- English

- 中文版

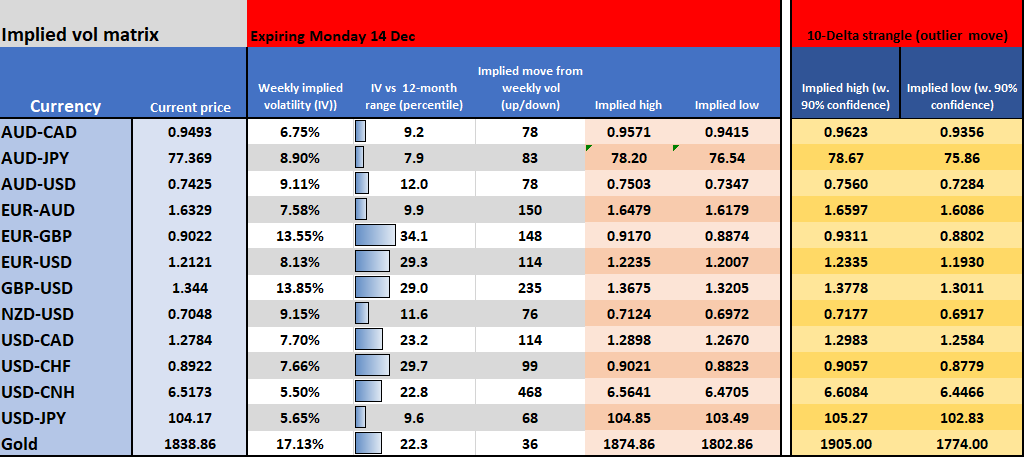

One which looks at the move with a 68.2% degree of confidence (i.e. a 25-delta straddle) and also a 90% level of confidence (10-delta strangle). As always, this is to help with the perception of movement and where the market is seeing more aggressive moves playing out.

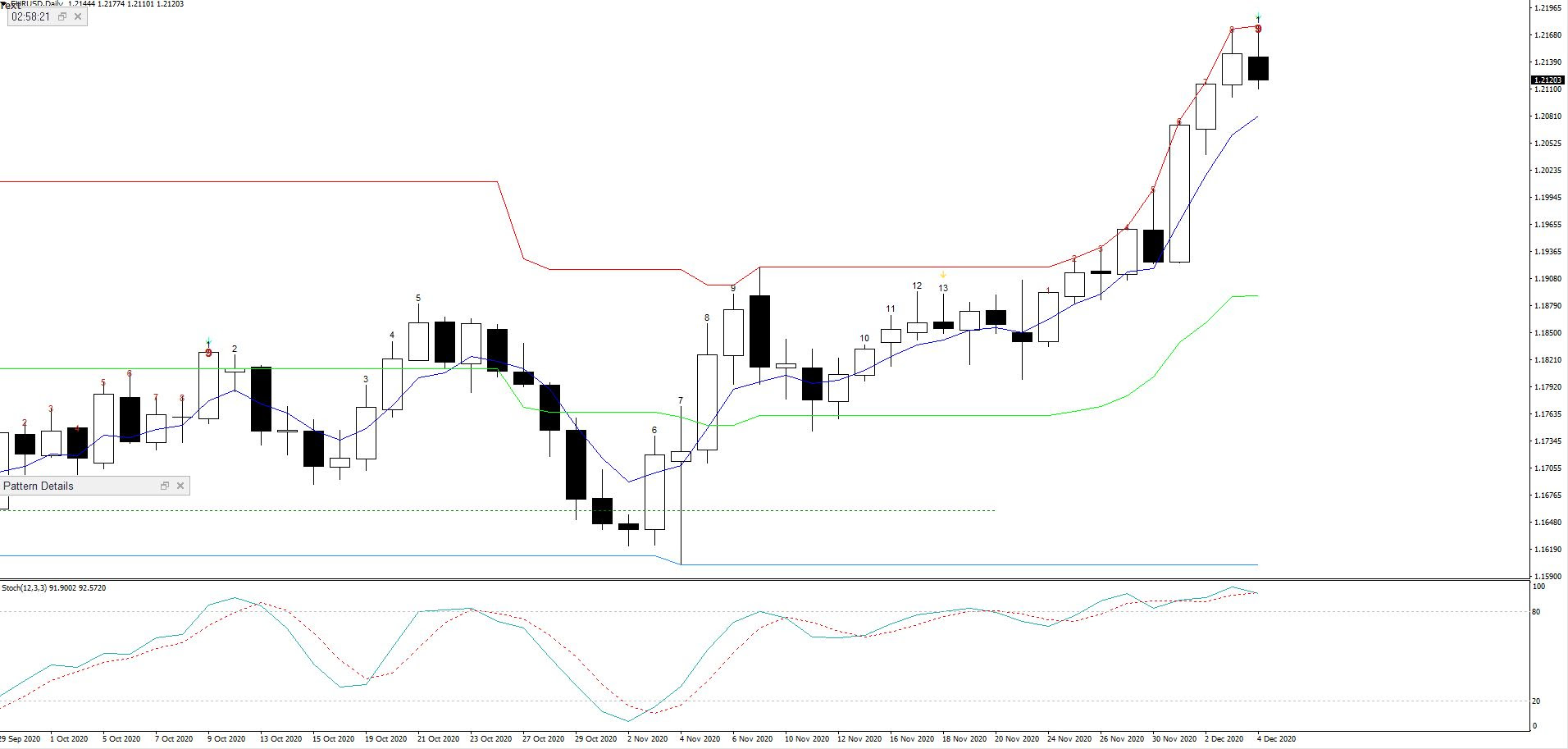

As we see it won’t surprise that the movement is aimed at GBP pairs and EUR to a lesser extent. All this makes sense as this is a huge week in the EU-UK trade talks and we see the ECB meeting on Thursday (23:45 AEDT). I certainly think the ECB meet will be one to consider whether running exposures over is prudent as the algos are going to hone in to the headline on the future of its Pandemic Emergency Purchase Program (or PEPP). There are many other considerations within the ECB meeting which could move EU assets, notably any rhetoric that signals the EUR appreciation may start to impact inflation expectations.

