- English (UK)

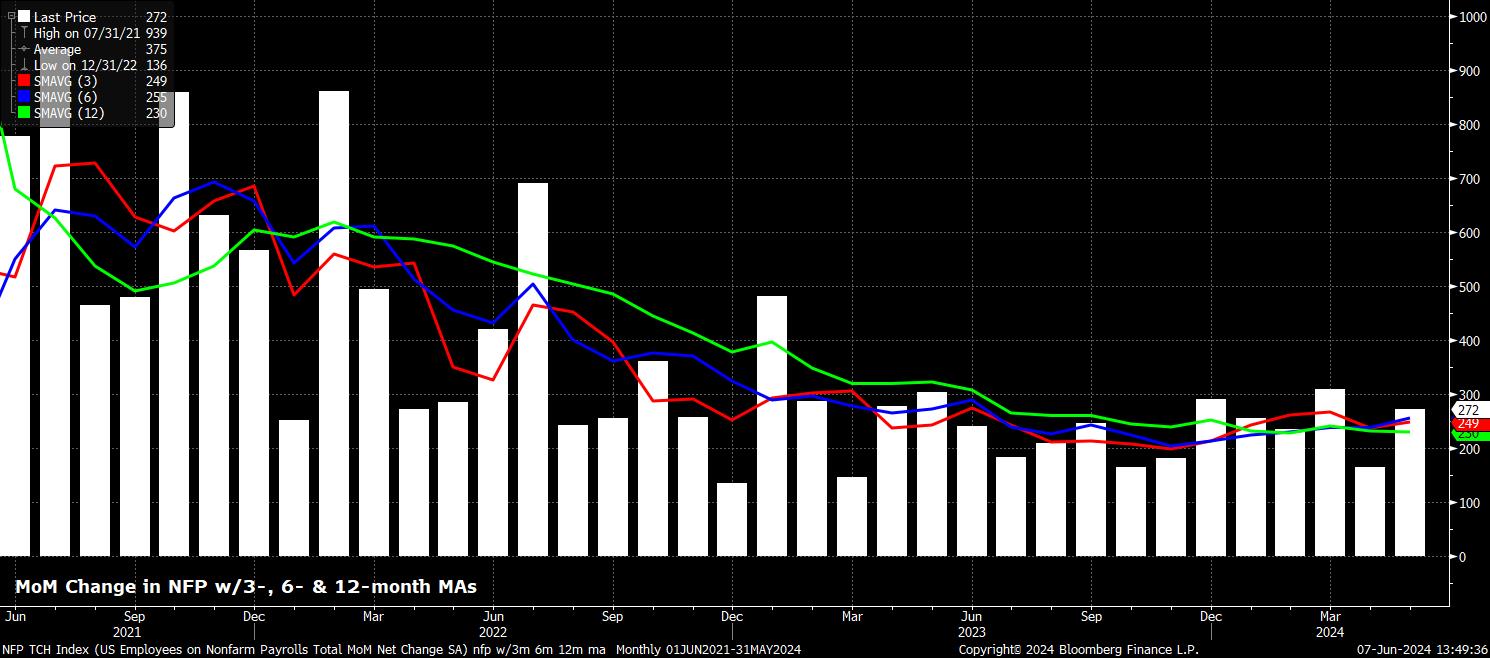

Headline nonfarm payrolls rose by a whopping +272k in May, considerably above consensus expectations for a +180k increase, while also being just to the upside of the forecast range, from +120k to +258k. Despite this, there was a net -15k revision to the prior 2 payrolls prints, for March and April. Altogether, this takes the 3-month average of job gains to +249k, pretty much bang in line with the ‘breakeven’ pace of payrolls growth required for job growth to maintain pace with growth in the size of the labour force.

Taking a deeper dive into the payrolls print, the sectoral split of job gains shows broad-based job gains across most sectors tracked by the BLS, with only ‘Mining and Logging’ notching a modest -4k fall in employment – the second straight month that the sector has lagged. On the other hand, the bulk of the job gains again came from ‘Education and Health Services’, along with a continued solid pace of Government, and Hospitality hiring.

