Analysis

Trader thoughts - we move past central bank super week and what's the trade?

The BoE close to a pause

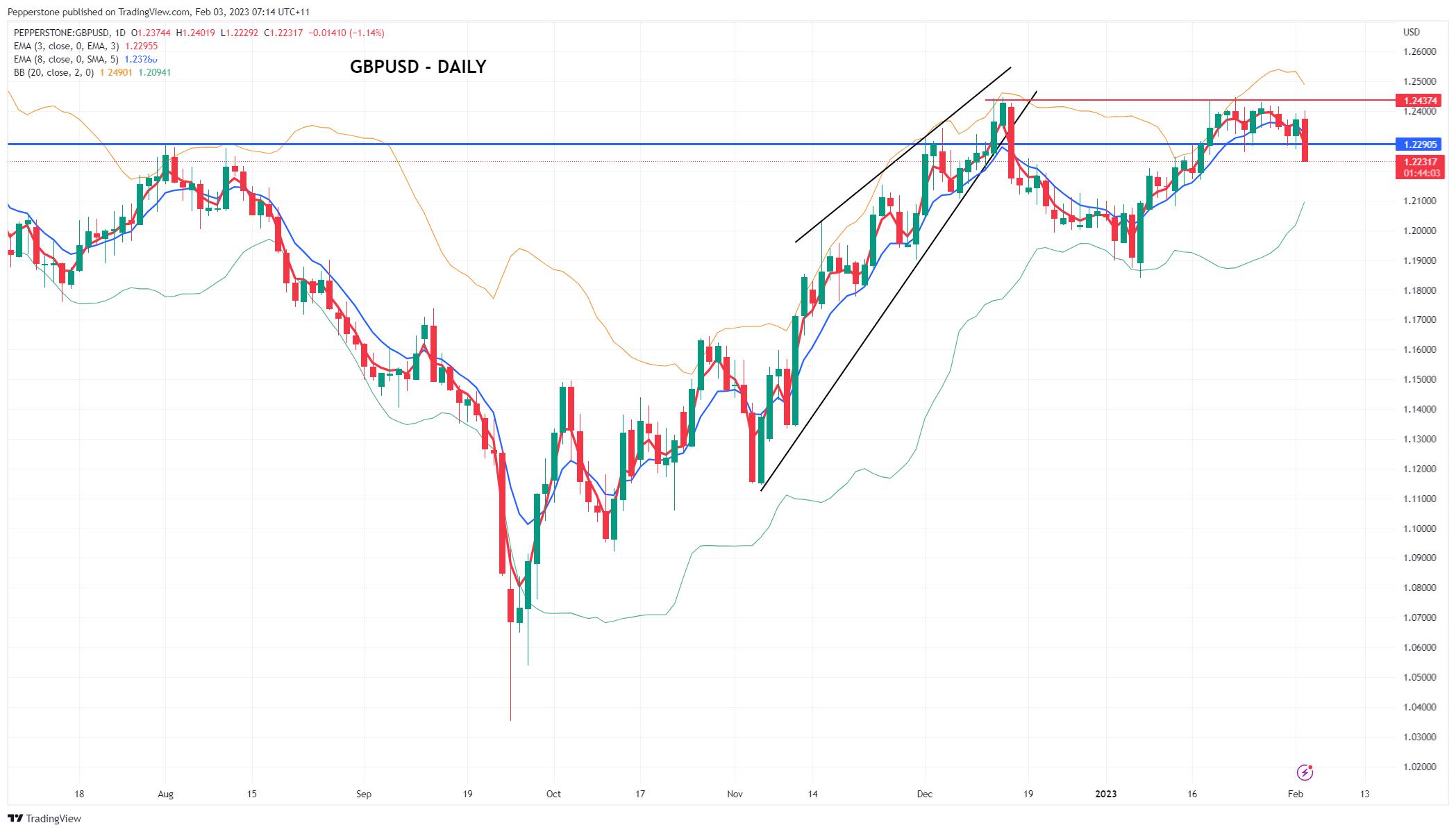

The BoE may have one more hike in them, but its 25bp at best with the market pricing terminal BoE rates at 4.27% by June – let’s see the next UK CPI print on 23 March and that could possibly seal the deal on a pause in the hiking cycle - the language from gov Bailey suggests a higher conviction of this playing out. UK gilts have found big buyers (10yr was -30bp, 2s -24bp) and GBPUSD 1-month implied volatility has dropped to 9.42% and eyes the 15 Dec lows of 8.52%. The inability of GBPUSD to break 1.2440 has cost the GBP bulls, and the new language from the BoE has seen price accelerate to the downside, with the range lows of 1.2263 giving way. With price now eyeing a daily close below the 5-day EMA, I am either flat or short on this pair, but longs are not for now.

Trading the USD comes with an additional risk in the session ahead, as you’re effectively fighting positioning ahead of the upcoming US non-farm payrolls (00:30 AEDT) – the consensus here is for 190k jobs to have been created in Jan, with the U/E eyed at 3.6%, and average hourly earnings (AHE) at 4.3% – it’s the AHE variable that I think moves the USD and NAS100 most intently, as it did last month – the market is positioned for a softer wages print, so the pain trade comes on a print above 4.5%.

Taking the USD out of the equation temporarily we see that GBPAUD has broken down and prints further lower lows – a tough cross to act on as we have the RBA meeting next week (Tuesday 14:30 AEDT), and that could inject some uncertainty to hold exposures - but the flow is certainly favouring shorts – GBPJPY is also one I favour lower, with important support kicking in around the 156.0 levels.

ECB moving to a data-dependant model

EURUSD has been well traded by clients, with a heavy skew in EURUSD shorts post-FOMC being reduced to a more nuanced position on the move below 1.0900. Like UK assets, we’ve also seen a decent bid playing through European govt bonds which shows how traders feel about the ECB meeting – we see German 10yr bunds -20bp to 2.08% and Italian/German 10yr spread coming in by 19bp.

We essentially heard that the ECB are committed to another 50bp hike in March but then there is greater flexibility to be data-dependant pot March – this suggests a 25bp hike in April and then a pause in the cycle is highly likely, a scenario fully shared by rates trader, where we see terminal ECB pricing (for the deposit rate) at 3.28%. We see EURUSD 1-month implied volatility falling to 7.73% and eyeing the 15 Dec lows of 7.50% - so, again the market is reducing its expectations of EUR movement over this period – not great for those who like a bit of intra-day movement!

Rates aside, EUR flows of late have partially been a rates play, but more so a growth play – lower EU Nat gas, leverage to China reopening and outperformance for EU equities have seen a big re-think of EUR shorts in 2023 – this dynamic shouldn’t change too radically and should underpin EURUSD in the near-term and hence we’re still seeing buyers on dips. With US NFP in play, EURGBP has re-emerged as the consensus trade, and the evolving central bank diverging policy paths is seen in the price action, with the breakout above the Jan highs – look for the re-test to confirm the break here.

FOMO is alive and well in equity land

Daily of NAS100

Another way to look at the moves in markets is the sheer relief seen in growth equity – granted, I’m saying this before we get numbers from Apple, Alphabet and Amazon, but the NAS100 is ripping and sits in a technical bull market, having rallied 20% from its Dec lows. EU equity markets, notably the GER40 is on fire too and the flow is in beast mode. This has the hallmarks of FOMO all over it, but this tape is not made for fighting – the market is trading a central bank pause, and active managers are understandably scared about missing out on performance – strength begets strength.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.