- English (UK)

Analysis

A traders’ week ahead playbook – the calm before an impending storm

When we drill down into wages, revisions and the balance between the Household and Establishment survey, the wash-up is it supports the ‘soft landing’ argument and won’t change the Fed’s course, where a 50bp hike next week and a peak 5%-5.25% fed funds rate is still the firm default position.

Taking a review of the week that was, it’s hard to go past the 37bp decline in US 5yr real rates to 1.12%, with US 2yr Treasury yields falling 18bp to 4.27% – Fed chair Powell had the opportunity to push back on the recent easing of financial conditions in his Brookings speech but refrained from doing so, and it was game on from there, with US real rates driving down the USD 1.5% WoW, and closing firmly below its 200-day MA.

In a world of falling real rates, the JPY reigned supreme gaining 3.6% (vs the USD) and much attention has been placed on BoJ Tamura’s comments around a potential review of BoJ policy – arguably one of the macro thematic’s that needs to be considered for 2023, where a change in BoJ policy stance could have massive implications for Japanese and global bond markets and of course the JPY and JPN225. USDJPY hit the 200-day MA and is getting a real work out from clients – would be looking at modestly lower levels to get long for a tactical bounce.

(USDJPY daily)

With limited data to drive this week and no Fed speakers, the market may start to think for itself and look at massaging exposures ahead of the following week – a week which is riddled with tier 1 event risk – the result could easily be traders pairing back USD shorts into the back end of the week – this same factor could see US Treasury yields rise and weigh on equity, where there are ever greater signs of overbought readings in the market internals.

In G10 FX I am particularly looking at NZDUSD, EURUSD and in the commodity space silver (XAGUSD), all of which have come up on my momentum scan - where price has made a new 40-day high, and the 3-day ROC is in the 75th percentile of its 12-month range. I am looking for further near-term upside in these plays but given this risk of position squaring into the tail of the week these markets are the markets I will be watching.

Watching crude on the open with OPEC leaving output levels unchanged on Sunday – it feels like traders had positioned for this outcome going into the weekend, although there may be some legacy positioning that needs to come out of price on the open - happy to hold Spotcurde shorts for $78

China remains a dominant driver and the good news has been rolling in – through the weekend we’ve heard more news with Shanghai and Hangzhou easing restrictions, with PCR tests no longer needed to visit certain public venues. Given the moves it feels like markets have discounted a lot and new news needs to be far more impactful. Well see, but the set-up in USDCNH interests and a breakthrough in the neckline of the head and shoulder pattern may see further USD selling across G10 FX – one for the radar, while I am watching Chinese/HK equity markets and would be adding to longs in HK50 on a close above 19,200.

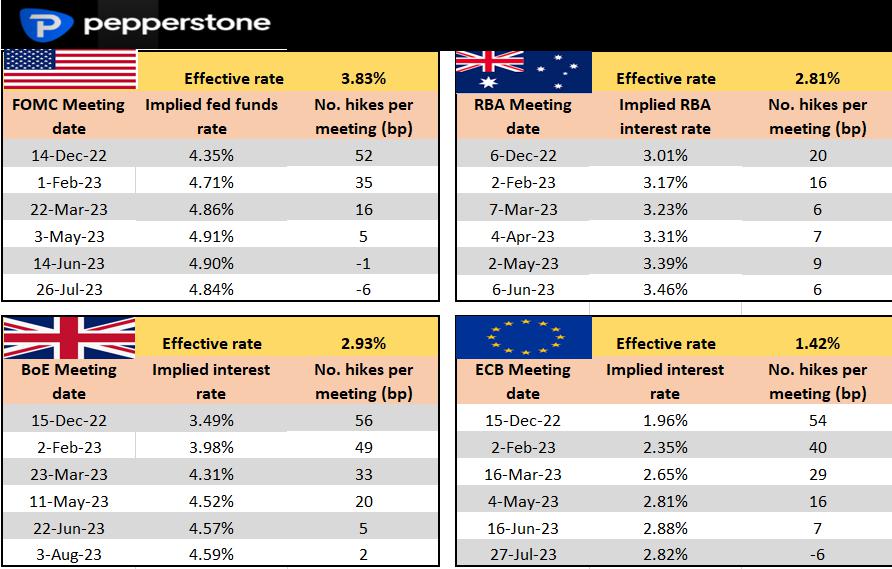

Rates Review – we look at what’s priced for the next central bank meeting and the step up in the following meetings