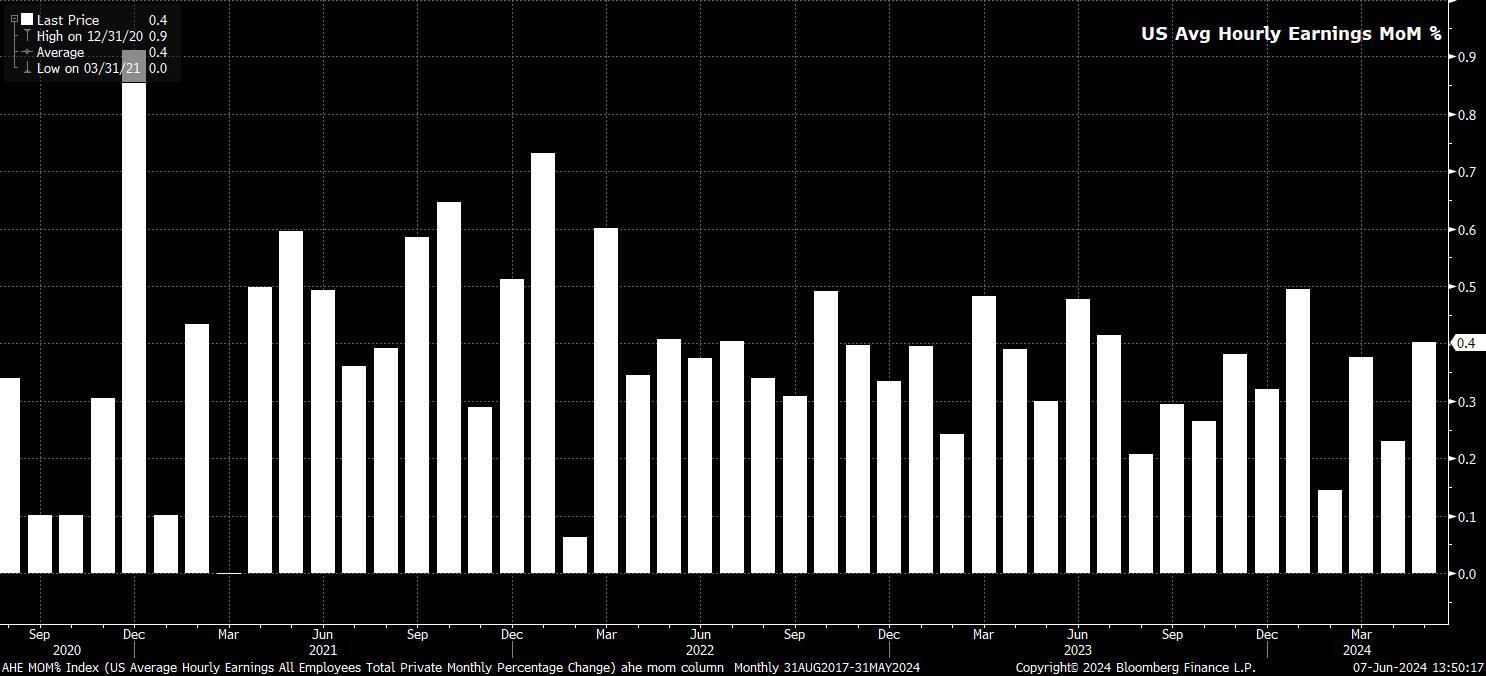

Remaining with the establishment survey, the employment report showed that average hourly earnings rose by 0.4% MoM in May, above consensus expectations for an 0.1pp quickening in earnings growth to 0.3% MoM, and the fastest monthly increase since January.

In turn, this saw the annual pace of earnings growth rise to 4.1%. Though this continues to represent a rather modest pace of real earnings growth, which remains somewhat consistent with a return to the Fed’s 2% inflation target over time, persistent earnings pressures are likely of increasing concern to FOMC policymakers, particularly given the stubborn nature of services prices, and the contribution that this makes to the bumpy disinflationary path back to 2%.

