A week ahead traders’ playbook – market landmines almost everywhere we look

Measures of interest rate volatility (vol) have been falling progressively since late 2022 and FX vol has started to turn lower. We see strong bullish trends and underlying momentum in DM equity indices CFD, with the NAS100 putting on 4.3% last week and breaking key level after level - the HK50 is a juggernaut, gaining 5.2% on the week – the AUD outperforms in G10 FX, although the bulls would love a closing break of 0.7142 to keep the dream alive.

Life is good in markets and the flow in risk assets suggests the path of least resistance is higher. As a risk manager one could easily feel reducing exposures into the raft of event risk is a prudent idea – where buying weakness in risk seems the right approach, with the idea that if the script does indeed change and the markets hear something new that suggests this lower vol world is mispriced, then we can adapt and revisit short exposures with more conviction. For now, we look at the data flow and see a market that senses a positive outcome for risk assets and where pullbacks should be shallow.

One aspect I feel is concerning is the rise in commodity CFDs – gasoline prices are 27% off the December lows, while crude is 13% higher from the lows. Copper has been on a tear, as has lumber. I can go on but while market measures of inflation expectations are rising, they are not setting off alarm bells just yet. Still, if commodity CFDs continue to push higher, and granted the moves are premised on a better demand picture, then it could pose a greater concern for central banks and by extension, financial markets – of course, it’s not all about commodity CFDs and we can consider other aspects within goods and services, as well as wages, but with the market positioned for core PCE inflation to head towards target late this year/early 2024, anything that really muddies the waters could see a return to volatility.

To surmise, inflation is falling but if 2022 taught us anything it's to expect the unexpected – for now, though the trend is your friend. So staying bearish on the USD and positioned for further outperformance from the NAS100. I’d like to see an upside break of 1.2435 in GBPUSD for a move to 1.3000 and silver is a must-watch, with price consolidating between $24.50 to $23.15 – A bullish break and silver could fly.

Daily chart of silver/XAGUSD

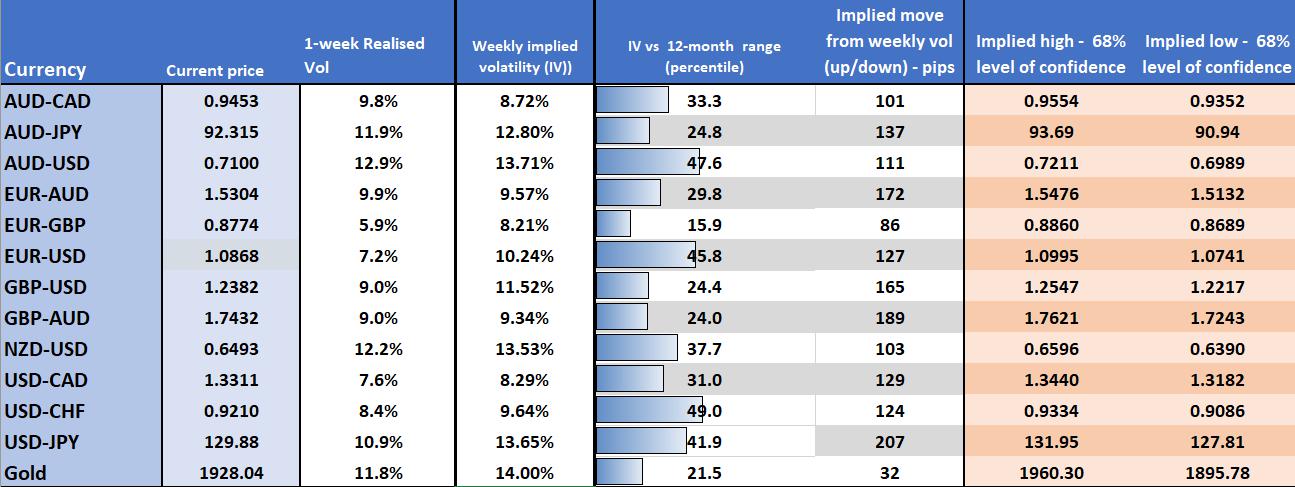

Volatility matrix – we look atoptions pricing of volatility over the coming week, where we can calculate the implied move and trading range.

