The Daily Fix – Risk runs hot into US CPI

- US equity markets look comfortable that they’ll get a US core CPI print that doesn’t round to 0.4%

- Small caps and tech fire up – energy finds few friends

- The USD reacts to lower US yields – EURUSD eyeing 1.0900, AUDUSD tests key resistance at 0.6640

- Crude lower, gold higher but it's copper that gets the attention

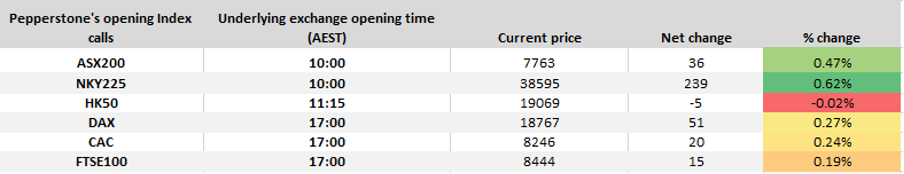

- Our Asia equity opening calls looking constructive for the open

In equity markets, EU/UK cash markets saw largely unchanged moves, but they do get a tailwind from a stronger US equity move after their respective closes, with our EU/UK index opening calls now eyeing moves made in the NKY225 and HK50 trade through the day. As it stands, new all-time highs (ATH) in the DAX40, CAC40, and FTSE100 look promising for the session ahead.

US small caps have outperformed with the Russell 2000 printing new run highs and the bulls, for now, are in control and driving this along. An in-line-with consensus US core CPI read (0.3%) is discounted and in the price, but that may be enough to promote relief buyers and see the index push further higher – a US core CPI read below 0.25% m/m and I wouldn’t certainly want to be short.

Tech has found form, with semis looking strong - Nvidia has offered a backbone to the rally (shares +1.1%), but it’s hard to go past the moves in Super Micro Computers, Qualcomm, Dell and Oracle – either way, the NAS100 eyes a test of the all-time high (18,464 in the cash market) and a US core CPI print below 0.25% m/m and we may well see new highs play out in the session ahead. The fact that the NAS100 cash index closed so close to session highs suggests the market is confident that US core CPI won’t be 0.35% m/m or above.

The S&P500 grinds higher (the index closed +0.5%) and sits a touch below the ATH printed on 28 March of 5264 – 63% of stocks closed higher, so participation was fine, with the tech sector firing up, while there was limited interest in energy, industrial or materials names. Historically the index has moved a little over -/+1% on US CPI days (on a 2-year look back), so we are expecting movement, and again if the month-on-month print doesn’t round up to 0.4% then the bulls will likely push on.

We see good buyers on the day in US Treasuries, where US PPI inflation hasn’t been of any real concern given the elements that feed the core PCE inflation calculation (due 31 May) suggest that this key inflation metric is running closer to 0.24% m/m. Positioning is always key for event risk, but traders have massaged duration accordingly and lower US bond yields (US 2yr sits -4bp at 4.81%) seem to have been a tailwind for equity markets, while it has also weighed on the USD, where we see EURUSD at 1.0820 and making new run highs – as suggested yesterday, it feels like the market wants to take this to 1.0900+. An 8bp narrowing of the German 10yr bund – US 10yr Treasury yield spread into 1.89% has been a clear tailwind for EURUSD.

NZDUSD is on the radar for a breakout above the 0.6040 which would extend the recent bull run and suggest 0.6100 is on the cards – US CPI permitting. AUDUSD looks primed for another test of 0.6640 – can it break this time? On the docket today we get the Aus Q1 Wage Price Index, an important metric for the RBA, but unless we get a sizeable deviation from the consensus of 0.9% QoQ / 4.2% YoY then I suspect the impact on the AUD will be limited.

For the higher beta players, USDCLP is trending strongly lower, backed by a solid move in copper, which has resulted in the Chilean govt upgrading its economic forecasts. Rallies look set to be sold and this trades lower in my view.

In commodities, we’ve seen good selling in crude (-0.8%) with price continuing to work in a $80 to $77.50 range, and some focus on headlines that OPEC+ members exceeded oil output quotas last month. In the session ahead crude traders will be watching the EIA’s weekly inventory report, with calls for a 222k barrel drawer. Copper gets the strong focus, with front-month futures pushing above $5.00 p/lb, amid a massive steepening of the futures curve, taking it further into backwardation. This is critically important for traders and exporters, as it means you can be long the front month futures contracts (increasing demand) and essentially ‘roll down the curve’ upon expiration into the next-month contract and pick up solid levels of carry.

Gold gains $21, amid USD weakness and a 4bp fall in US real rates and climbs to $2358. We saw good supply into $2380 on Friday, and a weak CPI print could see those who initiated shorts into that level reconsider that position, again part helping the yellow metal into $2400. A weak US retail sales print would also be helpful for gold longs.

Turning to Asia

Our opening index calls look constructive with the NKY225 set to be the region's performer. The ASX200 eyes a move into 7763 (+0.5%), with BHP central to the index charge, with the stock looking likely to open 2.8% higher. We see a flat open for HK, with Tencent likely to open above HK$ 400 on a largely solid set of results (revenue was a touch better, but NPAT was well ahead of expectations), while Alibaba will head the other way after disappointing numbers, which saw its US-listing -6%.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.