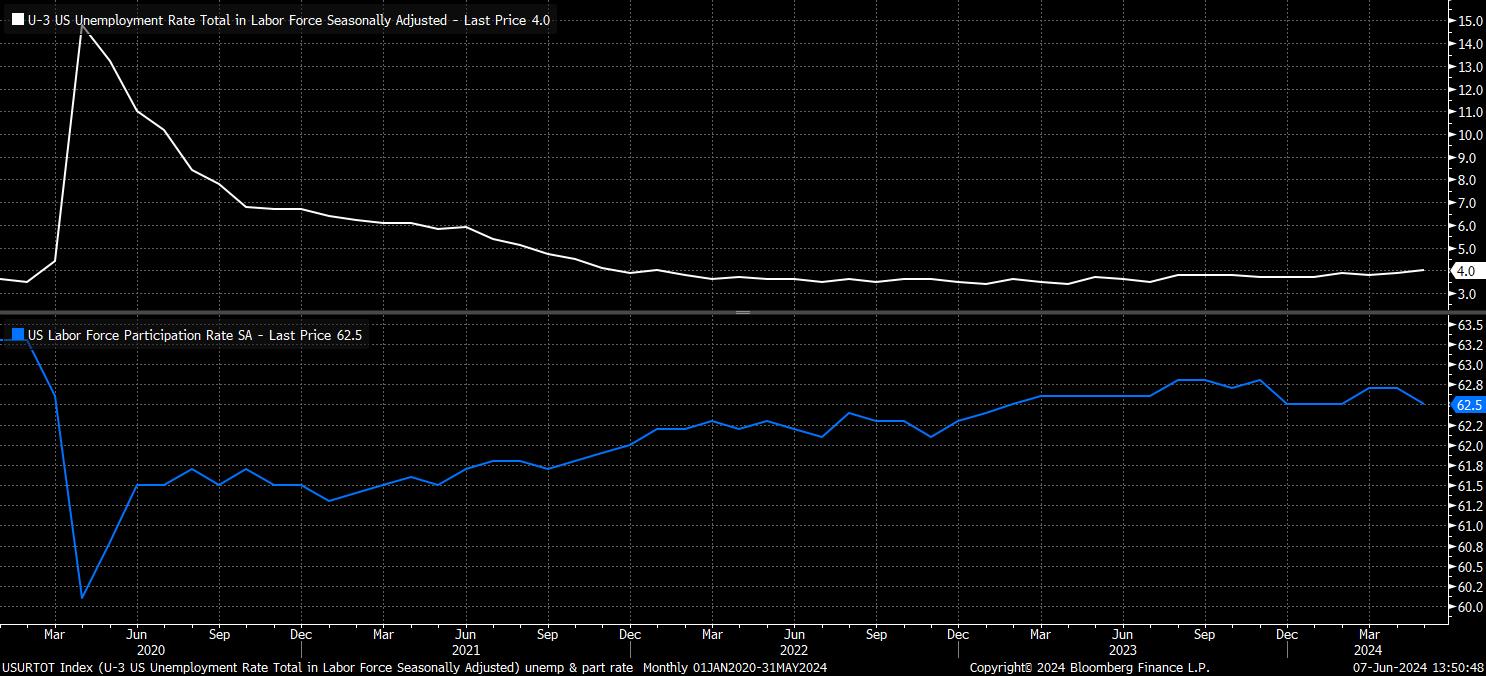

Turning to the household survey, things become a little more downbeat, though it is important to note how these measures have been incredibly volatile of late, particularly with the impact of increased immigration continuing to somewhat distort the data.

In any case, headline unemployment rose to 4.0% in May, the highest since January 2022, and above expectations for joblessness to have remained unchanged at 3.9%. Meanwhile, other measures of slack also sent relatively worrying signals, with participation ticking 0.2pp lower to 62.5%, albeit underemployment remained unchanged at 7.4%.