Key event risks to navigate:

US

- Q4 Employment Cost Index (ECI - 1 Feb 00:30 AEDT) – the market sees the ECI falling to 1.1% (from 1.2%) – given the ECI is one of the wage inputs the Fed look at closely, its, therefore, a data point that can move markets and is a risk to trader’s exposures. The consensus estimate is usually on the money, so expect big moves across markets on an extreme outcome – i.e. the USD falls hard on a read below 1% or a 1-2% rally on a read above 1.3%

- ISM manufacturing (2 Feb 02:00 AEDT) – the market expects the pace of slowdown in manufacturing to build, with the consensus est. on the index at 48.0 (from 48.4) - once again this data point highlights that ‘soft’, or the survey-based data, suggests greater recession risk. By way of potential reactions (relative to consensus), bad data is bad news for the USD and equities, as US growth is once again in the spotlight.

- JOLTS job openings (2 Feb 02:00 AEDT) – the market expects to see 10,293m job openings (from 10.458m) – while this comes before the FOMC meeting, there could still be a reaction – risk assets respond positively, with USD sellers, on a lower-than-consensus JOLTS print.

- FOMC meeting (2 Feb 06:00 AEDT) and Jay Powell press conference (06:30 AEDT) – a 25bp hike is fully discounted, and while a 50bp hike can’t be ruled out, it would be a WTF moment. We look out the interest rate curve and see two more 25bp hikes priced by mid-2023, where this pricing will be influenced by this week’s ECI and NFP wages data

- On one hand, financial conditions have loosened to a point where Chair Powell may detail the extent of easing is “unwarranted” – I’m not sure the market de-risks too intently should we hear this though. After three consecutive lower CPI prints, soft data that is concerning, and a consumer showing signs of pulling back on spending, the market anticipates a near-term pause in the hiking cycle – then there’s the lag effect, where some 425bp of hikes still need to fully feed through to the economy. To state a point we’re close to an end in the cycle we could see a tweak to the line in the FOMC statement, where “the Committee anticipates that ongoing increases in the target range will be appropriate” – where the word ‘ongoing’ is either removed or altered to “further increases”.

- Given leveraged and real money funds are positioned short of USDs (but not at extremes) and the risk of Powell maintaining a hawkish line - pushing back on easing financial conditions - one could argue the risks from the meeting are skewed towards modest USD strength. However, the market could easily sell USDs just on the premise that the Fed may strike a more constructive tone and acknowledge a vision already priced into rates. Preference, therefore, on the day is to hold a flat exposure and look to sell rallies on the USD.

- US non-farm payrolls (NFP - 4 Feb 00:30 AEDT) – the market looks for 185k jobs to have been created in January (the economist’s range of forecasts is 300k to 130k), which is a slower pace than the 3-month average of 253k. The U/E rate is eyed at 3.6%, while average hourly earnings (AHE) are projected at 4.3% (from 4.6%), which would be the lowest Y/Y pace since August 2021. AHE could be the key driver of markets in the NFP report, and a number below 4.2% could set off a solid rally in NAS100, gold and risk FX (AUD, NZD, MXN, NOK, and CAD). Conversely, a print above 4.5% would be a USD positive, although the magnitude of USD buying depends on the U/E and NFP print.

- ISM Services (4 Feb 02:00 AEDT) – after a poor read in the Dec print, the market expects a better tone with the index eyed at 50.5 and modest expansion in services in January.

