The tides are a changing - make or break for US equity markets

This week’s ‘The Trade Off’ is a must-watch. Blake and I review the picture on rates, the USD, and whether the balance of risk has shifted towards drawdown in risk assets – take a look.

After a 18.6% run since 17 June, the US500, NAS100, US2000 and US30 have all started to look a touch more vulnerable – the tone on social media is certainly more bearish - client flow has turned progressively more net short, with 60% of open positions now held short on the US500 – we can look at various oscillators like stochastic momentum and the 9-day RSI and see bearish signals – we see the 3-day ROC below zero, and I watch for the 3-day EMA to cross below the 8-day EMA.

Looking specifically at the US500 (we can draw similar conclusions on other key US indices) we can see the exhaustion in the buying flow – this comes at a time when we’ve seen the index run into a confluence of resistance levels, with supply coming in at the 200-day MA and early May highs – this comes ahead of the Jan downtrend and 61.8% fibo of the bear market drawdown.

The reasons why we got here are interesting in themselves, and while we can talk about a softer headline US CPI/PPI print and a somewhat more data-dependent Fed – for me, much of the move has to be credited with re-positioning from the suite of big money players – most who have moved away from a very bearish exposure, to currently sitting at a far more neutral stance. Notably, we’ve seen:

- Pension funds moving from a sizeable ‘underweight’ position in US and global equities to a more neutral stance.

- Options dealers had held sizeable short gamma exposure, which essentially meant when the S&P500 futures (as well as the NAS100, Russell 2k) fell then they would hedge their exposure by selling S&P500 futures – subsequently, as the index turned and rallied, they covered these shorts, pushing the index higher. Dealers are now long gamma, which means they short S&P500 futures on rallies and buy on weakness – this has the effect of lowering volatility and is part of the reason we see the VIX index at 20%.

- CTAs (Commodity Trading Advisors) – systematic trend following funds held a large short position in S&P500 futures – the market was trending lower, and their rules dictated they needed to be short. That positioning has reversed, and these big funds have covered moved to a small long position.

- Volatility-targeting funds have been buyers of equities – as 20-day and 30-day S&P500 index realised volatility has dropped, these players have been buyers of equities – their exposure to market risk is determined by volatility.

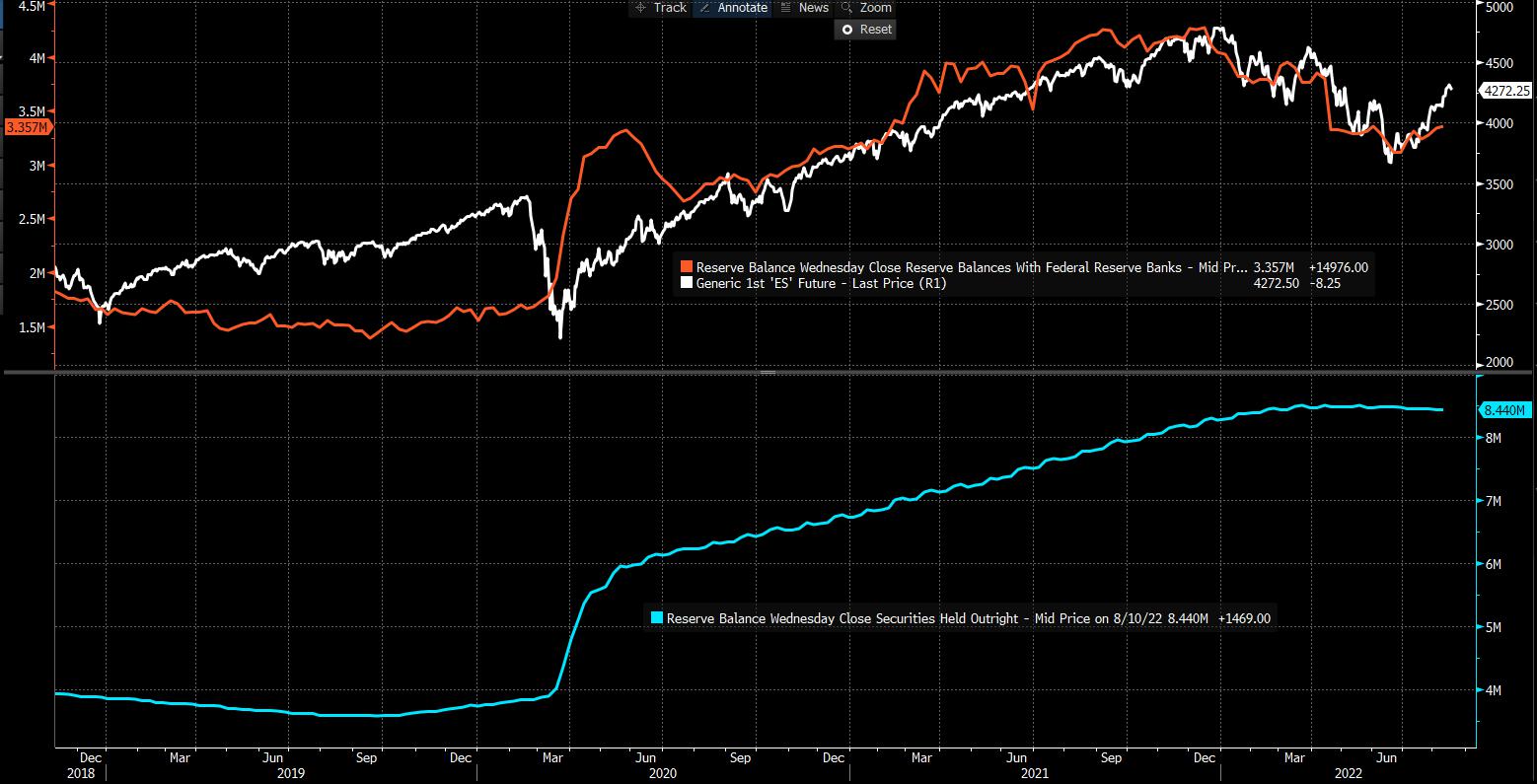

Top pane - excess reserves held with the Fed vs S&P500 futures

Lower pane - Fed's assets (US Treasuries/Mortgages)

It's not just the bearish positron re-adjustment – we’ve seen commercial bank's excess reserves they hold with the Fed – a liability for the Fed – increase by more than they sell down the securities held (an asset) under 'Quantitative Tightening (QT)' – the market sees this as 'Quantitative Easing (QE), and better liquidity equals risk-taking, which is part of the reason we’ve seen Bed Bath and Beyond, and memes more broadly, flying.

The question now we’ve moved to a far more neutral state, with increased supply coming in at multi-key resistance, the bears wrestling back some control (as seen in the evening star candle formations) – is has the balance of risk skewed itself sufficient to warrant a higher conviction on short positions? Clients are warming to this view – the USD, bond yields and volatility holds the key.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.