robust trend filter since October.

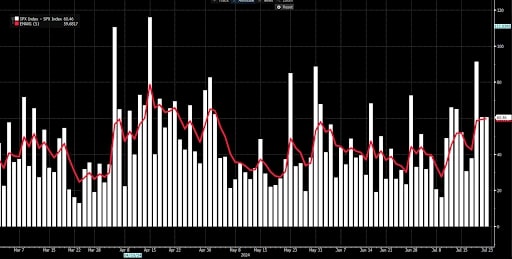

Trader’s buying volatility as uncertainty rises

There has been steady demand to buy equity/index volatility, with the VIX pushing into 16.5%, where a push into 18% to 20% can’t be ruled out this week, which for many day traders is the sweet spot for volatility. By way of daily trading ranges, we already see the S&P500 5-day average daily high-low trading range hitting 60 points and the most since early May, so that has offered plenty for the day traders to cut their craft in. While for those working off longer-term timeframes, such as swing strategies, may look to reduce position sizing accordingly to account for the higher volatility.

S&P500 daily high-low trading ranges

Elsewhere on the week, watch CAD exposures over the BoC meeting, with a 25bp rate cut largely priced. We get growth data points in the US, EU, and US, where we see manufacturing and services PMIs potentially impacting sentiment. Eyes on China too where we see the PBoC decision to alter the 1- and 5-year Loan Prime Rate.

Good luck to all.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)