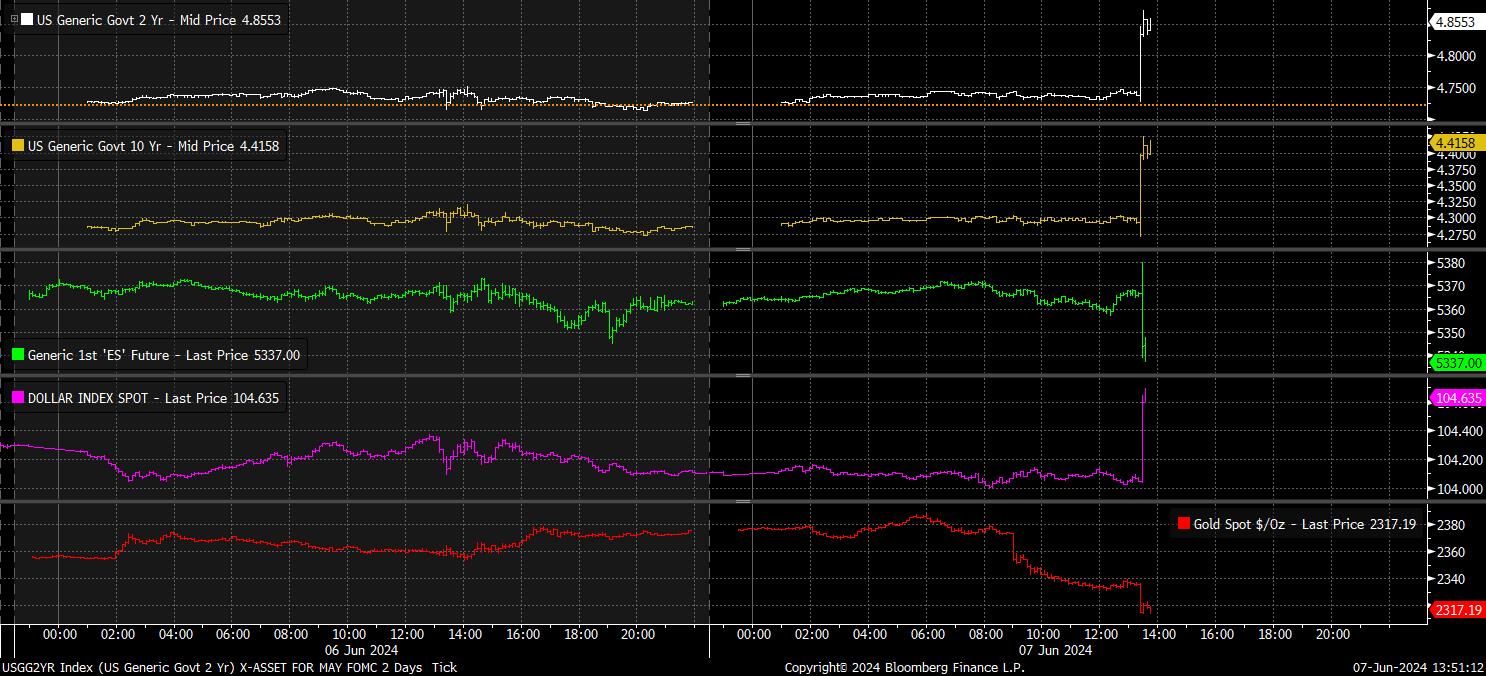

It was, however, the earnings component of the report that the market appeared squarely focused on as the dust settled on the release, in turn sparking a hawkish repricing of Fed policy expectations.

While next week’s meeting is still seen as a certainty for rates to remain unchanged, the OIS curve now implies just a 60% chance of the first cut being delivered by September, compared to over 80% pre-NFP. For 2024 as a whole, the curve now prices around 38bp of easing – implying around a 55% chance of two cuts being delivered – a rather significant repricing from the 48bp of cuts priced before the May jobs report.

This hawkish repricing had a significant follow-through impact onto markets more broadly. In the fixed income space, Treasuries sold off aggressively across the curve, led by the front-end, where 2- and 5-year yields climbed by around 15bp in the aftermath of the jobs data crossing news wires. In turn, this pressured gold, which at the time of writing trades over 2% lower towards the bottom of the recent range, while providing a fillip for the dollar, with the greenback rallying across the G10 board, to the tune of 70 pips or so against most majors.

In the equity space, initial two-way action turned into increased selling pressure as market participants digested the data, with both the front S&P and Nasdaq 100 contracts slipping around 0.5% in reaction to the hawkish repricing. Interestingly, this marks a departure from the ‘good news is good news’ vibe seen in reaction to the upside surprise in the ISM services PMI report on Wednesday.

Overall, however, he May employment report seems unlikely to be a game-changer in terms of the Fed policy outlook. FOMC members continue, unsurprisingly, to place greater weight on the inflation side of the dual mandate, and are likely to reiterate next week that they are yet to obtain the 'confidence' being sought on a return towards the 2% target to enable the first rate cut to be delivered. As such, the May CPI report, also due next Wednesday, is likely to be a much more significant event, particularly after the core CPI metric fell, on an annual basis, to a near 3-year low in April. Furthermore, Chair Powell has indicated that only 'unexpected' labour market weakness would necessitate a policy response; this report indicates that there are few signs of that significant weakness emerging just yet.

From a market perspective, with the Fed’s next move still set to be a cut, and the central bank ‘put’ firmly back in place, the path of least resistance for equities should continue to lead to the upside, with dips likely to be shallow and rapidly bought into. In the foreign exchange space, despite the hot data, the bar for substantial further USD upside remains a high one, particularly with G10 central bank divergence likely to be relatively narrow in nature, likely keeping a lid on vol for now.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.