Factors to watch in the week ahead

US – With the Fed now in a blackout period through to the FOMC meeting (15 Dec), the focus is firmly on the data flow – next week’s Nov CPI print is the main game and looms large, but it’s worth noting that this coming week is quiet by way of known event risks – unit Labor cost (8 Dec 00:30 AEDT) is an important data point, but despite an expected decline to 3.1% (from 3.5%) it is unlikely to spur vol across markets. The ISM service report (6 Dec 02:00 AEDT) is eyed at 53.3 (from 54.4), suggesting the service sector is holding up well and further supporting those in the ‘soft landing’ economic camp.

We also get Nov PPI (10 Dec 00:30 AEDT), which is eyed at 5.9% (from 6.7%) and while this could get more of a look this week, unless we see a dramatic miss, I’d argue it is most likely a non-market mover. We also get the University of Michigan's 5-10 inflation expectation no Friday, where a number below 3% would be welcome news to the risk bulls and promote further USD selling.

Australia – while we get the Q3 GDP print on Wed (consensus 6.2% YoY), the highlight of the week is the RBA meeting (Tuesday 14:30 AEDT) – it would be a huge surprise if they didn’t hike by 25bp, and given that outcome is thoroughly priced, the move in the AUD will come from the tone of the statement and whether they are seeing ever clearer evidence that inflation has turned on a sustained basis. We can also marry the tone of the statement with pricing further out the rates curve, where peak/terminal expectations for the cash rate sit at 3.57%, implying another 75bp of hikes by mid-2023 – one can argue that a further 75bp of hikes is too punchy.

China – while headlines on Covid freedoms will likely drive markets, it’s worth noting the China Politburo meeting on Tuesday, where we may get some additional colour on economic policy for the year ahead. On the data docket we get Nov trade data (7 Dec – no set time), CPI/PPI (9 Dec 12:30 AEDT) and Nov credit data (no set date) – CPI is expected to print 1.6% (from 2.1%), so in theory, this offers further scope for the PBoC to lower the prime rate later this month. USDCNH is ominously poised for a deeper correction, as the daily chart shows, with price testing the head and shoulders neckline – an outcome which would support the AUD and NZD. I like Chinese/HK equities higher and see a high probability the HK50 tests its 200-day MA soon.

Canada – We’ve seen the CAD underperform most G10 FX currencies over the past month, notably with some huge moves in CADJPY and NZDCAD. The Bank of Canada (BoC) meet Thursday (02:00 AEDT) and expectations are split between a 25bp or 50bp hike - with 32bp of hikes priced into Canadian rates markets it could be a lively meeting for CAD traders – I’d be taking some of CAD shorts off the table into the meeting, as there are real risks of a 50bp hike

UK – while we look at UK CPI and the BoE meeting in the following week, this week is pretty quiet on the UK data front, where it’s mostly tier 2 releases that shouldn’t dive too much flow in GBP – we do get the BoE’s inflation attitudes survey (9 Dec 20:30 EDT) which could offer some insights on inflation trends - but on the whole, it’s a week where the GBPUSD will respond to external factors and broad market sentiment

Eurozone – Another region where the data is unlikely to impact too intently – we do see 11 ECB speakers, with President Lagarde due to speak on Monday (12:40 AEDT). The market prices a 50bp hike at the Dec ECB meeting, but if the ECB is looking at 75bp then this is the week to guide expectations

The week that matters – this week will be about getting exposures in check and reacting to any landmines that fall in our path – looking at the following week it honestly doesn’t get any more potent – how’s this for event risk and a very lively 3 days in markets? We’ll cover it later in the week, but it doesn’t get bigger than this and could shape much of Q1 23.

- US CPI – 14 Dec 00:30 AEDT – this is the big event risk…when we look at implied volatility the CPI report is the defining risk event this year.

- UK CPI – 14 Dec 18:00 AEDT

- FOMC meeting (50bp hike expected) – 15 Dec 06:00 AEDT

- SNB (50bp hike expected) – 15 Dec 19:30 AEDT

- BoE meeting (50bp hike expected) – 15 Dec 23:00 AEDT

- ECB meeting (50bp hike expected) – 16 Dec 00:15 AEDT

- BoJ – 20 Dec

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.