- English

- 中文版

The January FOMC meeting playbook – assessing the risk to the USD

Trading considerations

Positioning – Investment banks who manage flow across spot FX, swaps, and FX forwards report that clients are net short USDs, notably in real money and leveraged, although the position is not at extremes. In the weekly TFF (Traders for Financial Futures) futures report we see that leveraged funds (hedge funds etc) have flipped to a long USD position, notably vs the AUD, EUR, and CAD. Real money accounts (asset managers, pension funds) are net long USDs, but that position is mostly held vs the EUR.

The notional position in futures is far smaller than those held in spot or forwards market, but the data is easier to source. So as we head into the FOMC meeting, there are risks of a USD short squeeze, notably vs the JPY.

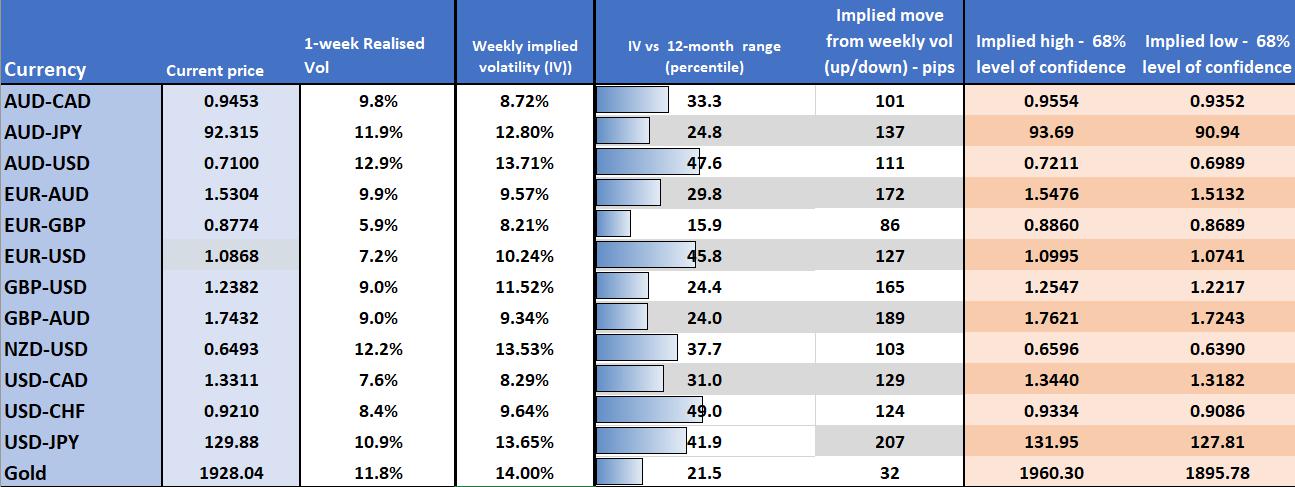

(1-week implied volatility from Friday’s close)

If I look at 1-week implied volatility across the USD pairs the expected moves (higher or lower) over the week are hardly explosive and many sits around the 30th percentile of the 12-month range – this suggests the market is not expecting any major surprises and refrains from paying up for options volatility – I see this as an important consideration in our risk management, as it is often prudent to reduce exposures over an event where the market is expecting significant movement and the range of outcomes are varied.

What to watch for?

I expect a hawkish statement from the Fed this week, but so do most market participants and it is a strong consensus view.

On the point of rate hikes, a 25bp hike is fully discounted, and while a 50bp hike can’t be ruled out, it would be a huge surprise. We look out the interest rate curve and after this week’s hike, see two more 25bp hikes pencilled in by mid-2023 - traders will need to marry the tone of the statement and Powell’s press conference with this pricing structure. In the less likely outcome that the Fed give the impression that they could pause after this week’s hike, then the USD could easily sell off and risky assets rally.

I suspect Powell will want to be non-committal either way and allow the Fed maximum optionality to react to unfolding economic data.