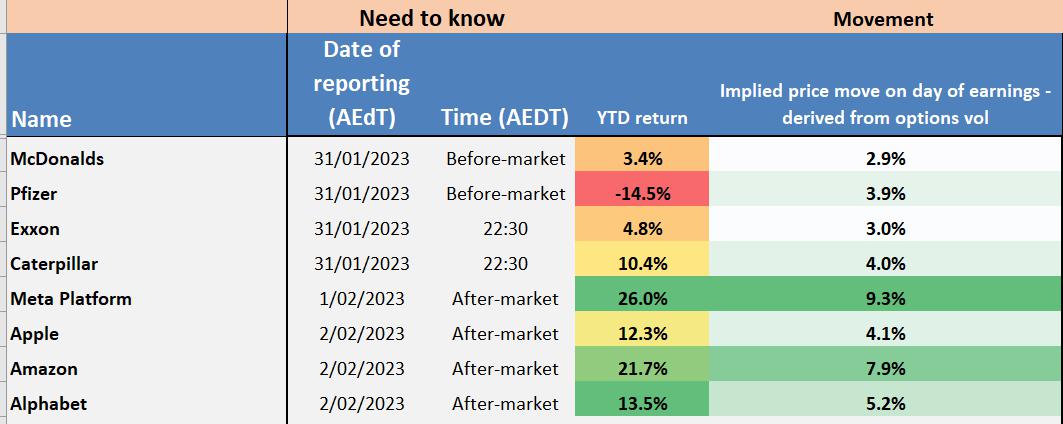

US corporate Earnings

As it stands, we’ve seen 29% of S&P500 companies report quarterly numbers. 69.7% of those who have reported have beaten EPS expectations, by an average of 2.1%. 50% have beaten on sales by an average of 0.9% - the guidance from companies has been quite neutral considering what we’d heard in the lead-up and how market expectations had been reduced. This week is the marquee week for earnings though and we see 31% of the S&P500 market cap reporting – as we see from the table, we see a number of trader favourites out, notably, Meta, Apple, Amazon, and Alphabet to name a few - so this is the week to keep an eye on the micro and notably the after-market trade.

China

- Manufacturing and services PMI (31 Jan 12:30 AEDT – 50.1 (from 47.0) & 52.0 respectively – the market consensus is for a rebound in the PMI series but given the bullish rip in Chinese equities and in the proxies (AUD, copper), better data should largely be in the price. Not one I’m expecting to move markets as the market is 3-6 months ahead of the data

Europe

- EU CPI estimate (1 Feb 21:00 AEDT) – the market expects a slight moderation in the EU inflation read, with headline CPI eyed at 9% (from 9.2%) & core CPI at 5.1% (5.2%) – for my risk assessment, I see a bigger rally in the EUR on an upside surprise than a downside move should CPI come in below consensus.

- ECB meeting (3 Feb 00:15 AEDT) – all signs point to a 50bp hike being a lock, with the market also pricing another 50bp hike in March, although there is some debate whether they could loosely guide towards a 25bp hike here. Wednesday’s EU CPI data could influence that call. Ultimate, despite a more constructive feel to some of the supply-side issues, ECB president Lagarde should remain steadfast in the view that now is not the time to take the foot off the peddle – in fact, we could hear of an appetite to reign in the balance sheet at a faster clip. EURUSD 1-week implied vol sits at the 45th percentile, so while I see small EUR upside risks from the meeting, the market is not betting on huge volatility this week. For more intel, see our ECB preview - https://pepperstone.com/en-gb/market-analysis/ecb-playbook-still-the-most-determined-hiker-in-g10/

UK

- BoE meeting (2 Feb 23:00 AEDT) & Andrew Bailey press conference (23:30 AEDT) – the market prices 45bp of hikes for the meeting and given GBPUSD 1-week IVOL sits at 11.5% (the 25th percentile of the 12-month range), traders hold strong confidence of not being surprised. I would note, however, that 10/34 economists are calling for a smaller 25bp hike, a factor that could see GBP smacked hard off the bat if it came to fruition. The split in votes will be closely watched, where the risk is we see 3 MPC members dissenting, with 2 calling for no change and 1 member calling for a 25bp hike. See the BoE preview for more intel - https://pepperstone.com/en-gb/market-analysis/another-reluctant-hike-from-the-old-lady-playbook-for-trading-the-boe/

- BoE chief economist Huw Pill speaks (3 Feb 23:15 AEDT) – Unlikely a market mover coming so soon after the BoE meeting, but he is someone the market listens to above other policy setters.

Japan

- Eyes on headlines, as the anticipation builds around who is the front runner for the BoJ governor. Reuters is reporting - https://www.reuters.com/markets/asia/new-boj-governor-nominee-likely-be-presented-diet-feb-10-sources-2023-01-17/ - that we’ll learn of the four nominees by 10 Feb but it could be earlier. FX strategists are already making their own shortlists and assessing how each candidate would look to exit yield curve control and appetite to move out of NIPR (negative interest rate policy) – clearly, this could be a big JPY driver.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.