However, the focus on its remaining E600b QE program will be where the EUR moves. We could see a commitment to push some stage into end 2021, which given the remaining E600b of capital left to buy bonds means a small increase in the fund. Or they could take it further into 2022, which would imply an increase closer to E900b given the current weekly run rate. If the program is pushed into 2022, I would expect buying across the European sovereign bond markets (yields down), which in turn would boost EU equity markets and likely weigh on the EUR.

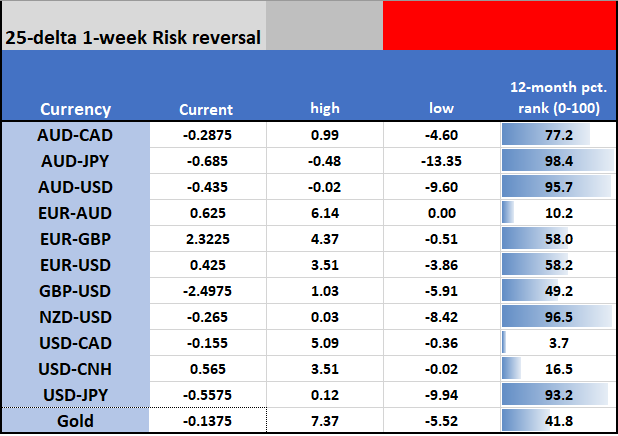

As we see 1-week EURUSD ‘risk reversals’ are slightly positive at 0.425, which shows options traders are better buyers of calls over puts and therefore if there's going to be a move traders are saying the more aggressive move will be to the upside. Risk reversal are one of preferred sentiment indicators. That said, I am cautious on near-term upside and would not be chasing this move – its hard to bet against the EUR trend but I do see risks near-term.

We have the EU Council Summit on Thursday and Friday with the EU budget in focus. This will be superseded by Brexit talks and whether there's an agreement put forward from Lord Frost and Michel Barnier. This will need to be put to Boris to put through the Commons, who's going to the House of Lords today to try and pass the controversial Internal Markets Bill, albeit now with clauses relating to trade with Northern Ireland removed. The French won't be happy if this bill passes and they remain a key player here as any trade agreement will need to get Macron’s blessing as he's suggested he will veto if he doesn’t like the outcome.

It’s no surprise GBP vols are elevated and it would not surprise if they push closer to 15%, which is the line where we may see far more erratic behaviour. As we see in risk reversals, traders have been far bigger buyers of GBP put vol and this is to hedge their spot exposure (and no-deal risk). We’ve seen some selling in the GBP in the interbank trade, but the next 24-48 hours will be key and if you choose to trade the pound, you need to be aware of the potential for bigger moves on headlines.

Instinct suggests common sense will prevail and they’ll find common ground over fishing and a level playing field, but trading this is a whole different thing.

Outside of these risks, there'll be a focus on China with November trade data in play today (no set time) and where solid import growth (the market is looking for a 7% YoY rise in USD terms). We also get CPI and November credit data (new yuan loans, M2 supply). Good numbers here could aid the reflation trade which clearly is in full swing, with global bond yield curves steepening as long-end sell-off (yield higher) more intently and seem ready to break prior highs, and inflation expectations are also flying. Equities are fine with this as value and cyclical areas of the market outperform. Industrial metals are trending higher and iron ore futures are in beast mode and eyeing a break of RMB1000 in futures.

The CAD was a star performer last week with USDCAD putting on 1.6% on the week and closing below 1.28 - the lowest levels since May 2018. USDCAD put vol trade at a premium to calls, as we see with risk reversal negative and with the BoC meeting also due on Thursday (02:00 AEDT) be aware of the potential for movement in this pair. The market doesn’t seem to be giving this meeting as close a vigil, but it seems the CAD is working well. AUDCAD shorts could be a better way to play a more positive view of the CAD.

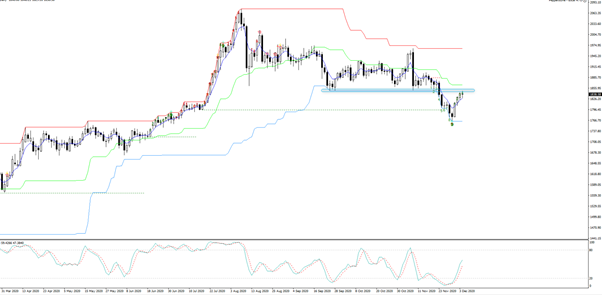

Any support in the USD may be a headwind for XAUUSD this week and this is one of the more interesting charts around. It’s make or break time with price having pushed back to the former range lows of 1848, with indecision to push this higher on Friday. As always, when trading around key levels take the time frame in and react to price – a rejection here could be very telling. That said, a push through 1848 and I’d be looking for 1865/78 to come into play.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.