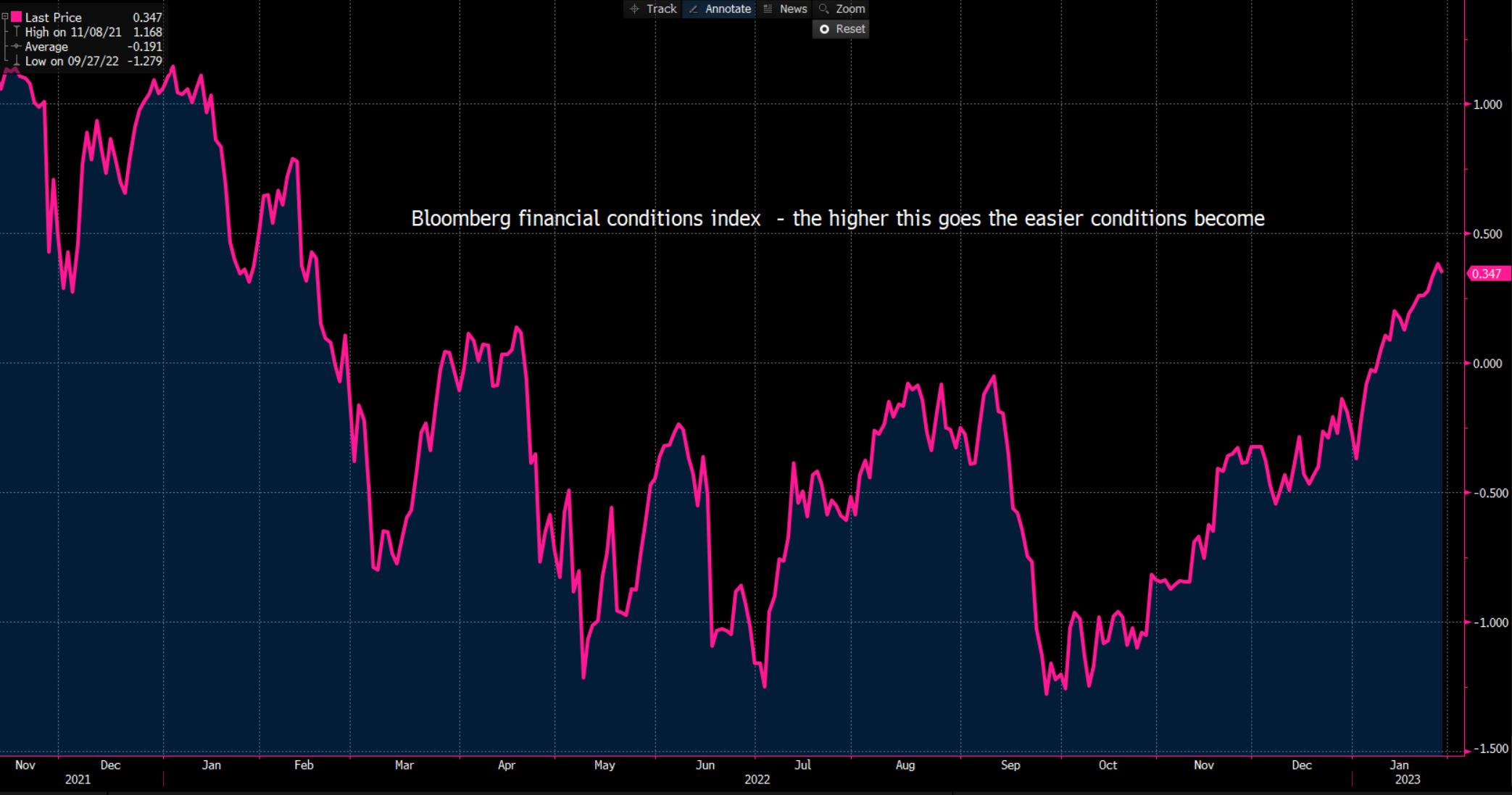

One big consideration is that financial conditions (as measured by moves in equity, bonds, credit, USD, and the VIX index) have loosened to a point where Chair Powell may detail the extent of easing is “unwarranted” – this pushback could be a key focal point, especially given we’ve seen a rise in commodity prices that is starting to lift inflation expectations.

Would the market buy this pushback?

I’m not sure the market de-risks too intently should we hear a push-back on easier financial conditions, as the market is seeing a Fed that is largely in control – at least at this stage. Wages are growing at a slower clip, while core PCE inflation is running at a 2.9% 3-month annualised pace - the slowest since Jan 2021. We see growth is still positive but below trend, and that should mitigate the need to really hit demand by taking the fed funds rate to say 6%.

Somewhat more concerning is that soft data is thematic of recessionary readings, leading indicators are negative, and the consumer is pulling back on spending – it’s no surprise then that then the market anticipates a near-term pause in the hiking cycle. Then there’s the lag effect, where some 425bp of hikes still need to fully feed through to the economy.

In a world of nuance, the Fed could portray that we’re closer to an end in the cycle – here, we could see a tweak to the line in the FOMC statement, where “the Committee anticipates that ongoing increases in the target range will be appropriate” – where the word ‘ongoing’ is either removed or altered to “further increases”.

Where do the risks sit?

There doesn’t seem much reasoning for the Fed to alter its course here and should continue to highlight a commitment to reducing inflation. At this juncture, it seems unlikely the Fed would want to appear dovish, so with the risk are for a hawkish Fed – albeit this is expected - and in a market where leverage funds are short USD (in the spot market), the risks are small skewed to USD upside, which by extension this means a lower NAS100 and XAU price.

Whether that plays out is another thing and perhaps the best way to trade this tactically is to stand aside and let the market react accordingly, with a view to selling rallies in the USD for a resumption of the bearish trend.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.