- English

- 中文版

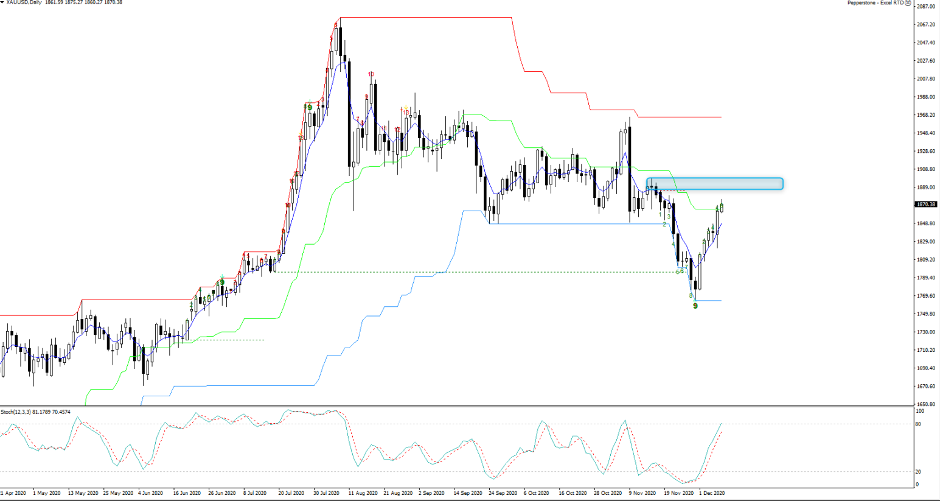

Further covering of gold shorts is assisting, as is the dip lower in US real (inflation-adjusted) Treasury yields and a stable USD. Moves into 1884/7 should cap rallies in the near-term where I’d expect traders to trim, but it’s all eyes on the ECB meeting tomorrow and whether they can affect the German bund market, which will invariably influence both the EUR and the USDX.

(XAUUSD daily)

More on the ECB meeting for tomorrow night here and here.

If we work solely on probabilities in trading I think the ECB should over-deliver, which suggests a higher risk that within a week that we see 1.2000 emerge (in EURUSD) before 1.22. Although the options market is slightly skewed for a higher probability of 1.2200 being seen at 20.6% (vs 17.8% for 1.2000).

Tesla has also crept onto the most traded flow report and remains a trader favourite, with good buying in the pullback into $618.50. The weakness was driven by the announcement that they plan the third share sale in 10 months, raising $5b in an at market sale. This should take the cash hoarding to $20b which is more than 88% of firms in the US. They may not have earnings, but they do have cash and that it seems gives them options and the market is happy to keep the bid alive.

Trading Brexit talks

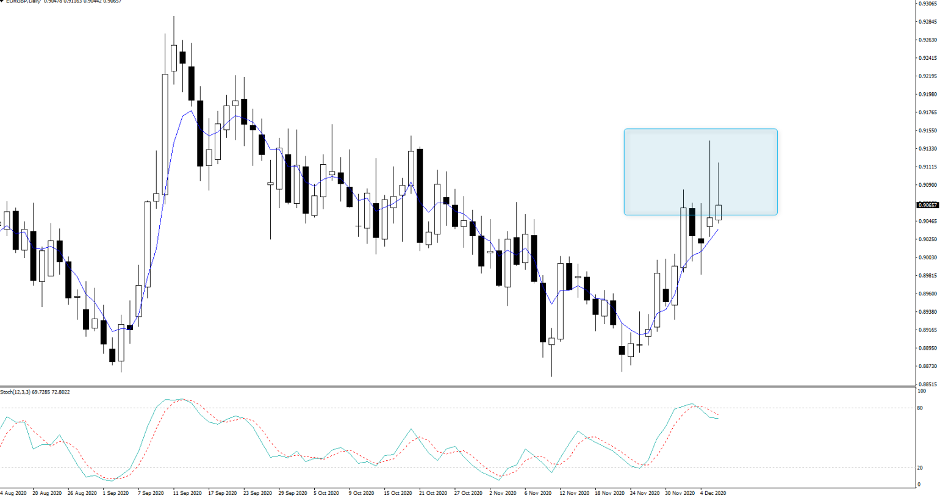

The GBP remains high in the mix too, with good flow in GBPUSD, GBPJPY and GBPNZD. EURGBP continues to find sellers in rallies into the 91-handle and you can see this portrayed clearly on the daily timeframe. GBPUSD 1-week implied volatility traded into 17.3% yesterday but has retreated somewhat to 16.5% which still suggests GBPUSD is where you go for movement in G10 FX. Overnight vol has been wild, moving to a punchy 27.9% before pulling back to 15.8%. I’ll inform traders around this today on Telegram, as it gives insight ahead of tomorrow’s now highly anticipated dinner between Boris Johnson and EC President Ursula von der Leyan.

EURGBP daily

Trading GBP has not been something those who cut their craft on daily charts would've found easy, with incredibly whippy price action and with some rapid moves from 1.3290 to 1.3393 - only to revisit those lows again within two hours. We’re now in the 51st percentile of the day’s range with very little conviction to do much other than scalp the pair.

Taking a view longer than five minutes and if this is indeed a binary event, which it's in the sense of whether we get an agreement of a deal this week or not. However, there's more to it than that and if we do get a deal the extent of the rally in GBP (should we get a so-called bare-bones free trade agreement and FTA) will be down to the duration of the implementation phase. I’d argue that for those calling for an FTA the consensus would be a phased approach which takes GBPUSD, theoretically, into 1.3500/36.

Put a gun to my head and I’d be a buyer of GBP, as I see the risk skewed that Boris would come back with some sort of agreement or at least commentary that leaves us believing an announcement is near. However, whenever I see implied vol at these levels I would be highly cautious with minimal position sizing and my stop would be sub-1.3100, which doesn’t imply a good reward to compensate for the risk.

If no agreement is found and the market is treated to headlines as such then the GBP bears will start to really work the market lower. A factor already seen in the options market with put volatility trading at a solid premium to calls.

Outside of the negative options skew, broad positioning is short GBP but not at extremes by any means. This limits the prospect we get an exaggerated short-covering rally to say 1.3800 - 1.4000. Perhaps for these levels to be seen we’d need to see a combination of USD weakness, equity momentum picking up and news that the FTA implementation would be 12-months or so which seems highly unlikely.

Outside of Brexit shenanigans we see moves in Tesla, XAUUSD and positioning ahead of the ECB meeting. We also see US equities march higher with new highs in the US500. Energy is leading the charge with staples and materials working well on the day – again, we’ve seen holiday level volumes play out with 900k S&P 500 futures contracts traded. The big hitters are seemingly calling it a year. Crude is marginally higher with net sellers in copper and iron ore.

On the docket today we get Chinese CPI/PPI (12:30 AEDT) with the consensus expecting price pressures to fall. Aussie Westpac consumer confidence is due at 10:30 AEDT, although this shouldn’t move the AUD to any great capacity.

At 02:00 AEDT we hear from the Bank of Canada so keep an eye on CAD exposures if running them. 1.2768 (in USDCAD) looks like good support, while any covering of shorts in the pair takes us into 1.2923/29 (the 38.2 fibo of the 1.3183-1.2768 move, and 9 Nov low) where this could offer better levels for those looking to fade rallies.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.