- English

- 中文版

This leads me to the focus of today's musing, that being the UK-EU trade talks. As we’re in the so-called ‘tunnel’ that isn’t a tunnel with EU chief negotiator, Michel Barnier, leaving the UK after two days of intense talks and returning to Brussels. One suspects he’ll be back in London to talk with Lord Frost on Saturday.

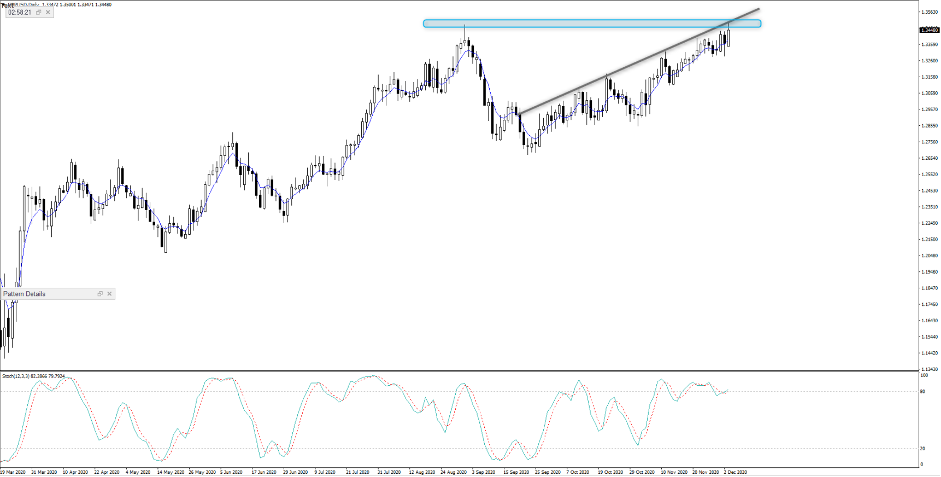

(GBPUSD daily)

Liquidity in GBP seems pretty good, even if price is moving around somewhat more erratically. To contextualise expected movement, 1-week GBPUSD implied volatility (vol) has risen to 13.2% where a push through 15% in the coming session would be a red flag that traders are really paying up for movement. On this vol the implied range over the coming week is 1.3659 to 1.3265 (with a 68.2% degree of confidence) and 1.3760 to 1.3029 if we take this out to a 90% confidence level.

1-week and 1-month GBPUSD risk reversals have completely diverged from spot and moved to the biggest premium for put option volatility over calls since April. Institutional players have been buyers and holders of GBPUSD but paying up for downside hedges in GBP optionality. It’s not often you see divergence like this, but traders are happy to hold spot, but protect via optionality. That dynamic will no doubt change, but I question whether spot plays catch up with the bearish options flow or do traders unwind hedges?

(White – 1-week GBPUSD risk reversals, blue – GBPUSD)

(Source: Bloomberg)

News flow has ramped up as you’d expect with the Irish foreign minister, Simon Coveney reaching out to the more hard-lined French, who've raised the issue of vetoing a trade deal if the terms don’t suit and appealing that Ireland doesn’t get “caught in the crossfires”. He suggested a trade deal could be forged in the next few days, which raises the prospect of a weekend agreement and possible gapping risk in GBP exposures.

That said, some of the optimism has been watered down with headlines coming through from the UK camp that “the chances of a Brexit breakthrough deal are receding” and that “the EU is making last-minute demands in talks”. The unnamed senior UK government source who made these comments did suggest a deal is still possible ahead of next week’s EU Summit (10-11 Dec). However, this is Brexit and we should not expect anything else other than political brinksmanship when we come this close to deadlines.

GBP has been a solid performer through trade with GBPUSD reaching a high of 1.3500 before pulling back to 1.3433, where buyers are now supporting. EURGBP traded into 0.8998 before trader’s part covered shorts for a quick-fire move into 0.9035. As we roll into Asian trade traders need to assess their GBP exposures into the weekend. If I were running GBP long exposures I wouldn’t be adding myself. Content in the position I had, but questioning if we see a deal how punchy the gapping risk will be. I don’t sit in the camp that a deal would result in a 300-400 pip spike higher and see the move closer to 100-pips (or less) and probably one to fade.

That said, the devil will be in the detail and one then turns to whether the French are on board and the prospect of selling this to Tory Brexit hardliners and passing a Commons vote.

On the other hand, if we don’t get a deal and the rhetoric from Barnier or the British camp shows limited progress then we could see GBPUSD gap lower on Monday. I’d guess 30-50 pips, but that's just my back of the envelope calculation. Of course, we’re used to these talks going close to the wire, time and time again. If there's even a glimmer of hope that a deal could be forged later that week, then the downside on the open in the GBP will be limited.

However, if nothing inspiring comes from news flow this weekend then traders will become far more nervous as the UK economy is still incredibly vulnerable and doesn't need the fallout from moving to WTO terms. The notion of a no-deal at the very least ramps up the prospect of BoE gov Bailey signalling negative rates will be rolled out early 2021. If funds are looking for a standout funding currency for the now much-owned carry trade, then the GBP would be it. However, it doesn’t have the safe-haven qualities of say the JPY or CHF.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.